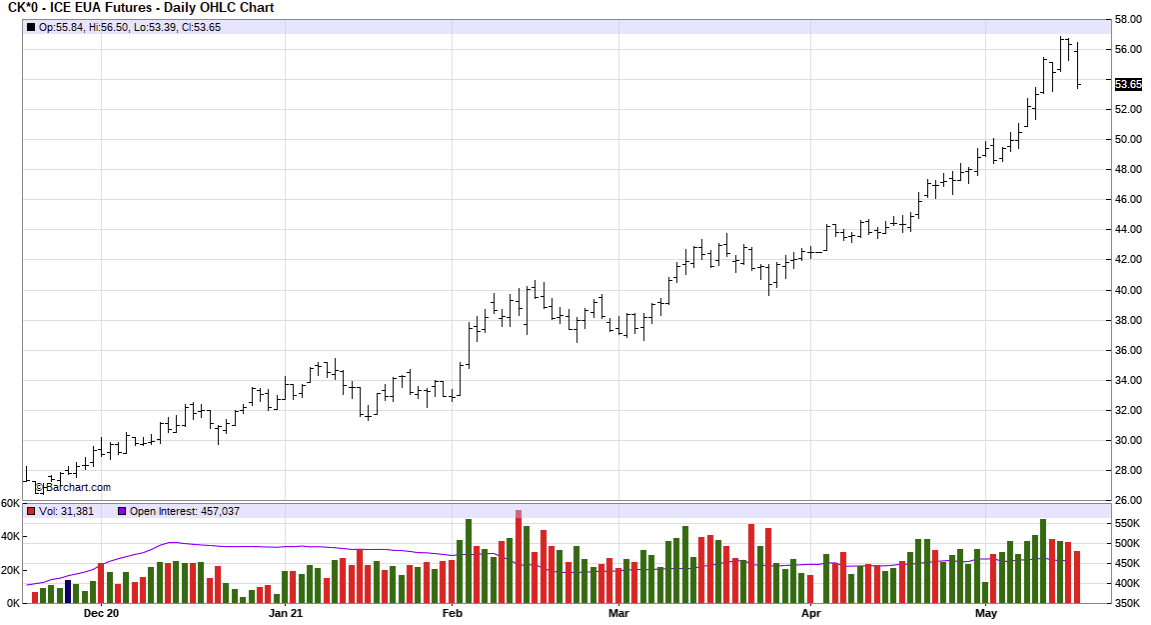

Carbon EUA prices have been in a structural uptrend since Europe stepped up its emissions targets and ‘green new deal’ policy response in 2020. Prices are up more than 130% over the last 6 months (as shown in the chart). But is there a growing risk of a major price correction?

Two factors that are set to provide some significant price resistance at current levels:

- The ‘in the moneyness’ of coal & lignite generators is declining on a forward basis as EUA prices rise, driving the unwinding of forward hedges and generator selling of EUAs.

- UK generators are set to sell EUAs they have been using as proxy hedges for carbon exposures and replace them with UK carbon allowances, as the UK ETS come online this month.

We become wary when we start hearing investment podcasts & message boards touting carbon as the ‘trade of the century’ as has been the case this month. This suggests there is a good deal of near term speculative froth driving what is at its core an emissions compliance focused market, with a history of heavy handed steering by regulators.