UK CCGT asset owners have had a tough few years, with the impact of falling wholesale margins compounded by low capacity prices. However CCGT value drivers have started to turn around in 2020, with a recovery in forward clean spark spreads and a sharp rise in capacity prices.

“The CCGT investment case is not a bet against decarbonisation…

.. but a bet on the flexibility required to support decarbonisation.”

There is a growing queue of UK CCGTs flagged for sale in 2021. At the front of the queue are the Calon assets (Severn, Sutton Bridge & Baglan Bay) and EDF’s West Burton B, but several other plants are likely to follow. Some of these CCGTs are key flexibility providers and have at least 10-15 years of remaining economic lifetime. Others are on death row.

Diamonds or dogs, there is a notable absence of interested buyers. That suggests CCGTs may sell at record low prices and a small fraction of new build cost. But are low prices enough to build a high return contrarian investment case?

In this article, we examine the outlook for the UK’s existing CCGT fleet and outline why, at the right price, UK CCGTs can deliver significant value.

A tough margin environment

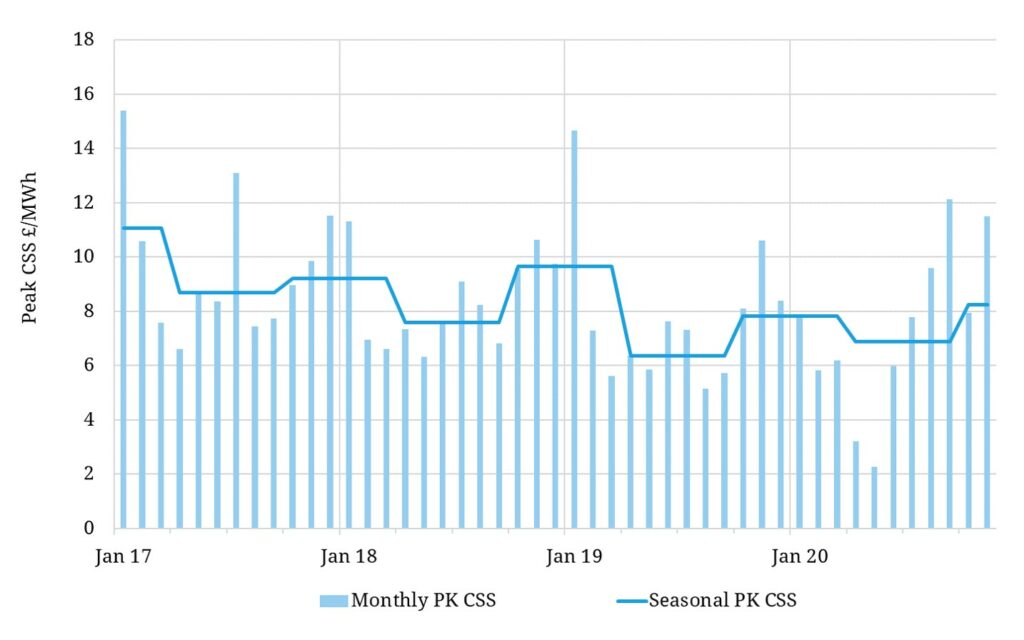

A CCGT’s profitability is largely determined by the peak clean spark spread (Peak CSS), the spread between the plant’s variable gas & carbon cost and the power price. Chart 1 shows the average monthly and seasonal historical evolution of Peak CSS at delivery.

Over the past 4 years, average Peak CSS has fallen from a winter high of over £11/MWh in Q1 2017, to a low of around £8/MWh in Winter 2019. This reflects the impact of consecutive warm winters, increasing renewable output and rising imports, reducing the requirement for gas-fired generation.

This year, demand erosion from the UK’s lockdown in Q2 2020 directly translated into lower Peak CSS as less gas generation was required to meet system demand.

However by Q3 2020, a recovery in power demand coupled with rapidly rising BSUoS (the variable grid balancing charge) saw Peak CSS recover. Gas plant returns were also supported by very low French nuclear output which reduced UK import flows (as we describe further below).

2020 has been a year of two halves for UK CCGTs. A key question is whether the second half recovery will continue into 2021 and beyond.

Forward market margins

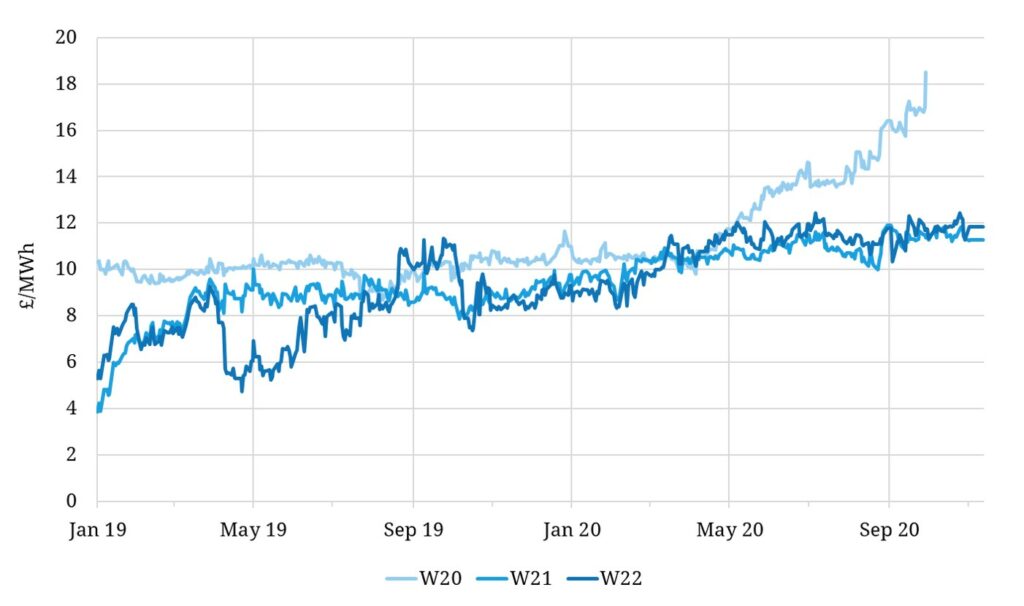

Forward market margins are signalling a more positive value story than that shown in Chart 1. Chart 2 shows a significant rise in forward winter Peak CSS levels across the last 18 months.

The Winter 2020 contract saw a particularly sharp rise from £10/MWh in Q2 2020 to over £18/MWh on expiry in Sep 2020. As we outlined previously, low French nuclear output was a key driver here.

EDF’s substantial downward revision of nuclear output across Winter 2020, drove up French power prices across Q2 and Q3 to reduce net exports to neighbouring markets. Whilst the French nuclear outlook has now improved across Q4-20, this incident is the latest in a run of nuclear output issues which are becoming more frequent. With the UK’s coal fleet dwindling, any fall in French nuclear output across winter is likely to see a similar price response in the UK, supporting Peak CSS.

This highlights a broader point: Europe is becoming more interconnected. And gas is increasingly dominating marginal price setting across Continental power markets. This is reducing the structural price premium of the UK over Continental power markets, leaving the UK increasingly exposed to NW European pricing & flow dynamics. This reinforces the role of CCGTs as the UK’s primary provider of volume flexibility.

Beyond the nuclear issues of 2020, the Winter 2021 and 2022 forward Peak CSS have also been rising steadily, up by almost 50% since the start of the year (from around 8 to 12 £/MWh). This reflects a tightening UK market balance as nuclear and coal plants close.

Hinkley Point B and Hunterston B are now set to close in 2022, years earlier than initially published. This structurally increases the requirement for CCGT generation output across the year.

The UK’s remaining coal fleet is set to retire by October 2024, but with most plants closing by the start of next winter. This increases the requirement for CCGTs to provide upwards flexibility.

CCGT margins are supported by a structurally steepening supply stack. As nuclear and coal plants are removed from the bottom and middle of the stack, they are being replaced by low variable cost renewables and higher variable cost peaking assets such as gas engines or OCGT. These peakers support CCGT margin uplift in the periods that they set prices.

The CCGT investment case depends not just on captured energy margins, but also on capacity payments. After a run of low prices, the last T-4 auction bounced back to deliver new capacity at £16/kW/yr. Whilst existing assets are only eligible for single year contracts, the UK requires continued new investment in flexible capacity across this decade. That provides structural support for T-4 capacity prices.

Decarbonisation risk is rising… but it cuts both ways

One of the major factors in building a viable CCGT investment case is putting a price on increasing decarbonisation risks. For example, the UK has re-confirmed its target for 40GW of offshore wind by 2030 and has doubled the CfD capacity out for tender in 2021 to 12GW, putting its money where its mouth is.

As renewable output grows towards the 2030s, thermal power generation will increasingly be forced to skirt around wind & solar profiles, disrupting conventional generation patterns. CCGTs will find their load factors compressed as shorter running patterns shift thermal plant economics towards favouring more nimble peaking plants with lower start-up costs e.g. gas reciprocating engines.

Carbon prices are also set to rise, with the UK having outlined a structurally tighter carbon market to replace the EU’s ETS from January 2021 onwards. This will shift the balance away from natural gas towards other lower-carbon forms of flexibility such as batteries and hydrogen. New CCGTs will need to incur additional costs to be CCS or hydrogen ready.

In combination, these factors weigh heavily on new-build CCGT economics, which require a long term capacity price of at least £20-25/kW/yr to underpin required returns. Challenges for new-build CCGTs are however supportive of existing CCGT margins, with higher barriers to entry reducing the risks of new CCGTs undercutting returns.

Despite the barriers to new build CCGTs, gas generation will be needed well into the 2030s, providing significant volumes of energy and flexibility to the UK grid. Storage and peaking assets will provide increasing balancing flexibility across the 2020s, but CCGTs will dominate the UK’s response to more sustained periods of low renewable output and higher winter demand.

Is this a window of opportunity?

We have so far set out three main drivers supporting the value of existing CCGTs:

- rising wholesale margins

- recovering capacity prices

- a structural role in the capacity mix into the 2030s.

The other key factor is acquisition price. This is illustrated e.g. by Centrica’s successful purchase of cheap CCGTs during the post Enron fallout in the early 2000s.

Over the past 5 years, UK CCGTs have been transacting in a 100 to 200 £/kW price range, with more recent transactions occurring towards the bottom end of the range. Rising decarbonisation risks and declining interest in CCGT sales processes, may see the next wave of CCGT transactions fall into the £50-100/kW range. This compares to CCGT new build costs in the 450-550 £/kW range.

Asset prices at these levels open up significant value opportunities. It is possible to build sensible basecase scenarios with payback periods as short as 3 years. Beyond that an investor owns substantial optionality and value upside.

However this opportunity comes with a strong warning: not all CCGTs are created equal. Building a robust investment case requires the right asset, in the right location at the right price.

The investment case is not a bet against decarbonisation, but a bet on the flexibility required to support decarbonisation. Attractive CCGTs have high levels of flexibility, low start costs and a relatively low fixed cost basis. There are assets queued for sale that fit the bill.