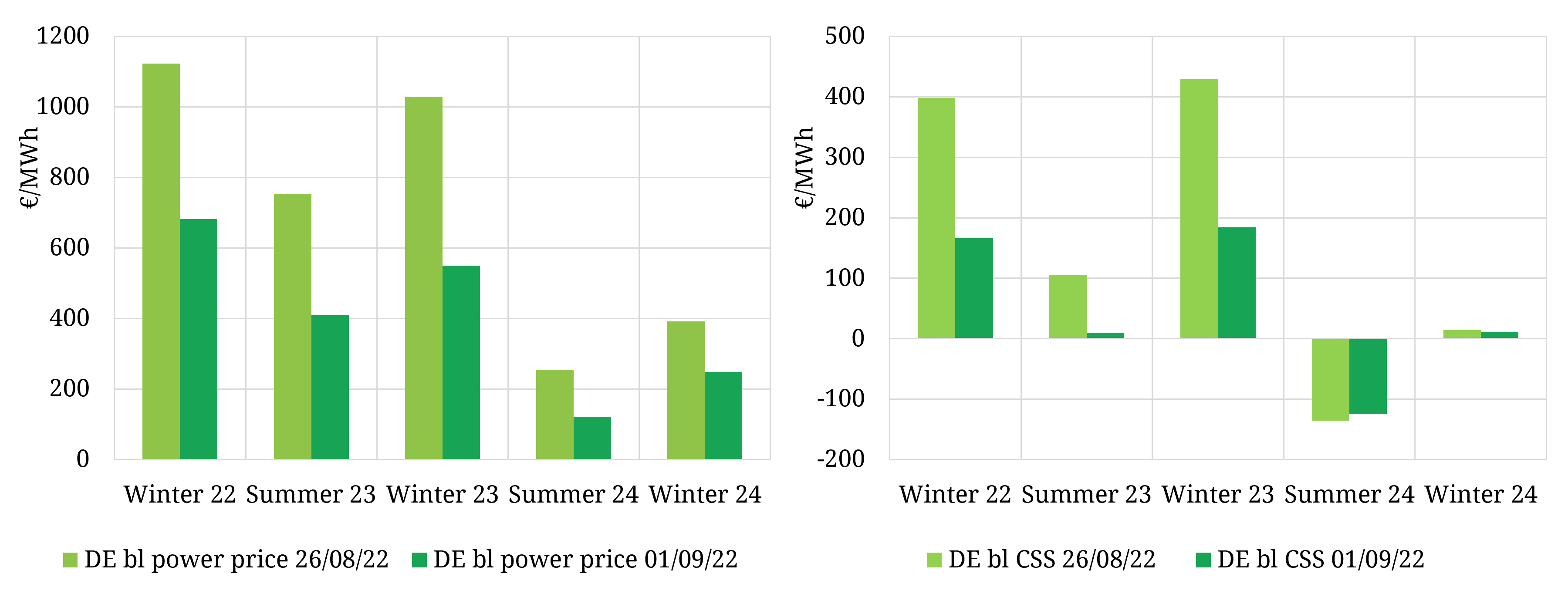

The European Union announced its intention to intervene in power markets to curb price rises a week ago. The left hand panel of the chart shows the resulting fall in German baseload forward power prices (40-50% across 2022-24). The right hand chart shows the decline in German spark spreads (CCGT margins).

Power & gas prices have surged across the summer, as markets price in an increasingly acute shortage of both power (electrons) and gas (molecules), given Russian supply cuts, low nuclear availability & low hydro volumes as we explain here.

These price rises are not driven by a ‘broken market’ or speculation. They are the result of a market hunting for price levels that will induce the required amount of demand destruction in order to clear.

What caused prices to plunge this week? The anticipation of a more concrete policy plan around how European power & gas demand will be rationed / reduced. This has caused the market to reassess the extent of price driven demand destruction required to clear. Price movements both up and down are exaggerated by very poor liquidity given extreme collateral and risk capacity constraints.

European politicians have bought themselves a bit of time to turn words into actions. The focus of their plan should be on volume intervention not price. Present a credible plan for demand reduction (e.g. via competitive bidding to reduce volumes) and prices will fall accordingly. Attempts at hasty redesign of market price signals will very likely result in volume shortages (otherwise known as supply cuts & blackouts).