The energy transition is accelerating across Europe, driven by Covid recovery plans and net-zero 2050 targets. This is being reinforced by a rapidly evolving energy policy response to the Russian crisis.

“At least £30-40bn of flexible capacity investment is required by early 2030s”

Energy transition is a cornerstone of the UK government’s policy platform, with a broad focus on the environment, economy, jobs, affordability & inequality (e.g. via the Northern Powerhouse strategy). Policy direction here is to a large extent bipartisan.

The UK is the first country in Europe to set a net zero 2035 power sector emissions target. However it faces a major challenge to achieve this goal. Extreme UK power price volatility & system stress events across 2021-22 have highlighted the requirement for major investment in flexible capacity.

In today’s article we set out the UK’s flex deficit challenge and put numbers around the scale of flexible capacity investment required to decarbonise the UK power sector.

Thermal closures outpacing renewables

The UK is retiring coal, nuclear & gas capacity faster than anticipated. The final 4GW of coal is set to close by 2025. Nuclear retirements of 5GW are scheduled by 2030.

At least another 15GW of ageing gas-fired capacity is set to retire in the early 2030s unless owners repower or invest in major life extension capex. Life extension of gas plants requires an economic decarbonization solution which remains elusive.

Wind & solar will form the backbone of power generation in a decarbonised power system. The UK’s FiT/CfD scheme has been an effective mechanism to support roll out of renewable capacity. The challenge is now scaling deployment as fast as possible, particularly of offshore wind e.g. to achieve the 40GW by 2030 target.

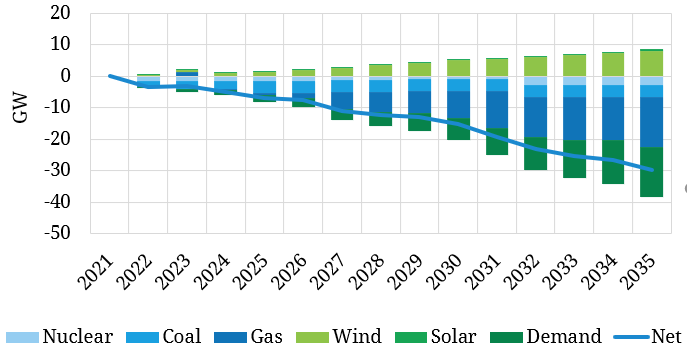

However security of supply standards across Europe are set based on derated capacity margins, with wind & solar making limited contributions. This drives the rapidly growing flexible capacity deficit illustrated in Chart 1.

The chart shows:

- projected UK wind & solar capacity build, derated at the government’s official capacity market derating factors (the green bars above the x-axis)

- projected closures of coal, nuclear & gas plants, also derated using CM factors (the blue bars below the x axis)

- projected incremental power demand from decarbonisation of other sectors e.g. transport, heat & industry (the dark green bars below the x-axis).

In summary, the UK needs at least another 15 GW of investment in flexible capacity by 2030, at least 30GW by 2035. That new capacity also needs to be emissions free by 2035 if the government’s decarbonisation target is to be met.

Wind & solar output requires balancing

Wind & solar penetration in the UK is still relatively low compared to a net zero system (25-30% of annual generation output depending on weather conditions). However there has been a sharp increase in the frequency & severity of network stress events since 2020.

These have partly been driven by a shortage of capacity & energy in periods of low wind & solar output. There have also been major frequency and inertia issues in periods of high renewable penetration and inadequate spinning thermal reserve.

As wind & solar penetration increases fast, there is a big challenge in balancing large swings in variable output as well as maintaining a stable network.

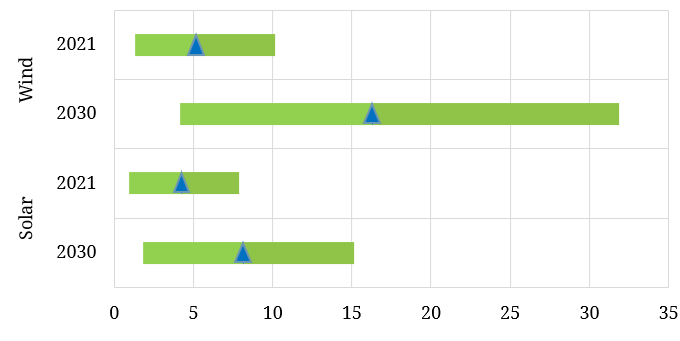

Chart 2 illustrates the scale of projected growth in within-day wind & solar output swings.

Chart 2: UK wind + solar intraday swing distributions (GW)

Source: Timera Energy stochastic power market model

The blue diamonds represent average intraday swings in wind & solar output in 2021 vs 2030. The green bars represent the 5th to 95th percentile range of intraday swing distributions.

By 2030, wind & solar output is set to swing by up to 40GW intraday, against a projected peak demand of around 75GW. These swings in output are frequent and can happen in a matter of minutes.

Maintaining security of supply and a stable network under these conditions entirely depends on adequate volumes of flexible capacity. As renewable output grows so do system balancing requirements, underpinning an ongoing need for investment in new flexibility.

Structural requirement for investment in flexible capacity

Our numbers in Chart 1 show a flexible capacity requirement of at least 15GW by 2030, and 30GW by 2035. We estimate at least £30-40 bn of new flex investment is required by the early 2030s to enable this.

In addition to the numbers above, another 14-17GW of residual gas capacity will require decarbonising to achieve the net-zero power sector emissions target by 2035. This can either be achieved by further capacity build, repowering (e.g. with CCUS) or via offsets.

The current menu of flexible capacity options includes:

- Batteries

- Emerging longer duration storage technologies e.g. compressed air, flow batteries

- Interconnectors (noting the challenges of correlated stress events across NW Europe)

- Demand side response (recognising limited flexible demand resource)

- Peakers (focus on engines, recognising requirement to decarbonise e.g. via hydrogen retrofitting)

- CCGT + CCUS (high CAPEX & likely limited to industrial clusters)

- Residual gas i.e. unabated gas dealt with temporarily via offsets.

If you want to see further analysis on the requirement and investment case for flexible assets you can download our briefing note by clicking here The case for UK power flex investment.