Batteries in the GB market have captured extraordinary returns across 2021 and 2022. For example 2-hr batteries have been able to earn over 200 £/kW/yr, more than double the required return on investment. The BESS revenue stack has been underpinned by strength across both ancillary service and energy arbitrage returns.

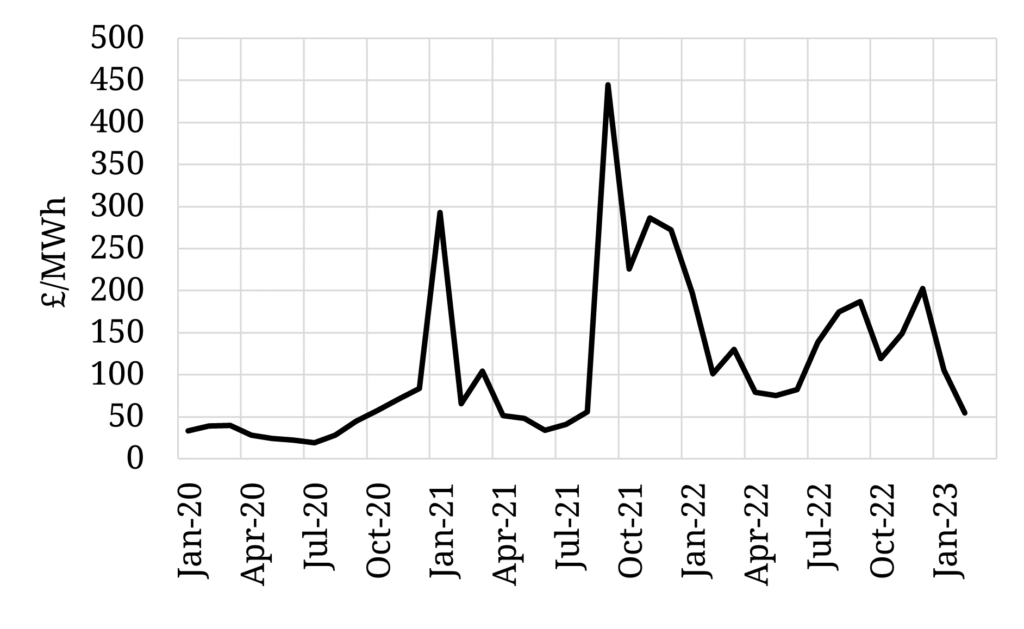

“Capturable price spreads have fallen from 200 £/MWh in Dec-22 to 55 £/MWh in Feb-23”

Q1 2023 has however seen an erosion in BESS revenues. A reduction in energy arbitrage returns has been driven by warmer weather, more subdued gas prices and improving nuclear conditions. Erosion of ancillary services revenues is the result of a more structural saturation of ancillary markets.

In today’s article we show backtesting analysis of the BESS revenue stack using our proprietary battery dispatch optimisation model. We also set out why BESS revenues may face a bigger challenge ahead, with a capacity market pipeline of more than 9GW of batteries to be deployed by 2026-27.

Backtesting the BESS revenue stack

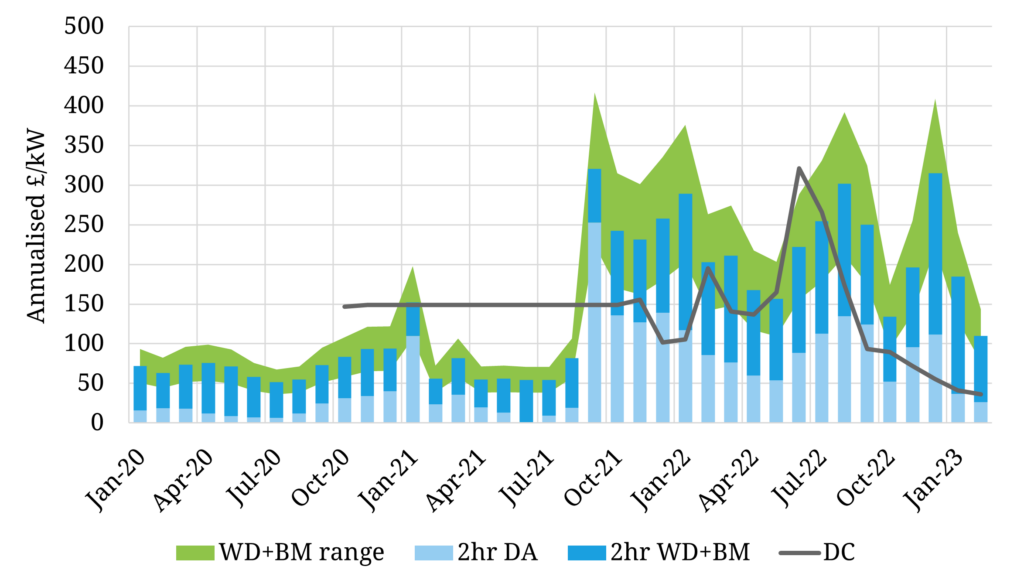

Chart 1 shows the backtested returns for a 2-hr GB BESS asset against historical day-ahead (DA), within-day (WD) and balancing mechanism (BM) prices. We analyse two representative optimisation strategies:

- An energy arbitrage strategy, optimising against DA, WD and BM prices.

- A simple DC focussed strategy benchmark, assuming 100% utilisation in the highest volume DCL service.

Our back-testing model optimises batteries using an imperfect foresight methodology to capture the reality of market uncertainty. We regularly benchmark backtesting analysis with leading BESS optimisers to ensure our results are consistent with those being achieved in practice.

The first takeaway from the chart above is the sharp decline in DC revenues, which have been impacted by relatively rapid ancillary saturation since Q3 2022.

The second takeaway is a decline in energy arbitrage revenues since Dec 2022. The absolute level of power prices is not the primary driver of BESS revenues. But as the gas crisis has eased peak power prices & volatility have fallen in sympathy with gas prices.

This has seen capturable Day-Ahead price spreads falling from £203/MWh in Dec to £106/MWh in Jan and £55/MWh in Feb as shown in Chart 2 below.

While the chart above shows a drop in capturable price spreads into Q1 2023, spreads still remain relatively robust at over twice their historical average level across the 2017-2020 period.

5 key takeaways for BESS investors

The Q1 2023 easing in battery returns should not be interpreted as an imminent threat to the BESS investment case. The GB power market remains historically tight with strong renewable build locked in and flexible thermal assets closing fast. However we think there are some important considerations for BESS investors to digest into 2023 which we summarise in Table 1 below.

Table 1: 5 key takeaways on GB BESS investment drivers

A new wave of capacity will test BESS revenue stack

Whilst BESS revenues remain well above historical levels, the volumes of BESS in the GB supply stack are about to rapidly increase. Across the last two T-4 capacity market auctions, over 8GW of nominal new BESS capacity has been successful.

This capacity growth is focused in the 2025-26 horizon with an incremental 3GW by Oct 25 and another 5GW by Oct 26. Wholesale and balancing markets are materially deeper than ancillary service markets. But under the weight of this volume of new capacity energy arbitrage returns may also struggle for a period.

Securing a capacity market agreement is a long way from actually delivering new capacity. Grid connection bottlenecks and cell & component lead-times continue to frustrate commercial operation dates. So far project cancellations have been infrequent, but delays are becoming an increasing reality that may impact the capacity market delivery pipeline.

As the GB battery market matures and competition increases, BESS investors are broadening their focus to Continental Europe. A big current focus area for our work is analysis of BESS revenue stack evolution across EU markets (e.g. Italy, Germany, Benelux and Spain) to assess where the next opportunities lie.

If you are interested in a more detailed discussion of the emerging European BESS investment landscape, join us for our free webinar (see details below).

Timera EU battery investment webinar

Webinar registration link – register here

- Date: Thurs 20th Apr (2-3pm BST, 15-16 CEST)

- Title: “Targeting battery value” – revenue stack, opportunities & challenges for BESS investors across EU

- Content:

- Ranking BESS investment potential across EU markets

- BESS revenue stack structure (energy arbitrage, ancillaries, capacity)

- Evolution of key price signals & revenue drivers

- Investment challenges (e.g. policy, network charging)

- Key BESS investment case drivers