The UK capacity market has had a rough ride over the last 2 years. But it bounced back in style on the 5th Mar with a capacity price just under 16 £/kW and 1.8GW of new build capacity clearing.

Market consensus had been rock bottom prior to this result. After three years of prices clearing around the 20 £/kW level, the T-4 capacity price slumped to 8.40 £/kW in early 2018. Later that year the Capacity Market was suspended. Although this suspension only had a temporary impact, the T-3 auction held in Jan this year saw prices further decline to 6.44 £/kW.

This is not a ‘lights out’ scenario. In a capacity accounting sense all is well & good. But this disguises a major shift in capacity mix favouring flex assets.

The low price in the Jan auction this year disguised a significant shift in UK capacity balance. The T-3 auction was a battle of attrition to drive out the remaining coal capacity and make way for some large new interconnector projects.

The primary price driver in the T-3 auction was the exit bids of existing capacity. That changed in the T-4 auction, where marginal pricing was dominated by the bids required to deliver new capacity. Expect much more of that to come as we set out this week.

Key T-4 auction takeaways

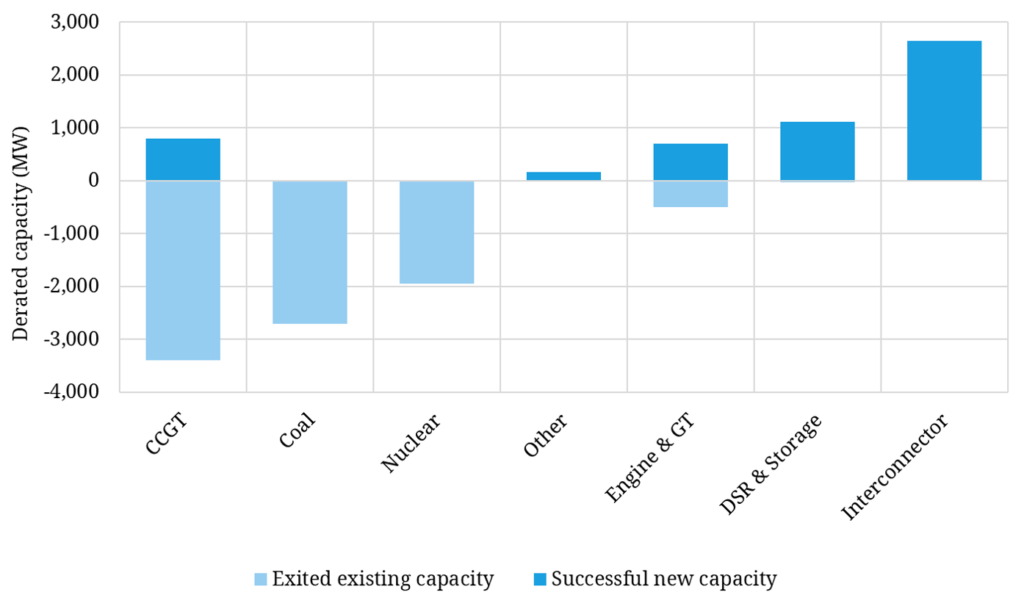

Chart 1 summarise some of the key drivers behind the recovery in prices in this month’s 2023-24 auction. In a nutshell, enough existing capacity exited that the price cleared at a level that to delivered replacement new build capacity.

This was a dynamic we flagged back in an article in Nov 2019, given bids for new build capacity in the 15 – 25 £/kW range. Quote from our article as follows:

“The combination of these higher bidding dynamics and a growing capacity deficit, creates the backdrop for an upside surprise in the T-3 and T-4 auctions, particularly the 2023-24 auction. So what do we mean by a price surprise? Something closer to 20 £/kW than 10 £/kW.”

There was no surprise in the T-3 auction. But there were not many people expecting a big price recovery in the T-4 price.

Here are some key takeaways from the auction results:

- Existing coal: Another 2.7GW of coal exited with UK coal now essentially gone. 3 units of Ratcliffe (1.3 GW) were the only survivors.

- Existing gas: 3GW of existing gas plants also exited – big ones were Keadby, Medway & the 3 Calon CCGTs)

- Existing nuclear: Heysham1 and Hartlepool exited. That makes a total of 4GW of exited EDF nuclear capacity (with Hunterston & Hinkley B also gone).

- New DSR/storage: 1GW of unproven (new) DSR cleared, a lot of which looks to be batteries exploiting a loop hole where they can ‘disguise’ as DSR to receive higher derating factors (expect regulatory action to close this loop hole by next auction, supporting capacity prices). There was also 115MW of ‘undisguised’ new batteries.

- New Interconnectors: 3 new projects successful (2.6GW derated), NSL, IFA2 & Eleclink. No real surprises here.

- New gas: SSE’s Keadby CCGT was successful (0.8GW) but was already committed (i.e. not genuine incentivised new CCGT build). But there was 715MW of gas peaking capacity successful, mostly gas engines. Expect more of these in auctions to come.

- Other new MW: Some other small volumes of merchant renewable capacity cleared: 153MW waste and 11MW onshore wind.

What happens next?

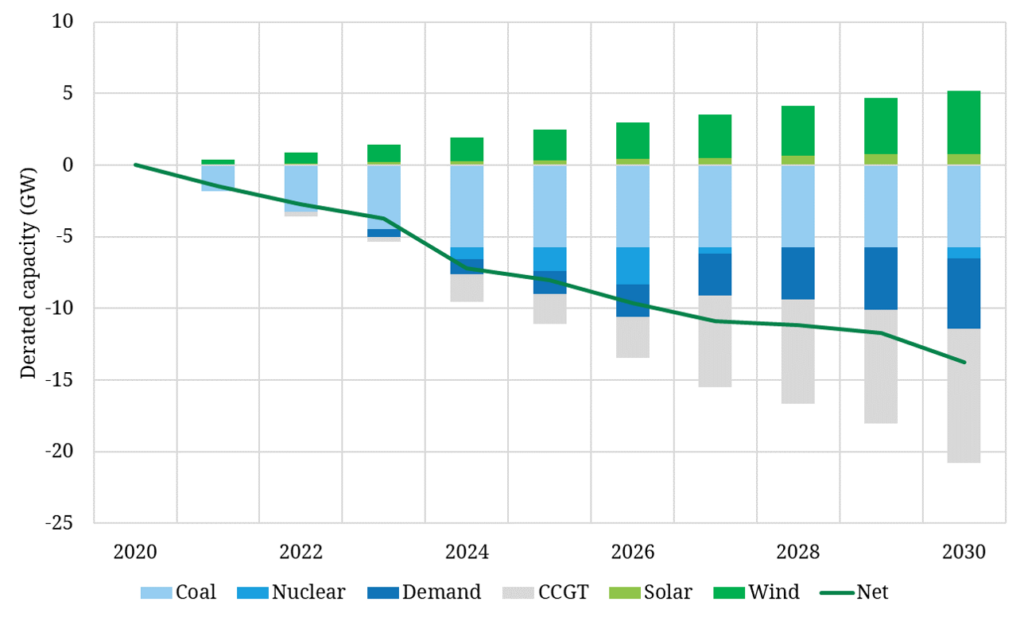

Chart 2 shows why we should get used to the capacity market clearing at prices that pay for new capacity (e.g. in the 15-25 £/kW range).

The green bars show derated new build of wind and solar capacity, assuming the UK meets its latest renewable targets. This is substantially outweighed by scheduled closures of coal and nuclear capacity and end of lifetime closures of CCGTs. The green line illustrates the rising UK capacity deficit across the 2020s, which needs to be plugged with new capacity delivered in the capacity market.

This is not a ‘lights out’ scenario. The capacity market has been implemented to maintain the government’s defined security of supply standard. So in a ‘capacity accounting’ sense all is well & good. But this disguises a major shift in capacity mix over the next 5 years.

Between now and 2025, at least 10GW of derated flexible coal, nuclear and gas-fired capacity will close. This will be replaced with intermittent wind & solar, Interconnectors, storage, DSR and high variable cost gas peakers. This is good progress in terms of the key goal of decarbonising the power sector. But it is also setting up a major transition in market price signals.

Our stochastic modelling of the UK market shows significant rises in both price shape & price volatility by the mid 2020s. In parallel there is a substantial growth requirement for flexible balancing services. When you combine this with an ongoing recovery in capacity prices, it is good news for investors in flexible capacity.

Briefing pack: The flexibility to decarbonise

Click on link to download our briefing pack with detailed analysis on flex capacity investment requirement, building an investment case and asset opportunities. |