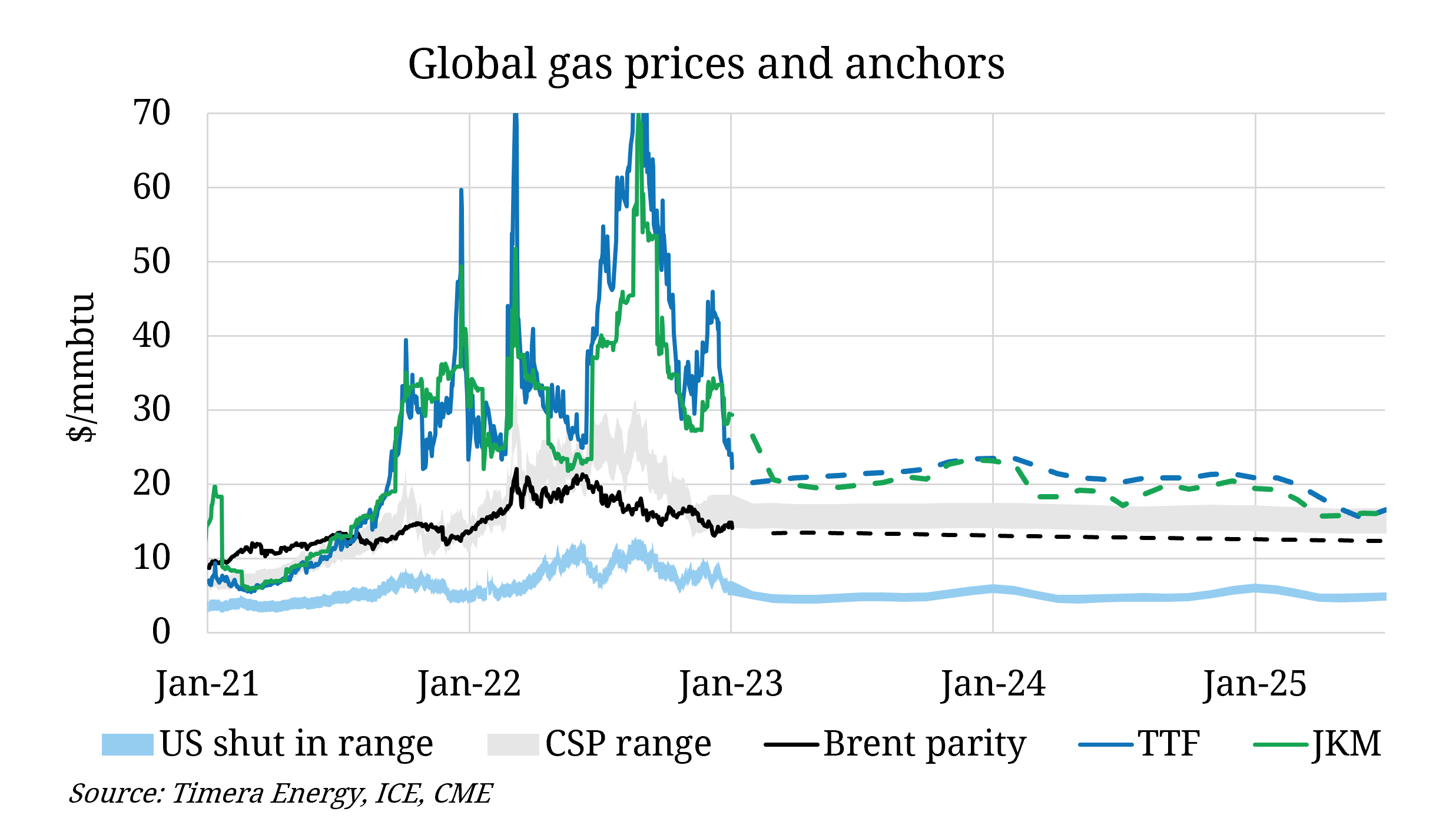

The TTF month ahead contract fell this week to its lowest mark since September 2021 as mild temperatures and price induced demand destruction savaged demand in Europe and Asia.

Storage inventories across the EU sat at over 83% full entering the new year, with historically weak withdrawals over winter-to-date offering both a large buffer against cold weather risk in Q1 and significantly reducing the volume of gas that will need to be injected into storage over summer 2023.

Resultingly, TTF has retreated to reduce the volume of assumed price induced demand destruction in both Europe and Asia, though the exhaustion of flexibility means any change in the fundamental picture could see a further sharp move in either direction.

JKM is now trading at a premium to TTF on the prompt, driven by the combination of expanding European regasification capacity and the return of some price sensitive Asian demand. This signals a near term easing of European regas capacity constraints, albeit imports are set to remain elevated by historic standards.

As such, TTF is heading in the direction of more traditional pricing anchors, with the top of the European coal to gas switching channel coming into focus, though with no overlap on the forward curve until 2025, when the next wave of LNG supply reaches the market.