The T-4 UK capacity auction (for delivery 2026-27) cleared yesterday at a record price of 63 £/kW/yr. To put this price in context it is around 3 times the historical average level. This represents a huge boost in fixed revenue for successful new build projects which received 15 year capacity agreements.

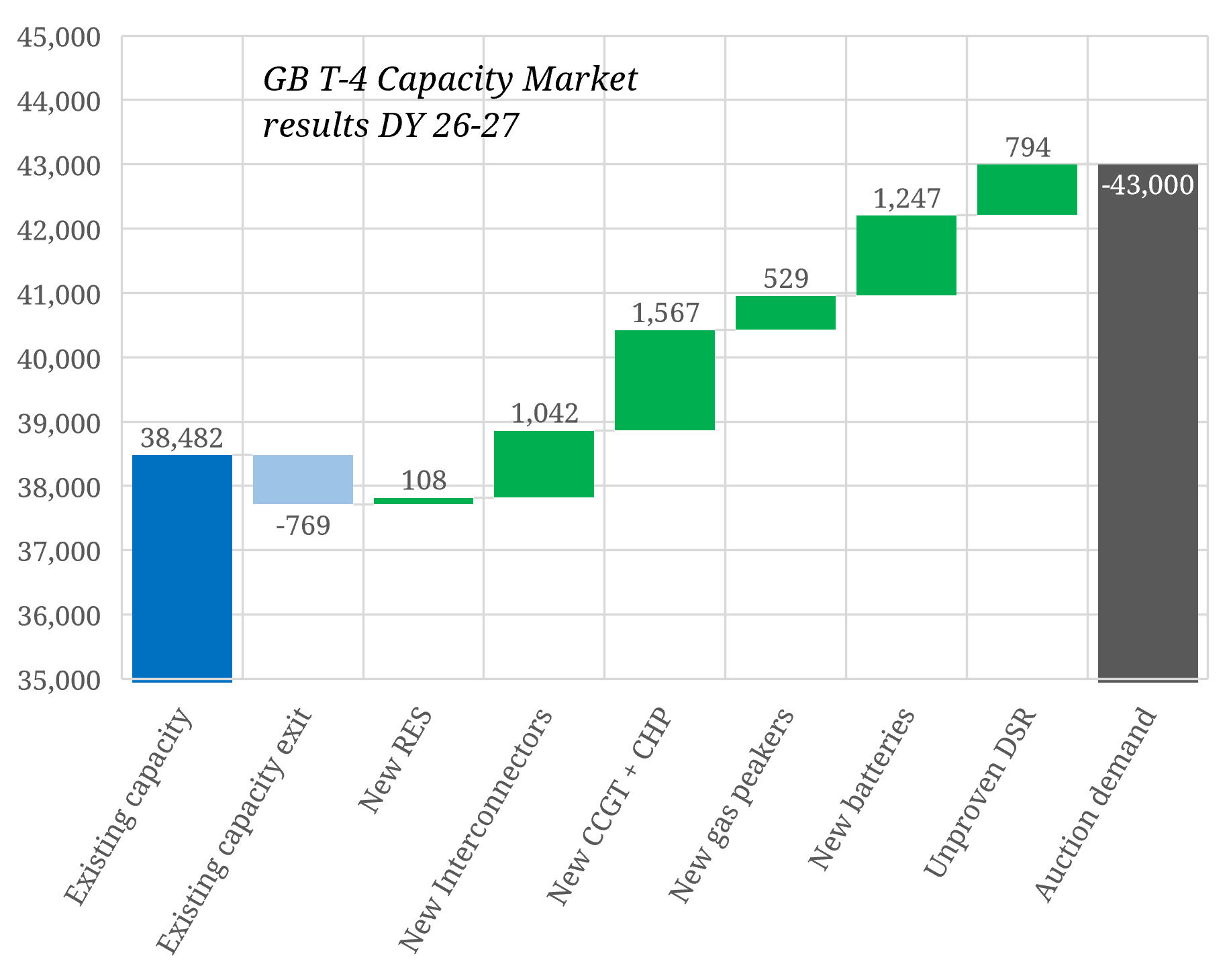

It was clear before the event that this was going to be a tight auction. There was a structural deficit of existing capacity (38.48 GW) vs the government set auction demand target (43.00 GW). This was exacerbated by an older CCGT (0.75 GW) exiting the auction early (South Humber 1).

Successful new capacity was dominated by a new CCGT (EPH’s Eggborough 1.55 GW project), batteries (1.25 GW), the Viking Interconnector (1.04 GW), DSR (0.79 GW) and gas engines (0.51 GW). The high auction price saw 352 MW of 4 hour duration batteries successful, benefiting from higher derating factors.

The big surprise in the auction was how high the offer price levels of new build capacity were. Historically there has been a strong overhang of gas engines, CCGTs and interconnectors above 30 £/kW/yr that have acted as strong price resistance. Our feature article on Mon will look at what is behind such a high clearing price, whether high prices are here to stay and what the impact is for flex asset investment cases.