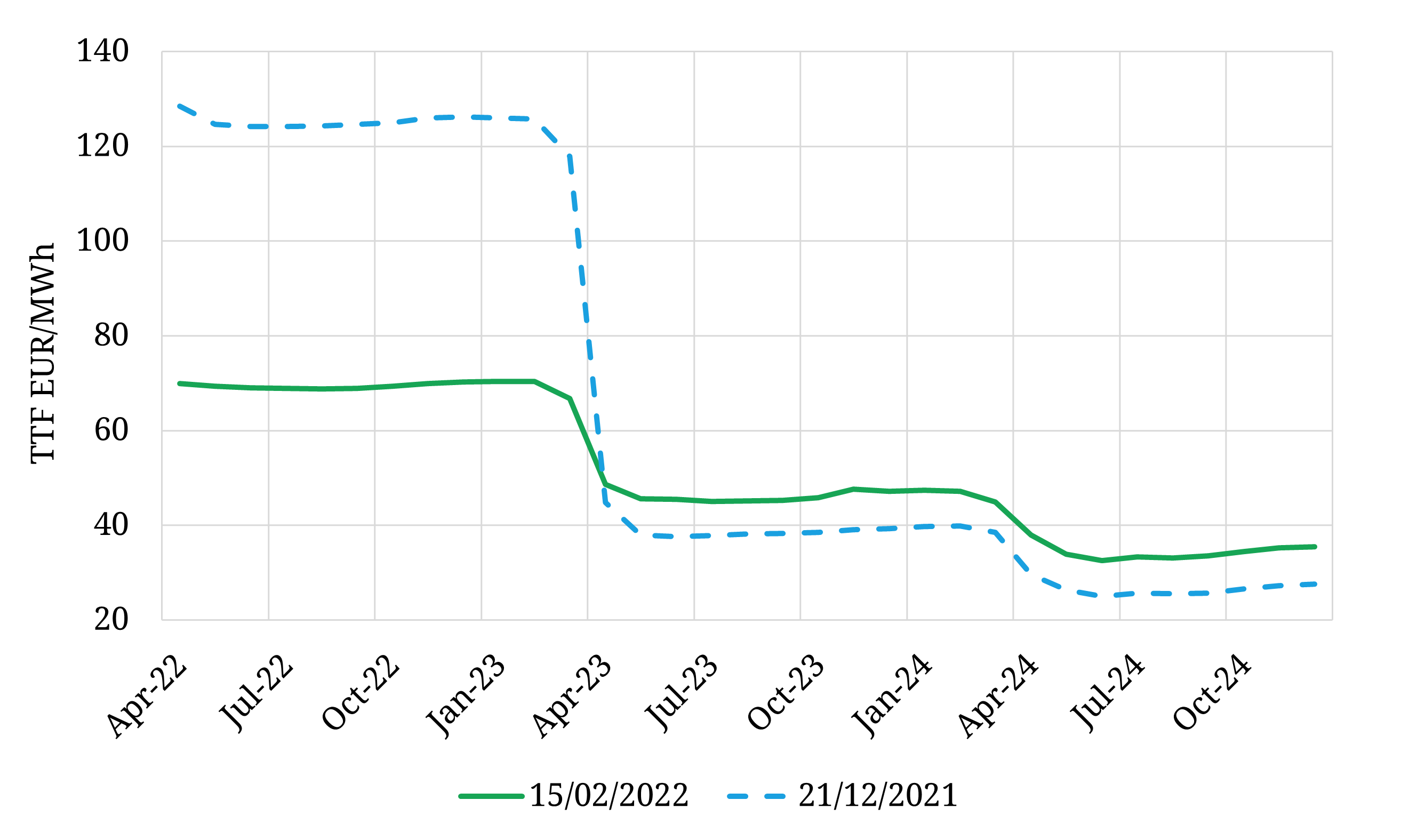

The European gas market moves quickly these days. While the sentiment can change daily, there are two clear trends that can be seen since the heady peak W21 price days of late December.

- Prompt prices have declined significantly. S22 prices have declined by 45% since 21st Dec, as an influx of LNG has helped to mitigate end of winter storage level concerns. While Russian supplies remain low, and tensions remain high, the market had a further leg down yesterday following Russian statements on troop withdrawal, and a potential quid pro quo regarding Ukrainian transit post 2024 and NS2 approval.

- Prices on the curve (S23+) continue to rise. While you may have expected the softer prompt dynamics to feed into the rest of the curve, the opposite has happened. Carbon is the main story here. Since 21st Dec, EUA prices have increased by 11 EUR/t, which combined with a 4 $/t increase in European coal prices has lifted power switching range anchors higher by over 5 EUR/MWh, dragging the TTF curve up with it. The back of the TTF curve has however paired gains over the last week as carbon has backed off from the 100 €/t level.