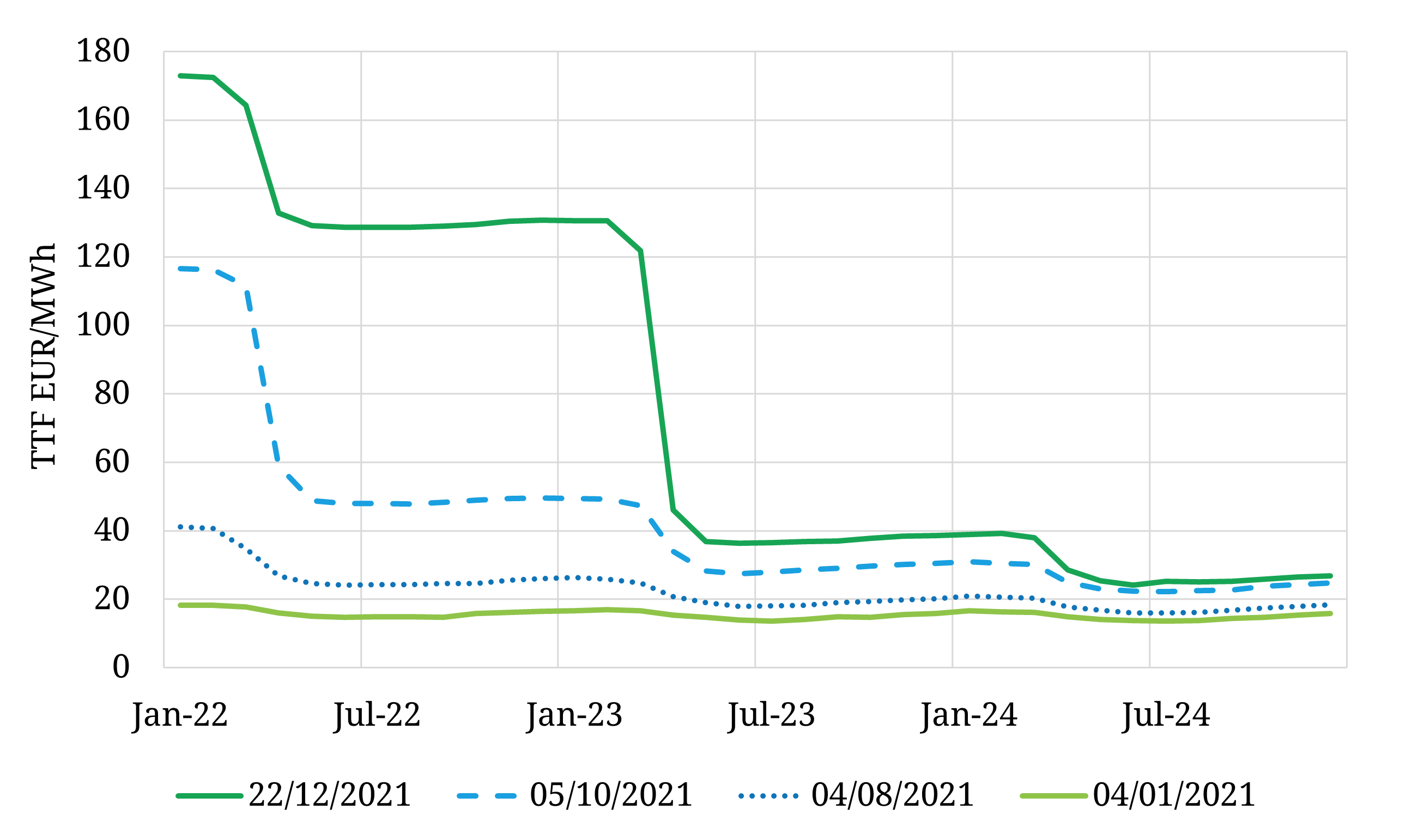

As we enter the closing stages of 2021, the European energy complex shows no sign of calming down for the holiday period. Storage levels in Europe are one month ahead of the normal winter schedule, while cold weather and dwindling Russian supplies have been piling on the pressure, and driving prices up the inelastic demand response curve.

High prompt gas prices (of up to 180 EUR/MWh) have been passed through to the power complex, with the added spanner in the works of nuclear plant maintenance issues driving French February baseload power prices up to around 1000 EUR/MWh. Industrial demand has been struggling in response, with metals & fertiliser producers having to curtail production.

The higher prices have not been confined to the prompt – surging carbon prices have driven switching anchors for 2023 onwards up towards 40 EUR/MWh.

There is one glimmer of hope for a meaningful supply response. A milder winter & more comfortable storage levels in Asia have seen JKM/TTF spreads violently invert, with tens of cargos on the water reported to have been diverted towards Europe. This will be one to watch as we enter the new year.