Welcome back to our first feature article for 2023. Upholding our long-standing tradition, we start the year with five surprises to watch for on your radar screens. Usual caveat: these are not forecasts or predictions but cover areas where we think it is worth challenging prevailing market consensus.

“There will be no energy security or transition without tackling this flexibility problem”

1. Policy response shocks

The policy landscape has never been more important for European energy markets. It has also never been more uncertain.

Europe faces an existential economic threat from high energy prices. A sharp recession in 2023 is not a surprise, it is the consensus base case.

The policy shock behind this recession could be just how large Europe’s fiscal & monetary response is to address the crisis. And the extent to which this stimulus response is focused on energy investment to tackle the twin challenges of energy security & decarbonisation.

2022 exposed a structural flexibility shortfall across European power & gas markets. There will be no energy security or transition without tackling this flexibility problem. Watch out for some major policy surprises to support investment in flexibility.

Key focus areas include: (i) battery investment (ii) thermal peaking capacity (iii) midstream gas constraints (iv) long duration storage support frameworks and (v) tangible policy support for hydrogen (could we see several GWs of European low carbon H2 production FIDs in 2023, albeit heavily subsidised?).

On the less optimistic side, watch out for major policy shocks or mistakes from panicked politicians. Some candidates here include: clumsy price caps driving volume shortages, poorly implemented windfall taxes undermining low carbon investor confidence & nationalistic policies that cause collective damage (e.g. grid operator isolation / separation).

2. Demand response surprise

The crux of Europe’s energy challenge across the next 3 years is limited supply response in both gas & power markets. Europe needs incremental LNG to replace Russian gas (historically around 30% of the supply mix), yet the lead times for new supply are historically 4-5 years. Europe also needs new power production capacity & flexibility, but this is constrained by both investment lead times & access to fuel.

These supply constraints are driving the key role of demand response both in (i) setting marginal prices and (ii) alleviating the parallel power & gas crises. Historically demand has been inelastic (unresponsive to price). But what if that were to materially change in 2023?

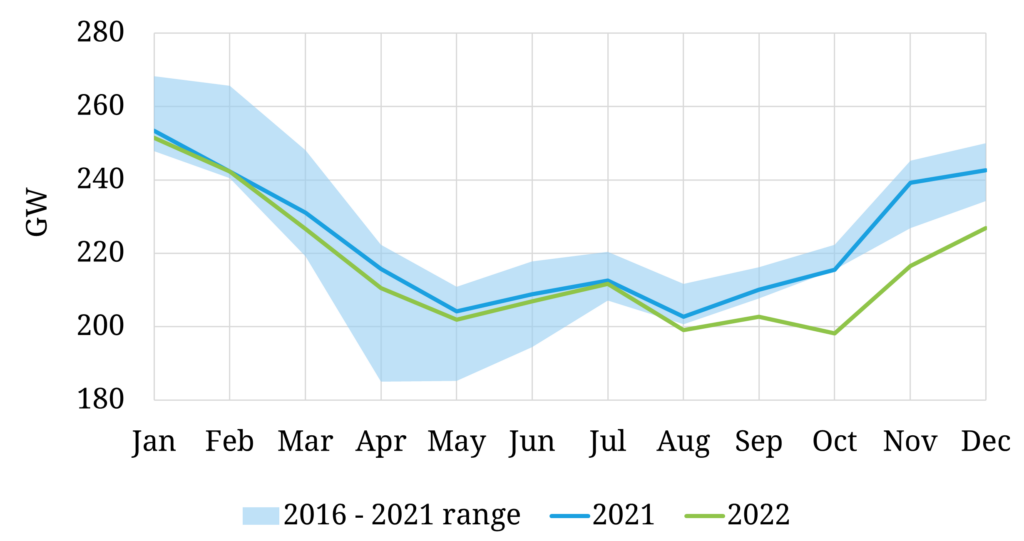

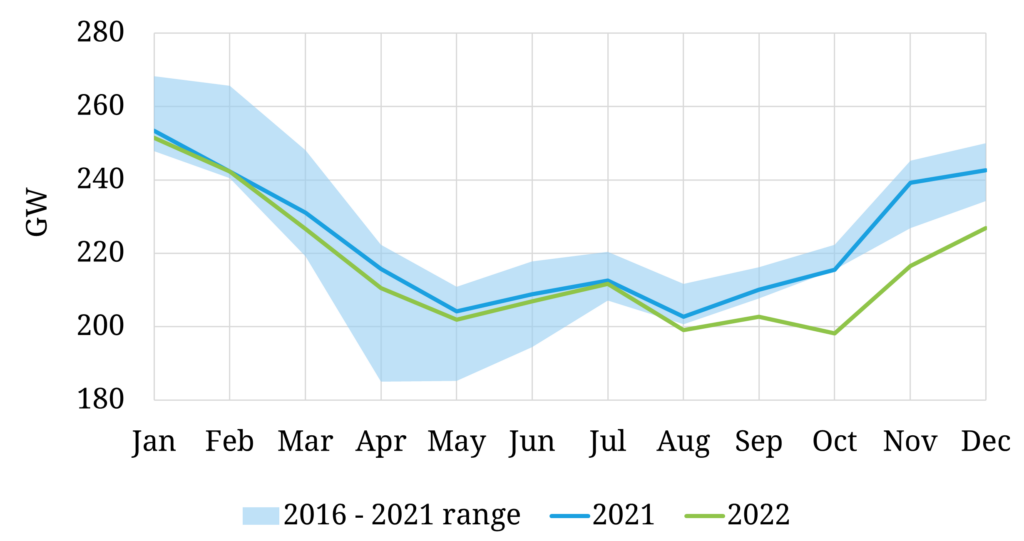

There was a significant reduction in both European gas & power demand in Q4 2022 versus 5 year averages. This is illustrated in Chart 1 which shows power demand across the 7 large Western European power markets (DE, FR, BE, NL, UK, IT & ES). However, this in part reflected unseasonably warm weather this winter driving low heating demand.

Chart 1: Power demand across 7 key European markets

Source: ENTSO-E, Timera Energy

What if in 2023 demand response in power & gas markets surpasses all expectations? The drivers behind this could be:

- Recession impact

- Permanent industrial demand destruction e.g. closure of chemical production/smelters

- Industrial & commercial adaptation to high prices e.g. via fuel switching, efficiency/process changes

- Residential & commercial consumer behavioural changes driven by prices, incentivisation schemes, education campaigns & smarter technology.

Some of these drivers may be transitory effects in 2023 but the other surprise could be the structural enduring impact of process & behavioural changes on demand.

History shows it is dangerous to underestimate the ability of humans to adapt when they face strong incentives to do so.

3. Chinese demand comes roaring back

China had a brutal 2022 in what was ironically the year of the tiger. Economic growth rapidly declined towards zero against a backdrop of weak manufacturing, negative retails sales growth and a major property bust. The Chinese Covid lockdown policy exacerbated the pain particularly across the second half of 2022.

The silver lining of this Chinese cloud was it materially dampened commodity demand from the world’s largest importer. From a European perspective an absence of Chinese spot LNG demand was a huge factor in surviving 2022. But weaker demand also extended across other key commodities such as oil, copper & iron ore.

Evidence began to emerge in Dec 2022 of a major policy pivot in China. This was focused on (i) easing of Covid lockdowns and (ii) monetary liquidity injection to support economic growth. What if the Chinese tiger turns up a year late and commodity demand surges in 2023?

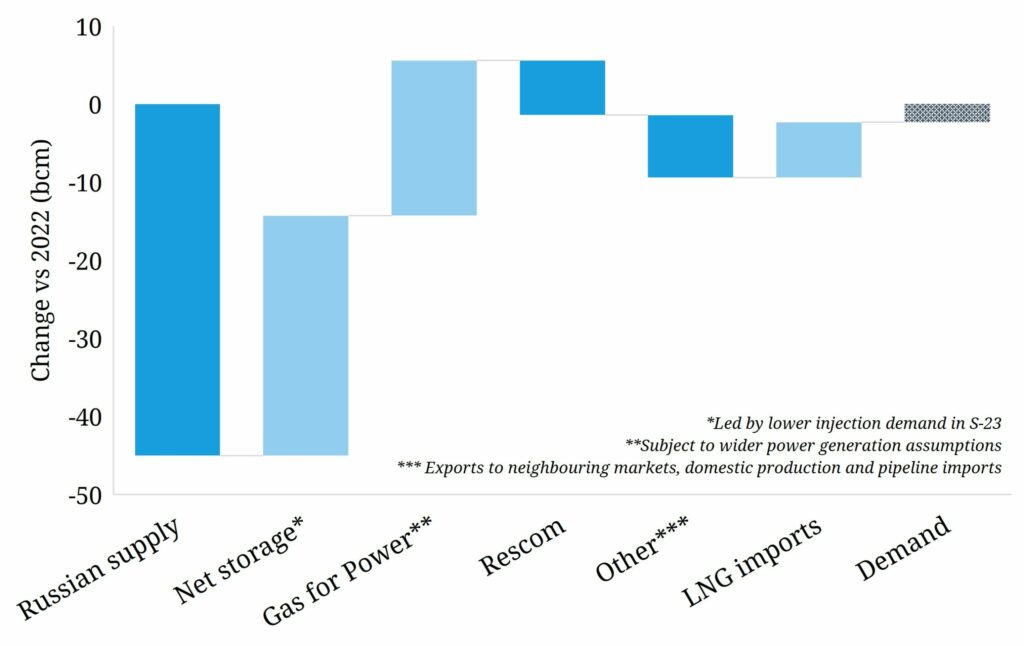

Europe is most exposed here from an LNG market perspective, with the region facing a likely 35-50 bcm reduction in Russian gas imports in 2023 vs 2022, as shown in Chart 2. Higher stocks exiting winter and a potential reduction in gas demand for power generation will offset a significant proportion of this gap. However, LNG imports and demand destruction/switching are going to have to run at similar levels (or higher) than 2022 in order to clear the European gas market.

Periods of direct LNG spot market competition for cargoes between Europe and China has the potential to drive price spikes and extreme volatility, especially given global LNG supply growth remains subdued in 2023. This volatility extends to key LNG market price spreads such as TTF vs JKM and TTF vs DES NW Europe. So far softer than expected European demand for LNG this month, alongside regas capacity buildout, has seen a substantial shift lower in TTF vs Asian benchmarks.

Broader Chinese driven commodity price inflation (e.g. across copper, nickel, lithium, rare earths & iron ore) could also be a major challenge for power infrastructure investors e.g. driving up capex across solar, wind & battery projects.

4. Price volatility shocks

The conflicting nature of our 2nd & 3rd surprises (demand response + Chinese growth) point to the risk of price volatility shocks in 2023. Energy markets are currently at the mercy of the unstable intersection of inelastic supply & demand curves (at least in the short term). Relatively small changes in volumes or volume expectations can drive big price moves.

In this environment some big power & gas price surprises could come in both directions this year.

Some examples of potential causes of upside European gas & power price shocks:

- Chinese LNG demand growth (see 3. above)

- Europe’s inability to replace Russian gas flows

- Further French nuclear issues

It is just as easy to construct potential downside price shock drivers:

- A material increase in Russian flows e.g. due to regime change (remember Russian can still flow over 150 bcma of gas via Ukraine & Belarus without Nordstream 1 or 2)

- Major demand response surprise (i.e. our surprise 2 above)

- A severe parallel European & Asian recession

This is an environment for quantifying & managing risk exposures rather than taking large directional bets on markets.

5. Energy business model pivots

A structural change in market conditions is often the catalyst for structural changes in company business models. 2022 saw liquidity & balance sheet shocks as large energy companies struggled to survive margin calls & market volatility (e.g. Uniper, Fortum & Axpo bailouts). Will 2023 see a surge in energy company restructuring and M&A activity?

Current market conditions are defined by extreme volatility, poor liquidity and high counterparty risk & collateral requirements. That is an environment that favours diversified asset backed portfolios, a physical vs financial trading focus and vertical integration.

Let’s consider some examples of companies likely to ‘expand & acquire’ in this environment:

- Large commodity traders with strong physical supply chain optimisation (e.g. Vitol, Trafigura, Gunvor, Glencore)

- Vertically integrated producers (e.g. Shell, BP, Total) & diversified upstream players (e.g. Exxon, Qatar, Chevron)

- Diversified power flex asset portfolios with strong optimisation & trading capabilities (e.g. large players such as Brookfield & Shell as well as fund backed plays such as Asterion, Aquila Capital)

- Established renewable portfolios that have cost of capital advantage to support scaling (e.g. Iberdrola, Orsted, GIG).

On the other side of this equation are companies that may ‘downsize or exit’:

- Independent retailers (targets for aggregation into larger generation backed portfolios)

- Smaller power flex developers with generic 3rd party market access (targets for aggregation by established flex portfolios & traders)

- Utility trading functions (set to shed staff to commodity traders & producers given utility capital & bonus constraints)

- New entrant LNG & gas market players (likely to exit or be aggregated by established players given lack of supply chain footprint)

- Smaller or more financially focused traders (likely to exit or be aggregated).

One of the surprises of the year may be just how much energy companies & business models evolve to adapt to changing market conditions.

We wish you all the best in navigating these (& many more) surprises in 2023!

Timera is recruiting

As the energy transition and focus on flexibility gathers pace, we are seeing a strong increase in client demand for our services. As a result we are actively looking to expand our team by recruiting Analysts with 1-4 years experience.

Click here for more details on the roles we are looking to fill:

- Analyst – technical focus

- Analyst – commercial focus

If you are interested, please send a CV and brief covering note to recruitment@timera-energy.com.