“In a buyer’s market, optionality trumps volume – and Asia will set the clearing price”

We kicked off February 2026 by attending the LNG 2026 conference in Doha, including a presentation on the “Portfolio impact of the LNG supply wave” by our LNG & Gas Director, David Duncan.

This is the world’s leading LNG focused conference and always a useful barometer for industry focus – here are 5 takeaways.

1. US supply momentum is fading

A record 60 mtpa of US LNG export capacity reached FID in 2025. The last global gas conference, GasTech Milan in September 2025, featured Texans marketing LNG from cocktail bar stands.

Less than 6 months on, the momentum behind additional US LNG supply was fading in Doha. Perhaps the clearest indication of this was Energy Transfer scrapping its 16 mtpa Lake Charles export project in December.

A couple more US terminals may take FID in 2026, but the heyday for contracting US tolling supply looks to have passed for this supply wave.

2. All eyes on the impact of Henry Hub volatility

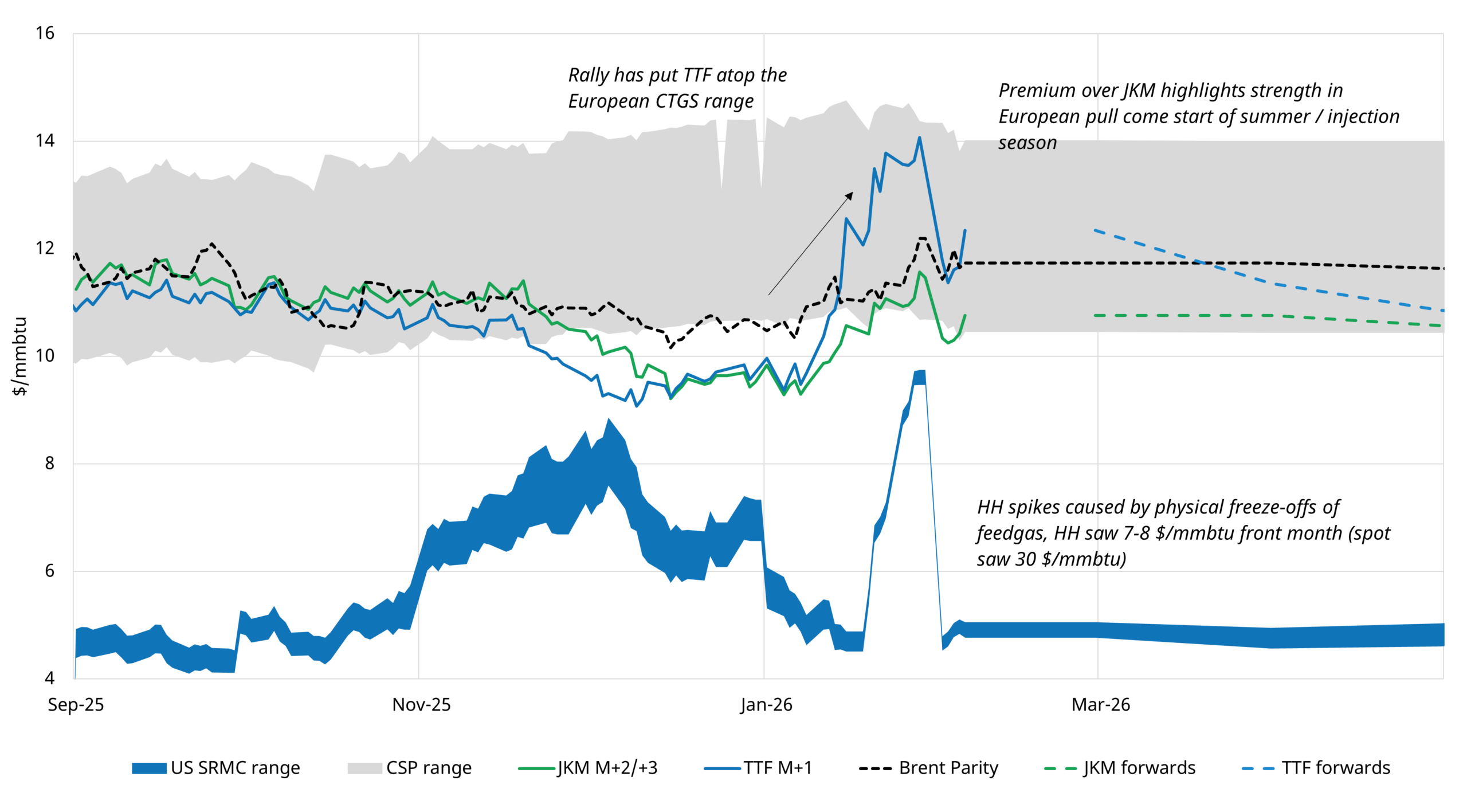

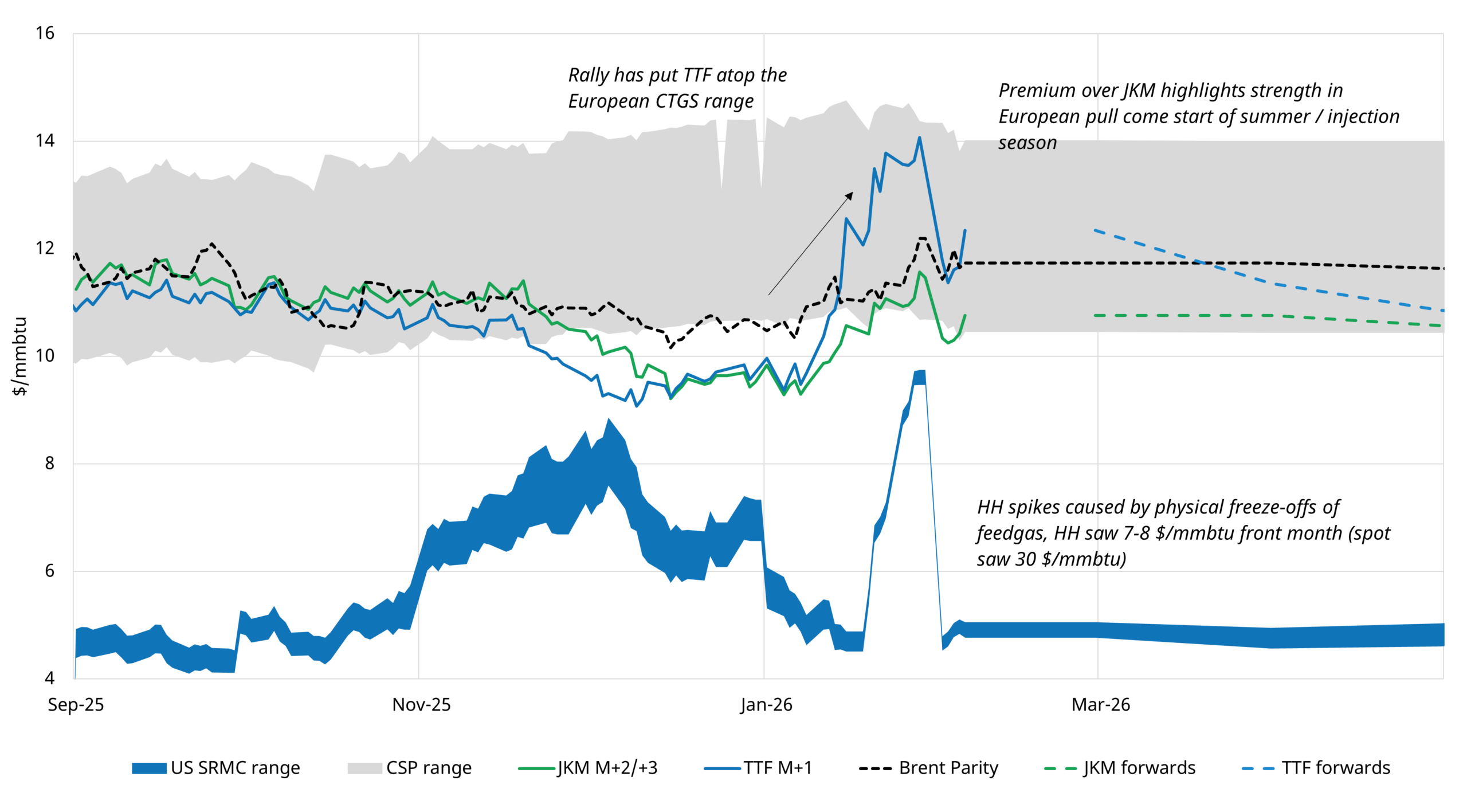

The impact of Henry Hub (HH) on global gas prices was a key topic in focus in Doha. This in part reflects recent HH volatility, particularly the recent price spikes shown in Chart 1.

Chart 1: Global gas price benchmarks

Source: Timera Energy, ICE, CME, Spark

HH volatility is directly transmitted into US export contract margin variability – as illustrated by the spread between the blue HH linked US variable cost (SRMC) range vs TTF & JKM prices in the chart.

LNG players are being increasingly cautious not to oversize their US HH indexed LNG short positions within portfolios. HH price risk management strategy was a strong focus of our client conversations in Doha.

3. LNG portfolio growth focus remains

It was clear in Doha that the appetite to grow LNG portfolios remains strong across most major players, even if momentum behind US projects is fading. This includes a renewed focus on evaluating equity and Brent indexed supply opportunities. Many players are also eyeing secondary market opportunities in the current supply surge, anticipating downside pressure that may create attractive fishing opportunities.

We had several conversations on valuation of secondary deals – properly quantifying value & risk is key given market risks and timing uncertainty.

4. European regulatory uncertainty driving risk

European regulatory uncertainty remains a key point of frustration. This is impacting portfolio players’ willingness to sign new term deals with both regas and downstream counterparties.

This includes, at an EU level, the methane regs & corporate sustainability reporting directive, and is exaggerated at a country level by national policies (i.e. DE 2043 LNG import ban, IT regulatory intervention).

There was strong interest in our upgraded stochastic market modelling framework as a tool to quantify the impact of different outcomes on asset & portfolio value distributions.

5. Asian demand key driver of global pricing

The market continues to anticipate Asia as the key source of demand to soak up the current supply surge. The questions in Doha were ‘when and at what price’.

Price-sensitive buyers such as China and India remain largely on the sidelines, expecting further price declines and a clearer shift towards a buyer’s market.

Sellers are looking for origination opportunities, and increasingly confronting the fact that buyers want flexibility given uncertainties. Robust structuring & valuation of this flexibility using our stochastic modelling framework was another point of focus in our client discussions.

For further details on our LNG services, feel free to reach out to our LNG & Gas Director, David Duncan (david.duncan@timera-energy.com ).