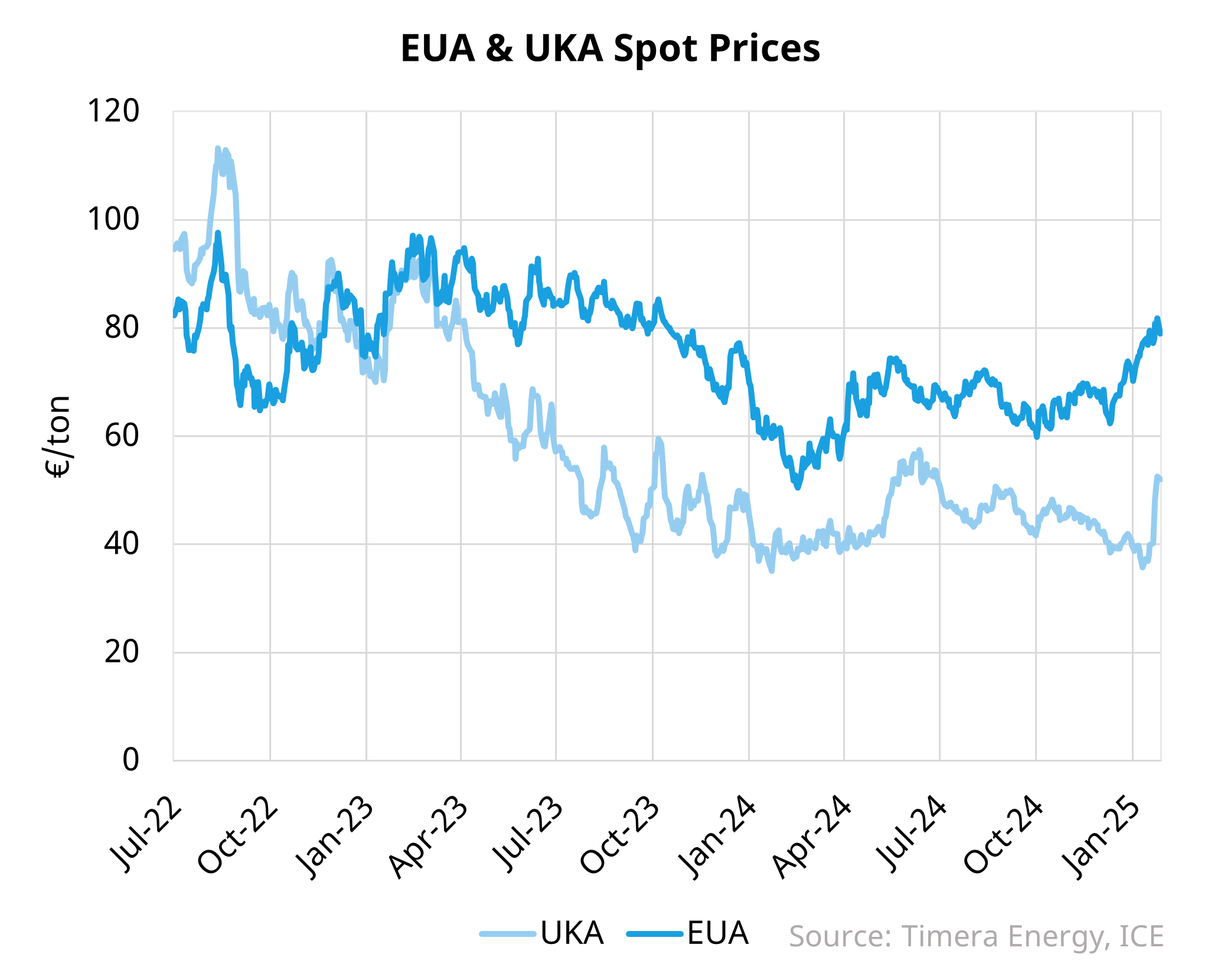

EUA spot prices surged past 80 €/t last week, hitting levels not seen since pre-2024. The rally is partly driven by rising TTF prices, as low gas storage and a colder-than-average winter drive a shift toward more carbon-intensive coal generation (Gas & LNG market state of play in 5 charts). Commitment of Traders data reveal market participants have expanded their net long positions to a three-year high, indicating expectations of sustained price strength.

UKAs continue to trade at a discount to EUAs, driven by the lack of a Market Stability Reserve (MSR) to curb excess supply. However, speculation that a Labour government could seek EU-UK ETS linkage ahead of CBAM implementation in 2026 has triggered a recent rally in UKA prices, rising from 33.82 £/t at the start of the week to 43.93 £/t by week’s end. For renewable energy assets, sustained high carbon prices enhances capture prices and increases asset value. Additionally, this widens spreads and creates greater opportunities for flexible assets to capitalize on price volatility.