Two deals were announced at the end of February that highlight two structural trends transforming European energy markets:

- Small players driving innovation &

- Large incumbent players looking to diversify business models.

Deal 1: Gridserve sets out a new model for unsubsidised solar + batteries

UK based developer Gridserve has agreed a deal with a local council (in Warrington) to build a large unsubsidised solar plus battery storage project. The project consists of 60 MW of latest solar farm technology and 27MW of battery storage, with construction financed via private capital. The council will own the assets once operational, but Gridserve will operate and maintain them.

Deal 2: Oil & gas major Shell acquires power aggregator Limejump

Shell announced its acquisition of Limejump, a digital platform based aggregator of decentralised flexibility (e.g. engines, batteries, DSR). This deal follows Shell’s acquisition of German residential battery producer Sonnen (earlier in Feb) and UK retailer First Utility (in 2017).

The first deal is one of many current examples of innovation being driven by smaller players. The second deal reflects a growing desire by large incumbents to diversify portfolio risk and look for new growth opportunities.

Small player innovation

European gas & power markets were dominated by large vertically integrated utilities in the 2000s. Boardrooms were focused on acquisition and aggregation as a way to gain scale. But the financial crisis left the balance sheets of many companies overextended.

This decade has seen a steady erosion of utility dominance, coinciding with a rapid growth in the role of smaller players and new entrants, particularly in the power sector.

These companies tend to be innovative, nimble and unconstrained by the rigid structures of large utilities & producers. They are particularly well suited to developing more effective customer relationships in increasingly decentralised markets, typically with lower cost overheads than incumbent players.

Examples of areas where smaller players are making inroads:

- Aggregators: smaller companies such as Limejump, UKPR and Flexitricity are leading the aggregation of flexible distribution connected resources such as engines, batteries and demand side response.

- Retailers: Growth in new entrant retailers (e.g. Smartest Energy, Ovo & Octopus) has been particularly prominent in the UK, although not all of these have survived the ‘risk management 101’ test.

- Developers: Gridserve is only one example of dozens of smaller innovative companies & funds developing power assets across solar, gas peakers, storage, DSR and onshore wind.

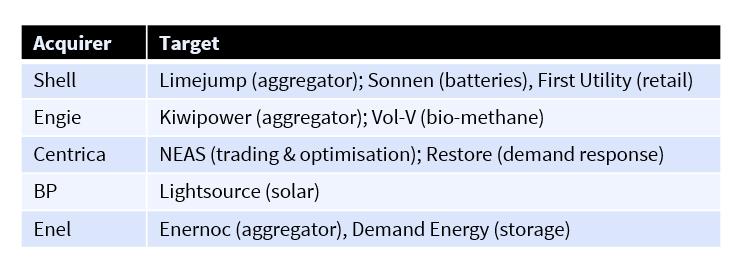

But as these smaller companies grow, they become prime targets for acquisition by incumbent utilities and producers looking to diversify portfolio exposures and access new growth opportunities. Some examples of this are set out in Table 1.