“German security of supply hinges on new gas capacity as coal retires”

Thermal generation state of play in Germany

Germany’s thermal fleet is undergoing a structural transformation. The nuclear fleet was fully retired in 2023. Germany is also pursuing an ambitious schedule for regulatory closures of the coal and lignite fleet, with 5GW of recent closures.

Ambitious targets to retire another 13GW of coal & lignite capacity by 2030 mean that the German power system faces a substantial loss of firm capacity across the next 5 years. This poses a direct threat to the security of supply, and coal closures require replacement with new gas-fired capacity.

Successive governments have explored mechanisms to replace retiring thermal plants. The design and scale of Germany’s gas capacity mechanism has been refined over several policy cycles, with capacity requirements moving between 10 & 20GW.

European Commission approval has now finally been secured for a 12 GW tender. In this article, we look at the structure of capacity support for new gas plants as well as 5 key investment case drivers.

Capacity support contracts

The latest details on the proposed capacity tender design are as follows:

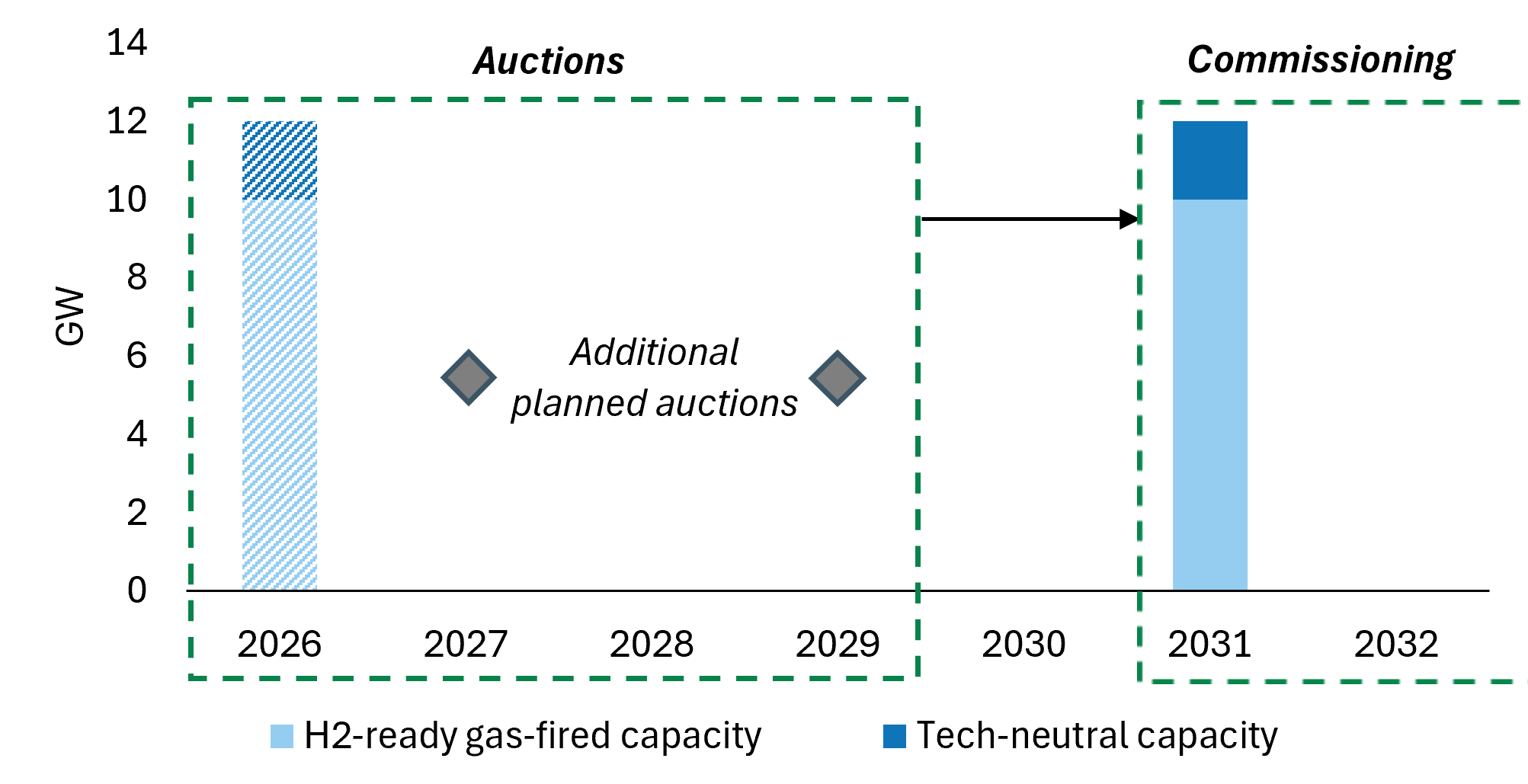

- First tender to be held in 2026, with further auctions possibly in 2027 and 2029.

- A total of 12 GW of new-build dispatchable capacity will be procured.

- 10 GW of the capacity will be required to deliver at least 10 hours of dispatchability.

- The remaining 2 GW will be auctioned without a long-duration requirement.

- All plants must be new-build and reach commercial operation by 2031.

- Successful projects will receive 15-year contracts.

- Gas plants must be hydrogen-ready at commissioning, with a mandatory switch to hydrogen required from 2045.

Tender timelines are summarised in Chart 1.

Asset pipeline begins to take shape

While the tender is newly confirmed, the market is not starting from zero. Several major German utilities have already positioned themselves for participation. Based on previous tender publications, around 6 GW of gas capacity across six sites has been announced by RWE, Uniper and Steag Iqony.

Although greenfield developments remain an option, most proposals focus on converting decommissioned coal and lignite sites into gas-fired generation. This approach offers clear advantages: existing grid connections, established permitting, and proximity to demand centres. As a result, much of the new capacity is likely to be well aligned with Germany’s major load regions, supporting both system stability and efficient market integration.

5 factors driving a viable investment case

Despite the support provided by the tender, capacity payments alone will not be sufficient to underpin the investment case. We set out 5 key factors for investors to consider, recognising that competitive edge will be focused on merchant value capture:

1. Market requirement for gas flex

Gas plant value capture will strongly depend on the evolution of RES penetration, demand, coal closures, interconnection & storage roll out. In an increasingly wind, solar & storage dominated system, gas will play a key role in producing power across periods of low RES output, enabling coal to retire. But that role will by definition mean significant asset margin variability.

2. Cross border flows & system constraints

Germany has the highest level of interconnection of all European power markets, and new interconnector investment continues. It also has substantial internal transmission constraints that impact asset value and exacerbate German reliance on interconnector flows. The ability to robustly model flex & flow requirements on a pan-European basis is key to quantifying the value of German gas fired assets.

3. Gas asset margin distributions

Configuration of gas plant flex (e.g. ramping flex & start costs) is important for value capture from swings in clean spark spreads. Stochastic modelling of gas asset margin distributions, based on hundreds of correlated simulations of gas, power & CO2 market price outcomes, is key to quantifying intrinsic & extrinsic margin capture. Margin distribution analysis also underpins debt sizing and project financing bankability.

4. Gas market evolution

Gas market dynamics are a core driver for flex power assets (as evidenced across the last 5 years). German gas price dynamics are strongly linked to the global LNG market. Robust stochastic modelling of gas price evolution is just as important as it is for power prices.

5. ‘Hydrogen readiness’

Capacity contracts stipulate requirements for ‘hydrogen readiness’. But in practice, there is a wide range of uncertainty as to when and how hydrogen may replace gas as a fuel source. This means it is important to design a cost-efficient compliance solution, retain flexibility (recognising uncertainty) and analyse the evolution of hydrogen vs natural gas usage.

After years of waiting, it is likely that gas plant tenders and investment will now move fast in Germany. In our view, competitive advantage in the auctions will be underpinned by focusing on the 5 factors above.

Interested in more on German gas plants?

We have extensive experience supporting German flexible power asset investors, including gas-fired plants. This is supported by a unique stochastic gas plant model, as well as stochastic pan-European power market & European gas market models.

If you would like more information on our services in Germany or how we support clients with asset valuation and investment, please contact Sam Kayne, Principal, at sam.kayne@timera-energy.com.