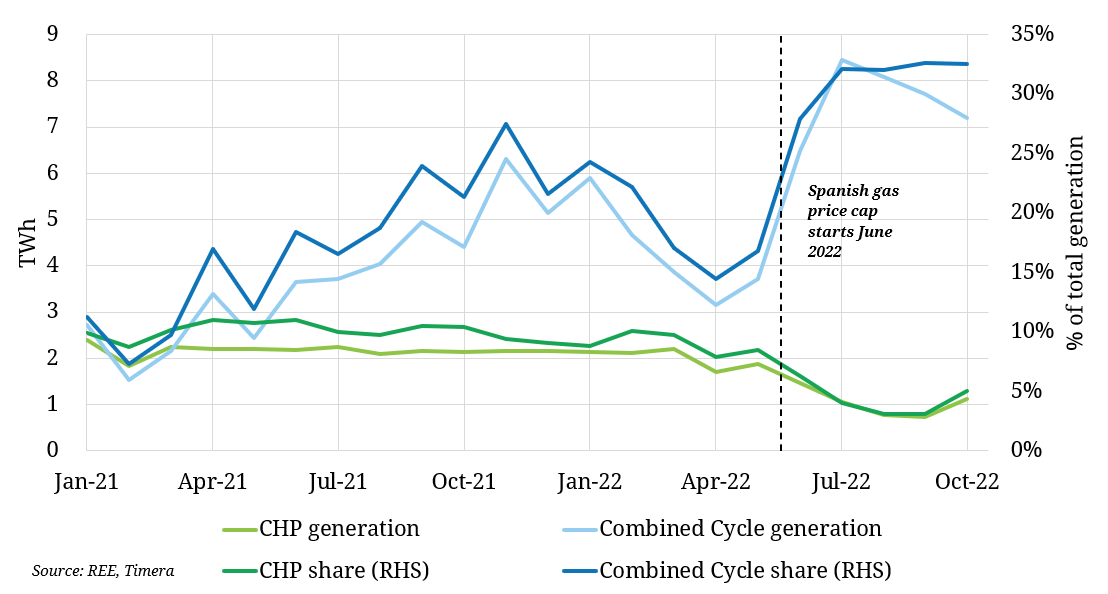

Whilst the majority of continental Europe has seen CCGT generation fall year-on-year as gas prices have soared, Spain has seen a sustained increase in CCGT generation, up 69% from 22TWh in Summer 21 to 37.5TWh in Summer 22. Spanish gas burn has been supported due to a regional gas cap of €40/MWh imposed on gas supply costs for CCGTs (the “Iberian exception”). Whilst CCGTs have been supported, a quirk in the gas price cap has led to a similarly sharp reduction in gas burn by CHP, down 42% Summer year-on-year as CHPs (a more efficient technology than CCGTs) have been excluded from the price cap mechanism.

Spain’s gas price cap has also had broader implications on cross border flows, with Spanish power prices trading at a structural discount to neighbouring France and prompting a large increase in exports. Whilst this is welcome in France, where nuclear generation has remained significantly down year-on-year, limited interconnection capacity has reduced the overall impact and prompted a complete disconnect in power prices. With the gas cap in place across Winter 2022, we expect to see robust flows & CCGT generation continue at historically elevated levels unless we see sudden changes to the Iberian gas price mechanism.