Welcome back to our first feature article for 2024. Following a 10 year tradition, we start the year with five surprises to watch out for on your radar screens.

Usual caveat: these are not forecasts or predictions but cover areas where we think it is worth:

- challenging prevailing market consensus

- at least considering the potential value & risk impact of each surprise coming to pass.

Now with the small print out of the way, let’s get into it.

1. Europe doubles down on RES

2023 was not a good year for wind in Europe. Large increases in cost of capital and component costs drove a set of weak wind auction results and project cancellations. We recently set out 5 challenges facing wind investors which caused a material slowdown in investment momentum last year.

Solar investment was more promising in 2023 with a 40% increase in capacity installed vs 2022, led by German rooftop PV growth. However cost pressures are also impacting solar investment and growth rates are widely expected to slow in 2024 (e.g. SolarPowerEurope predicts only an 11% increase in capacity this year).

What if, despite the 2023 cost headwinds, we see a surge in wind & solar investment momentum in 2024 as Europe doubles down on its support for renewables?

Potential drivers:

- European Wind Charter signed by EU member states in Dec 2023, with 111GW offshore wind capacity target by 2030 (vs ~32GW in 2023) – very unlikely this target will be met but it supports stronger policy action

- Fiscal support packages across Europe focused on economic recovery after a tough 2022-23, targeting renewables investment to address both decarbonisation & security of supply

- Policy reforms to address RES tender/auction processes (e.g. raising caps & allowing for cost increases) and reductions in planning & permitting hurdles

- Easing component cost pressures combined with a declining cost of capital (financial markets are pricing in multiple ECB & Bank of England interest rate cuts across 2024).

Europe suffers from bureaucratic hurdles, but the energy crisis shows how things can happen fast when Europe has its back to the wall.

2. German & Italian battery investment take off

Interest in German & Italian batteries may have picked up in 2023, but installed grid scale capacity volumes remain relatively low (~2GW in Germany & 3GW in Italy). The GB market is currently the ‘fastest horse’ in the battery race with over 11GW of committed capacity due online by 2027.

What if 2024 is the year when German & Italian investment momentum accelerates to a position where both markets could overtake GB BESS deployment by 2030?

Potential drivers:

- Implementation of a new long term contract based mechanism in Italy, targeting up to 71GWh of energy storage by 2030 (approved by the EU in late Dec 2023)

- Large flows of utility, Stadtwerke & foreign capital into German battery projects, supported by strong BESS returns across 2022-23 and grid tariff exemptions

- Ongoing near term aFRR revenue support across synchronised NW European power markets (e.g. France recently joined the expanding aFRR market)

- Increasing debt & equity investor comfort with BESS revenue stack model

- Easing in cost of capital & component cost pressures (vs 2022-23).

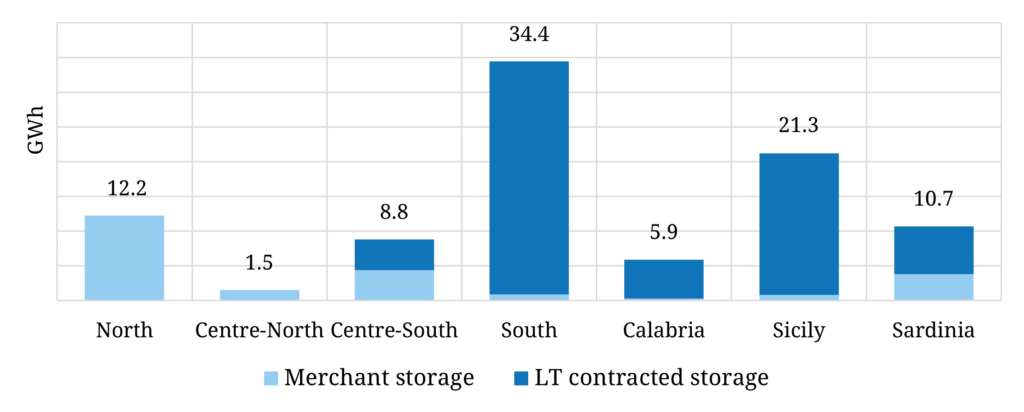

Chart 1 shows a breakdown of Terna’s indicated volume requirements for Italian storage of 71 GWh by 2030. This is the equivalent of 15-18GW of capacity depending on storage duration – in other words it’s big!

Chart 1: Italian system operator BESS target volumes by 2030

Source: Terna, Timera Energy

Investment actions over the next 1-2 years are likely to determine which players dominate these two key storage growth markets.

3. Surge in LNG commercial activity

The LNG market now drives the European gas market which in turn is the primary driver of European power prices. So let’s step back and consider a global gas market perspective.

The major focus of the LNG market in 2023 was on the contracting & subsequent FID of the next wave of (i) liquefaction capacity (focused on US & Qatar) and (ii) European regas capacity (focused on Germany, Italy & the Netherlands).

What if 2024 sees the focus shift to a surge in commercial activity in the form of secondary market deals and M&A transactions?

Potential drivers:

- Growth in volume of SPAs signed directly with portfolio players (vs primary producers) given physical length held by many major portfolio players, risk of oversupply in second half of decade and consumer demand for DES supply

- Growth in secondary market contracting of European regas capacity, including derivatives e.g. put options on capacity that enable primary holders to sell excess capacity to portfolio players

- Strong growth from more recent market entrants backed by large balance sheets (e.g. Aramco), upstream players (e.g. ConocoPhillips) & large consumers (e.g. INEOS, BASF).

- Growth in M&A transaction activity driven by player exit and portfolio acquisition & consolidation e.g. large balance sheet players expanding portfolio footprints.

The next couple of years represent an unprecedented opportunity to build LNG portfolio value given strong growth and structural shifts in market regimes, pricing dynamics & business models.

4. Commodity price inflation returns in force

Commodity prices were consistently weaker than consensus expectations across 2023. There were idiosyncratic drivers across different markets but the common theme was weaker demand than expected.

Despite ample geopolitical tension & rising costs of US shale, crude struggled to stay above 80 $/bbl. ARA coal prices fell 35% across the year. Carbon EUAs tested 100 €/t before falling back into the 70s. The Cal 2024 TTF gas price declined more than 50% across 2023, the spot lithium price by more than 80%.

What if commodity prices end their grind lower in 2024, turn around and rally hard?

Potential drivers:

- Synchronised fiscal & monetary stimulus supports commodity demand & prices e.g. across

- Europe – in response to economic weakness & to address energy crisis impact

- US – given a US presidential election year (traditionally strong stimulus)

- China & India – strong stimulus & capex spend to bolster economies

- The much-anticipated global recession never happens & economic growth reasserts

- Broader goods & service inflation ends its decline and starts to rise again (e.g. in H2 2024)

- The US dollar weakens materially (a strong historical driver of commodity price rallies)

- European gas & power demand shows some recovery.

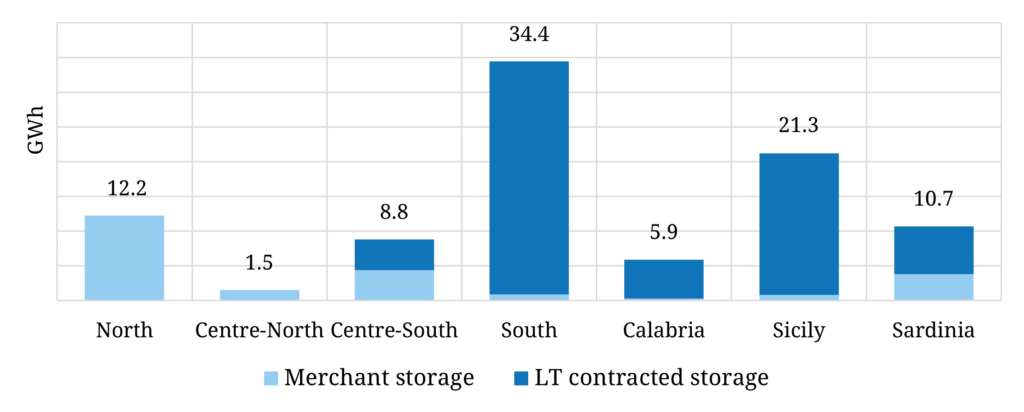

What could this mean for European gas & power prices? Chart 2 shows the current state of play for the key benchmark TTF gas price relative to (i) oil indexed LNG contract benchmarks (ii) coal for gas switching price range (driven by ARA coal & EUA carbon price levels).

Chart 2: Global price benchmark chart

Even without any recovery in European gas & power demand, a rise in LNG market switching levels (e.g. driven by a coal, carbon & oil price rally) could materially lift gas & power prices across Europe.

Commodity prices may have further downside in H1 2024 before they recover, but markets have a habit of kicking hard when there is a strong consensus to the downside.

5. Nuclear renaissance is accepted as reality in Europe

Nuclear has been a dirty word across most of Europe since Fukushima (with the notable exception of France and the UK). Many countries have specifically targeted accelerated closure of nuclear plants, most prominently Germany who finished closing its fleet in 2023. The net impact has been the erosion of security of supply, the burning of more fossil fuels to plug the gap & higher marginal power prices.

This strong anti-nuclear stance started to crack in 2022-23 as a result of the energy crisis. What if it split apart in 2024 and nuclear became broadly accepted as a key pillar of Europe’s strategy for both decarbonisation & security of supply?

Potential drivers:

- Growing global narrative that nuclear is key to accelerating the phase out of coal (e.g. COP 28 pledge by 22 countries in support of nuclear as key to achieving net zero)

- Likely 2024 creation of an EU driven European Alliance on Small Modular Reactors (SMRs), supporting a new generation of much smaller & safer nuclear generators

- Large increase in US policy & investment behind nuclear technology (particularly SMR)

- Shift in European political resistance to nuclear e.g. conservative German parties backing return of nuclear; Sweden backing new nuclear; France backing a renewed nuclear growth push.

This is a tougher surprise to benchmark – it is not about building lots of new capacity in 2024, but about a major shift in acceptance of nuclear as a pillar of energy transition in Europe.

There you have it – 5 surprises to consider. All the best in navigating these (& many more) surprises in 2024! And feel free to reach out to us if you would like to catch up.

You can also catch us in person at the Energy Storage Summit in London.. more details below.

Timera sponsoring & presenting at 2024 Energy Storage Summit

Our Power Director, Steven Coppack, will be speaking on:

BESS Investment Case in Germany & Italy

- Factors driving BESS investment momentum in DE & IT

- How the DE & IT investment cases differ from GB

- Revenue stack breakdowns for DE & IT

- Market access, offtake & financing

- Key investment risks

Drop by the Timera stand to meet some members of our power team. It would be great to catch up face to face if you are coming along – feel free to contact Steven steven.coppack@timera-energy.com.