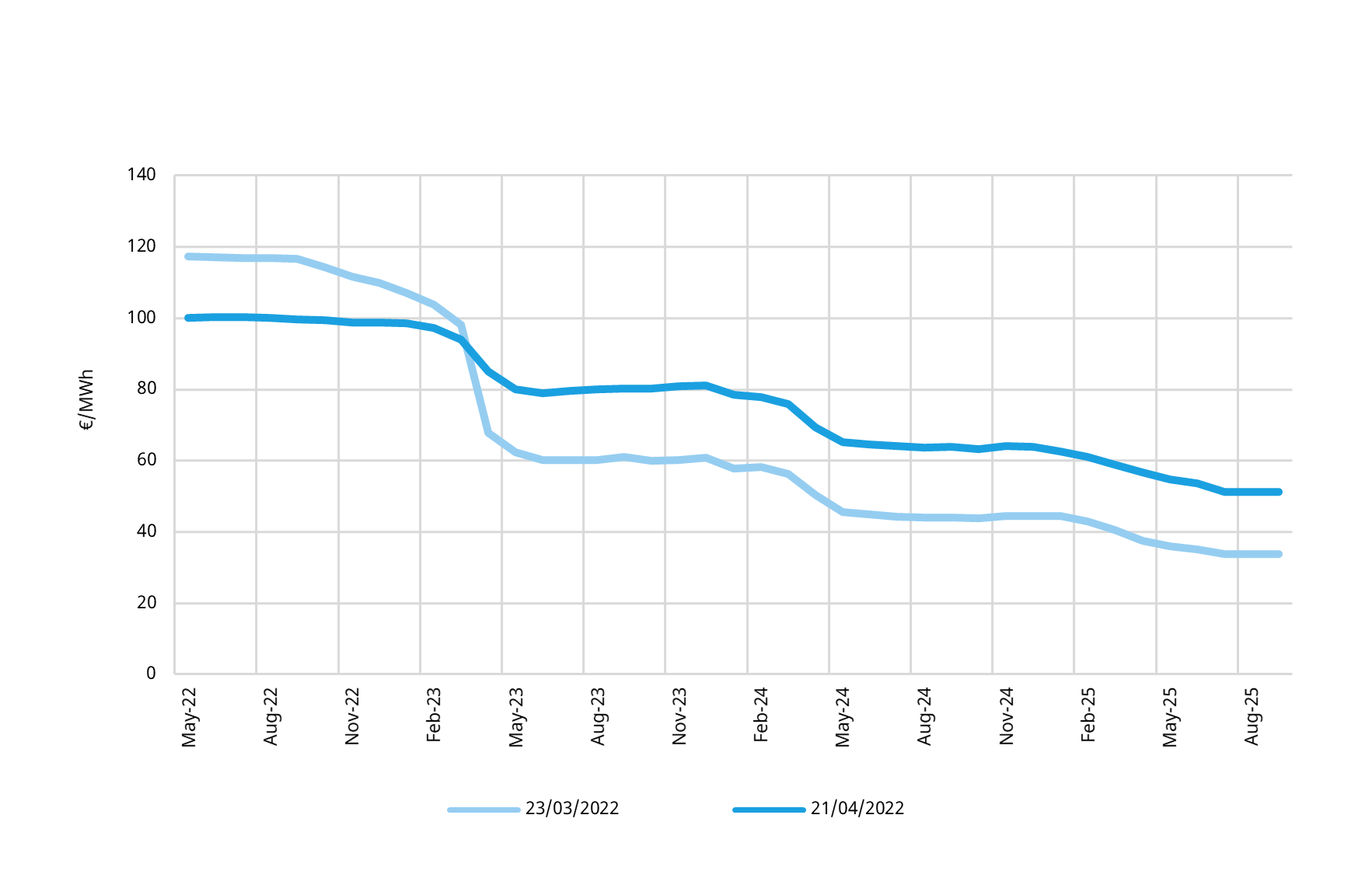

A month ago (23 Mar) Putin made his rather opaque demand for gas contract payments in ruble terms. This has attracted a lot of media headlines, but the chart shows a significant fall in 2022 forward TTF gas prices since the announcement (dark blue forward curve from yesterday’s close is well below light blue).

The trader’s setting the marginal price at TTF are the large buyers of Russian gas. They have a better view than anyone as to the risks associated with ruble payments. So far the market doesn’t look to be pricing in any imminent disruption of Russian gas supply despite clear EU ruling that paying in rubles would constitute a breach of sanctions.

What has attracted less attention is the very large move higher in the 2023-25 forward TTF prices across the last month. Coal & carbon prices are a little bit higher across this period, pulling up switching ranges. But this does not go close to explaining the size of the move.

The TTF curve looks to be pricing in more sustained supply tightness across at least the next 3 years. Over that horizon there is very little incremental global supply response available (Russia aside), given project lead times of 3-5 years. That effectively means re-contracting and re-routing of gas & LNG between counterparties, which is essentially a zero sum game of musical chairs from a global pricing perspective.