“Regas valuations require a respect for uncertainty”

The energy crisis of 2021-22 saw Russian supplies to Europe cut from 30% to 5% of the supply mix. This caused a sharp pivot of the European gas market towards LNG imports to plug the gap, with Europe suddenly facing a structural shortage of regas terminal capacity.

Regas capacity constraints drove a boom in value to capacity holders. It also sparked a surge in investment in new regas terminals, predominantly in FSRUs, as well as some onshore capacity growth in Germany.

Commissioning of new regas terminals and an unprecedented wave of more than 200 mtpa of new LNG supply by 2030 is underpinning a pronounced pick up in regas contracting and M&A activity, despite a post crisis easing of regas access constraints.

In today’s article we look at regas utilisation dynamics, strategic drivers behind regas commercial activity and challenges in valuing capacity.

Regas utilisation dynamics

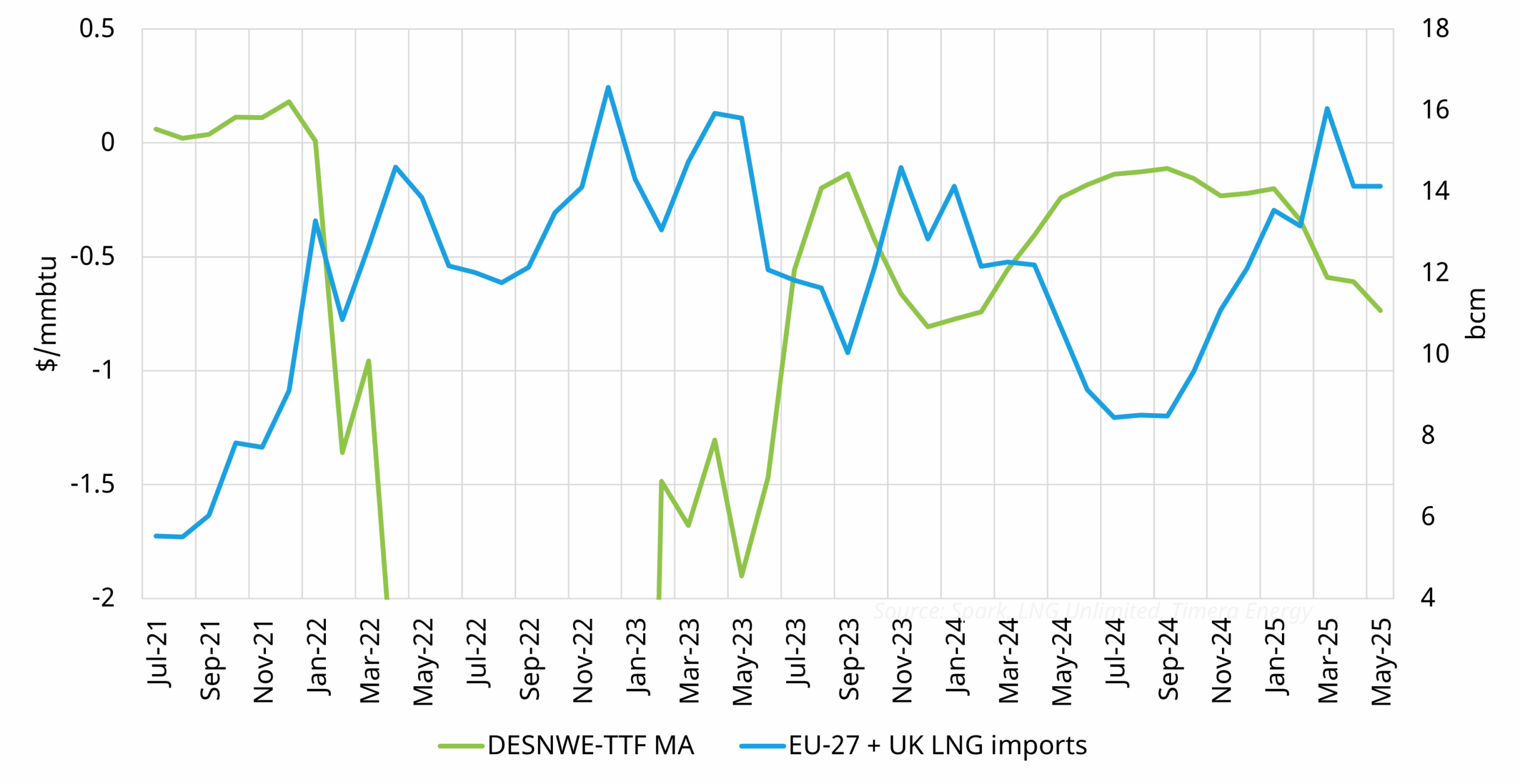

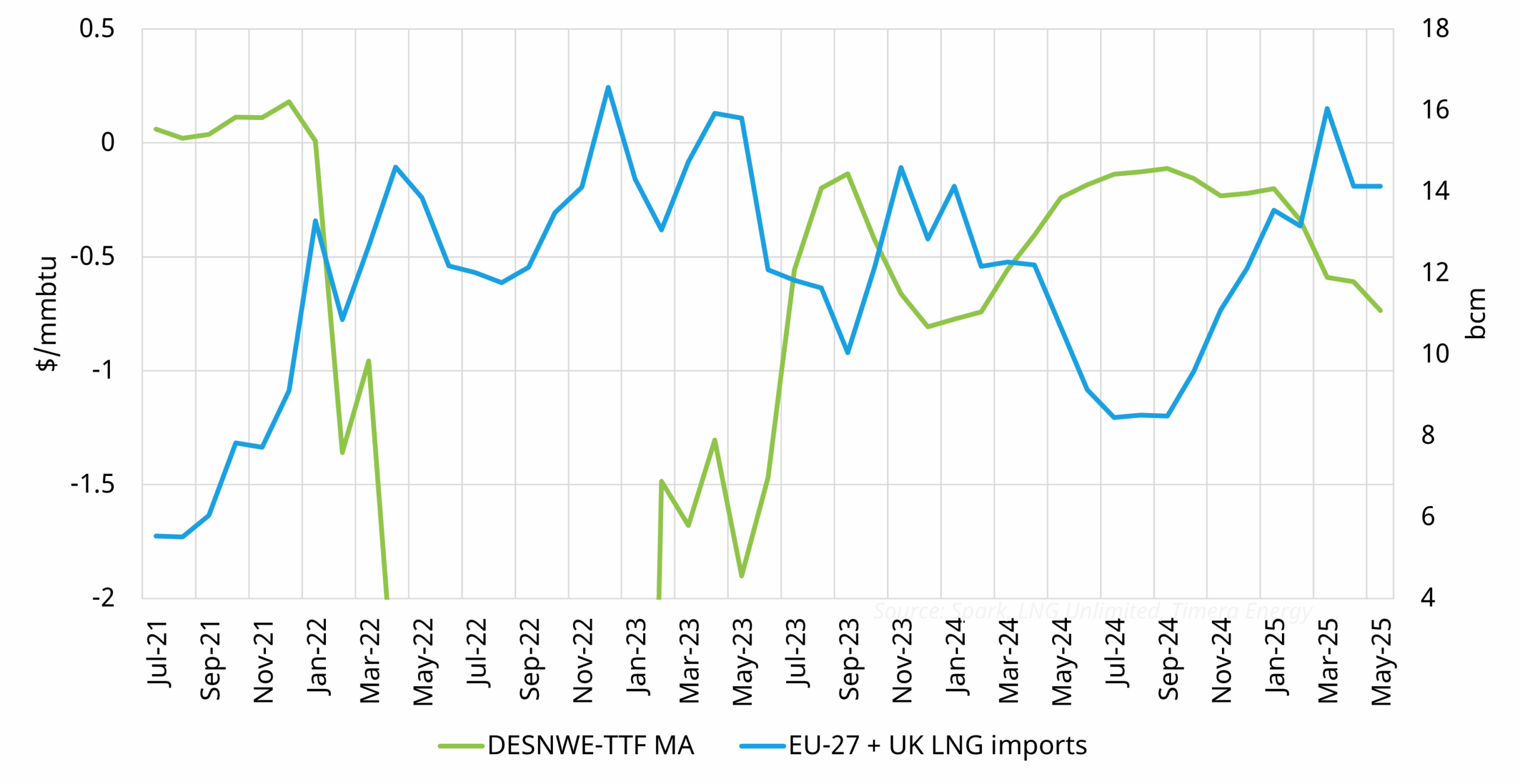

Regas terminal utilisation in Europe has been anything but boring across the last 5 years as shown in Chart 1. The chart shows European LNG import volumes (blue line in bcm) vs the key price signal driving regas utilisation: DES NWE minus TTF price spread (month-ahead).

Chart 1: DES NWE - TTF MA spread and European LNG import volumes

Source: LNG Unlimited, Spark, Timera Energy

Winter 2022-23 was literally ‘off the chart’ in terms of regas price signals & constraints. This was followed by a significant easing of regas constraints in Summer 2024 as high prices impacted demand, and gas for power demand fell with strong renewable output.

The chart also shows a resurgence in early 2025 utilisation, driven by storage injection demand after a colder winter. In summary, regas capacity utilisation strongly depends on prevailing LNG & European gas market balance and price signal dynamics.

Why the surge in interest in regas capacity?

Russian supply cuts and the European pivot to LNG had a structural impact on the strategy of all LNG portfolio players. This has seen a strong pick up in European regas activity across 2022-25, underpinned for example by:

- European utilities looking to secure access to physical LNG supply

- LNG portfolio players wanting physical access to TTF and other European hubs

- New regas terminals marketing capacity to support capital deployment into terminals

- Existing terminal owners looking to sell down terminal stakes & auction available capacity into a ‘hot’ market

- Operators / funds / TSOs evaluating the case for investment in incremental terminal capacity.

Across the last 12 months we have seen an intensifying in client activity around regas. This is being driven by strong M&A activity in the space e.g. Adriatic LNG, Grain, Klaipėda (as well as several other major terminal stakes likely to come market soon). There has also been strong long term contracting activity e.g. from GATE, Hanseatic & Alexandroupolis terminals.

Strategic drivers behind regas activity

There is a common set of strategic challenges around regas capacity that buyers, sellers & investors are confronting. We summarise these in Table 1 from the perspective of a LNG player looking to acquire capacity. However these considerations are just as relevant for terminal owners and investors assessing regas terminal contracting & investment strategy.

Table 1: Strategic considerations buying regas capacity

At the core of these strategic considerations lies the question of valuation of regas capacity.

5 factors underpinning robust regas valuation

Both M&A and long term contracting activity depend on a robust structure for valuing regas capacity. In our experience there are 5 important things to focus on that we summarise in Table 2:

Table 2: 5 factors behind robust regas capacity valuation

We recently published a case study analysis of European regas capacity valuation if you’re interested in the application of some of these details.

We will also be discussing a range of the market drivers we refer to above in our upcoming webinar, focusing on the evolution of the LNG market across the next 5 years (see below).

Join our webinar on LNG & European gas markets

Topic: A framework for confronting gas market uncertainty

Time & access: Wed 2nd July 10:00-10:30 CET (09:00-09:30 BST)

Registration: Pre-registration required (access is free); webinar registration link – register here

Coverage:

- Macro drivers of gas market uncertainty as new supply wave looms

- 3 scenario framework to navigate LNG & gas market evolution

- Supply & demand curve framework sheds light on pricing dynamics

- Why demand is key to shaping market evolution & price formation

- Commercial & value implications of different market paths