Europe entered winter confronting the threat of gas & power supply cuts and price spikes. Policy makers scrambled to protect consumers. Energy companies did their best to protect portfolios.

“It is dangerous to assume we have seen the last twist in this crisis.”

Across the 4 weeks from mid Dec 2022 to mid Jan 2023 Europe’s energy crisis delivered its latest twist. Instead of spiking, gas & power prices slumped. Benchmark TTF forward gas prices for delivery across 2023-24 were cut in half, falling 40-60%.

The knock-on impact of this rapid decline was a textbook case study in why the European gas market is so important to broader energy market pricing. European power prices saw an associated decline as the variable cost of marginal gas generators fell. Pacific & Atlantic basin LNG prices also followed TTF south given Europe’s key role in anchoring global LNG prices.

What the …. happened? Let’s explore using 5 charts.

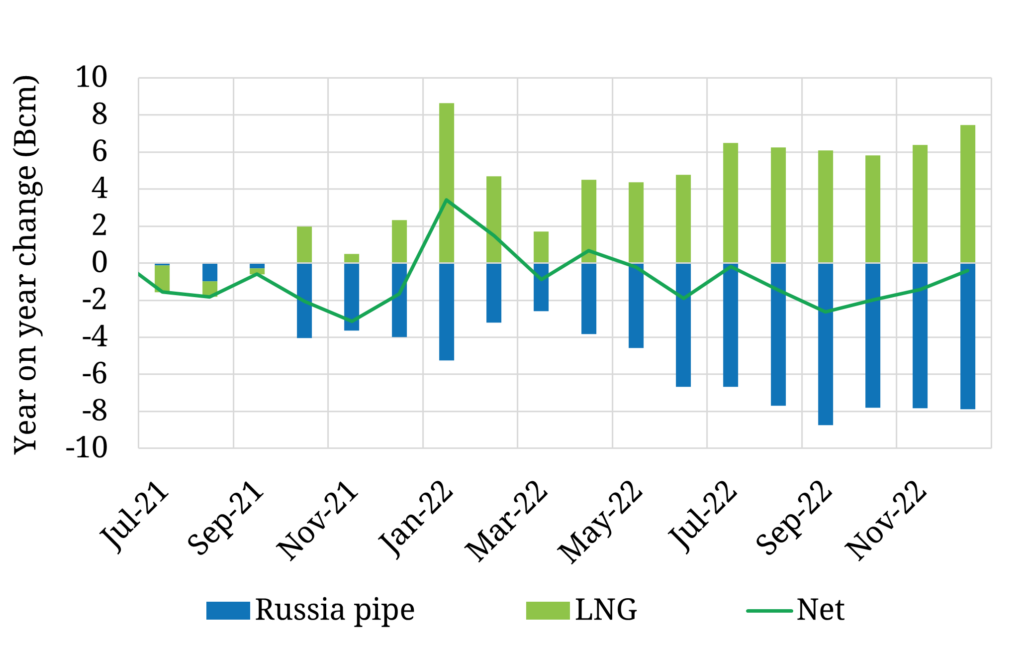

1. Record European LNG imports

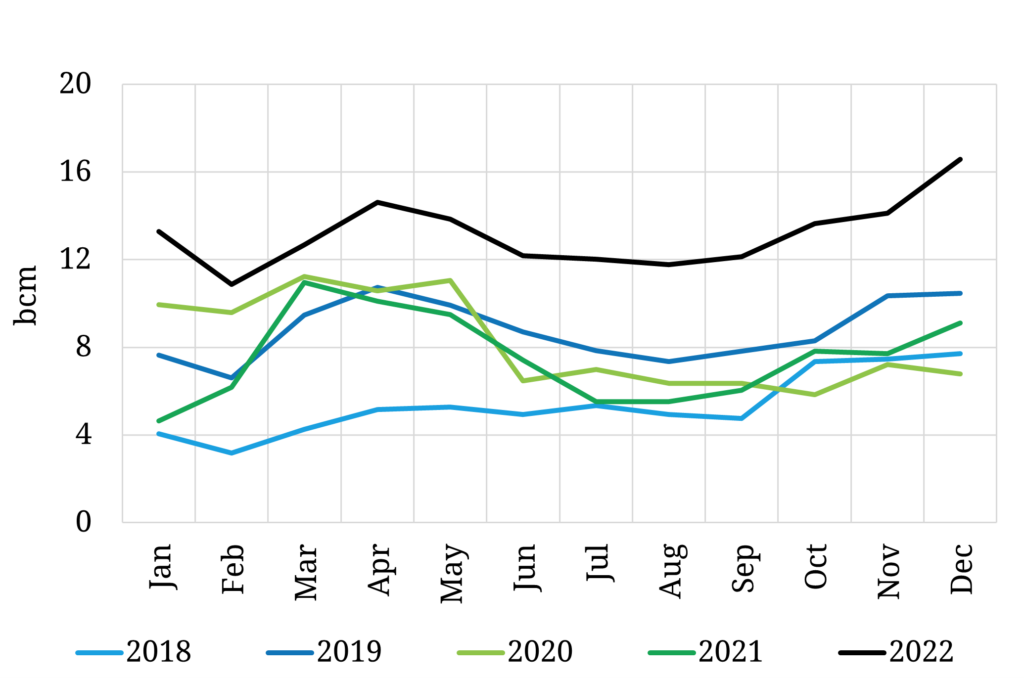

Europe is absorbing LNG like a sponge. LNG imports were up 74% in 2022 vs 2021, a huge increase as shown in the top panel of Chart 1. This went a long way to making up for the 2022 drop off in Russian pipeline supply volumes (excluding Turkstream) as shown in the bottom panel of Chart 1.

Chart 1: European LNG imports surge (top panel) vs Russian pipe flow declines (bottom panel)

European LNG imports

Source: Timera Energy, LNG Unlimited

Russia vs LNG supply to Europe

Source: Timera Energy, ENTSOG, LNG Unlimited

Incremental LNG imports saved Europe in 2022. But Europe likely faces an additional 40-50 bcm reduction of Russian flows in 2023 vs 2022. That is a material hole to fill!

2. Weak Asian LNG demand

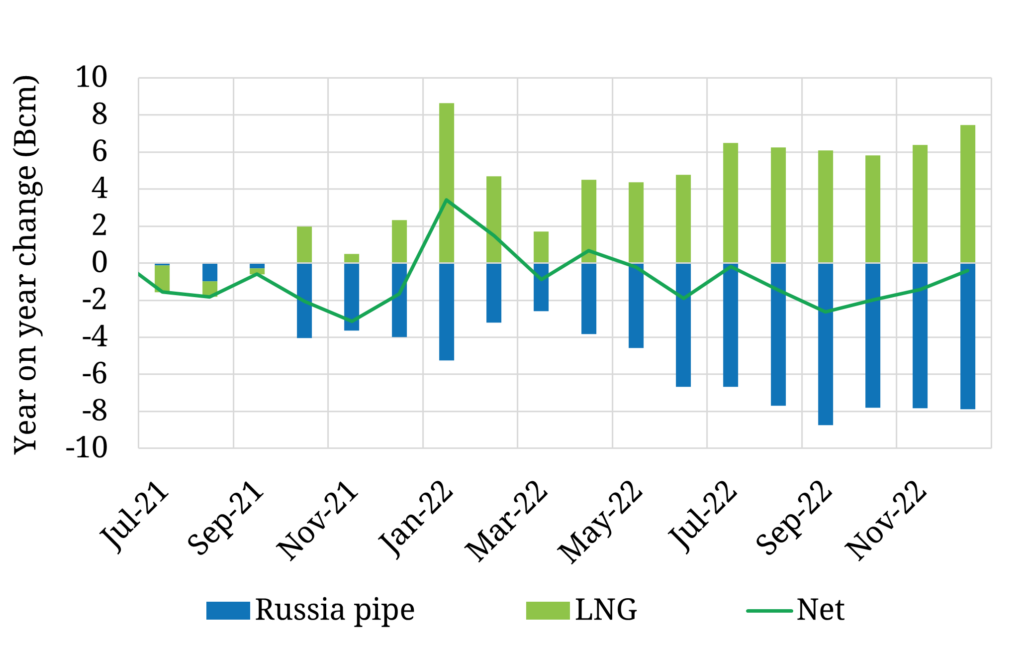

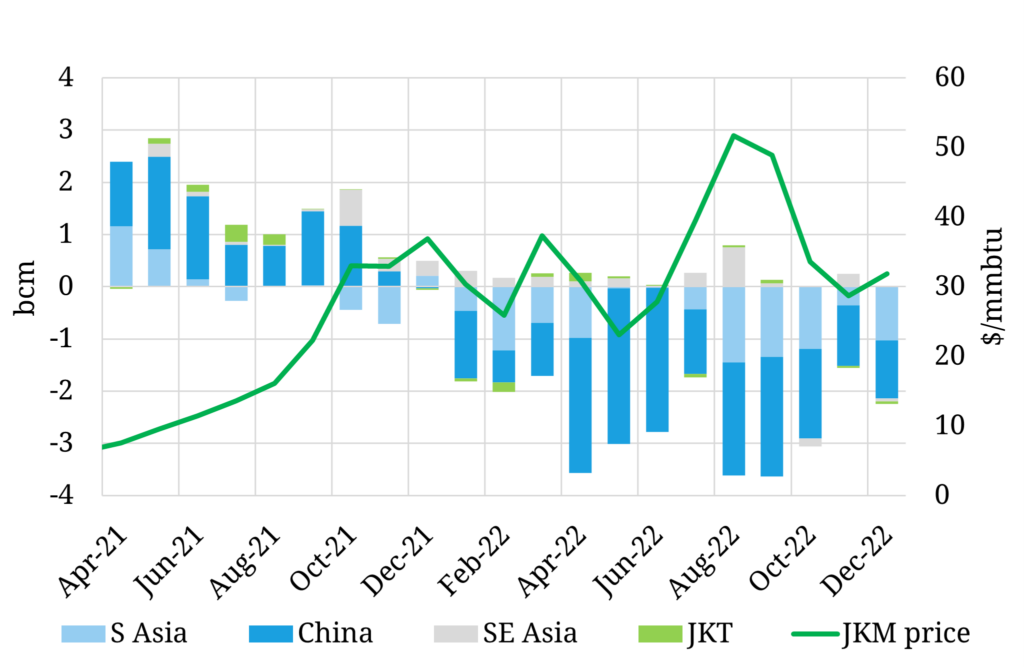

Europe’s surging LNG imports were supported by a substantial reduction in Asian LNG demand in 2022. Asian LNG imports declined 8% in 2022 vs 2021, as shown in Chart 2. This was the major factor allowing incremental LNG volumes to flow to Europe.

Chart 2: Asian LNG demand year-on-year change vs JKM price

Y-o-Y change in Asian LNG imports vs JKM

Source: Timera Energy, CME, LNG Unlimited

This decline was driven by Asian demand response to soaring LNG prices, as shown by the JKM price in Chart 2 (green line). But lower demand was also helped by a mild winter and a weaker 2022 macroeconomic backdrop in China.

Two factors represent headwinds to further weak demand in Asia in 2023: (i) China’s post-Covid lockdown re-opening & policy stimulus is set to spur economic growth (ii) the recent price decline supporting incremental LNG demand.

New LNG supply volumes are also set to be relatively weak in 2023 (given low volumes of project FIDs in 2018). It is not until 2025 that the LNG market is set to see a material increase in new supply.

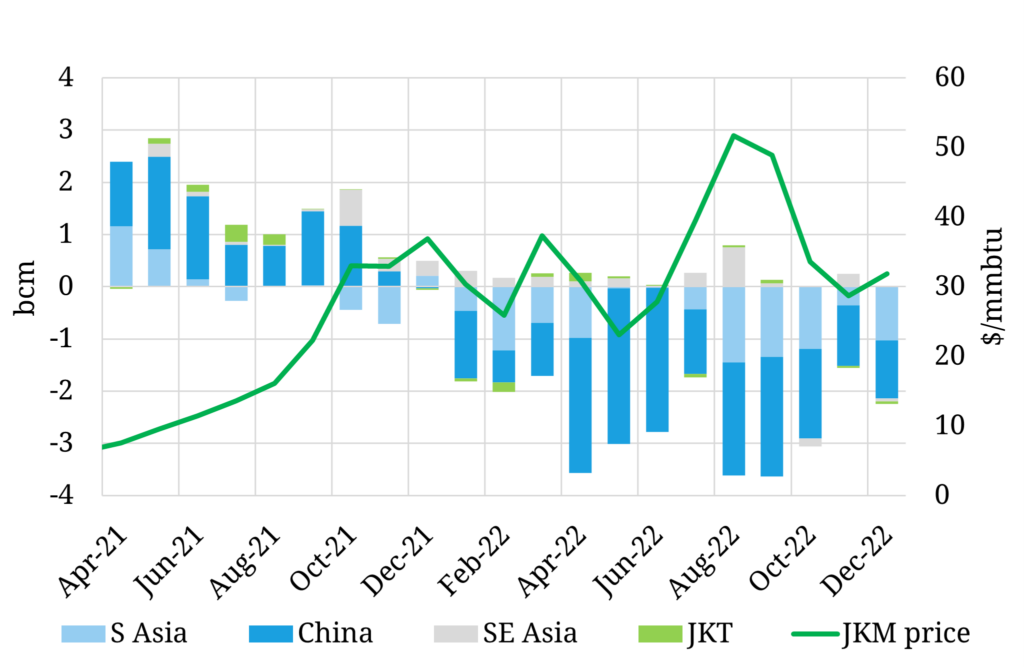

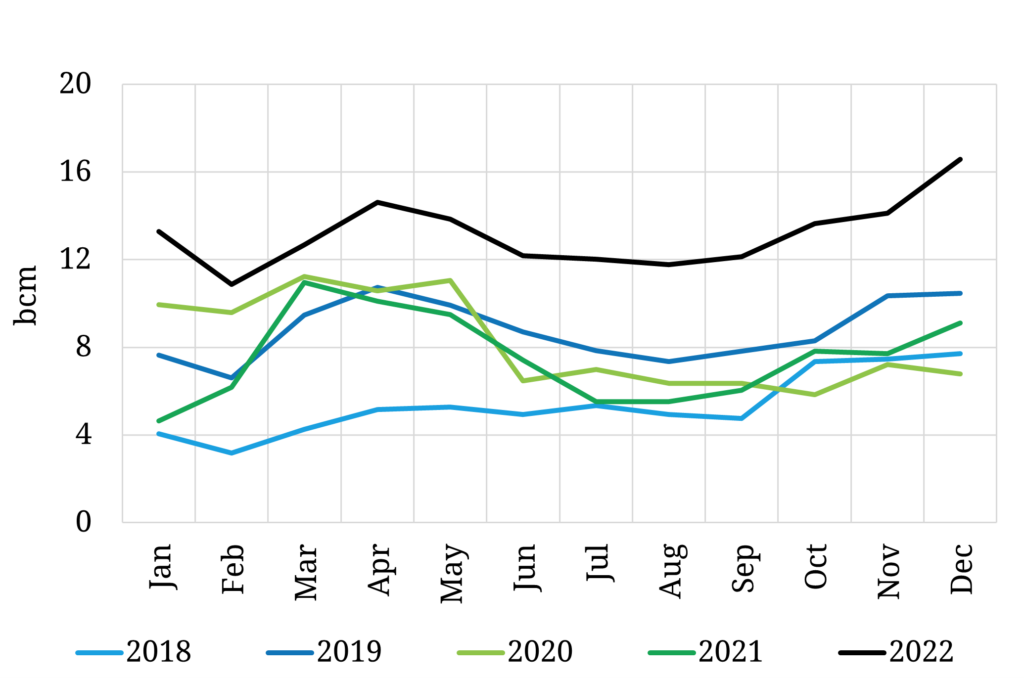

3. Low European gas & power demand

European gas demand declined more than 10% in 2022 vs 2021, with the biggest declines focused in Q4. A mild winter definitely helped. But there has also been evidence of:

- genuine demand destruction given high prices (e.g. industrial production cuts)

- shifts in consumer behavioural patterns driving energy efficiency (e.g. turning down thermostats)

- fuel switching (e.g. oil for gas and refinery optimisation).

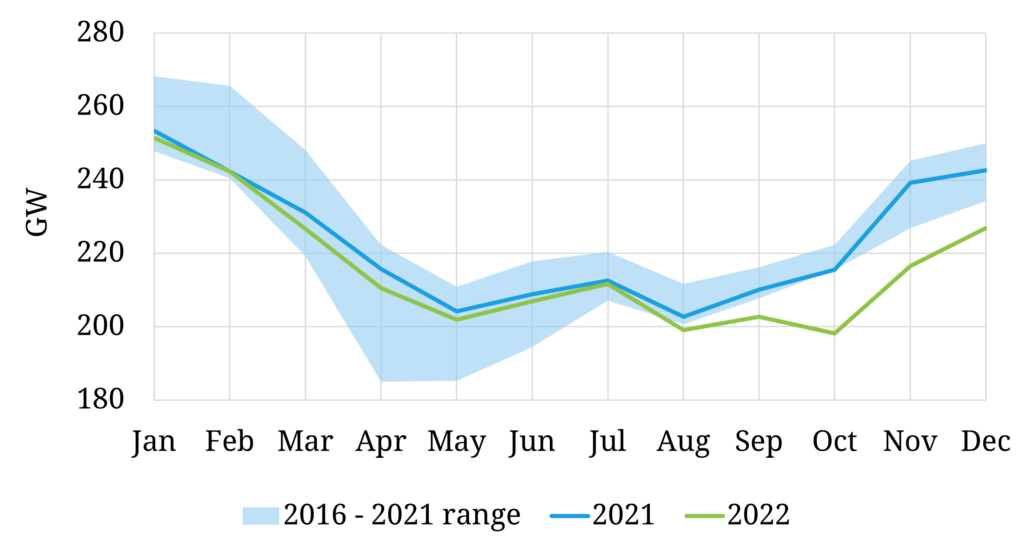

Power demand has also fallen significantly which has helped to ease gas demand from gas-fired generators. The scale of gas & power demand declines since Sep 2022 has been a big surprise and a major contributing factor to declining gas & power prices. Chart 3 shows the pronounced fall in power demand across 7 key markets vs previous years.

Chart 3: Power demand across 7 key European markets

EU7 power demand

Source: Timera Energy, ENTSO-E

If this structural decline in gas & power demand continues in 2023 then Europe may weather the crisis better than most expected. The reductions in residential & commercial demand since Q4 are encouraging, but we only have several months of data across an unusually warm winter.

Demand reductions are a key factor to watch in 2023!

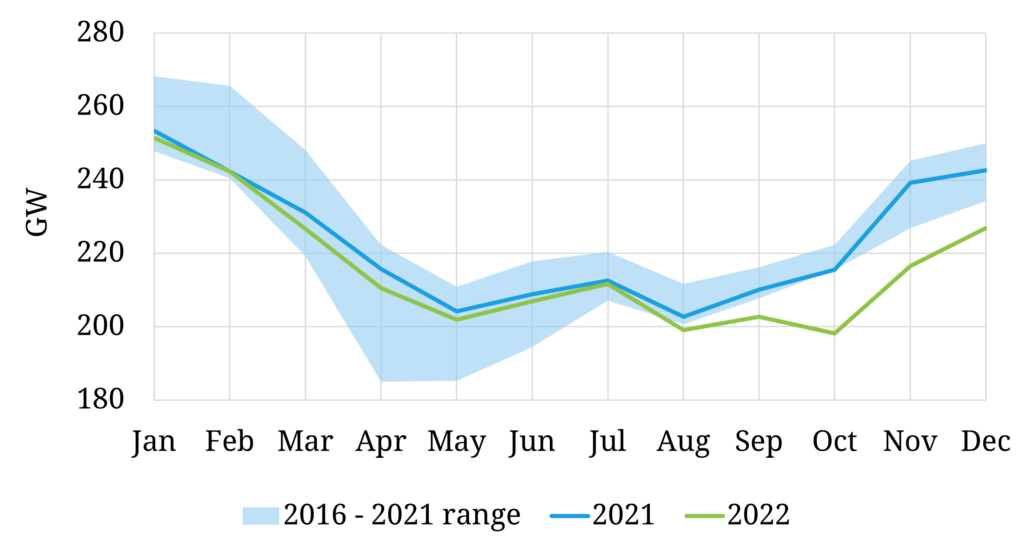

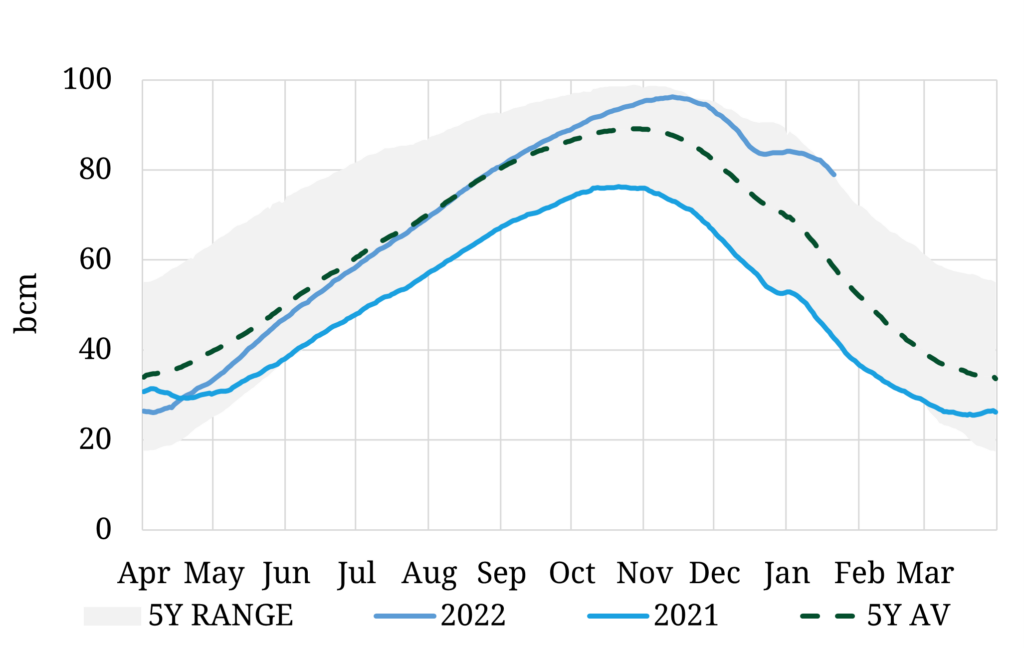

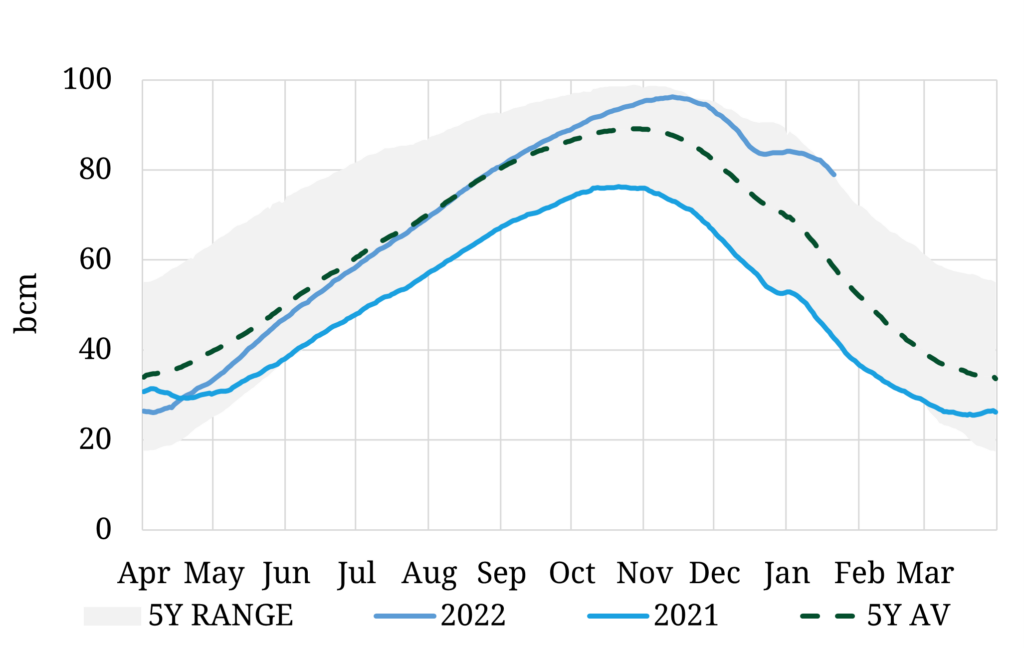

4. High European storage inventories

Storage inventories across the EU sat at over 83% full entering the new year, helped by government storage mandates and mild weather. Europe has also seen historically low withdrawal volumes winter-to-date. The pan-European storage position is summarised in Chart 4.

Chart 4: EU underground gas stock levels

EU underground gas stock levels

Source: Timera Energy, GIE

There is currently little incentive for storage withdrawals given (i) a TTF price curve in contango (ii) continuation of relatively mild winter. We published a snapshot article last week with more detail on current European gas storage dynamics.

High storage inventories weigh on the market because they reduce summer demand for injections (by ~15 bcm) and provide an insurance buffer into next winter. Whether this buffer will be sufficient depends on the factors above (i.e. European LNG imports, Asian LNG demand and European power & gas demand).

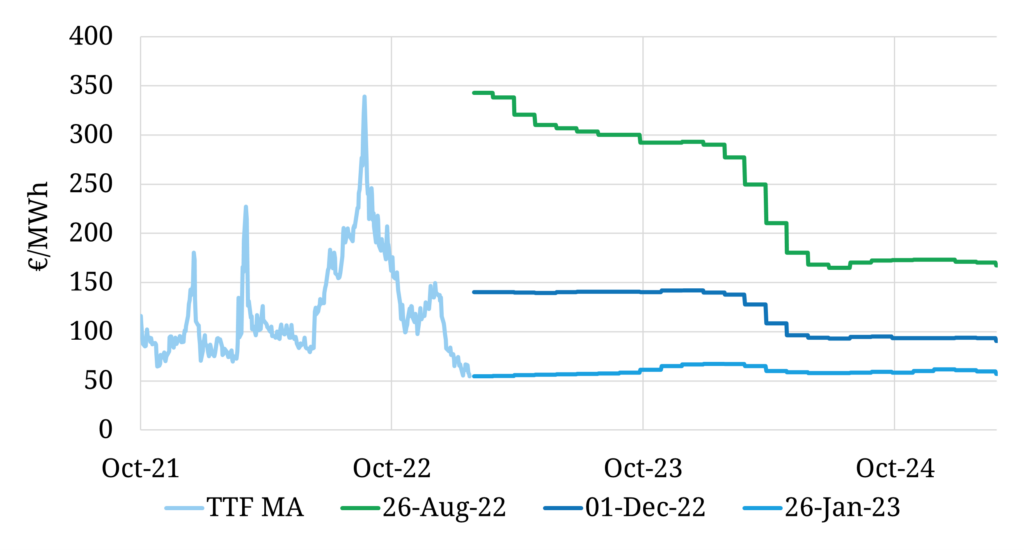

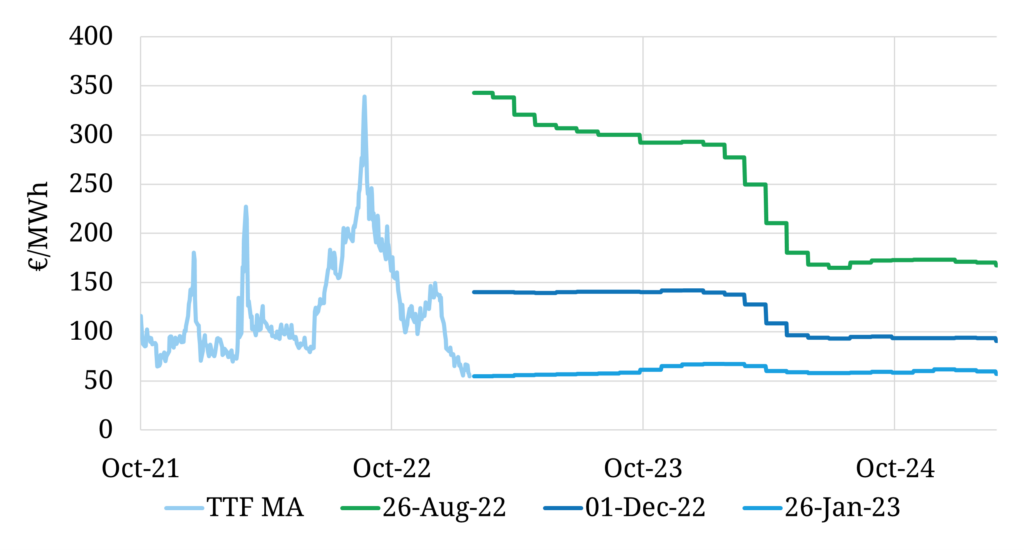

5. Falling gas & power prices

The 4 factors set out above have combined to push European gas & power prices lower into 2023. Chart 5 shows the TTF forward curve (i) in Aug 2022 at the peak of the crisis (ii) at the start of Dec 2022 (iii) at the end of last week.

Prices have fallen substantially since last summer’s peak but remain elevated versus pre-crisis levels.

Chart 5: TTF prices

TTF price formation

Source: Timera Energy, ICE

The substantial premium of TTF over JKM has now diminished (but not disappeared). The fact that European prices remain at or above JKM levels reflects the fact that both the European and LNG markets remain in a tight regime despite recent price declines.

The DES NWE price discount to TTF has also declined (back to a 1-2 $/mmbtu range) as new regas capacity is coming online to ease import bottlenecks and some of the acute market stress of 2022 has eased.

Not yet out of the danger zone

There has been widespread reporting that European gas prices are now ‘below pre-invasion levels’. Sounds comforting right, the crisis must be largely over? No.

While it is factually correct that front month TTF prices are now below pre-invasion levels this says little about the tightness of the European gas market across the next two years. 2023-25 forward TTF prices are substantially higher than pre-Russian invasion levels.

Both the LNG market and European gas market remain in a very tight regime of inelastic supply and demand curves. In this environment small changes in volumes drive big changes in price, both up and down.

The factors we set out in this article are the key drivers that will determine market dynamics across 2023. It is dangerous to assume we have seen the last twist in this crisis.