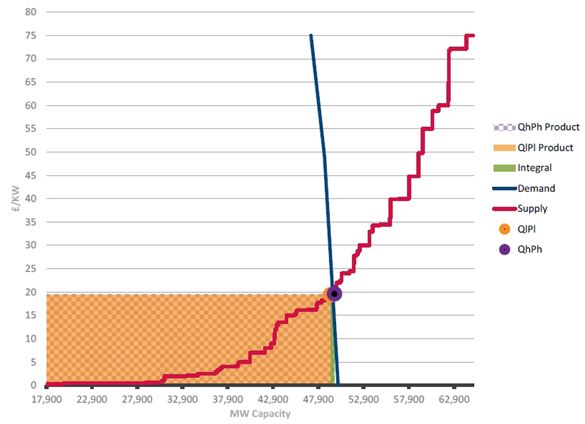

The first UK capacity auction was concluded just in time for Christmas, with 49.3 GW of capacity procured at a clearing price of 19.40 £/kW. The auction results gave little in the way of Christmas cheer for most UK generators, with the clearing price close to half that of market consensus expectations. However the first UK auction marks the start of an important transition of Europe’s larger power markets towards market based mechanisms to remunerate flexible capacity.

First auction headlines

The conditions that set up the downward price pressure in the auction stemmed from a relatively low government capacity target that saw an ‘oversupply’ of existing capacity. Existing capacity volume (54.9 GW) exceeded the procured volume in the auction (49.3 GW) by 5.6 GW. 2.8 GW of new capacity was successful in obtaining capacity agreements despite the low auction clearing price. But this meant 8.4 GW of older existing coal and CCGT plants failed to secure a capacity agreement, leaving plant owners in a precarious position.

The auction outcome is being heralded as a success by the government (‘capacity procured cheaply for the consumer’). But it is unclear whether the first auction has done anything to improve UK security of supply over the critical period of market tightness from 2015-18. In fact the outcome may have exposed one of the key weaknesses in the capacity market design, where capacity is procured on the basis of uncertain forecasts of conditions four years in advance. This leaves little ability for the capacity market to respond to market tightness over the next 3 years.

National Grid has published plenty of data on the 1st auction outcome. Rather than duplicating any of this analysis, our intention in this article is to focus on the key lessons learned from the auction and the implications for evolution of the UK power market.

How did the auction results match our expectations?

Prior to the 1st auction we published a ‘First Auction in Focus’ report. The following are excerpts from the summary section of this report which give a quick overview of our analysis ahead of the auction:

- Marginal plant: 3 key plant types are likely to drive the 1st auction outcome (older coal, older CCGT, low capex peakers).

- Pricing: Our analysis indicates a 1st auction capacity price around 30 £/kW if participants bid rationally to recover costs. But the 1st auction outcome will come down to EM (&CM) expectations (diverse range likely across players).

- Downside risk: The low 1st auction target and ‘Fear of Missing Out’ dynamics may lead to a lower clearing price than expected. These factors could easily combine to reduce the 1st auction clearing price by 5-10 £/kW.

- Older plant: 6-8 GW of older CCGT/coal to be unsuccessful in 1st auction → most of this uneconomic without capacity returns.

- Energy market impact: It’s likely a significant volume of older capacity is closed/mothballed as a result, supporting wholesale energy market generation margin recovery.

The auction outcome was broadly consistent with these expectations. However the downward price pressure dynamics were somewhat stronger than we had expected, resulting in a lower clearing price (19.40 £/kW) and higher level of unsuccessful older plant (8.4GW).

We also expected a higher volume of coal capacity to be successful in securing 3 year refurbishment agreements with a view to covering the costs of IED capex. The fact that a number of existing coal plants missed out on refurbishment agreements raises a query as to the economics of IED cost recovery if these plants are going to remain open in the 2020’s.

There was around 1 GW of new build peaking & unproven DSR capacity which was in line with our expectations. But we were surprised by two factors relating to new build CCGT:

- The Carrington CCGT project did not secure a capacity agreement despite already being under construction. Sunk cost dynamics were perhaps trumped by expectations of higher capacity returns in the future.

- One of the other new CCGT projects, Carlton Power’s Trafford plant (next door to the Carrington plant), was successful in the auction. This suggests that there may be some unique benefits to this project (e.g. low capex, synergies with the Carrington project construction) as well as one of the parties to the project taking a very optimistic view of the evolution of the wholesale energy market.

The success of the Trafford CCGT project raises an important question going forward. Was this an anomaly, or can we expect significant volumes of new build CCGTs at lower capacity prices (e.g. < 40 £/kW). We suspect the former. We also note that it is one thing to secure a capacity agreement, but this does not guarantee an ability to raise the capital, secure offtake contracts and construct and commission the plant.

Lessons from the auction results

While the specific bids of each plant have not been released, Grid has published a representation of the supply stack shown in Chart 1.