Despite gas prices trending higher at European hubs, price volatility has fallen to its lowest level since gas market liberalisation. We have written previously about why we think it is brave to assume the ‘death’ of gas volatility in Europe. Yet the volatility expectations implied in current flexible gas asset values, such as swing and storage, suggest the market is pricing in a continuation of volatility at the current depressed levels. In this article we explore the nature of this decline in volatility.

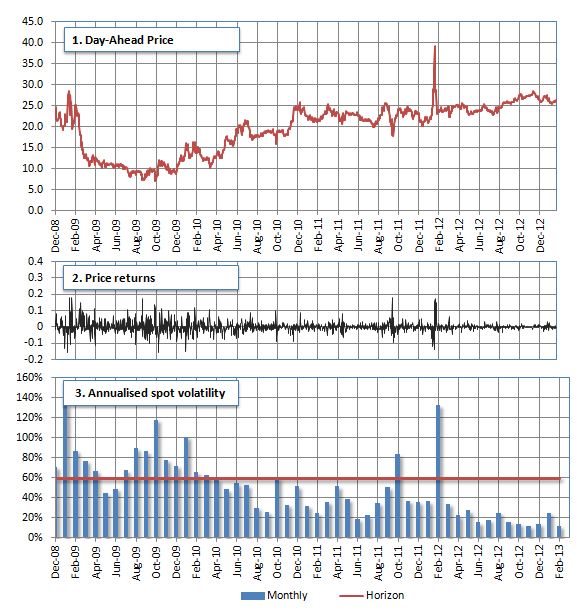

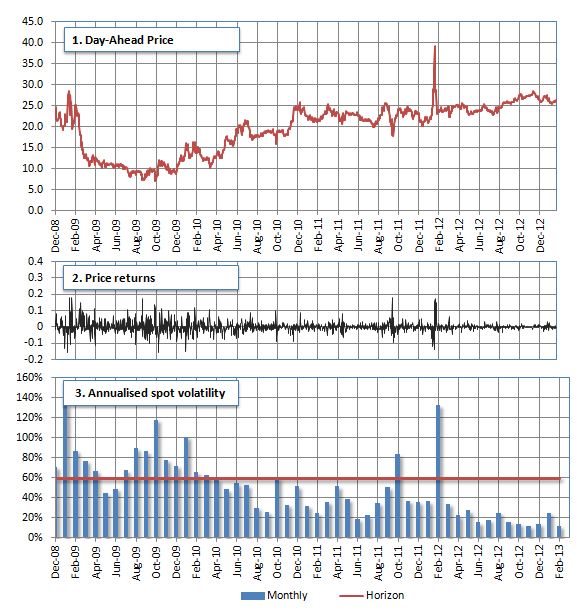

Chart 1 shows the absolute price, price returns and historic volatility for Dutch TTF day-ahead / weekend prices since the onset of the financial crisis in 2008.

Chart 1: TTF day-ahead / weekend prices, price returns and spot volatility

Source: LEBA, Timera Energy

TTF prices have been trending higher since the peak of the financial crisis. Price volatility on the other hand has been falling over the same period. Since the cold snap in February 2012, volatility has barely averaged 20%. Wind the clock back 5 years and market consensus would have considered the prospect of sustained volatility below 50% as almost implausible.

Volatility deconstruction

It is possible to deconstruct the decrease in volatility, shown in the bottom panel of Chart 1, into two factors:

- A clear reduction in the average day on day amplitude of price movements (returns) over last year, consistent with the inherent surplus flexibility within European gas portfolios during a period of soft and stable demand.

- A lack of extreme price spikes resulting from shocks to market fundamentals (e.g. major asset outages or whether sensitive demand uncertainty).

Both of these factors are currently playing an important role in determining individual and market consensus expectations of future volatility, which are being reflected in depressed market values for flexibility products and services.

However, it is useful to consider some of the drivers behind each factor. Supply and demand for gas flexibility is a complex function of the interaction between drivers including:

- Storage inventory levels

- Relative levels of gas hub to pipeline contract pricing

- Availability and pricing of flexible LNG cargos

- The relative cost of coal and gas fired generation

- Levels of intermittent renewable capacity and output

- Weather sensitive demand

- Elastic industrial gas and power demand

A number of these drivers are combining to cause subdued volatility, specifically, relatively mild weather, gas plant running at low load factors, ample storage levels and a general softening in gas demand due to weak economic growth.

Beware of fat tails

A simple extrapolation of current volatility levels into the future overlooks the complexity behind the drivers of volatility described above. Gas market pricing is subject to sharp jumps (or price spikes) given the inherent inelasticity of short term demand. Over the last 2 years the frequency of these jumps has been very low relative to historical levels.

But a risk unobserved is often a risk forgotten. In our view, subdued volatility has led to a degree of market complacency as to risk exposure from extreme events. In turn this has reduced the insurance value that companies place on flexibility products (i.e. protection against “fat tail” events). Gas suppliers are structurally short volatility. It may only take one market shock to cause a step change re-assessment of the value of flexible gas assets as a hedge against volatility.