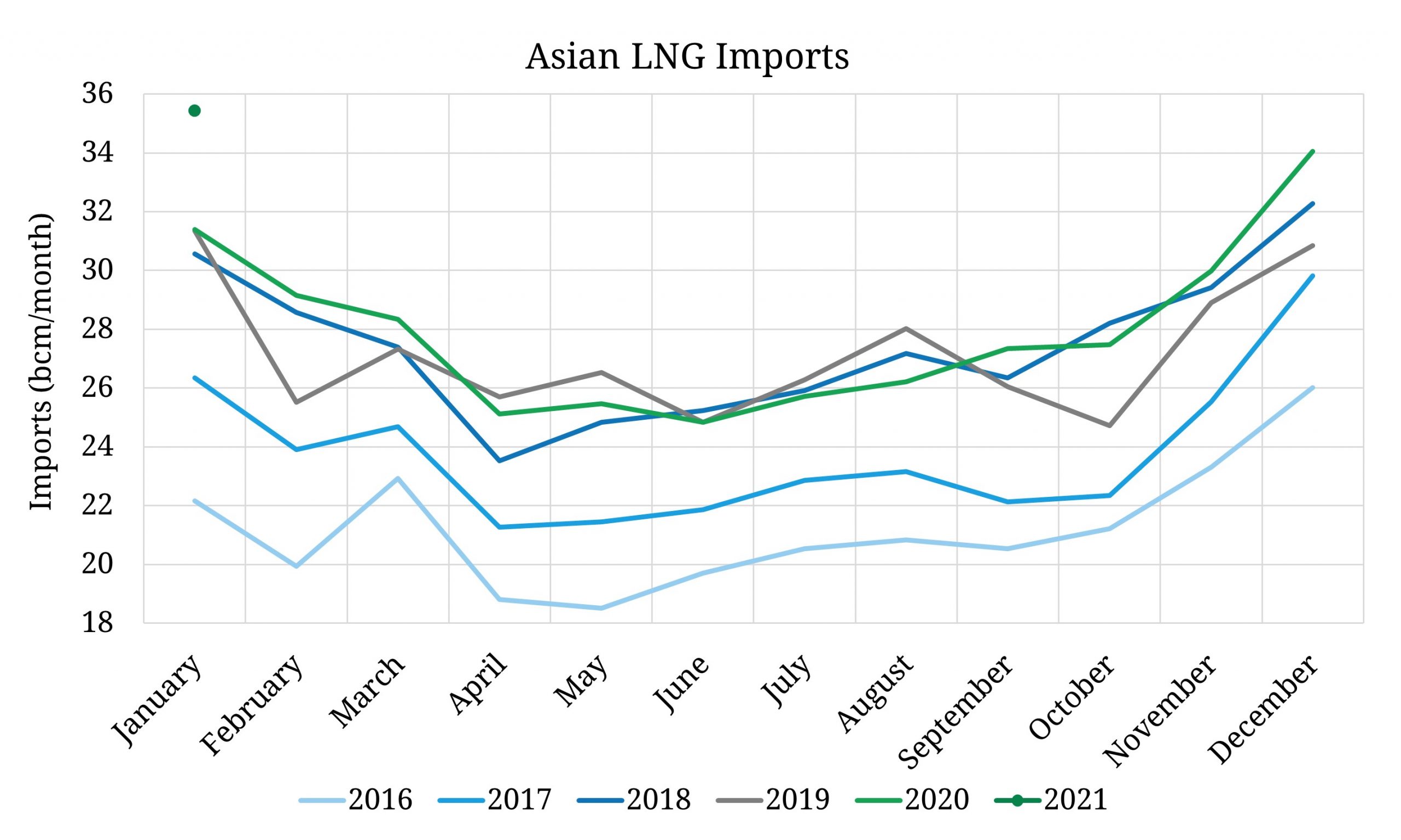

Following the fireworks seen in the JKM market through January, it is little surprise to look back and see Asian January LNG imports having surged to record levels. This caused a stark change in global flows from last January as the market shifts from loose to tighter. This can be seen both in the drop in LNG imports into Europe (the global sink), but also within Asia, with North East Asia dominating the import growth at the expense of more price sensitive markets such as India.

Chinese demand led the charge with 16% growth year on year, in line with strong economic data. However demand across the region has been robust with extreme cold weather and low stocks seeing under-contracted end users scramble to pick up spot cargoes which priced as high as 39 $/mmbtu. There has also been reports of LNG tanker heel being bought up, likely before oil fired generation could be brought online. The resultant market spike has seen small pockets of flexibility in the Asian market, e.g. reloads from Thailand and Indonesia into North East Asia.