Search results

BLOG

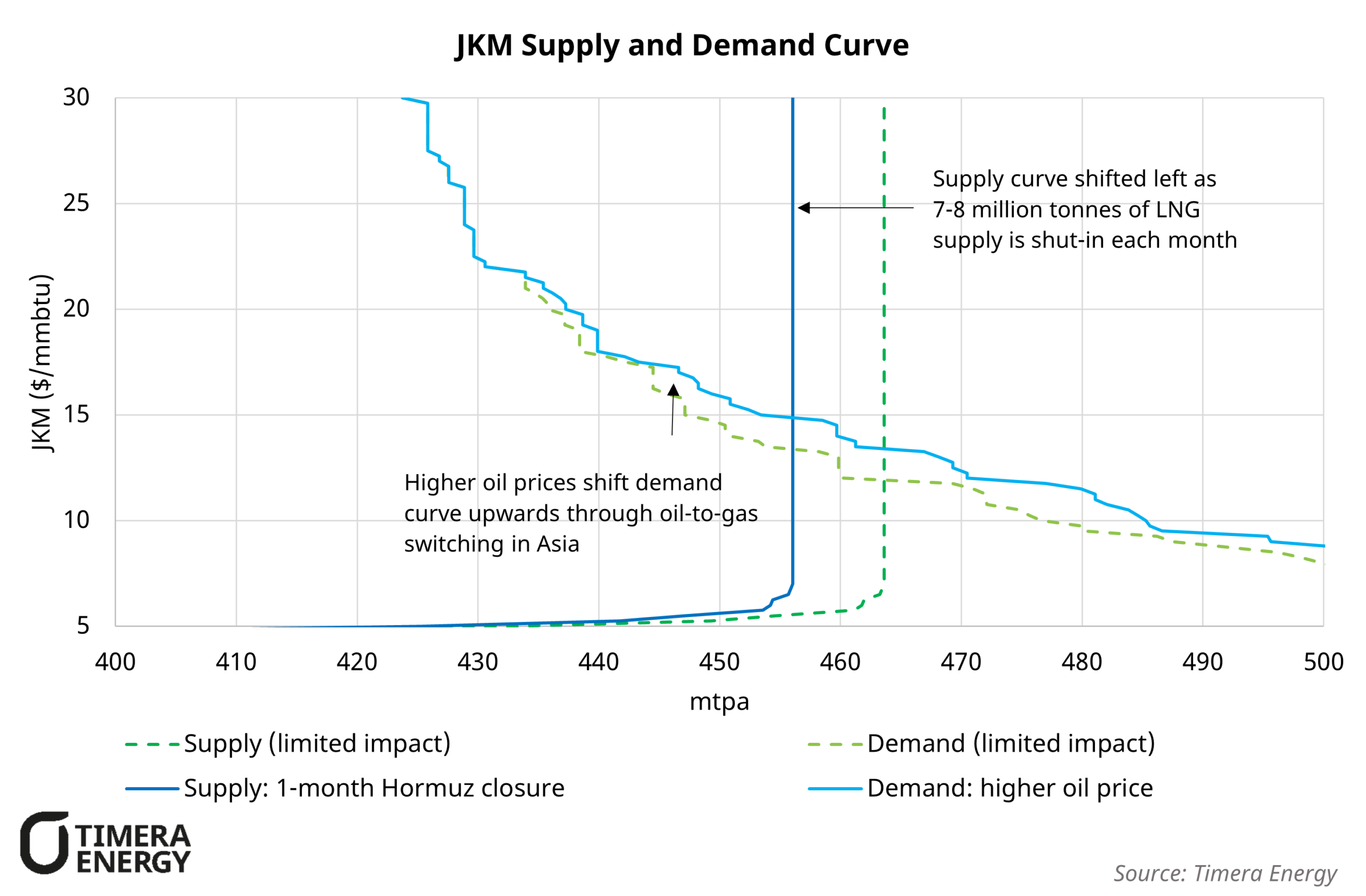

Five key impacts of LNG supply disruption via Hormuz

The effective closure of the Strait of Hormuz and halted Qatari LNG production mark a major global gas supply shock, driving sharply higher prices amid acute uncertainty over duration and wider disruption.

BLOG

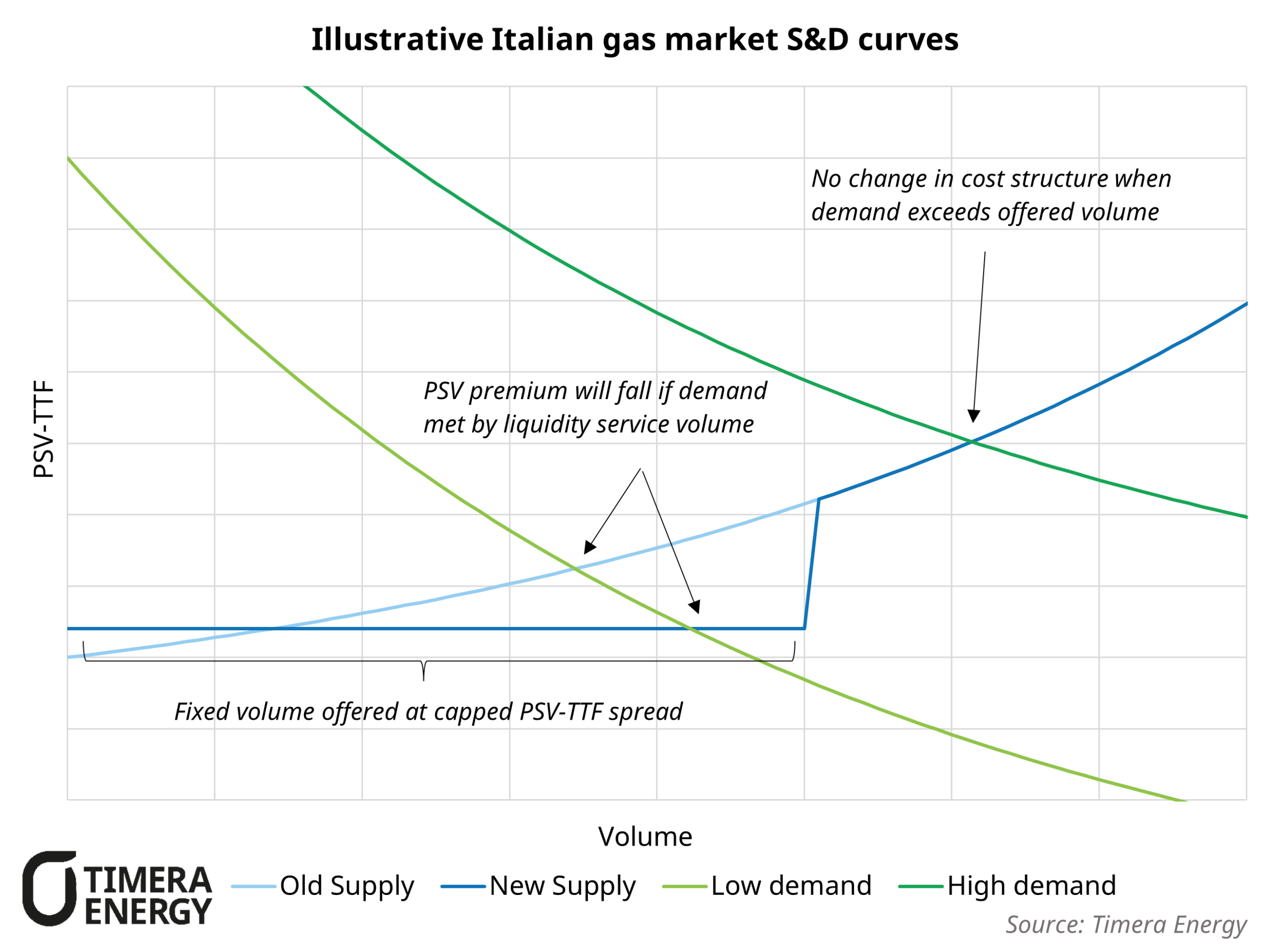

Italy’s major policy intervention & asset value implications

We look at 8 important investor implications of Italy’s recent emergency policy decree and its impact on power asset values

BLOG

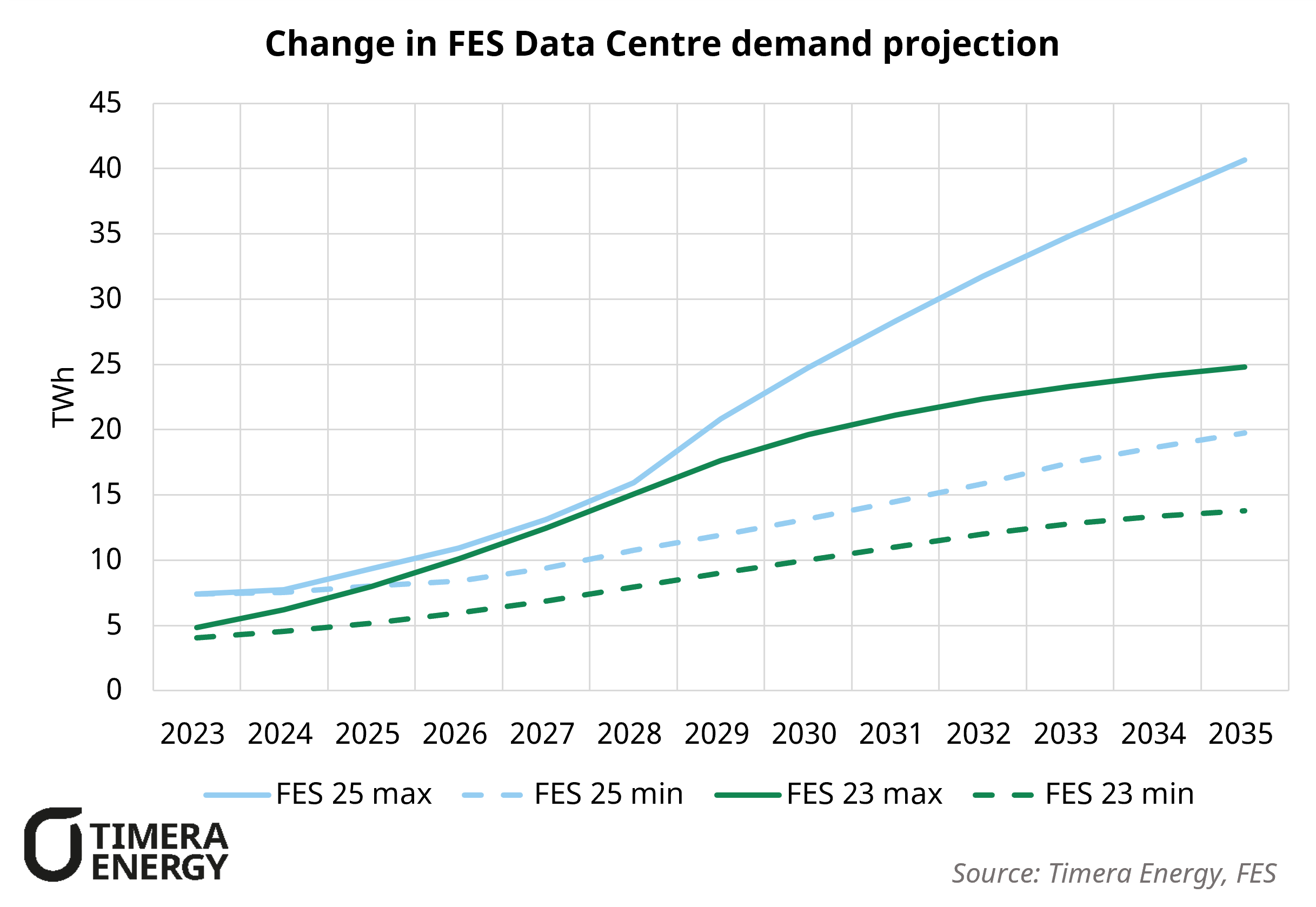

GB data centres: Will queue reforms unlock the next wave of power demand?

Proposed GB grid connection reforms could unlock a wave of data centre demand, but Ireland shows how quickly power systems can strain following rapid demand growth.

BLOG

TTF premium boosts European regas margins

We look at how low storage levels in Europe are widening offshore vs onshore price spreads, driving up LNG regas margins.

BLOG

Italian government confirms PSV – TTF liquidity service

The “liquidity service”, designed to offer volumes of gas into the Italian market at a fixed premium to TTF, has been passed into law