Global gas prices have plummeted from their late August peak, with a mild start to winter and brimming storage levels in both NE Asia and Europe reducing the scale of the required demand response this Winter.

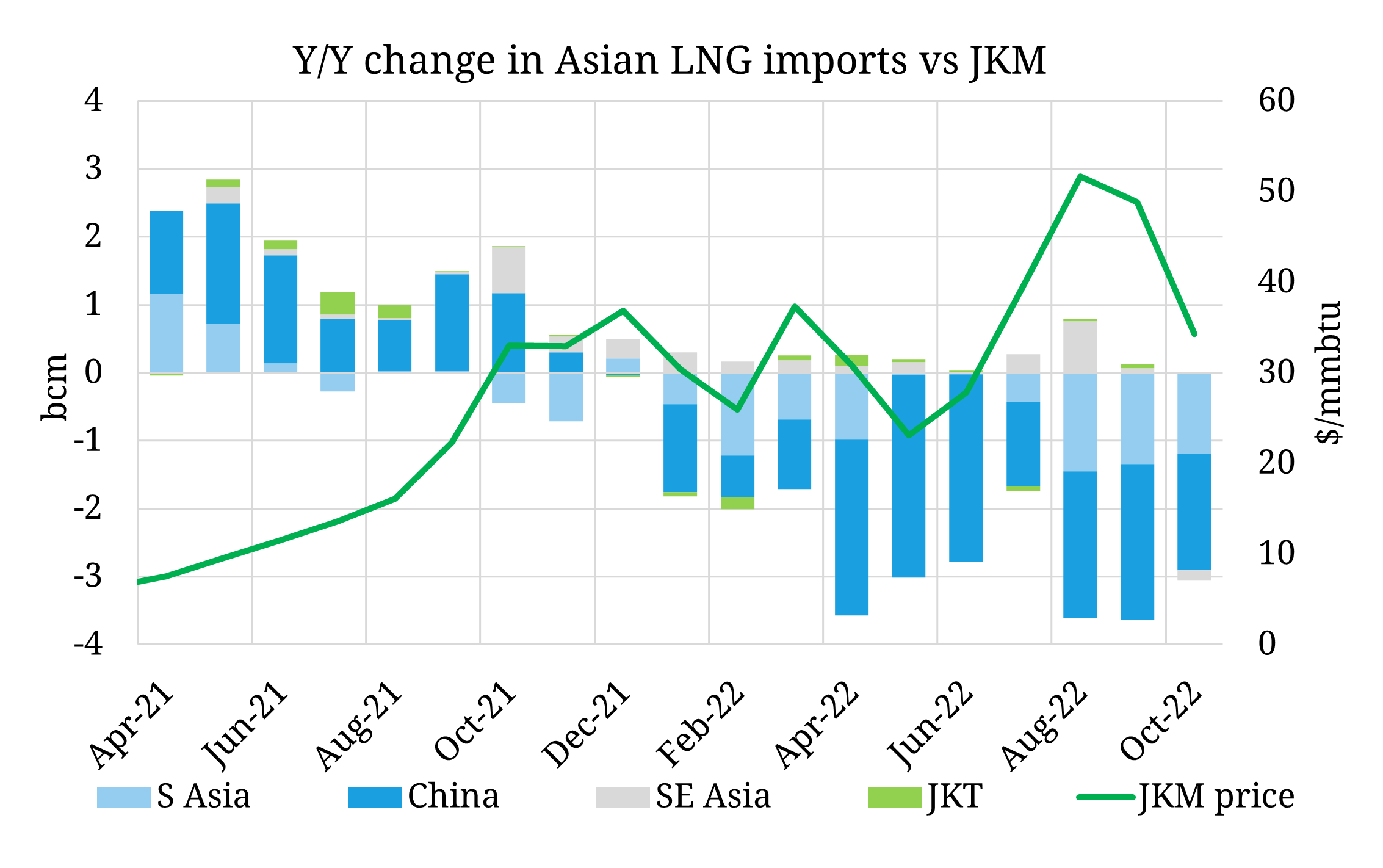

Nonetheless, Asian LNG imports across October continued to show significant year-on-year losses, led by China and South Asia (Bangladesh, India & Pakistan). Losses are being driven by the combination of fuel switching from gas to coal-fired generation and gas to oil substitution, as well as outright demand destruction.

Prompt JKM prices over November have continued to trend lower, trading below the $30/MMBtu mark, implying limited buy-side activity even as we move into the assessment window for core Winter months. The story could change next year, were Chinese demand to rebound with any potential loosening of Covid restrictions. Any increase in Asian demand would clash with the European challenge of replacing ~40 bcm of lower Russian supply in 2023 vs the previous year.