When Russia slashed European gas exports in 2022, Europe’s regas terminal infrastructure suddenly became a critical focus for security of supply.

Russian pipeline supplies to Europe fell from around 30% of the European supply mix (pre Ukraine invasion) to around 5% in 2023. This drove a sharp pivot in European supply towards LNG and a recognition that regas capacity was inadequate, especially in markets that were most dependent on Russian gas (e.g. Germany & Italy).

The ensuing energy crisis saw a jump in regas utilisation, the emergence of significant bottlenecks (particularly accessing key continental NW European hubs) and a surge in the merchant value of regas capacity.

This shocked both policy makers and industry players into pursuing a wave of investment in new regas capacity (both FSRUs & fixed capacity).

In today’s article we use 4 charts to check in on European LNG imports, regas capacity utilisation and how the wave of new regas investment is impacting market price signals.

LNG imports at record levels

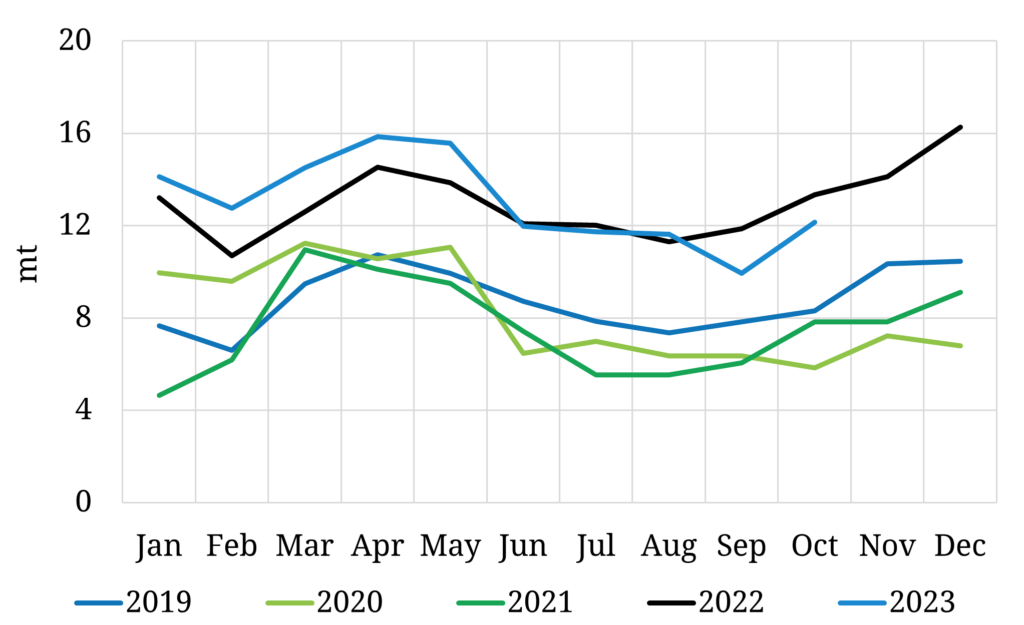

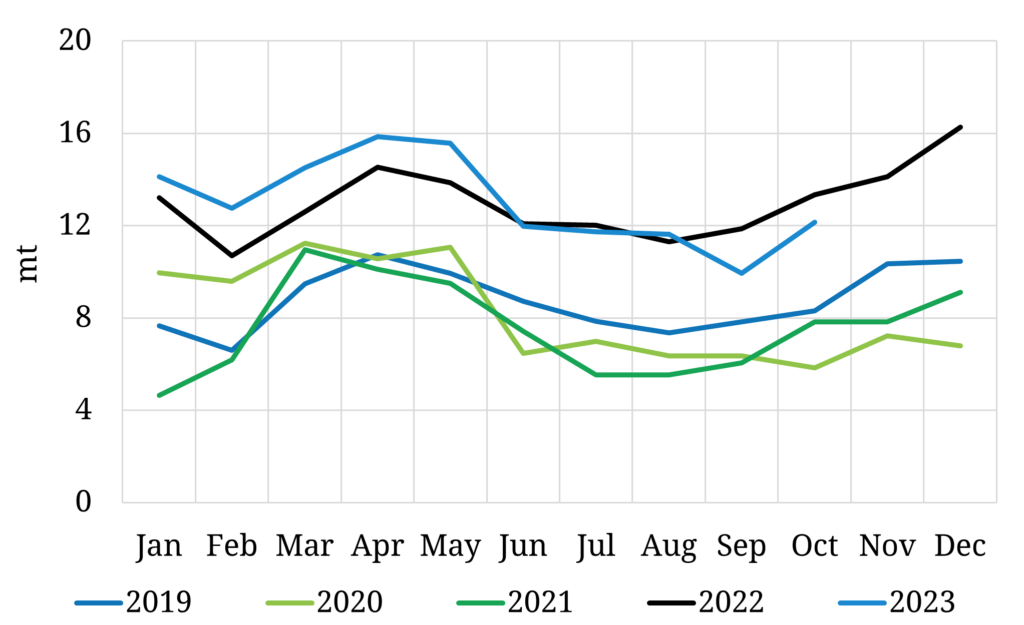

There was a step change increase in European LNG imports from Q2 2022 as a result of Russian supply cuts. This can be clearly seen in Chart 1.

Chart 1: European LNG imports across last 5 years

Source: Timera Energy, LNG Unlimited

Imported volumes have continued to grow in 2023, although deliveries across the summer have been dampened by very high European storage inventories and a boost in Asian LNG demand (partly in response to lower prices).

The combination of structurally higher volumes of LNG imports and security of supply concerns have spurred a frenzy of investment in new regas capacity, particularly in Germany. We put some numbers around this next.

Strong increase in regas capacity volumes

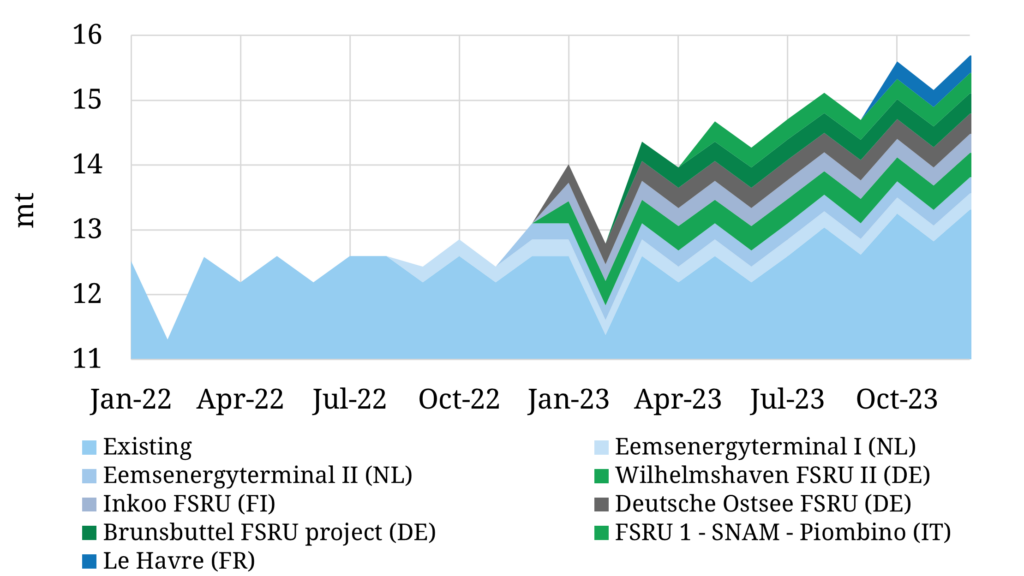

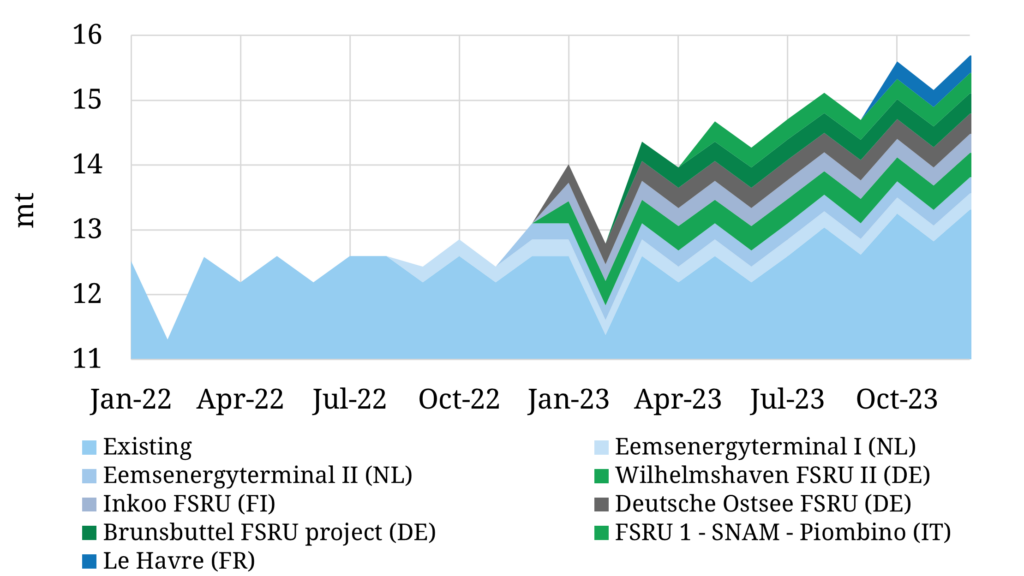

Europe’s aggregate regas capacity volume has increased around 20% since Oct 2022. The breakdown of new capacity coming online in shown in Chart 2.

Chart 2: Incremental European regas capacity volumes by terminal

Source: Timera Energy

The pace of the ramp up in regas capacity across the last 12 months has been enabled by:

- Crisis driven policy backing to enable aggressive expenditure

- The deployment of Floating Storage & Regas Units (FSRUs)

- A surge in demand for access to European LNG infrastructure.

This new wave of regas capacity is not over with several regas terminals still under construction.

The next piece of evidence that is interesting to explore is regas terminal utilisation.

Regas utilisation falling as capacity outpaces import growth

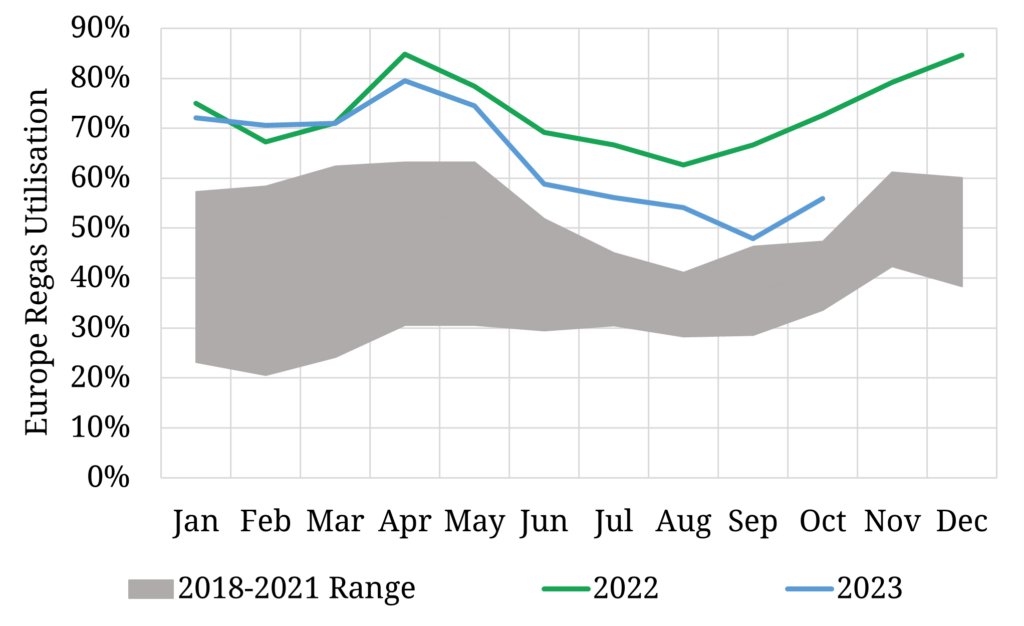

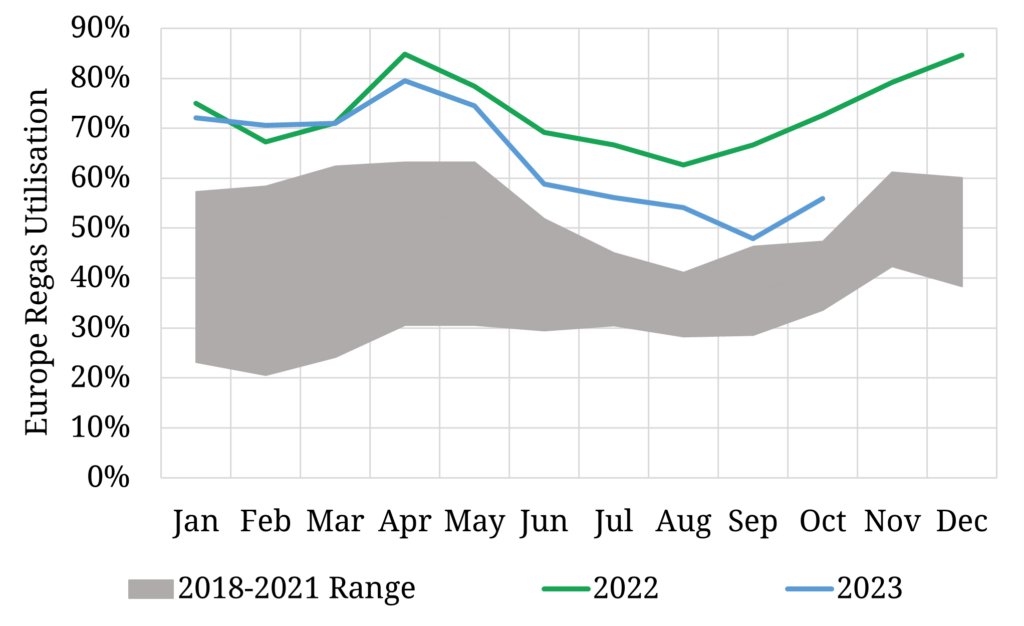

The regas capacity ramp up (Chart 2) is outpacing the rise in European LNG import volumes (Chart 1). This is causing a decline in aggregate regas terminal utilisation in 2023, from the very high levels reached during the crisis last year, as shown in Chart 3.

Chart 3: Regas capacity utilisation vs historical range

Source: Timera Energy, LNG Unlimited

In 2022, aggregate regas capacity utilisation was predominantly in the 70-80% range. Importantly, utilisation was much higher in continental NW European terminals with key access to liquid, premium hubs.

The impact of new capacity driving down aggregate utilisation can be seen from Q2 2023. Despite further regas capacity build out across the next 3 years, our modelling shows utilisation remaining above pre crisis levels of 30-50% (but below the 73% average seen in 2022). Utilisation is supported by a large ramp up in global LNG supply volumes (2025-29) as well as the ongoing erosion of domestic European gas production and pipeline imports. .

So what does all this mean for market prices?

Market price signals reflect easing in regas constraints

Regas capacity utilisation is a key driver of the difference between European hub prices (e.g. TTF) and the price of LNG on the water (the DES NW Europe LNG price). Major regas constraints in 2022 caused DES NWE LNG prices to plunge to a steep discount to TTF (above 20 $/mmbtu in Q3).

The ramp up of new regas capacity has seen a normalisation of this spread across H1 2023 as shown in Chart 4.

Chart 4: DES NWE LNG prices

Source: Spark Commodities

Market prices are now consistent with an unconstrained access regime for LNG cargoes into Europe. Under these conditions the DES NWE vs TTF price spread reflects the variable cost of marginal regas terminal throughput.

The easing of regas constraints alongside pipeline constraint debottlenecking has also normalised the price spreads across European hubs, after substantial divergence through 2022.

Implications for regas capacity value

European regas capacity is a key component of the toolkit for many large LNG portfolios, because it allows access to the deep physical liquidity at European hubs.

Structural regas capacity value varies significantly across Europe depending on (i) downstream hub accessed from terminal (i.e. liquidity, spread to TTF) (ii) levels of fixed & variable costs (iii) capacity flexibility (e.g. on slot scheduling, storage sendout).

As an example, strong bidding interest in recent German auctions reflects the German THE hub’s premium to TTF as well as multiple downstream parties after security of supply.

The blow out of the DES NWE vs TTF spread in 2022 (shown in Chart 4) drove a surge in the merchant value of regas capacity given it enabled market participants to capture the majority of this spread.

As the spread has normalised the value of regas slots has reverted back to three traditional drivers:

- Capacity utilisation levels (driven by market fundamentals)

- The extrinsic value of slots

- Portfolio value of access to European hubs.

Both these factors are driven by the interaction between regas slots and other components within LNG portfolios (e.g. supply, SPAs, time charters, downstream positions). Quantifying this portfolio value underpins a robust approach to pricing & bidding for regas capacity.

We explore regas capacity dynamics and valuation drivers in more detail in our latest Global Gas Report (part of our quarterly subscription service). Feel free to contact David Duncan (david.duncan@timera-energy.com) for a sample copy of the report if you are interested.