Batteries have been making extraordinary returns in the GB power market since Q4 2020. Revenues for 1 hour duration batteries have soared above 200 £/kW/yr in 2022, more than double levels required to cover long run investment costs.

“Transition to energy arbitrage will sort the sheep from the goats”

The primary driver of high BESS returns has been ancillary service revenues. There has been a structural shortage of BESS capacity relative to the system operator’s demand for the Dynamic Containment (DC) frequency response service.

Evidence is however rapidly emerging that the DC market is nearing saturation as new BESS capacity comes online. This does not spell the end of strong returns. But it does mark the start of a rapid transition in the revenue stack away from ancillary services towards energy arbitrage across wholesale & balancing markets.

In today’s article we look at DC saturation, the rising importance of energy arbitrage and why the Balancing Mechanism is set to be a key driver of BESS returns going forward. Finally we provide a sneak preview of the battery investment subscription service Timera has launched.

Dynamic Containment nearing saturation

DC is an ancillary service product that was specifically introduced to procure ultra-fast battery flexibility to manage grid frequency.

DC was introduced in Sep 2020 as a single product procured in daily blocks at the day-ahead stage. Then in Nov 2021 DC was split into DCH & DCL (high & low frequency) products with procurement transitioning to four hour EFA blocks.

Since Sep 2020, a simple ‘DC only strategy’ has yielded battery revenues in the 150-200 £/kW/yr range (for 1 hr duration). A structural shortage of BESS capacity vs DC demand has driven very high clearing prices. Operational BESS assets have been harvesting high returns with limited dependence on trading & optimisation skills to extract value.

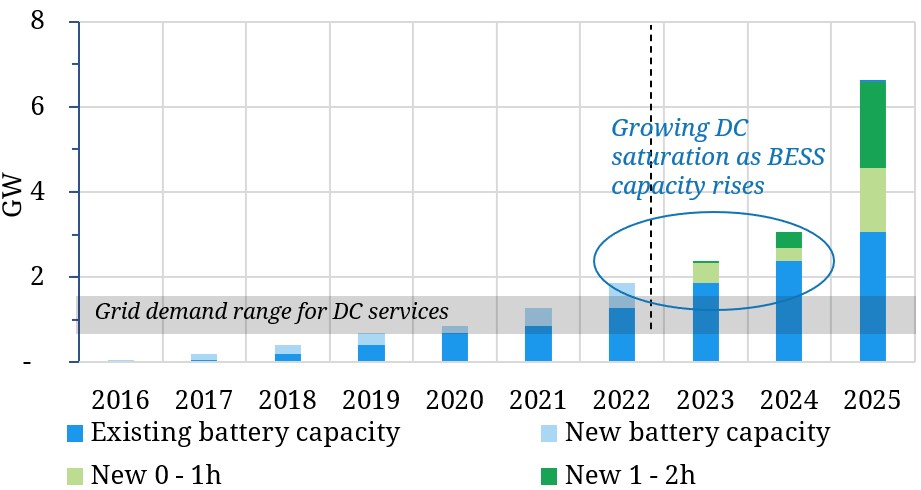

Chart 1 shows why it is past midnight at the DC revenue party.

Grid’s demand for DC services (DCL + DCH) has sat mostly in a 0.8-1.6GW range across the last year. DCH accounts for just under half of this demand and is a substantially lower value service versus DCL. Installed BESS capacity is set to exceed the upper end of the DC demand range by the end of this year, with capacity growth to dwarf DC requirements across the next 3 years.

Clear evidence of the impacts of DC saturation emerged across Sep 2022. This was a month of lower DC demand (vs e.g. Jun-Aug) and many batteries saw a sharp drop in DC revenue stack contribution in favour of wholesale & BM revenues. In other words BESS revenues swung from ancillary services to energy arbitrage.

The transition to energy arbitrage

As the DC market becomes saturated into 2023 returns are set to fall further. DC revenues are likely to continue to decline until a level where energy arbitrage returns become more attractive on a risk adjusted basis.

That means DC revenues at a significant discount to energy arbitrage, given the risk capital and trading & optimisation overheads required to extract value from BESS asset optimisation across Day-Ahead & Within-Day markets and real time dispatch in the Balancing Mechanism (BM).

This represents a structural transition in the BESS revenue stack across the next 1 – 2 years. BESS operators will still dynamically optimise across DC, FFR, wholesale & BM revenue streams going forward. But energy arbitrage revenues are set to anchor the revenue stack & drive BESS asset value.

This energy arbitrage dependence will also ‘sort the sheep from the goats’ amongst the battery optimisers. Achieving average returns from an ancillary service focused strategy is relatively straightforward. Harvesting energy arbitrage returns across the BESS revenue stack requires strong trading & optimisation expertise capabilities.

The Balancing Mechanism will be a key driver of BESS returns

To date BM revenues have made a relatively minor contribution to the BESS revenue stack. This has been due to a combination of:

- Strong ancillary service returns (from DC / FFR)

- Many BESS optimisers not being fully set up to access BM value

- Optimisers pursuing a NIV chasing strategy targeting cash out prices as an alternative to the BM (a strategy increasingly undermined as BESS capacity grows).

All three drivers are changing fast, increasing value focus on the BM.

BM revenues are to an extent stackable with DC (e.g. using BM bids & offers to manage battery State of Energy). This has seen more BM activity emerge in 2022 despite strong DC returns.

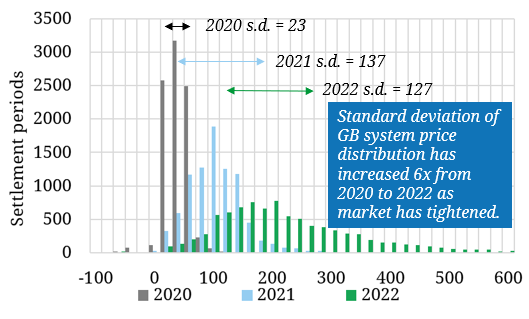

BM revenues are set to play a much more structural role in driving the BESS revenue stack as DC becomes saturated. The reason for this is illustrated in Chart 2 which shows the evolution of Summer system price distributions across 2020-22.

Put simply, energy arbitrage is about harvesting price spreads and volatility. Price volatility is at its most extreme in the BM given real time dispatch.

Chart 2 shows two important characteristics of BM price distributions that have emerged across the last 2 years:

- The standard deviation of BM price distributions has increased substantially i.e. prices have become much more volatile

- Prices are becoming more asymmetric to the upside i.e. there are very valuable discharge opportunities in the BM for BESS assets.

This combination of volatile and asymmetric BM prices presents significant value upside for BESS assets. For example offers can be placed in the BM to monetise high value discharge when the system is short or BESS can be bid down in the BM against pre-contracted wholesale positions.

BM revenues for BESS assets are complicated but are a key part of the revenue stack underpinning a viable investment case.

Gaining BESS investment edge

The saturation of DC (& FFR) markets & transition to energy arbitrage means the battery investment landscape is about to get more complex. Wholesale & BM returns for BESS assets are strong, but value capture is structurally different from ancillary service revenues.

Focusing on the evolution of ancillary revenues when analysing a BESS asset investment case is a bit like trying to drive a car through the rear view mirror.

Wholesale & BM returns will underpin the viability of battery investments going forward. This will open up stronger value differentiation across:

- battery optimisers, based on their trading & optimisation, data analytics & systems capabilities

- consultants analysing BESS revenue stacks, based on their commercial experience, storage modelling & data capabilities.

There is an enormous growth opportunity for BESS investors, but value capture depends on a robust capability to tackle energy arbitrage revenues.

Timera Battery Service launch

At Timera, our analysis of BESS assets is built on a team with extensive storage modelling, market analysis and commercial trading & optimisation expertise. We have a unique stochastic BESS asset valuation model that has supported many of Europe’s leading BESS investors develop and acquire capacity.

We have recently launched a GB battery investment subscription service. This covers a Battery Investment Tool with quarterly updated BESS revenue stack projections to 2050, a detailed bi-annual Report on battery value drivers and direct access to our team of storage experts. It is also competitively priced.

Click here to download a brochure if you are interested in details of the service.