Europe’s hydrogen ambitions were launched in earnest in 2020. It was a year of lofty targets and conceptual dreams set against a backdrop of Covid lockdowns.

An ambitious EU Hydrogen Strategy was announced, anchored by a 40GW by 2030 EU hydrogen production target. This has since spawned equally ambitious individual country target announcements across Europe.

The energy crisis this year has fuelled further policy momentum behind Europe’s transition from gas to hydrogen (H2). The policy push is now about energy security as well as decarbonisation. It is difficult to find a politician talking about crisis resolution without some reference to H2.

Behind this enthusiasm for the role that H2 may play in 10-20 years’ time, there are three material barriers inhibiting capital investment into H2 projects:

- Low carbon H2 is very expensive to produce

- There is very limited (if any) demand for low carbon H2 at unsubsidised prices

- Effective policy support mechanisms are not yet in place to bridge the cost gap between 1. and 2.

Today we throw the glossy powerpoint presentations away and look at the reality facing H2 investors. In doing so we draw on a broad range of work we have done supporting clients to configure, value and structure H2 projects across the last two years.

We take the UK as a case study because by most measures it is leading Europe in implementing practical H2 investment support measures. But many of the issues in the UK case study are relevant across Europe. We focus on investment support for electrolyser-based projects as those most likely to scale first. However many of the support mechanisms are also relevant for other forms of H2 production (e.g. SMR + CCUS).

The EU is separately launching a hydrogen investment support scheme based on carbon CfDs (CCfDs), which guarantee a price for carbon abated, we will come back to that in an article to follow.

UK hydrogen roadmap headlines

Let’s start with a brief summary of the UK’s hydrogen roadmap and support mechanisms.

Policy targets

- Initial target of 5GW by 2030 of low carbon H2 production capacity announced in 2020.

- Target doubled this year to 10 GW by 2030 (not technology specific).

Key support mechanisms

There are two key support mechanisms:

- The Net Zero Hydrogen Fund (NZHF) focused on kickstart funding of project development costs

- The Hydrogen Business Model (HBM) ongoing revenue support mechanism implemented via Low Carbon Hydrogen Agreements (LCHA); more on those below.

“This means there is now a mechanism to underpin H2 project investment cases and FID.”

Table 1 contains a brief summary of these.

Table 1: Key UK support measures for H2 investors

Applicants can apply for either HBM revenue support only or joint HBM revenue support and NZHF CAPEX support.

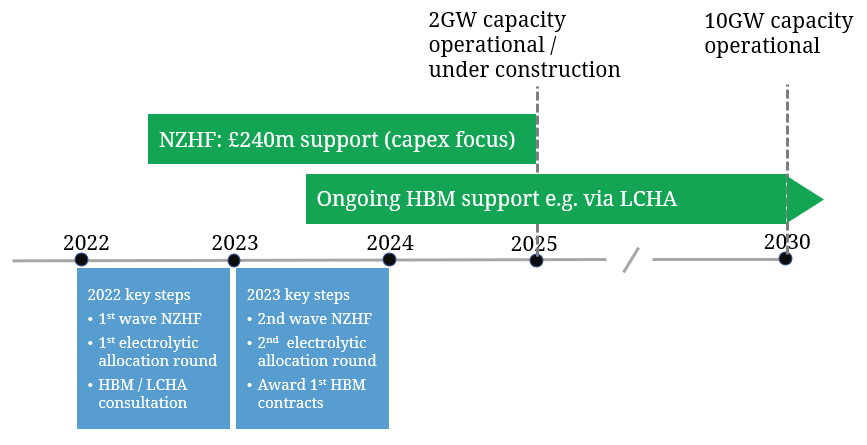

Diagram 1 shows a summary timeline for deployment of these support measures, with some details on allocation rounds happening in 2022-23.

Confused by a soup of acronyms yet? Let’s do a quick summary of where hydrogen investors stand given the packages above.

You can apply for upfront support via NZHF to fund development. Then HBM is the key mechanism that provides ongoing revenue support, with LCHA contracts enabling this. These LCHA contracts are our focus next.

Ongoing revenue support for H2 investors

Ongoing revenue support is critical for underpinning a viable investment case, whether it is a green or blue H2 project. It is this support that addresses the production cost gap.

The UK is focusing on a producer subsidy model (vs subsidising offtakers). LCHA contracts are the principle mechanism to enable this. The LCHA is constructed around (i) existing renewable CfD principles and (ii) an assumption that gas is the primary alternative fuel being displaced by H2.

The LCHA aims to address two key risks faced by H2 producers:

- H2 price risk – how can investors ensure adequate payment per unit of H2 produced.

- Volume risk – how can investors ensure they can sell adequate H2 volume to underpin a viable return.

The specific details of the LCHA mechanism are still being refined. This is effectively happening via real time investor input and negotiation in parallel to the launching of allocation rounds. But the UK government has provided guidance on its intended LCHA structure which leans heavily on the existing low carbon CfD structure.

How does the LCHA support investors?

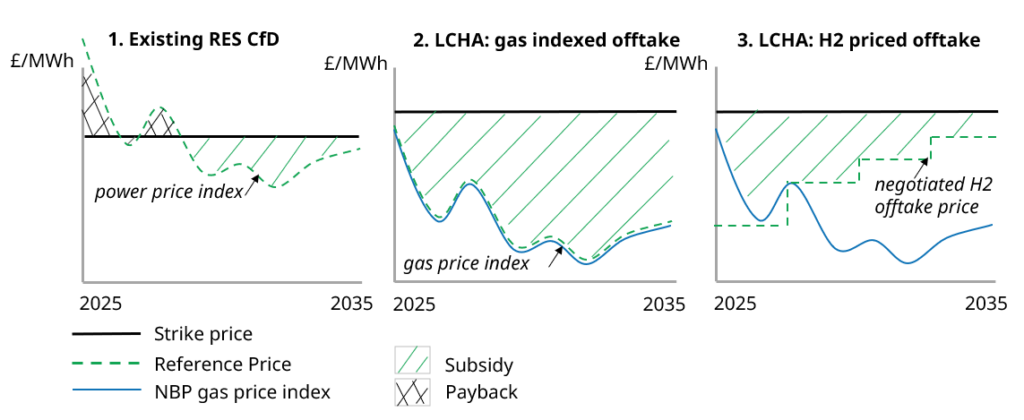

The existing renewable CfD mechanism is structured around a Strike Price reflecting the long run average revenue required to support a viable return on investment. The reference price for the CfD is then the wholesale market power price. If the Strike Price exceeds the reference power price the government reimburses the asset (or vice versa). This is illustrated in the Panel 1 of Diagram 2.

The problem with trying to adopt the renewable CfD structure for H2 projects is there is not yet any H2 market reference price (and there is unlikely to be a liquid reference for many years). So the reference price for the LCHA structure is instead the project’s ‘Achieved Sales Price’ for H2 (i.e. the price paid by the offtaker).

The bilateral negotiated nature of this Achieved Sales Price (vs an objective market benchmark) creates considerable opportunities for investors to game the mechanism to maximise support payments. To try and address this, the LCHA design sets a floor on the reference price at the level of a front month NBP gas price index.

Take an example where an electrolyser project indexes the sales price of a H2 offtake contract to this NBP price index. This will then result in support payments shown by the shaded area of Panel 2 in Diagram 2. This in theory maximises the LCHA subsidy pay-out but there is another layer to consider.

Long term reference price linkage to gas prices has some clear issues given the relationship between hydrogen prices and gas prices is tenuous at best. The government has made it clear that it is aiming to also introduce clear incentives for H2 producers to negotiate higher H2 sales prices (e.g. as demand for low carbon H2 increases over time).

The aim here is to break the link between the LCHA support and gas prices and transition to a hydrogen driven price signal (albeit illiquid at first). This should also see subsidy support payments decline over time as a market for H2 offtake matures as illustrated in Panel 3 of Diagram 2.

The other important aspect of the LCHA structure is that support will vary based on production volumes. The LCHA is negotiated and signed based on a defined production volume. Any excess production above this volume can be sold by the producer, but without receiving any subsidy. If production volumes decline below the negotiated level, then support ramps up (i.e. the strike price effectively increases). The aim here is mitigate producer volume risk but the exact mechanism is still being refined.

Where does this leave H2 investors?

You would be forgiven for thinking that all the above mechanisms achieve is to give investors a complicated headache. It’s actually more optimistic than that.

The UK has set out an initial cut of what will likely become Europe’s first viable mechanism to support scaling of investment in hydrogen. It is unclear how much this will cost the taxpayer or how much hydrogen production costs will come down as a result. But it gives investors a framework to work with.

The LCHA strike price provides negotiated recovery for (i) project construction capex & opex (ii) small scale H2 transport & storage and (iii) an allowed return on investment. These are the ingredients that can underpin a viable investment case, project financing and FID.

Plenty of uncertainty remains, but the way the mechanism evolves in practice will be driven initially by detailed project level negotiations in the early allocation rounds. And that creates a clear first mover advantage for early investors.