Welcome back to our first feature article for 2022. This is the 10th year of the Timera blog and in line with tradition we start the year with five surprises to watch for on your radar screens in 2022.

“Fast moving markets strongly influenced by policy intervention are a recipe for accidents”

Usual caveat: these are not forecasts or predictions but cover areas where we think it is worth challenging prevailing consensus views.

1.Big decline in European gas & power prices

One of our 5 surprises from last year was a broad based surge in commodity prices. Inelastic supply works in both directions. 2021 was a text book study in demand pushing up an inelastic European gas supply curve, causing hub prices to surge. Power prices followed, with gains amplified by rising carbon prices and capacity tightness issues. Could 2022 see prices drop at an equally savage pace?

We have a Timera team brainstorm session to define our 5 surprises at the end of each year. Since we flagged a surprise decline in gas & power prices in late Dec 2021, markets have already sold off aggressively. Summer 2022 TTF prices have already fallen around 50% since they peaked on 21st Dec 2021, with German power prices down 40%.

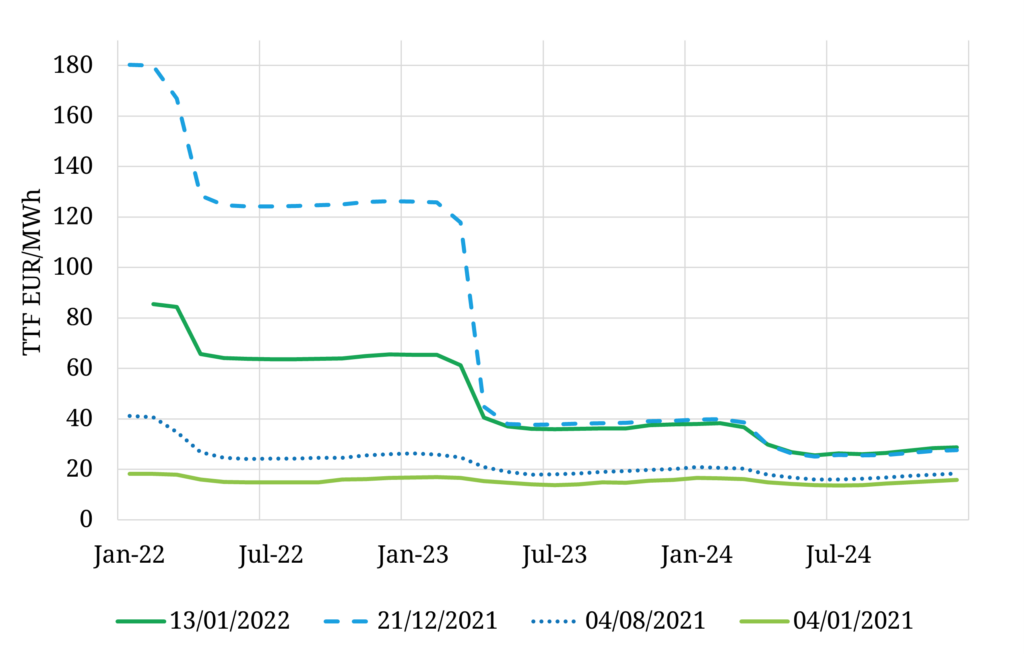

Chart 1 shows just how much TTF prices have risen from the forward curve this time last year (the light green line). It also shows the huge decline in forward prices across the last 3 weeks since the 21st Dec 2021 peak (blue dashed curve to dark green curve).

Despite the recent sharp decline shown in Chart 1, we still flag the potential risk for a further big move down in European forward prices from current levels. What do we mean by a downside price shock? Gas & power forward prices across the curve being cut in half again i.e. another 40-50% decline on top of the one seen across the last 3 weeks.

We are not talking about the risk of a broad based commodity price decline here. The fundamentals supporting commodity prices remain strong over the next 3-4 years. Rather we are flagging the risk of a normalisation of European gas & power prices from the extreme levels reached in 2021.

Let’s consider some factors in play that could, individually or in combination, drive a big correction in gas & power prices:

- The Winter 2021 risk premium has been a key factor driving the TTF forward curve. In 10 weeks, come what may, winter will be behind us.

- Europe is competing directly with Asia for LNG this winter. Given very elevated price levels, we could see major Asian LNG demand response into 2022. This could temporarily dampen Asian demand growth and cause European import volumes to pick up.

- Some of the acute global supply chain issues of 2021 may be substantially alleviated through 2022 as markets respond & constraints ease.

- The gas market is now heavily discounting the likelihood of Nordstream 2 given regulatory & Ukraine tensions. What if these issues are resolved and incremental gas is flowing via NS2 in H2 2022?

- Industrial & commercial gas & power demand response within Europe to (i) elevated prices & (ii) a potential economic slowdown due to tightening global monetary policy (see next surprise).

Whether prices rise or fall in 2022, don’t bet on volatility going away. 2022 is set to be another bumpy ride.

2.Policy mistakes or clumsy intervention

We are operating in a world of very high levels of policy intervention. This comes in the form of accelerating decarbonisation policy. But it also includes unprecedented fiscal & monetary policy stimulus to drive the Covid recovery.

Fast moving markets strongly influenced by policy intervention are a recipe for accidents.

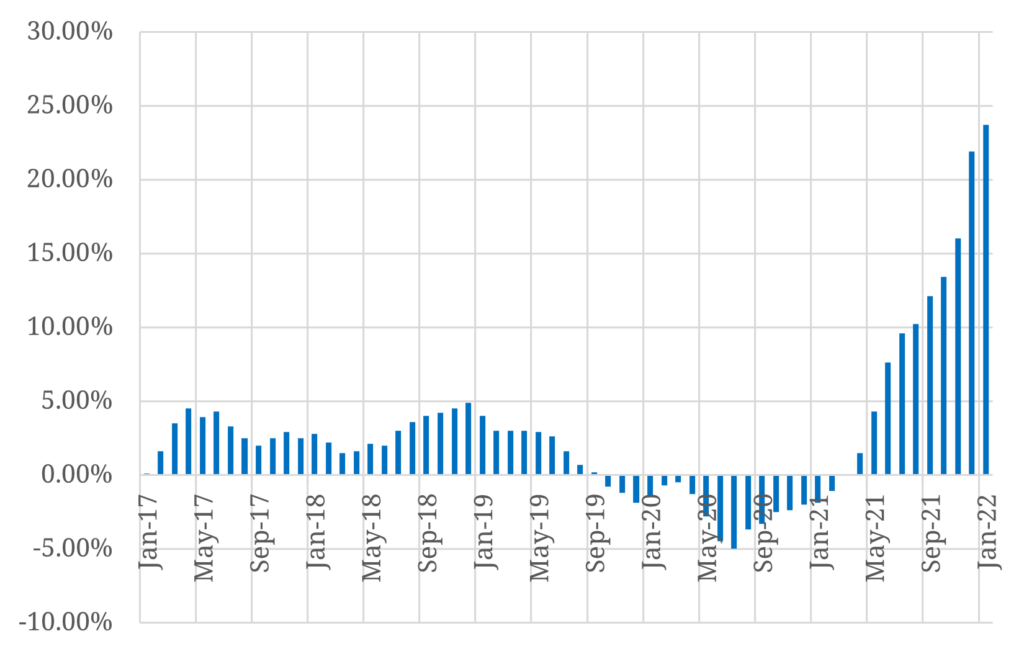

Europe is facing soaring inflation. The year on year change in the Eurostat European Producer Price Index has surged almost 25% across the last 12 months as shown in Chart 1. We have not seen anything like this for at least 40 years and surging energy costs are a key driver.

If nothing else, the impact of inflation on investment decisions should be considered much more carefully in the current environment. A euro today is not the same as a euro next year.

What are examples of potential policy mistakes or clumsy intervention?

- Central bank mistakes e.g. delayed response to an inflation scare causes the ECB (and / or Federal Reserve) to rapidly tighten monetary policy inducing a temporary economic slowdown.

- Clumsy energy policy intervention e.g. national level controls to try and address the impact of rising energy prices e.g. price regulation/caps, gas storage/supply mandates or even energy asset nationalisation.

- An escalated geopolitical conflict with Russia over Ukraine.

More broadly it is a big year for European politics which may hold its own surprises. The new German Social Democrat led coalition is still finding its feet while trying to manage a delicate geopolitical situation with Russia and a complex domestic energy policy arena. There is also a key French election with a potential risk to Macron. And instability in Dutch and Italian politics continues. It feels like the anchor is drifting.

3.The year of long duration storage

Lithium-ion batteries are scaling fast and represent a viable solution for at least 1 to 6 hour duration flexibility response. But there is a much more open battle heating up for storage flex of 6 hour to 6 days duration.

There is a range of potential long duration storage technologies that might be able to plug this gap. But most of these are either very expensive or at the earlier/pilot stages of development. Could 2022 be the year when large scale investment starts to flood into long duration storage?

A policy pivot to focus on long duration storage could be key catalyst for further investment. Periods of extreme power market stress in 2021 have highlighted the challenges of rapidly scaling renewables while accelerating thermal capacity closures. This is helping to drive home to policy makers that batteries solve balancing issues but do little to help a two week period of no wind.

Another related surprise for 2022 could be the emergence of alternative long duration flex solutions. A good example here is hydrogen storage as part of an electrolyser supply chain. Hydrogen is much cheaper to store than power. And tank storage allows electrolyser turn down in order to provide ‘flex up’ services to power grids across multiple hours or even days.

4.LNG market investment frenzy

Benchmarks for the marginal Long Run Marginal Cost (LRMC) of new LNG supply range from 6.50 – 8.50 $/mmbtu. TTF forward prices are well above these levels across the curve (caveat our inflation point above). Could these market conditions spur an LNG investment frenzy in 2022?

Supply project lead times of 4 to 5 years underpin the cyclical nature of the LNG market. For example the current market tightness (2021-24) is the result of a period of low prices & low investment across 2016-18. FIDs of new supply in 2022 may set up the next downturn in the 2025-27 horizon.

The key producers to watch in 2022 are Qatar (do they go for broke and FID everything they have?), another potential wave of US exporters and several other big balance sheet producers e.g. East African projects.

Independent of LNG supply investment, we also suspect there could be a surprise acceleration in LNG company capability investment. Market conditions across the last year have caused a huge increase in portfolio value… and in market and counterparty risks. This is creating strong incentives for LNG players to invest in more robust commercial & risk management capabilities to operate in what is a rapidly maturing market.

5.Europe rings the flex alarm.. led by Germany

2021 was the year that many countries across Europe realized that the current policy path to decarbonization does not compute.

Net zero targets require an acceleration of investment in renewable capacity. But this needs to be backed by a huge acceleration of investment in low carbon flexibility. The alternative is that we either (i) bake in a dependency on gas (inconsistent with net zero) or (ii) learn to live with 2021 style market stress on a permanent basis.

Germany lies at the center of the European decarbonization challenge. Yet it is one of the least friendly markets in Europe for investors in flexible capacity. Could it be that the new German coalition pivots policy in 2022 towards flexible capacity investment in response to the looming flex deficit? The implementation of a German capacity market could play a big role in turning the tables.

This surprise is not limited to Germany. What if flexible capacity support measures were implemented more broadly across Europe e.g. in the form of new ancillary products, sharper balancing market signals and capacity payments?

If policy makers haven’t learned the flexibility lessons of 2021, the market is likely to remind them on a regular basis going forward.

If you’re interested in more…

Just a reminder that we also publish regular ‘Snapshot’ articles in between our features. If you want to receive a weekly summary of new blog content in an email you can subscribe via the link on this page (it’s free). You can also receive content as it is published via our LinkedIn or Twitter feeds.

We wish you all the best in navigating these (& many more) surprises in 2022!