Wind power is forming the backbone of the transition to a low carbon power sector across markets in NW Europe. The challenge is that wind resource in most countries is focused in a limited number of locations. This is particularly true for offshore wind.

“There is no guarantee that negative 100 £/MWh prices today will be there in 5 – 10 years”

Transmission networks are struggling to keep up with the pace of wind deployment. This is causing increasing network congestion and wind curtailment as we set out recently. System balancing costs are rising rapidly as a result.

Transmission upgrades are typically slow & expensive. But flexible assets such as batteries and electrolysers offer an alternative means of absorbing surplus wind output. While this sounds like a major tailwind for flex asset investment, there are some key practical challenges to monetising congestion management value.

Today we look at wind constraint management challenges in the GB market and consider the impact of this on battery investment cases.

Where are the key GB constraints?

The GB market faces several key challenges from a network management perspective:

- Demand is focused in the South, where existing thermal generators are steadily closing

- Generation capacity growth is focused in the North, particularly in Scotland where the majority of new offshore wind capacity is set to come onshore

- The combination of 1. & 2. is causing major network constraints flowing power South from Scotland

- There are to a lesser extent constraints associated with growing interconnector flows from the Continent into South East England.

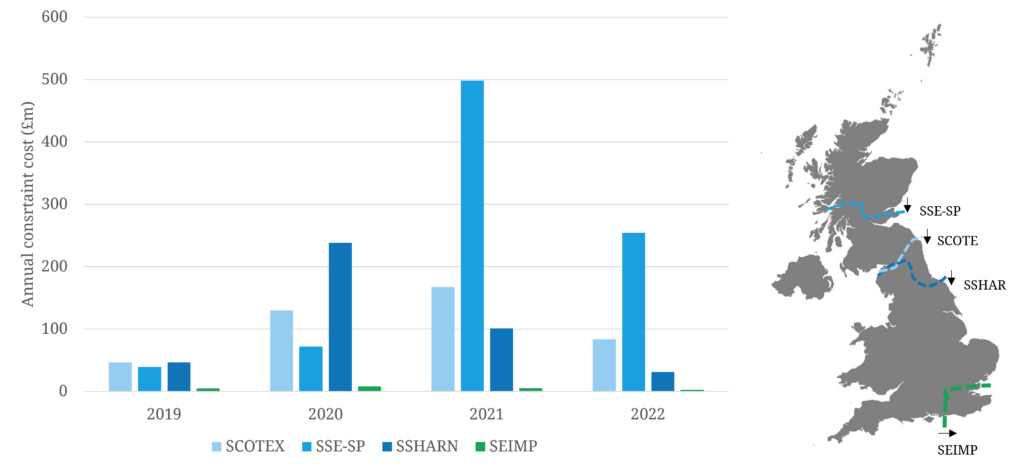

Chart 1 shows a map marked with the key constraint boundaries and the costs of managing these constraints across the last few years.

Two main takeways from the chart: (i) constraints flowing power south from Scotland are by far the biggest issue and (ii) constraints & costs are rising quickly (as wind output grows).

Options for constraint alleviation

There are two broad approaches to alleviate network constraints & reduce wind curtailment costs:

- Upgrade transmission networks

- Incentivise flexible demand to absorb surplus output (e.g. via batteries or electrolysers).

There are some clear advantages of the latter which we summarise in Table 1.

Table 1: Benefits of transmission upgrades vs incentivising flex asset investment

It would appear logical then that it is a ‘no brainer’ to invest in lots of flexible assets behind the key network constraints in Scotland. The reality is not so straightforward.

How do batteries generate value uplift from constraint management?

We focus in this article on the battery investment case impact of constraint management. Much of this logic also applies for electrolyser assets, but these are more complex given evolving economics & policy support framework.

The main revenue generating mechanism for batteries from constraint management services is Balancing Mechanism (BM) constraint actions. Battery operators place bids & offers in the BM to provide flex down & up services to help Grid (as system operator) to manage system constraints.

For a battery in Scotland, revenue generation is focused on being called to charge during higher wind periods to absorb surplus wind output. As a result, the marginal pricing of BM constraint actions is linked to the pricing of wind curtailment.

This can currently result in deeply negative charge prices for batteries (increasing cycling value). This is driven for example by wind farms in Scotland being incentivised to generate at negative prices to receive Renewables Obligation (RO) revenue.

Grid’s Pathfinder tenders are another potential source of system revenue for batteries. Payments here are not specifically focused on congestion management but on associated voltage & stability issues (e.g. inertia). The strong advantage of Pathfinders vs BM constraint payments is that they represent contracted revenue streams to underpin margin downside. The same is true of network service contracts with DNOs for distribution connected batteries.

5 factors to consider before investing in Scottish batteries

We have supported a number of battery asset investors analyse value uplift from constraint management. The impact of constraint management actions on the investment case for Scottish batteries make these projects significantly more complex to analyse than other battery projects.

Here are 5 issues we think are worthy of in-depth analysis:

- What drives value uplift & how may this change? Low/negative BM charging prices are a key value driver. These are determined by the evolution of congestion patterns, variable cost incentives & competition across wind & flex assets to set marginal BM prices.

- What can drive value erosion over time? Just because negative prices are available today (e.g. in excess of -100 £/MWh), does not mean that they will be there in 5 or 10 years. Despite rapid wind growth, RO incentives are rolling off and competition to provide congestion services is set to increase across wind, battery & electrolyser assets.

- What is my ability to lock in value? There is no easy way to limit congestion management revenue downside (Pathfinders & DNO contracts aside). Value uplift is very location specific and can be eroded fast by new asset deployment or transmission upgrades.

- What is my extra network cost burden? Grid connected batteries need to pay transmission network (TNUoS) charges. These are significantly higher in Scotland than for battery projects further South. TNUoS tariffs are reset annually and rapid offshore wind growth may increase the incremental cost burden on Scottish sites over time.

- How robust is the investment case without congestion uplift? On a risk adjusted basis, BM constraint payments are ‘icing on the cake’. Effective capture of energy arbitrage revenues forms the backbone of any robust GB battery investment case over an investment horizon (via capture of Wholesale & BM price spreads).

From a system management perspective it is a ‘no brainer’ to use batteries as a tool to alleviate congestion. But there is no guarantee that this translates into a compelling investment case for individual battery projects.

The point of the 5 issues above is not to dismiss battery constraint management investment opportunities. It is to highlight factors that make investment cases complex, some of which in our view should be addressed by policy refinement.

Quantifying battery margins

A battery project investment case is built on margin distribution analysis not margin forecasts.

You can buy a consultant battery margin forecast and the only guarantee you have is it will be wrong. If you buy Base, High & Low scenarios you will have a range of 3 wrong outcomes.

Quantifying realistic battery margin distributions requires the dynamic modelling of price volatility, trading strategy, degradation, and margin stack co-dependence. This needs to be done with a stochastic dispatch optimisation model that captures path dependent exercise of storage optionality.

This is not a ‘black box’ approach, it is a source of valuation transparency with a direct relationship to how the battery is optimised in practice.

A margin distribution quantifies the risk/return profile of the battery. The expected level of margin (or mean of the distribution) is a key valuation benchmark. The shape of the margin distribution (e.g. P10 & P90 percentiles) is just as important in quantifying how margin may deviate given uncertain market conditions.

We set out the challenge above presented by limited downside margin protection for BM congestion payments. This makes quantifying margin distributions and risk adjusted impact on project value even more important for battery projects targeting constraint revenue.

If you are interested in more details on battery investment case drivers, you can download our recent briefing pack on Investment in flexible power assets.

Supporting battery & electrolyser investors is one of Timera’s key focus areas. We are currently recruiting Analysts – see here for more details.