Today we’re introducing a new form of content – a ‘Feature Light’ article, based around a single chart but with more extended analysis than our Snapshot.

“The ‘emergency’ nature of regas development means the majority of capacity is yet to be sold”

Europe is embarking on one of the most rapid gas infrastructure build outs in its history. Independence from Russian gas can only be achieved via much higher LNG import volumes. And that requires the development of more regas terminal capacity.

Capacity to rise, utilisation to fall

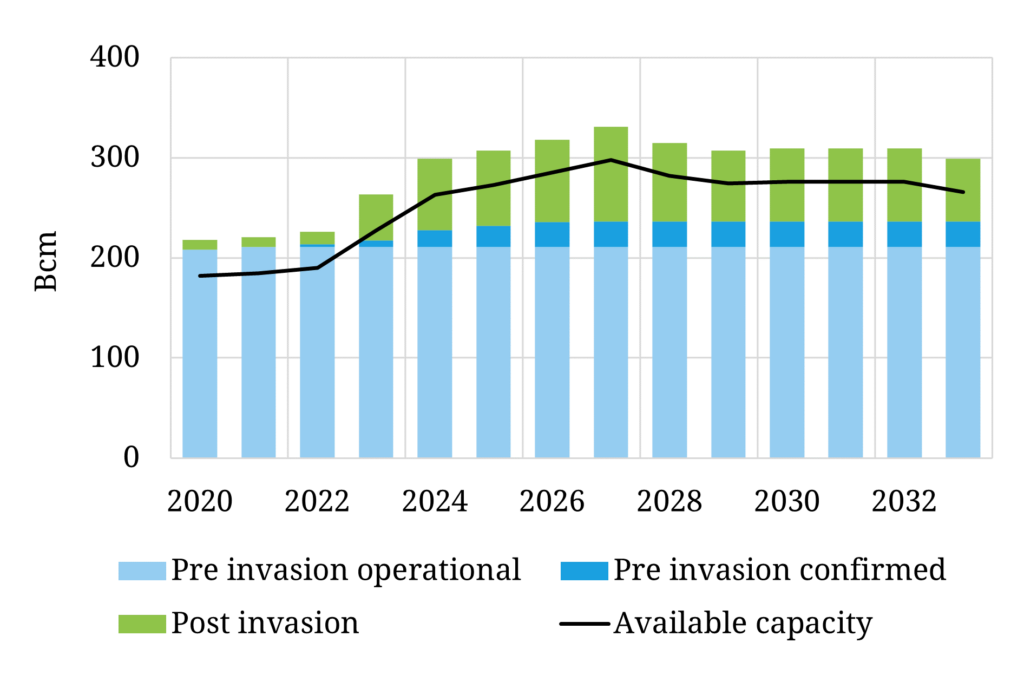

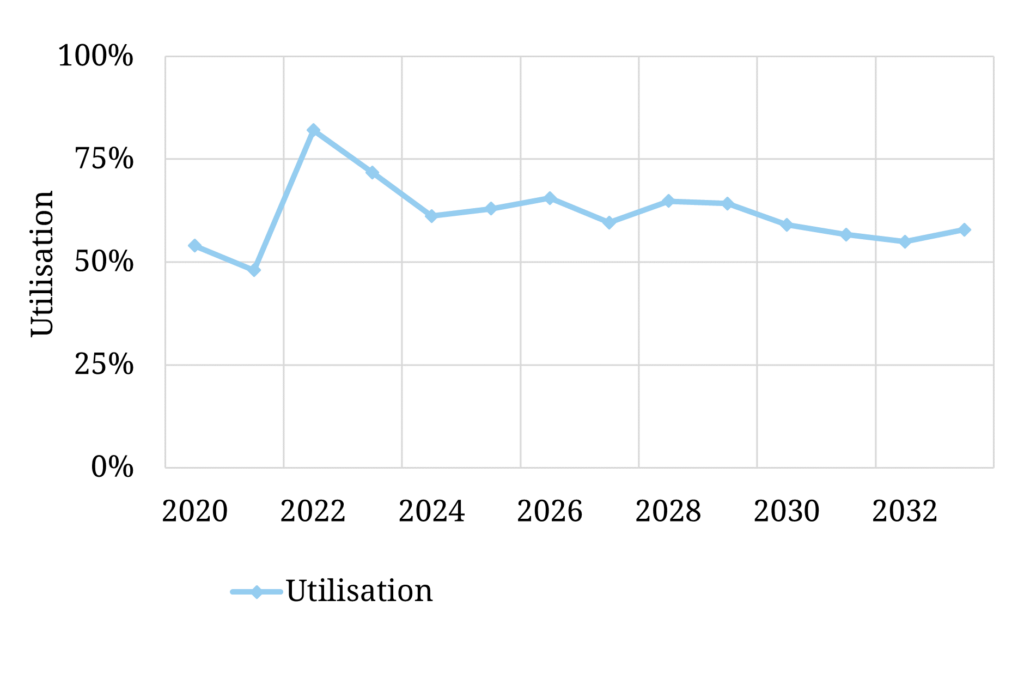

Chart 1 shows some outputs of our global gas market model. The top panel shows the profile of the increase in European regas capacity volumes. The bottom panel shows a scenario for regas capacity utilisation.

Europe nameplate regas capacity

Source: Timera Energy, LNG Unlimited

The chart shows rapid growth in regas capacity across the next 5 years (2023-37). Germany is leading the way on regas capacity growth, with 6 FSRUs and 3 onshore terminals under development, pushing operational capacity above 40 bcma by 2027.

Regas capacity growth is set to reduce European regas utilisation from the very high levels (80%+) triggered by Europe’s post invasion pivot from Russian gas to LNG imports. However we see regas utilisation at structurally higher levels than pre-crisis.

Our integrated global LNG & European gas market model shows regas utilisation falling until 2027, as new capacity outpaces import growth. However, utilisation stabilises in the late 2020s as regas capacity growth ends, but global LNG supply growth in the second half of this decade sees increased flows to Europe.

The big regas sale & 5 value drivers

Because of the ‘emergency’ nature of new regas terminal development, the majority of capacity is yet to be sold. This means large volumes of regas capacity will be sold across the next couple of years. German primary capacity from state owned FRSUs will be the largest source of new capacity, with auctions to allocate terminal capacity to be announced later in 2023.

One of our focus areas this year has been valuing regas capacity for clients across both a shorter term & longer term horizons. Capacity sales across the next 2-3 years will have a strong influence on which players dominate market access into North West Europe. However the risks of overpaying for regas capacity are also substantial e.g. as was discovered by many buyers after regas overbuild in the early 2000s.

In the table below we set out 5 considerations in valuing regas capacity.

Regas valuation may be complex but there is one clear conclusion from the surge in new capacity: the liquidity & sophistication of the secondary market for regas capacity is set to increase substantially across the next 3-5 years.