Just as the energy crisis appears to be easing in Europe in 2023, a potential banking crisis ignited last week.

“Macroeconomic drivers are buffeting energy prices”

This was initially sparked in the US with the collapse of two mid-tier banks (Silicon Valley & Signature). But contagion quickly spread to Europe with solvency concerns resurfacing over some large European banks e.g. Credit Suisse & Deutsche Bank.

The threat of a banking crisis triggered a strong market reaction with falling commodity prices and one of the sharpest ever declines in global interest rates, as markets priced in an increasing risk of a sharp economic contraction.

It has been a while since we stepped back and looked at the macro factors impacting energy markets. So in today’s article we take a 5 chart tour of some key macro drivers in play and their implications for energy markets.

1. Bank risk

The banking sector is not our area of expertise, but it is useful to start with some quick factual context on current market events.

Banking stress emerged two weeks ago with a ‘deposit run’ on mid-size US banks. Depositors withdrew cash in a flight to safety, moving into larger banks or government securities (which also offered higher returns). The US Federal Reserve has been forced to make large liquidity injections into the banking system in an attempt to stem contagion.

Stress then spread to European banks. Credit Suisse in particular suffered a sharp fall in its share price given growing solvency concerns. This was not helped by its largest shareholder (Saudi National Bank) stating it will not inject more capital to prop up the bank.

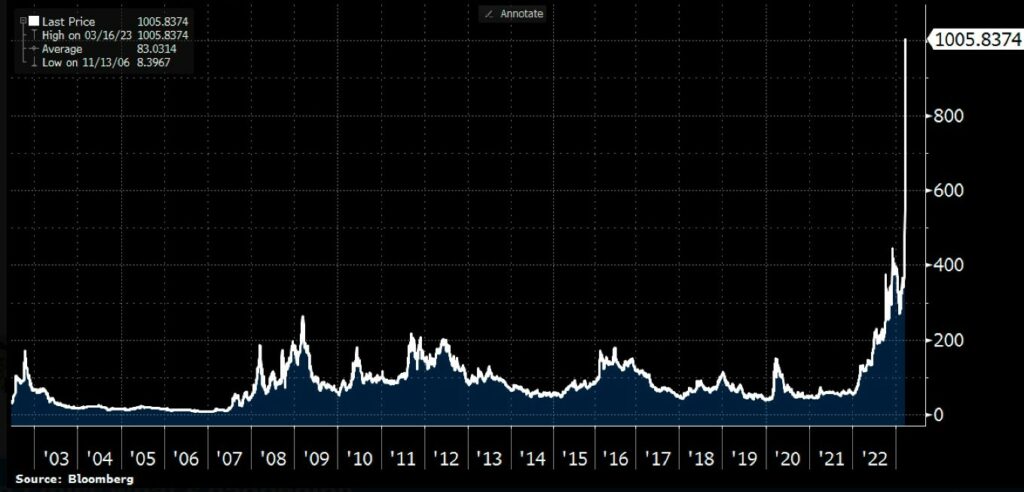

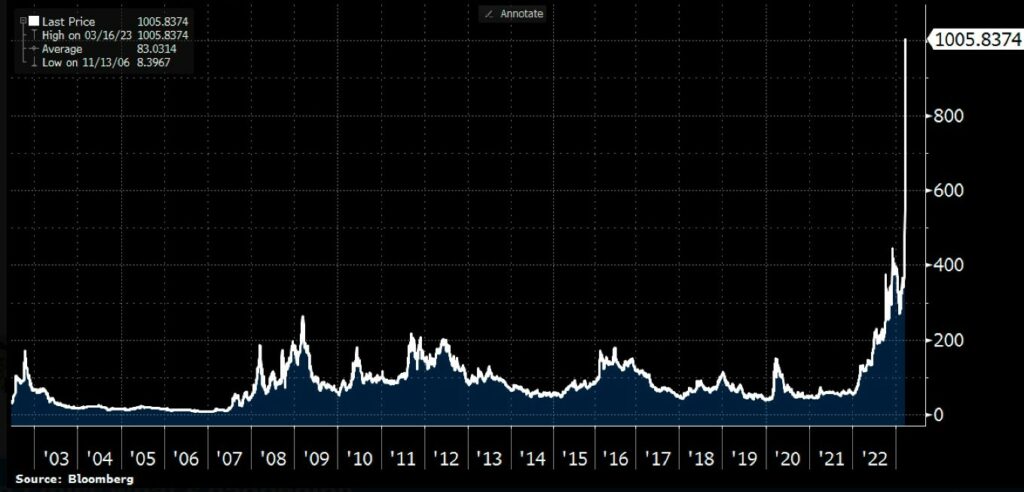

The Swiss central bank stepped in to provide Credit Suisse with liquidity support but despite this default risk soared. Chart 1 shows market pricing of insurance against Credit Suisse default surging exponentially late last week.

To stave off a disorderly collapse, Switzerland’s largest bank UBS agreed to buy Credit Suisse on Sunday afternoon in what was effectively a forced takeover that wiped out a substantial portion of remaining equity value.

Chart 1: Credit Default Swap cost of insuring against Credit Suisse default

Source: Bloomberg

Importantly, other large European banks also saw sharp declines in share prices last week given contagion fears, with Deutsche Bank a particular concern.

From an energy market perspective the policy response to banking stress may have a bigger impact than the banking issues themselves. In order to explore the policy response it helps to take a look at two key macro drivers: inflation & interest rates.

2. European inflation

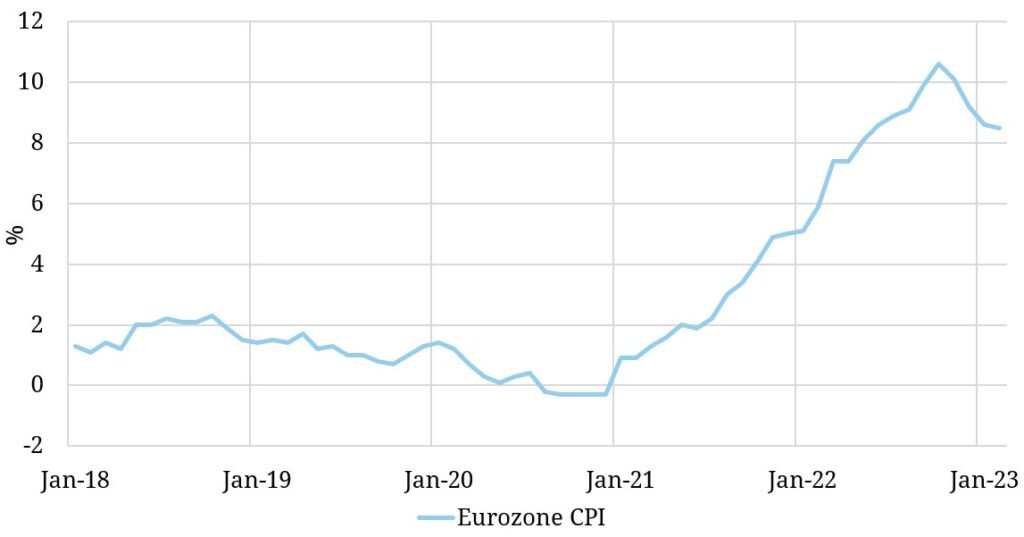

Inflation has been the dominant driver of both fiscal (government) and monetary (central bank) policy across 2022. Gas & power prices have been a key factor driving Eurozone inflation.

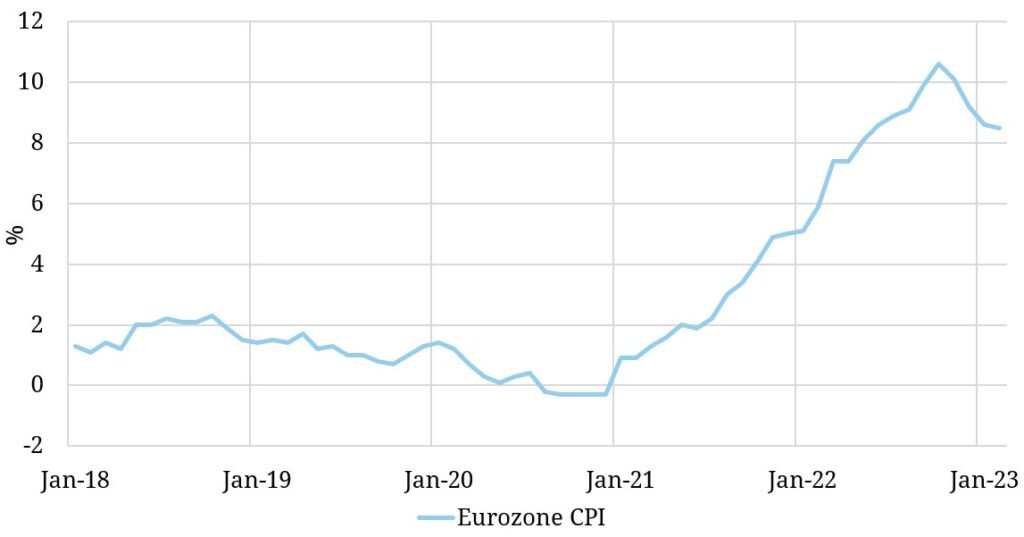

Chart 2 shows the surge in Eurozone consumer price inflation (CPI) across 2021 & 2022 after years of relatively low and stable levels.

Chart 2: Eurozone inflation

Source: ECB

Although inflation has eased slightly in 2023 it remains at elevated levels versus the 2% European Central Bank (ECB) inflation target.

Until the recent bout of banking stress hit, the ECB was firmly focused on tightening monetary policy (e.g. via interest rate hikes). However the threat of a banking crisis trumps inflation concerns, at least temporarily.

Banking stress may force central banks and governments into changing policy direction to prevent contagion. That was reflected in some very big moves in interest rates last week.

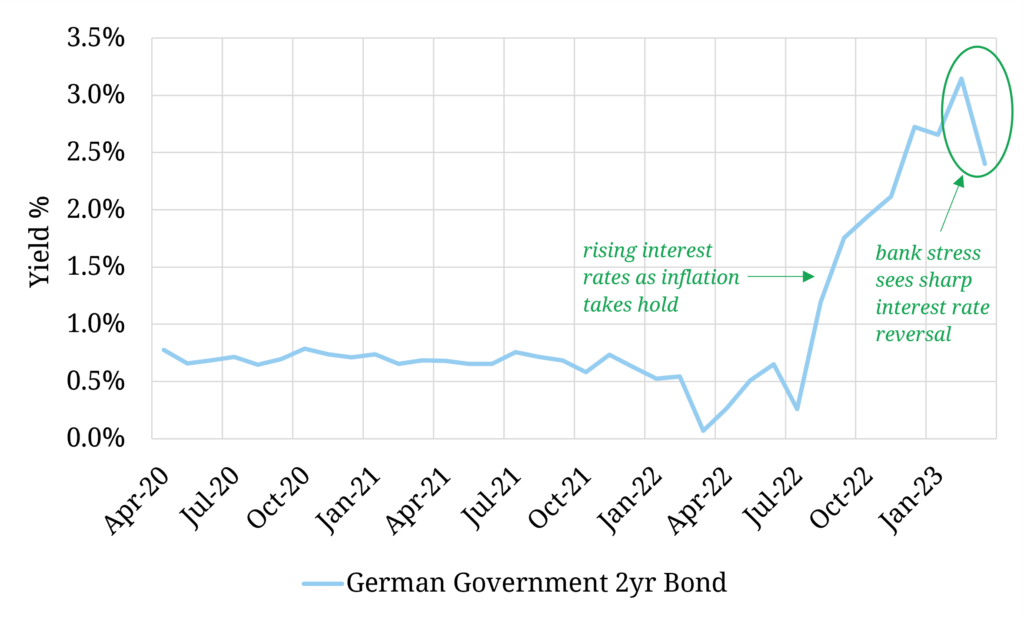

3. European interest rates

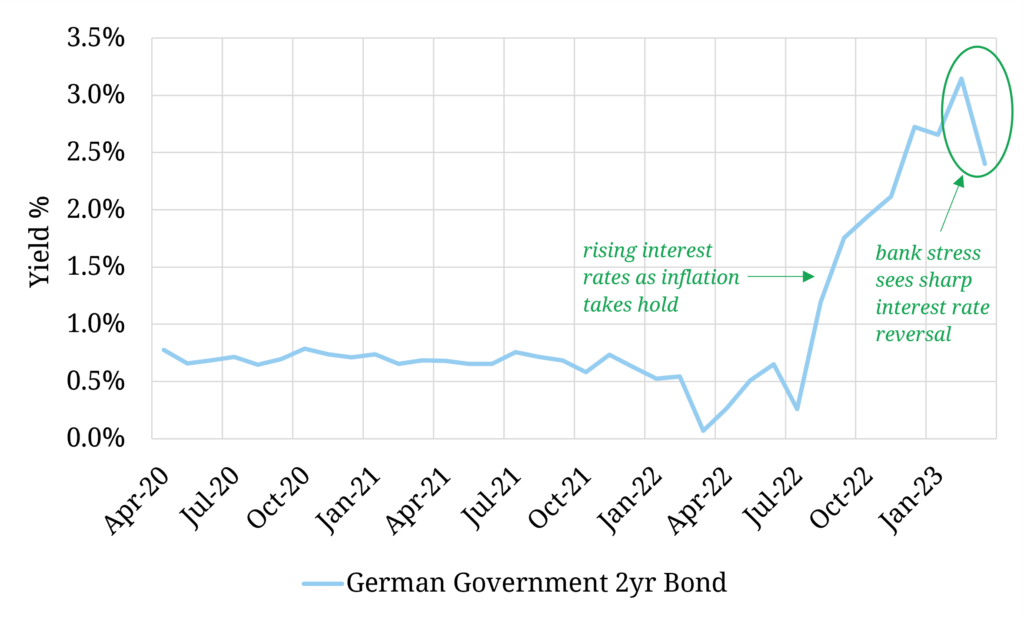

European interest rates surged in 2022 as inflation took hold and the ECB started hiking rates. Chart 3 shows a big move higher in German 2-year interest rates since Q3 2022. That is until last week when rates rapidly reversed course in response to bank stress.

German 2 year rates fell from 3.3% to 2.4% over the course of a week, mirrored by similar moves across other European countries. This was one of the sharpest interest rate moves for decades and signals the emergence of a major economic threat.

Chart 3: German 2-year interest rates

Source: Bloomberg

The sharp decline in interest rates last week was a global not just a European event. It reflects markets pricing in a potential shift in central bank policy due to:

- a need to back off rate hikes (& potentially cut aggressively) in order to contain banking stress

- rising risk to economic growth as a result of a rapid contraction in bank lending.

The growth threat has also impacted commodity markets.

4. Commodity prices

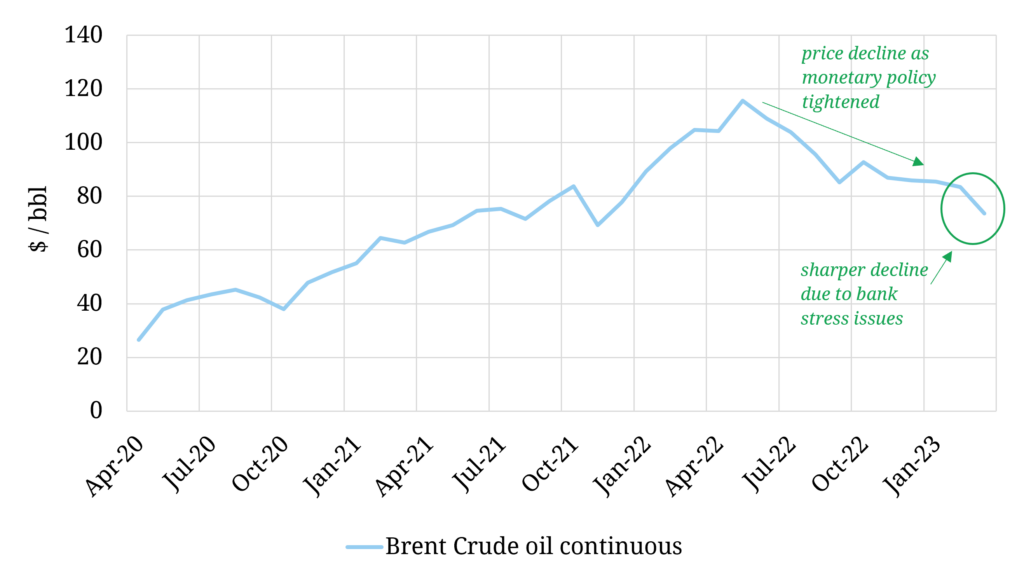

Economic growth is closely linked to commodity demand. Banking stress has been reflected in commodity price movements over the last two weeks, e.g. across oil, gas, carbon & metals prices.

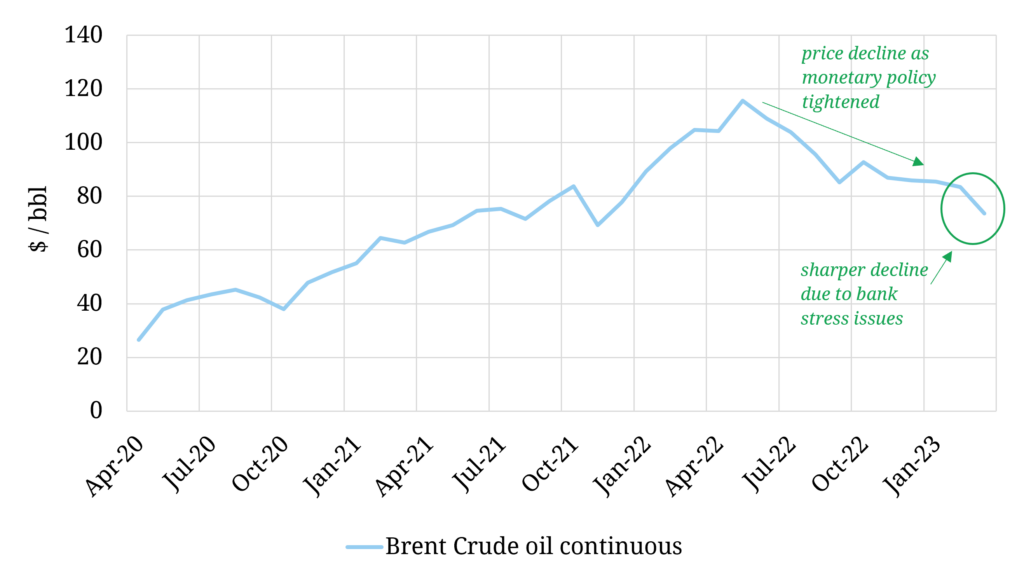

Chart 4 shows the decline in Brent crude prices from around 85 $/bbl two weeks ago to 72 $/bbl last Fri.

Chart 4: Brent crude front month contract price

Source: Bloomberg

European energy markets have been dominated by specific supply & demand balance issues relating to the energy crisis across 2021-22. But macro drivers are becoming more important again in 2023 as the crisis has eased.

European gas & power markets have once again become re-anchored to coal for gas plant switching levels, with oil for gas switching also playing a role in setting Asian & European gas prices. As global commodity prices reassert their influence on European energy markets, there is on one more key macro driver worth looking at.

5.Central bank balance sheets

It is very unlikely that current banking stress turns into a 2008 style banking crisis. Governments and central banks have a much better prepared set of policy response tools. But the nature of the policy response may have important implications for energy & other commodity markets.

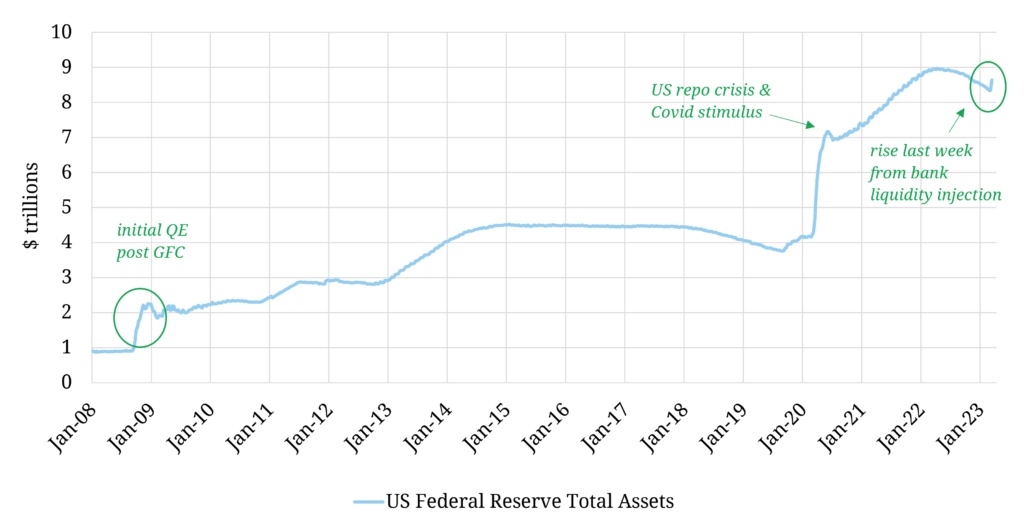

Central banks are likely to fight a banking crisis with some form of monetary easing e.g. quantitative easing (QE) and balance sheet expansion (as they have done in the past).

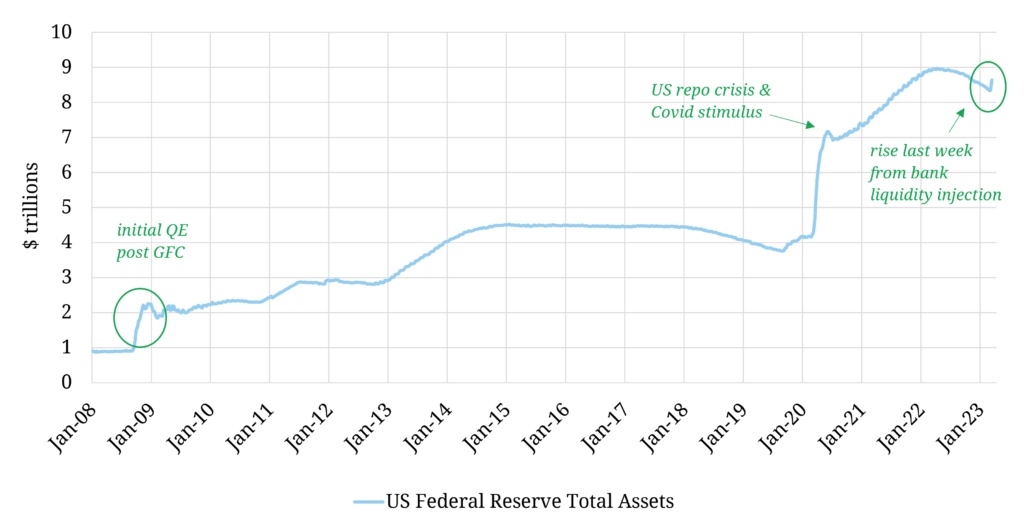

Chart 5 shows the size of the US central bank (Fed) balance sheet. The broad trends here are reflective of the ECB and Bank of England balance sheets which have undertaken similar QE programs.

Central bank balance sheets contracted across 2022 after a long period of expansion, as central banks raised rates and wound down QE in an attempt to fight inflation. That has contributed to commodity price declines across the last 6 to 9 months.

There was a clear inflection in the Fed balance sheet last week (a $300 bn surge) as it was forced to inject liquidity into the banking system.

Chart 5: US Federal Reserve balance sheet assets

Source: US Federal Reserve

The scale of central bank response required to contain banking stress will be a key factor to watch across the next few weeks. There are two time horizons in play.

In the near term, the more that banking contagion spreads, the greater the risk of contraction in bank lending & economic growth. That will likely weigh on commodity & energy prices.

But if the threat of a banking crisis forces central banks to back off rate hikes and resume Quantitative Easing, it may provide more structural tailwinds again for global commodity prices as the dust settles, as we saw from the policy response to the Covid demand shock in 2020.

We are actively looking to expand our team by recruiting Analysts with 1-4 years experience. If you are interested, please send a CV and brief covering note to recruitment@timera-energy.com.