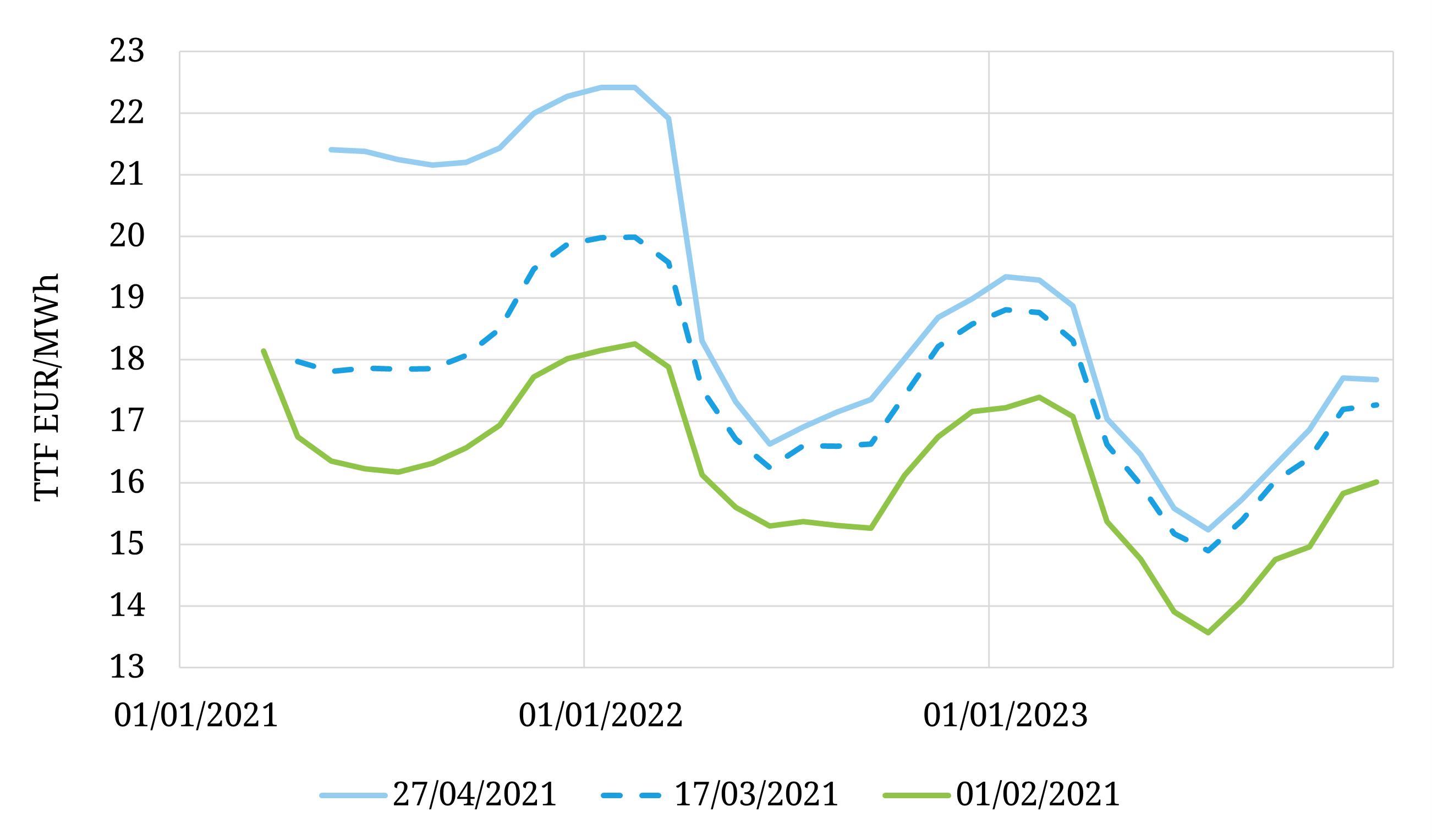

Since mid-March, the front of the TTF curve has shifted over 3 EUR/MWh higher. Carbon has contributed to a large proportion of this move (another ~6 EUR/t increase has moved the coal and lignite switching ranges ever higher), along with a cold start to April extending the storage withdrawal season, exacerbating the already lower than normal stock levels.

The immediate demand for gas in May (high injection demand, heavy Norwegian maintenance and an apparent lack of additional Russian capacity bookings to make up the shortfall) has driven an unusual curve shape, with May-21 pricing above Q3-21 and the summer-winter spread tightly compressing. This is followed by steep backwardation into 2022, where TTF is much lower in the coal switching ranges, pricing additional gas burn demand. This curve shape may change if European storages are unable to replenish this summer, and the global gas market continues to tighten.