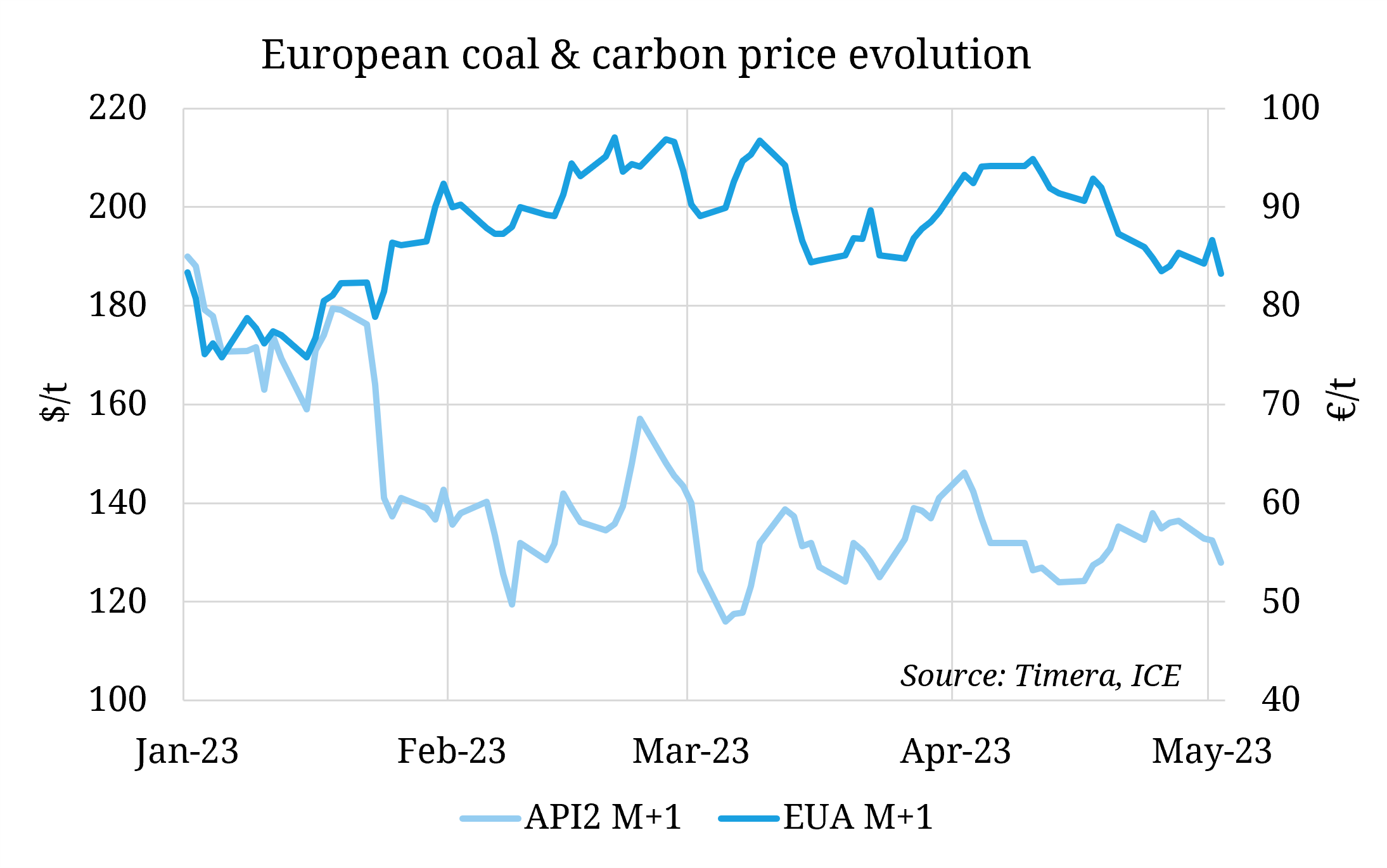

As we laid out in our feature article on Monday, European gas to coal switching economics are back in focus as the key anchor for Summer 2023 gas prices, and potentially a floor for Winter 2023 gas prices. In this snapshot we therefore turn to a quick update on European coal & carbon prices, the key ingredients of switching channel economics.

Carbon front month prices are at a three-month low, but steady vs levels at start of 2023:

- Compliance demand reduces following April deadline

- Low power sector demand and significant switching away from coal to gas for the first time since 2021 reduces buying interest.

European coal prices have dropped by 70 $/t (~40%) since the start of the year:

- Demand fell 11% year on year in Winter 2022/23 with low power demand, coal closures and rising renewables

- Pacific coal prices retain significant premium as Australian supply suffered disruptions alongside some returning Chinese demand.

Summer switching dynamics are set to return European gas, coal & carbon prices to a more correlated state than we saw across 2022.