The scale of the European gas price surge of 2021 will ensure it becomes etched in history. It has transitioned from an energy industry phenomena to the brink of an energy supply crisis.

“Russia’s ability to flow additional volumes is misrepresented and misunderstood.”

European industries are being buffeted by surging energy costs and in some cases shutting down production. Energy retailers are falling over as their hedge cover proves inadequate. And policy makers are trying to grapple with the consequences of potential winter supply disruptions.

We set out 5 charts explaining surging European gas & power prices at the end of August. This was one of several articles reinforcing our thesis of a multi-year structural rally in gas prices, which we first set out during the peak of the Covid slump in Q2 2020.

In our August article we also flagged the risk of a near term correction in Winter 2021 TTF prices. There has been no sign of this across the last month. Winter prices have continued to surge (from high 40s €/MWh to more than 70 €/MWh). In what has been a relatively low wind environment, power price rises in many markets have outpaced gas.

In today’s article we set out 5 factors currently in play as the explosive rally continues.

1.Demand destruction setting winter prices

European gas demand is at 5 year highs. European LNG imports are anaemic given Asian and South American buyers are paying a premium to divert cargoes. Pipeline suppliers look to be flowing all available molecules. And the conventional response mechanism of coal for gas plant switching in the power sector has effectively been exhausted.

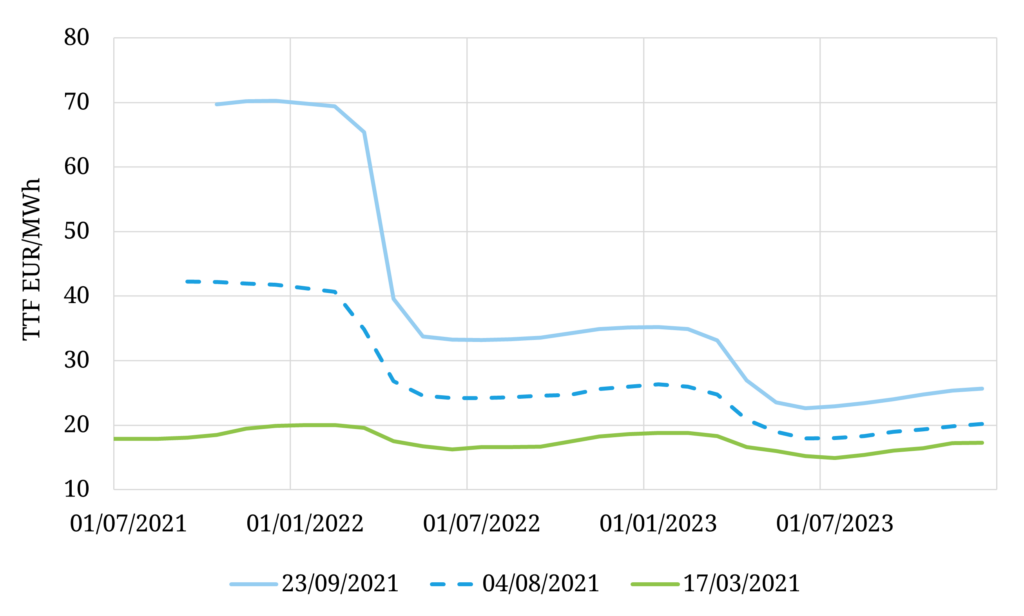

The result is illustrated by the explosion in the front of the TTF curve, from March (green line) to August (blue dashed line) and now to September (blue straight line).

Chart 1: Winter 2021 prices disconnect from rest of TTF curve

Source: Timera Energy, CME

This is a case study in inelastic demand ramping up an inelastic supply curve. Winter 2021 prices for both gas & power are now being set at levels that induce the destruction of demand from large industrial users e.g. ammonia producers (for gas) & zinc smelters (for power).

2.Longer dated forwards rallying with coal & carbon

Gas prices may be dominating headlines, but the gas rally is not happening in isolation. ARA coal prices have also risen 30% since late August. The move higher in TTF prices across 2022 – 23 is not just in sympathy of surging Winter 21 prices. It is consistent with rising switching range levels as coal prices rally and carbon prices remain firm above 60 €/t.

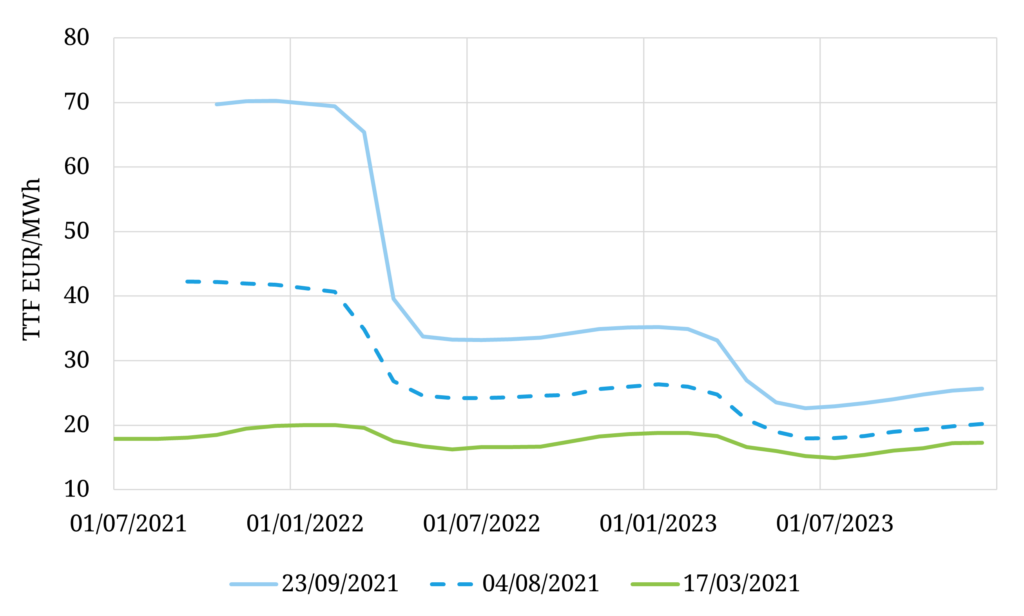

Chart 2 shows the steep TTF forward curve backwardation from the end of winter, with Q2 2022 prices falling back to levels anchored by the coal switching range (shaded grey).

Chart 2: Long dated TTF price remain anchored by switching ranges

Source: Timera Energy, CME

TTF prices in a 25-35 €/MWh range across 2022-23 may seem steep compared to recent history, but they are consistent with the pricing of coal as an alternative fuel in a tight energy market (accounting for the incremental cost of carbon).

3.Incremental Russian supply is key

Norway is trying to optimise production and outages to eke out extra molecules, and has raised its annual production permit by 2bcm. But Russia is really the only potential source of meaningful incremental pipeline supply volumes across this winter. And as usual with Russia there is politics in play. But Russia’s ability to flow additional volumes is misrepresented and misunderstood by politicians and the media.

In a nutshell the Russian situation is this:

- Cold weather last winter has constrained Russian export volumes to Europe in 2021 due to (i) high Russian domestic demand and (ii) the ongoing requirement to refill Russian domestic storage in preparation for the current winter.

- Gazprom’s European storage sites were drained last winter and are carrying very low inventories into this winter.

- Gazprom’s gas production capacity in the key Nadym-Pur-Taz (NPT) region is falling as old fields mature. Additional investment (if it takes place) will not bring new gas online until around 2024.

- Yamal peninsula is the region with the most promise for new gas productive capacity through near term investment, but this likely requires the completion of Nord Stream 2 to allow increased export flow.

- Gazprom is flowing gas via Ukraine around ‘ship or pay’ levels (40 bcma) under the current transit agreement. While these look low historically, the factors above mean that it is unlikely that Gazprom is ‘withholding’ significant volumes from export to Europe via this route.

High prices may be politically convenient for Gazprom at a time it is trying to secure approval to flow gas through Nordstream 2. But a TTF gas price above 70 €/MWh is not a Russian conspiracy. The gas market is doing its job and signalling acute tightness and it appears that Gazprom’s ability to respond is somewhat limited.

That said, if Nordstream 2 is approved in a timely fashion (as looks increasingly likely), Russia has a strong political motivation to play the ‘white knight’ that averts Europe’s energy crisis.

Recent statements from Russia that (i) prompt approval of Nordstream 2 would cause a reduction in European prices and (ii) Russia is meeting all buyer nominations through its long term contracts (by implication not selling gas in addition to contracts for example via the ESP), suggests that Russia may have some flexibility to provide a quid pro quo for Nordstream 2.

Behind this is a genuine political trade off for Russia between prioritisation of exports vs domestic requirements that may come into play.

4.Midstream gas assets value may not be dead

There has been a major shift in strategic appetite against midstream gas infrastructure over the last 2 years, as the pace of decarbonisation has accelerated in Europe. This is a space traditionally dominated by large & conservative infrastructure and pension fund investors. But these investors are finding it very difficult to price the risks associated with decarbonisation.

There is a growing queue of current owners that are heading towards or queueing at the exit. There is also very limited capital being deployed on existing assets beyond minimum operational maintenance requirements.

Midstream European gas assets have become near to uninvestable for their traditional capital base. Yet the current market environment is illustrating Europe’s strong dependency on gas supply infrastructure and flexibility. That is an environment that is ripe for a major shift in asset ownership.

The new natural owners of gas infrastructure require greater risk tolerance and an understanding of how to monetise assets in an inherently more volatile gas market. But most importantly they need to be able to understand and price decarbonisation risks and potential upside (e.g. from the evolution of hydrogen & CCUS supply chains).

That points toward private equity and alternative investors buying assets from utilities, infrastructure & pension funds. A similar story has already played out with ownership of maturing North Sea production assets. Current market conditions may accelerate this trend in gas markets.

5.Higher prices won’t necessarily incentivise new supply

One of the oldest commodity market adages is ‘the best cure for higher prices is high prices’. Market price signals are usually pretty effective at incentivising investment in new supply. But applying that logic to gas (& oil) markets is complicated by long investment lead times and decarbonisation.

The lead times to bring new conventional gas supply online typically range from 3 – 5 years. This fact underpins our thesis of gas markets remaining tight until at least 2024 (when the next wave of LNG supply starts to come online).

Decarbonisation risk presents a much more structural hurdle. Gas prices above 25 $/mmbtu this winter may help the margins of existing producers. But investors in new supply are questioning who will buy their gas in 20 years in a rapidly decarbonising world. And it is a good question, which has a very practical impact in raising the cost of hydrocarbon investment capital.

It is a reasonable assumption that a structurally higher cost of capital should lead to structurally higher prices.

Timera is recruiting We are actively looking for new people to join the Timera team across a range of roles. Two specific ones we are currently targeting:

- Senior Analyst (Power) – strong practical knowledge of European power markets and value drivers of flexible assets, particularly storage & batteries.

- Senior Analyst (LNG) – strong experience of LNG portfolio commercial & value drivers / risk / analytics.

We offer very competitive packages as well as the ability to directly participate in company value upside. We offer significantly more flexibility & autonomy than other companies, covering e.g. location, work hours & remuneration structure.

Timera has an open, innovative & entrepreneurial environment and we work on a variety of stimulating analytical challenges across the rapidly evolving energy industry.

See here for more details https://timera-energy.com/careers/ or email us at recruitment@timera-energy.com