Welcome back to 2020! We will shortly be cutting over to a new website and blog page. This is part of a comprehensive Timera brand refresh currently in progress. This includes revised service lines, a new website, new publication format and a new blog layout.

As the year progresses we will be incorporating new blog content, drawing on a broader range of input from our expanding team. If you want to receive a weekly summary of new content in an email you can subscribe via the link on this page (it’s free!). You can also receive content as it is published via LinkedIn or Twitter feeds.

So without further ado, we start the year with our usual 5 surprises.

- Green New Deal goes global

Wind back the clock two years and ‘climate change’ was a taboo topic in US politics. That started to change with the Democrats winning a House majority in 2018. Then the concept of a ‘Green New Deal’ policy platform was born in 2019.

2020 is likely to be dominated by the US presidential election. All prominent Democrat candidates have adopted some form of the Green New Deal. This could mean that climate action is a central policy issue in the lead up to the election, particularly given such a stark contrast to Trump’s policy approach.

The US debate may be a catalyst for growing momentum behind the Green New Deal concept globally (even if the Democrats lose the election). For example Germany is already in the process of adopting its own version.

Our first surprise for 2020 is just how quickly this policy concept could spread. It is supported by three powerful tailwinds:

- A shifting public mood towards climate action, particularly in Europe

- A global transition in policy focus away from fiscal austerity towards fiscal expansion

- Very low interest rates and a tame inflation outlook (resulting in a historically low cost of capital).

Europe could be a particularly fertile source of surprise given a new and capable European Central Bank president (Christine Lagarde) who looks to be gearing up as a champion of fiscal expansion to fight the dual battles of economic weakness and climate change.

- Asian LNG demand recovers

2019 saw a big downside surprise in Asian LNG demand growth. Four of the ‘Big 5’ Asian buyers saw declining demand (vs 2018) and the demand growth for the 5th (China) halved. This has fuelled growing pessimism on demand growth in 2020.

Our second surprise for the year is that Asian LNG demand growth rebounds back towards 2018 levels. Weak economic growth played a significant role in driving soft LNG demand in 2019. US-China trade tensions were also an important factor.

A watered down trade deal was signed last week, at the same time that forward economic indicators have started to stabilise. There has also been a global ramp up in fiscal and monetary expansion across the last twelve months.

There are also some specific LNG market drivers that could support demand recovery. For example, issues with Japanese nuclear restarts and switching from coal to gas to improve air quality (e.g. Sth Korea, China). A cold snap in Q1 2020 could also significantly boost demand.

- Europe wakes up to the German capacity gap

Continental European power markets have lived through a decade of overcapacity as a result of lower than expected demand since the financial crisis. This has helped to contain power price levels and volatility.

That situation could be set to rapidly change over the next three years as a substantial volume of regulatory driven capacity closures are implemented. The German power market lies at the centre of what could be a transformational shift in European supply & demand balance.

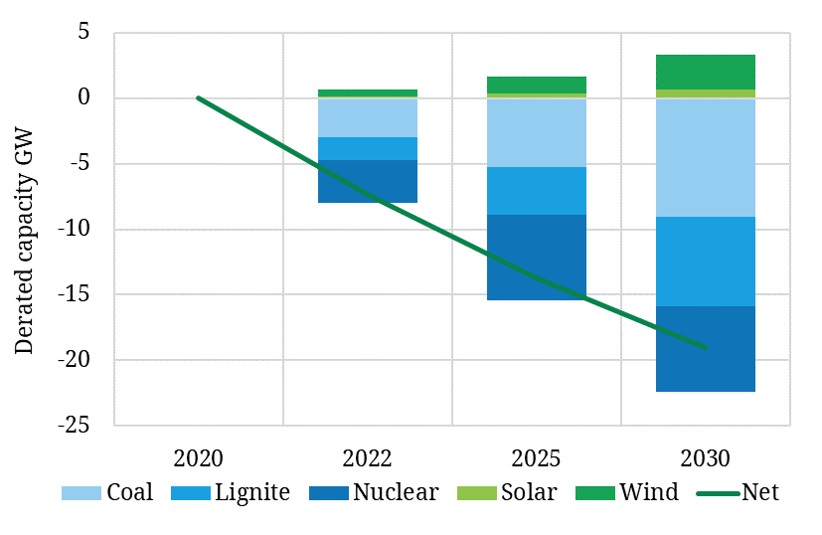

The official German policy line is that renewable build will keep pace with closing nuclear, coal & lignite capacity. The numbers tell a different story as illustrated in Chart 1 which shows derated capacity volumes of scheduled coal, lignite and nuclear closures versus derated new wind and solar build.