Two weeks ago we published an article setting out the prospect of accelerated coal closures in Germany. This was based on simple maths showing the incompatibility between Germany’s 2030 emissions targets and its current coal closure timeline.

“The chart shows a huge (41GW) derated capacity deficit & peak demand growth could add another 10GW”

Last week we interrupted this two-part series on German power to look at drivers behind the unprecedented current price surge in European gas & power markets.

But we travel back to Germany this week to examine the size of its emerging capacity deficit and the urgent requirement for new flex investment.

The scale of the problem

In our first article we set out two paths for German coal closures:

- the current legislated coal closure path with 17GW remaining in 2030

- accelerated closure of the coal and lignite fleet by 2030, in order to comply with new emissions targets.

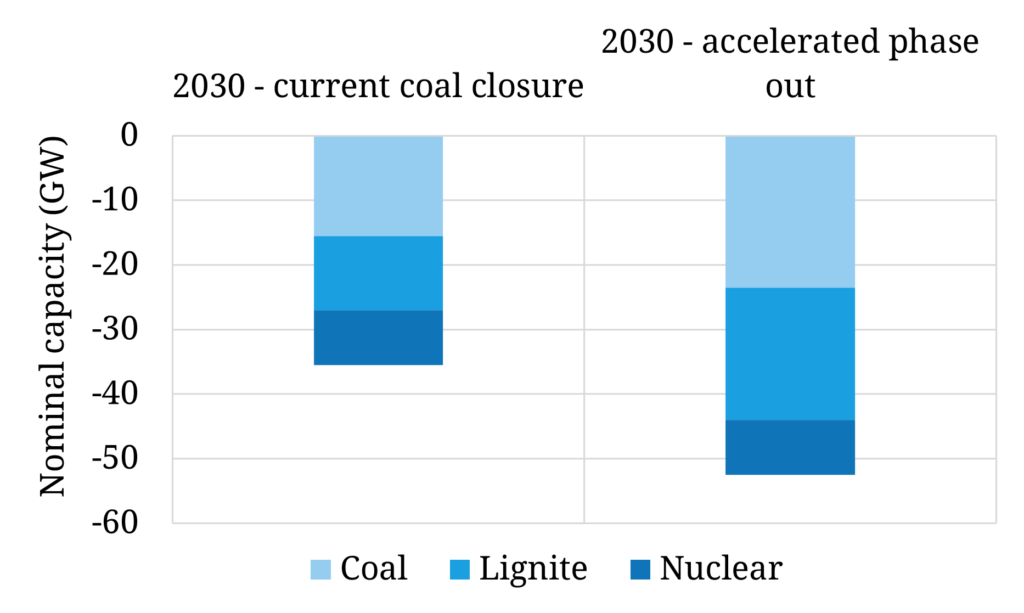

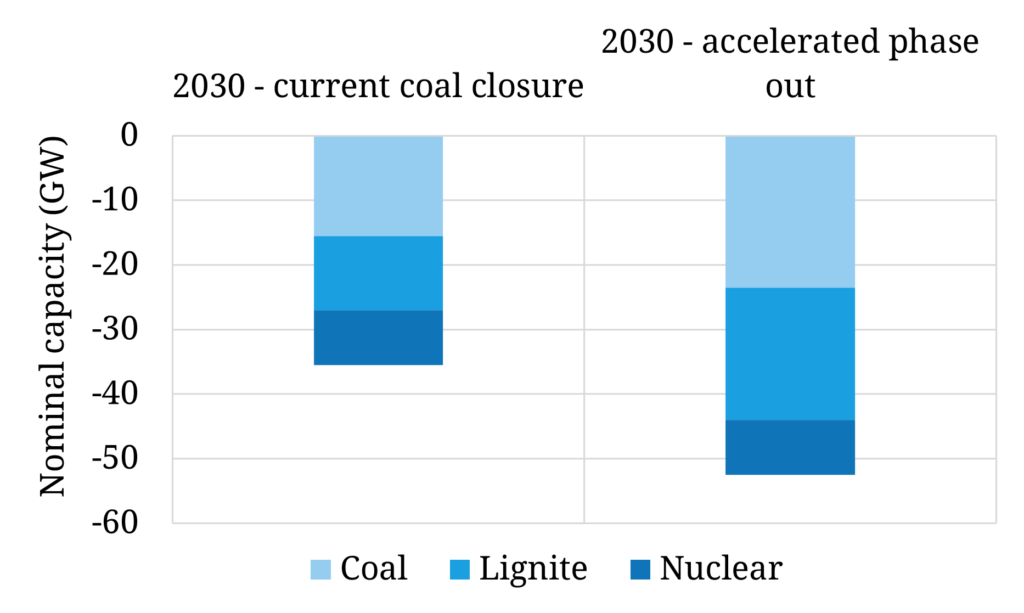

The cumulative 2030 capacity retirements under these two cases is shown in Chart 1.

Chart 1: Current vs accelerated coal closures paths in 2030

Source: Timera Energy

Based on the current coal closure timeline, Germany is legislated to retire over 30GW of firm, flexible capacity by 2030. However this could increase to over 50GW if coal closures are accelerated.

The logic of closing coal plants as quickly as is practical is clear if Germany is to decarbonise its power sector. This effectively represents the ‘low hanging fruit’. Closing nuclear plants early is more of an own goal, as a number of senior academics and industry figures set out in a letter to the FT last week.

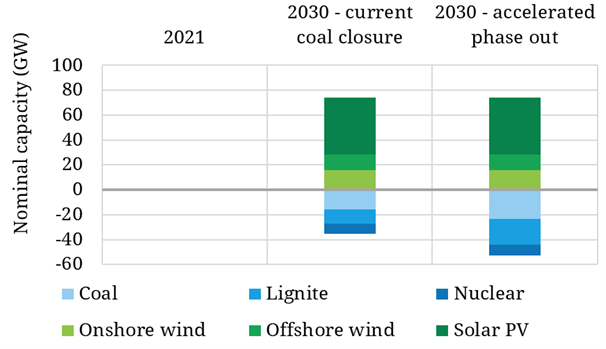

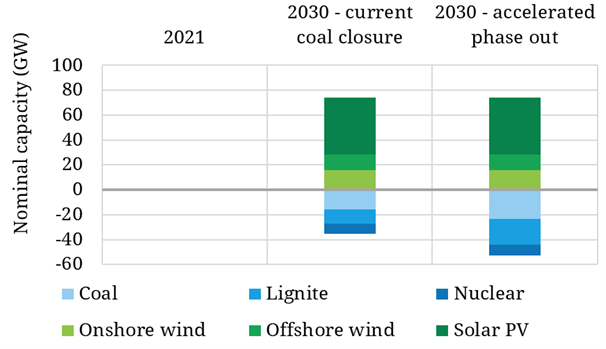

To replace coal & nuclear capacity, Germany aims to significantly increase renewable penetration with almost 50GW of new Solar PV and 30GW of combined on and offshore wind targeted by 2030.

This growth in renewables is compared to retirement of coal & nuclear plants in nominal capacity terms in Chart 2. Note this ignores any closures of ageing gas-fired plants which would increase thermal retirement volumes further.

Chart 2: 2030 renewable vs thermal capacity changes in nominal capacity terms

Source: Timera Energy

Even assuming the accelerated coal closure timeline (with the entire fleet closed by 2030), Germany still has a positive net gain in nominal capacity. So what is the problem?

Derated capacity numbers show a huge deficit

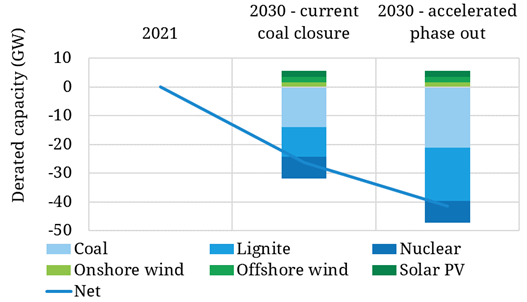

One MW of new wind or solar capacity is not equivalent to one MW of retiring nuclear or coal capacity.

Wind & solar produce at significantly lower average load factors e.g. around 20-25% for onshore wind and 10% for solar vs 80-85% for nuclear & coal. In addition, the dispatchable nature of nuclear and coal plants, allows them to provide flexibility to the system that wind & solar cannot.

These factors combine to impact the ability of different technology types to contribute ‘firm’ capacity to the system. When planning for system security, derating factors are applied to nominal MW to enable comparison across different capacity types on a consistent basis.

The derating factors represent the effective firm capacity contribution for each technology to system security. The exact derating factor percentages vary over time and by location across Europe. But coal and nuclear is typically around 80%-90%, wind around 10-15% and solar PV less than 5%.

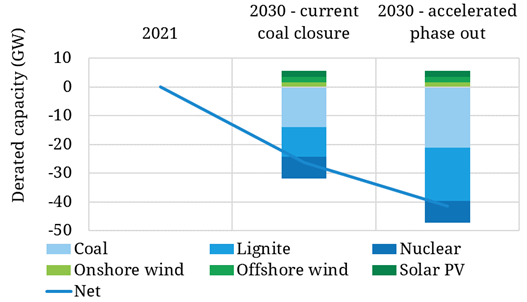

Chart 3 shows the same comparison of renewable build vs thermal retirements as in Chart 2, but this time on a derated capacity basis (vs nominal).

Chart 3: 2030 renewable vs thermal capacity changes in derated capacity terms

Source: Timera Energy

Chart 3 shows a huge (41GW) derated capacity deficit between renewable build and thermal closures if the coal fleet closes by 2030. It is important to note that this deficit does not include flexible capacity that is currently under construction e.g. new interconnector projects, demand response & storage. But the pipeline of committed projects falls well short of closing the gap.

In addition, it is very likely peak demand will increase by 2030 as Germany electrifies other sectors e.g. transport, heat & industry. For example the German economy minister’s projection of 14 million EVs on the road by 2030, could see peak demand rise by up to 10GW, further exacerbating the capacity crunch.

New flexible capacity options

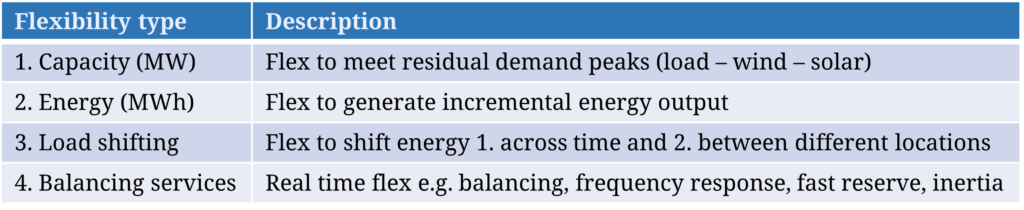

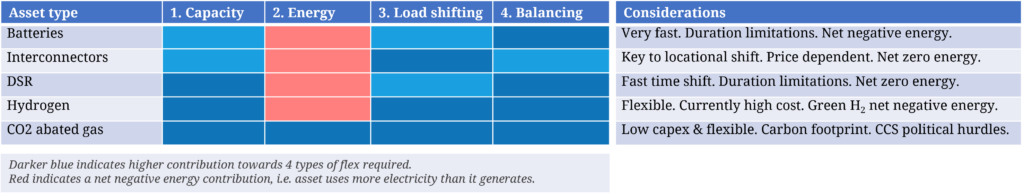

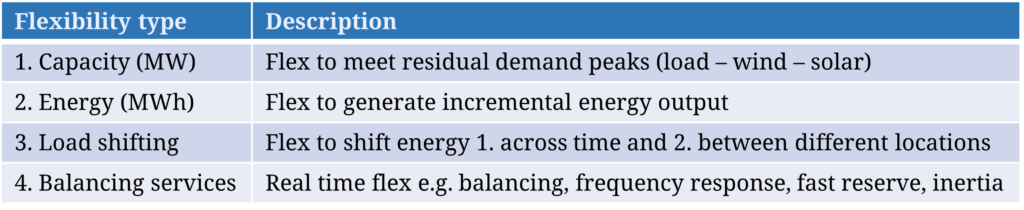

A range of capacity characteristics are required to plug this deficit. Power systems are complicated and different forms of capacity are required to meet different needs of the system. In Table 1, we outline the 4 key flexibility characteristics needed to maintain stability in a decarbonising power system.

Table 1: 4 key types of flexibility required to support a decarbonising power system

Wind and solar can provide significant volumes of energy, but provide limited derated capacity, load shifting & balancing services due to weather driven intermittency.

By contrast, retiring nuclear & coal plants are strong providers of both capacity and energy while also providing some balancing services (subject to operational constraints).

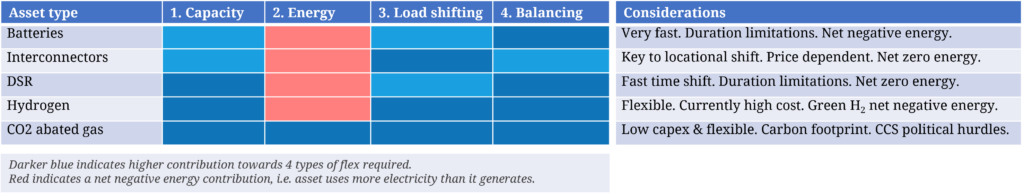

Germany’s options to plug the deficit are summarised in Table 2.

Table 2: The currently available ‘set menu’ of new capacity options

- Batteries & DSR are very useful balancing options but net consumers of energy and typically limited to short duration response.

- Interconnectors provide important load shifting but rely on energy & flex being provided in neighbouring markets, i.e. a zero-sum game. As the rest of Europe undergoes similar transitions cross-border flexibility may be in short supply.

- Hydrogen fuelled power plants may be able to scale as a source of flex, but are likely to be very expensive to run and a net consumer of electricity if sourced from electrolysers.

- Carbon abated gas fired plants may appear to be an attractive solution from Table 2, but face substantial practical hurdles in the form of political unease with Carbon Capture Utilisation & Storage (CCUS), dependency on CCUS infrastructure development, high capex costs and a residual carbon footprint (across both power & gas supply chains).

In order to decarbonise the German power market in an orderly fashion, all of these capacity types will likely be required in some form. None represent a silver bullet.

The German challenge in a nutshell

Germany’s challenge can be summarised as follows:

- Firm capacity is closing faster than its being built

- Ambitious new emissions targets accelerate this

- Germany is facing a sharp and structural market tightening over the next few years

- Decarbonisation requires investment in a diverse mix of flexible capacity

- Germany needs a credible policy mix to plug the gap, and fast.

Historically, Germany has relied on market price signals and targeted support for particular technologies to deliver flexible capacity e.g. TSO reserve contracts with peaking plants. This approach has worked in the past but is increasingly incompatible with EU state aid rules.

A capacity market could be a big part of the German solution but there is a lack of policy momentum behind this.

In lieu of a strong capacity price signal, Germany will have to rely on energy & ancillary market price signals to encourage investment. As coal and nuclear plant closures accelerate across 2022-23, expect these signals to get sharper and more frequent.

The volatility currently impacting German power prices, with Winter 2021 prices above 250 €/MWh, is driven by extreme fuel price movements. Add the looming flexible capacity deficit on top of this and price dynamics would be an order of magnitude more disorderly.

Timera is recruiting We are actively looking for new people to join the Timera team across a range of roles. Two specific ones we are currently targeting:

- Senior Analyst (Power) – strong practical knowledge of European power markets and value drivers of flexible assets, particularly storage & batteries.

- Senior Analyst (LNG) – strong experience of LNG portfolio commercial & value drivers / risk / analytics.

We offer very competitive packages as well as the ability to directly participate in company value upside. We offer significantly more flexibility & autonomy than other companies, covering e.g. location, work hours & remuneration structure.

Timera has an open, innovative & entrepreneurial environment and we work on a variety of stimulating analytical challenges across the rapidly evolving energy industry.

See here for more details timera.sobold.dev/careers or email us at recruitment@timera-energy.com