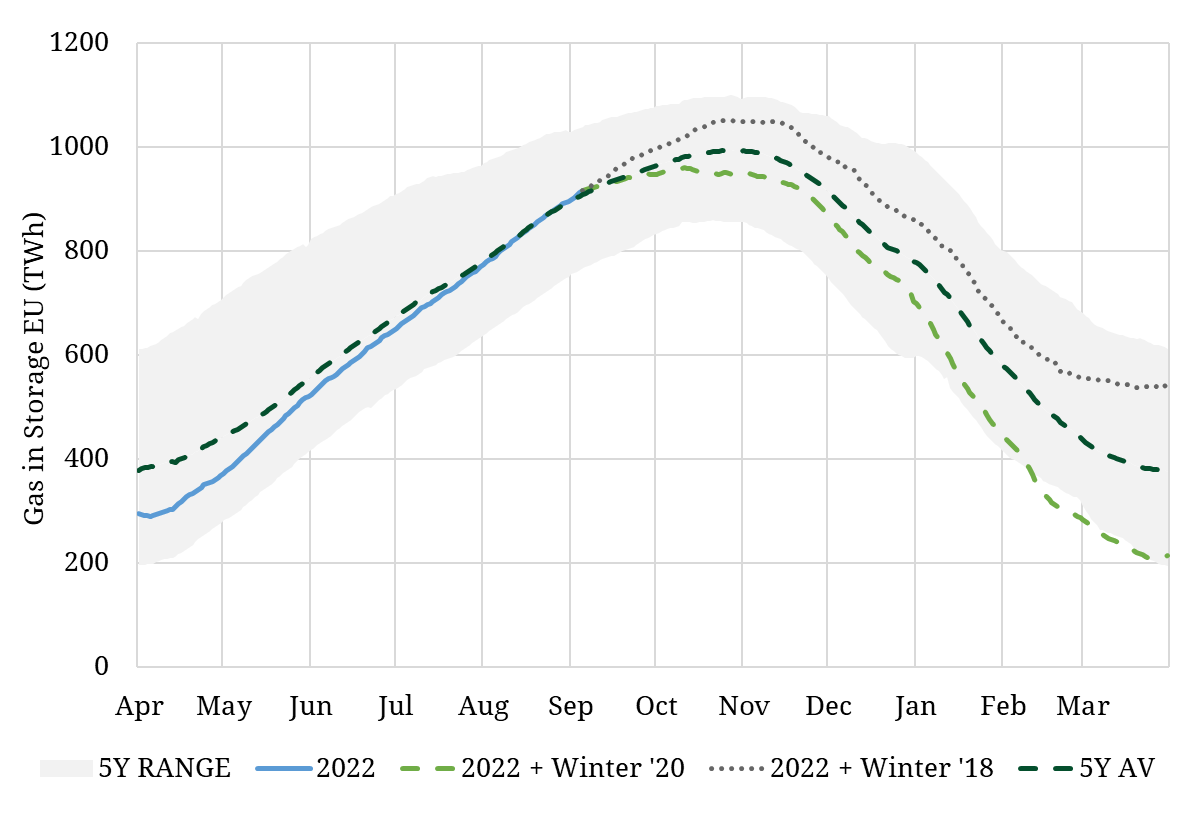

If you were asked to judge the European gas market tightness on current storage levels alone, you may see little reason for concern. Strong injections across summer have led EU storage levels to in line with the 5 year seasonal normal (with Germany >80% full), to buffer against security of supply concerns this winter.

Those concerns however, are widespread. Russia continue to ratchet up the pressure on Europe, most recently with NS1 flows not returning following recent maintenance – a incremental decline of ~6 bcm if continued from now to 31st March 2023. A further decline of max ~8 bcm is still possible if current Velke flows were also cut. Winter weather also poses a risk. A cold winter can have a rough impact of increasing demand by c.20 bcm. Given the difficulty in reducing gas for power generation demand in the tight European power market, further significant industrial demand cuts would be a must in the case of a cold winter with supply cuts – supported by the existing EU targets to cut overall demand voluntarily by 15%, and upcoming proposals for demand side auctions in the power market.