We wrote recently about how front month European gas prices had dropped to pre-war lows, as fears around end of winter storage levels (EU storage currently at a healthy 81%) recede. While the market still requires economic demand response to balance (and is likely to continue to do so until the next wave of LNG in the middle of the decade), the level of storage refilling anticipated to be required in 2023 is lower than 2022 to the tune of around 15 bcm.

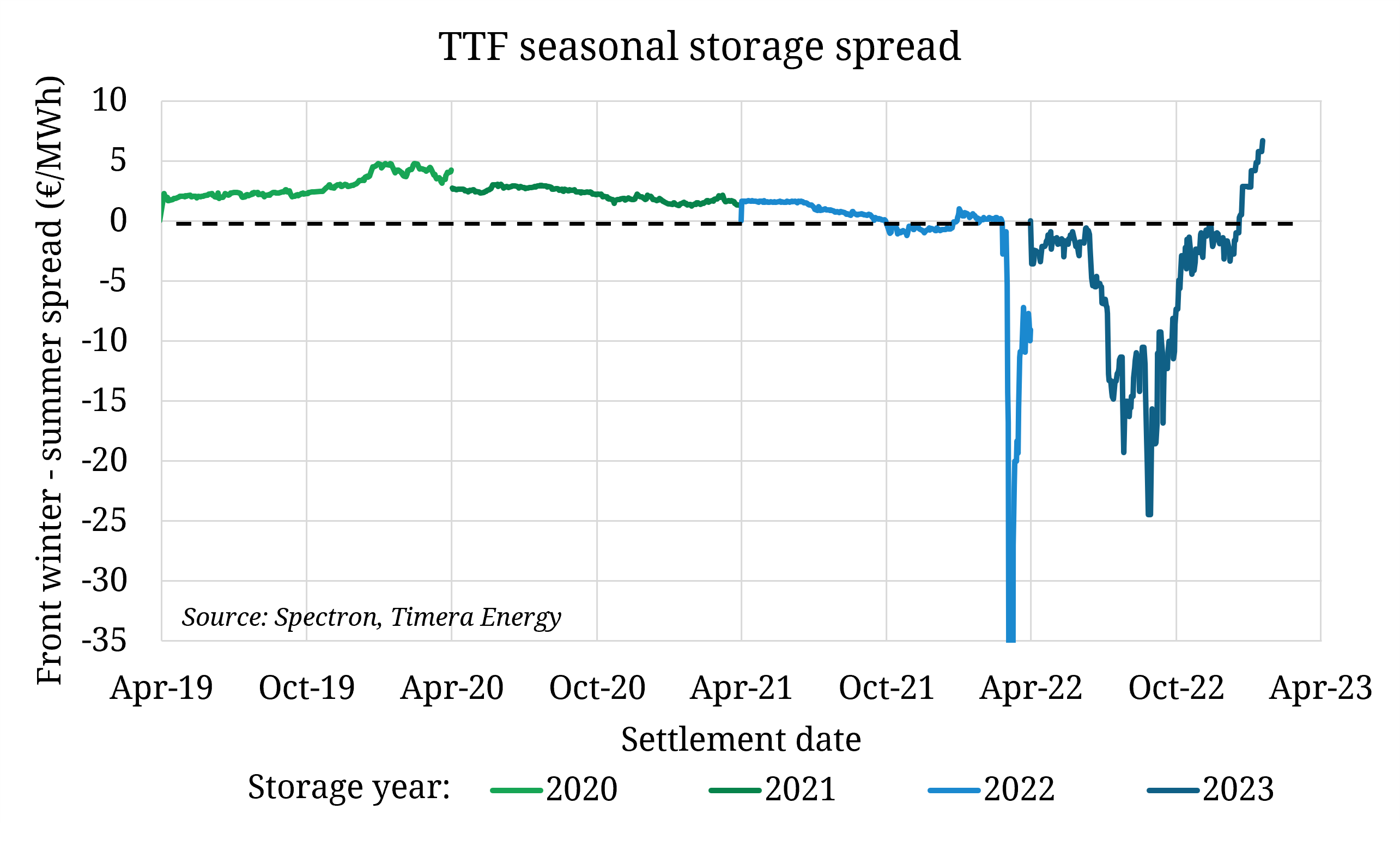

The reduced challenge of balancing the spot has seen front seasonal storage spreads (next Winter – next Summer) climb into positive intrinsic value territory for the first time since before the war, rebounding from recent lows in August of -25 €/MWh. The link between volumetric storage refilling and seasonal spreads has largely disconnected however, due to the EU minimum storage level mandates enforcing injection & withdrawal profiles and removing flexibility from the market (focussing value into assets which have been able to retain some flexibility). By historical standards, seasonal spreads have been very volatile over the past couple of years and are likely to remain so because the inflexibility of demand as the marginal balancing mechanism amplifies market uncertainty.