The path to decarbonisation of European power markets depends on the successful deployment of battery storage. There is currently no other form of low carbon flexibility that can scale at the pace required to support the rollout of wind & solar.

“Step forward to the later 2020s and the picture is likely to change… shifting investment dynamics in favour of longer duration batteries.”

However, the rapid scaling of battery volumes required, does not mean that this capacity will simply turn up as planned in a policy maker’s spreadsheet. There are some very real challenges battery investors are currently facing in building a viable investment case.

One of the key investment case drivers is battery duration (the amount of time it takes to discharge the battery). European battery investment to date has focused on 0.5 to 1.0 hour duration batteries. But cell costs are falling fast and battery value focus is shifting from frequency response to wholesale and balancing revenues. These factors are gradually improving the investment case for longer duration storage.

In today’s article we look at a UK power market case study of the revenue vs cost dynamics of three different battery durations (1 vs 2 vs 4 hours). We also consider some key factors that are helping battery investors gain an edge in building investment cases.

1 vs 2 vs 4 hr duration batteries

1 hour duration batteries are already being widely deployed across Europe, although still in relatively small scale versus policy ambition. There has been increasing investor interest this year in 2 hour duration batteries, but volumes installed remain low to date. Aside from a handful of specific network support cases, the economics of 4 hour duration batteries currently fall well short of investable.

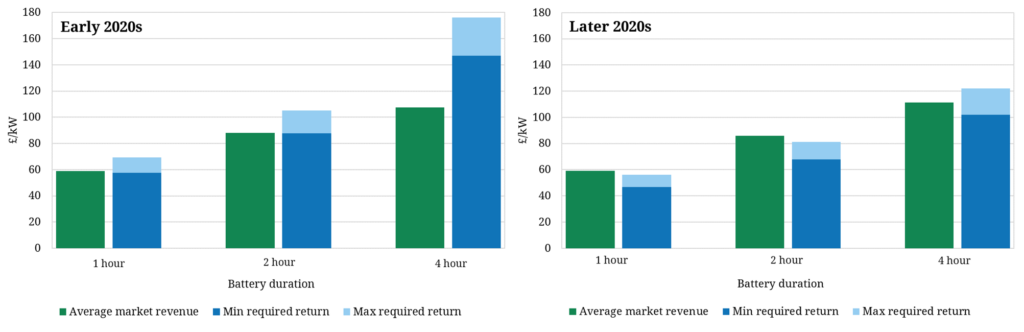

The left hand panel of Chart 1 provides an overview of UK grid connected battery economics by duration in the early 2020s.

The blue bars show the required real return to cover battery project capex (e.g. cells, balance of plant, installation & connection) and opex (e.g. operation & maintenance costs, network charges, business overheads and the cost of monetising battery value). The minimum to maximum range of required returns reflect the different sourcing costs & risk/return requirements of investors.

The green bars show average battery lifetime revenue (in real terms), consisting of wholesale & balancing mechanism revenues, ancillary revenues (e.g. frequency response and reactive power) and capacity payments.

The investment case for 1 hour duration batteries is currently marginal, but with the right project-specific advantages is investable. Reductions in cell costs mean that advantaged 2 hour duration battery projects are now also starting to make sense. But the extra cell related capex associated with 4 hour duration battery projects currently leaves a big gap between projected market revenues and required return.

Step forward to the later 2020s and the picture is likely to change significantly, levelling the playing field and shifting investment dynamics in favour of longer duration batteries. This is primarily driven by declining cell capex which reduces the relative cost disadvantage of extra duration. As the 2020s develops longer duration batteries are also set to benefit on the revenue side from widening intraday price shape.

How do we model battery value?

Storage valuation is one of the most challenging analytical tasks in energy markets. But it is a challenge that has been around for a long time. Hydro storage value, particularly pump hydro, has strong parallels with batteries. There are also close links to fast cycle gas storage value dynamics. These other storage assets have been effectively valued and optimised for many years. As long as the unique characteristics of batteries are accounted for (e.g. very fast cycling, shorter duration & degradation), the same valuation & monetisation techniques apply.

At Timera we have two of Europe’s leading energy storage valuation experts in Olly Spinks and Rosie Read. They are not academics or theoretical quants. Both of them have extensive industry experience of valuation, investment and practical monetisation of storage assets within energy trading functions.

The battery valuation techniques we use have been developed by Olly & Rosie to replicate the actual decisions that battery operators make to monetise flexibility value. Our stochastic battery storage optimisation model:

- Generates battery margin distributions from 500+ simulations of correlated wholesale power and balancing mechanism prices (e.g. 2020-50)

- Captures price uncertainty and a lack of perfect foresight in monetising value

- Optimises battery dispatch across ancillaries (e.g. FFR), day-ahead & within-day wholesale markets and the balancing mechanism (or cashout)

- Captures the physical & cost constraints of the battery (e.g. efficiency, speed, variable degradation costs)

So there is quite a bit of analytical capability ‘under the hood’ of the numbers shown in Chart 1.

5 ways to gain an edge with battery investment cases

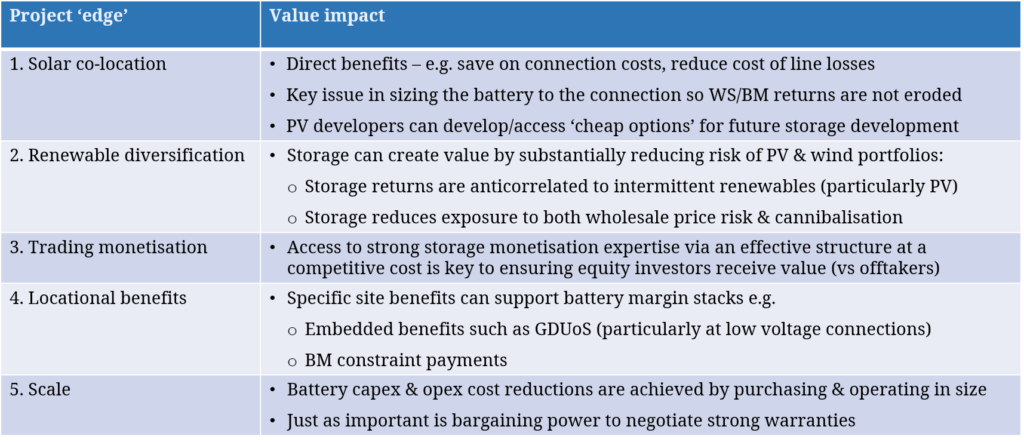

Chart 1 illustrates how battery investment case viability is currently still marginal. So how is it that hundreds of MW of UK batteries are passing Final Investment Decision? Some form of ‘edge’ or advantage is required at a project level.

We summarise 5 ways that individual battery projects are gaining that edge in the table below.

For many investors, even these specific advantages are not enough to currently support an investment case. Policy makers are becoming increasingly aware of this challenge across Europe. As a result we believe that policy support tailwinds for storage may evolve rapidly over the next 2 to 3 years in order to facilitate scaling of batteries at the rates required to decarbonise power markets.

So our parting recommendation on storage is to think ahead. Even if the numbers don’t work yet, look for options now that leave you well positioned to scale in 2 or 3 years time.