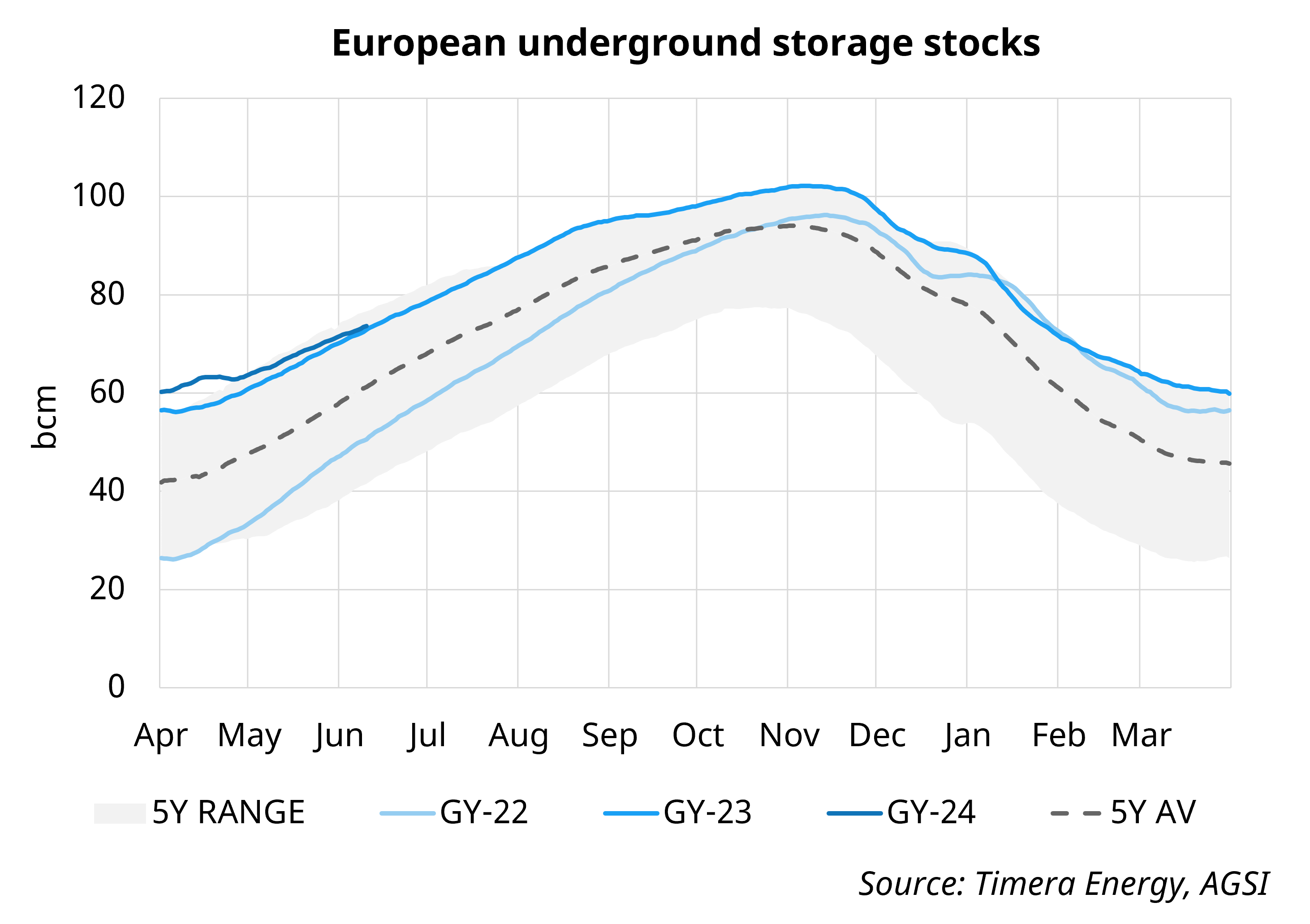

A second consecutive mild winter in Europe left underground stocks at a record 58% full exiting winter, 3.7 bcm above GY-23 previous record. The first two and a half months of summer however have seen this surplus all but eroded.

As laid out in a recent blog post, Asian demand has been rebounding over recent months, with buyers returning to the market for spot cargoes, buoyed by lower prices, robust industrial output in China and a heatwave across the S & SE Asia region.

With limited new supply coming online in 2024, this is acting to pull flexible LNG cargoes away from Europe, with LNG imports across the region falling to 11.2 bcm in May, 5.3 bcm lower year on year.

European underground stocks remain elevated vs the 5-year average, and this, alongside the price sensitivity of emerging Asian buyers, may cap upside to global gas prices across summer.

The erosion of the stock surplus is reducing fears of tank top towards the end of summer, with the September November TTF contango beginning to narrow (from around 3.20 €/MWh at the end of winter to below 2.90 €/MWh on the 11th June). A narrower contango would reduce the incentive for LNG traders to float cargoes into the later dated winter months, and in turn subdue the upwards pressure on charter rates into Q4.

We are about to publish our Q2 2024 Global Gas Report as part of our quarterly global gas service, with much more detail on gas market evolution, pricing dynamics and commercial & value implications.

If you would like a free redacted copy feel free to contact our LNG & Gas Director David Duncan (david.duncan@timera-energy.com).