In a tight market regime, small changes in market balance can cause big moves in price

Get ready for an interesting winter in the European gas & LNG markets. This will in turn drive what happens in European power markets. In today’s article we focus on a preview of key market drivers, market balance and 5 key risks that will shape the path into 2025.

European gas prices have continued to exhibit heightened volatility across late summer, as growing geopolitical risks & major new monetary stimulus clash with weak European fundamentals.

High European storage levels entering winter provide an important buffer against market shocks. However the market remains skittish given weather risks, delays in new LNG projects and expectations of a further cut in Russian pipe flows to Europe by the end of 2024.

As we outlined in our last winter outlook, we remain in a structurally tight market post Russian supply cuts, until the next wave of LNG supply comes online into 2026. This leaves gas markets supply constrained and balancing on inelastic demand. As a result relatively small changes in market balance can have a big impact on prices.

Let’s look at some analysis of European gas market winter balance from our Global Gas Model and flag some key drivers & risks.

The state of play

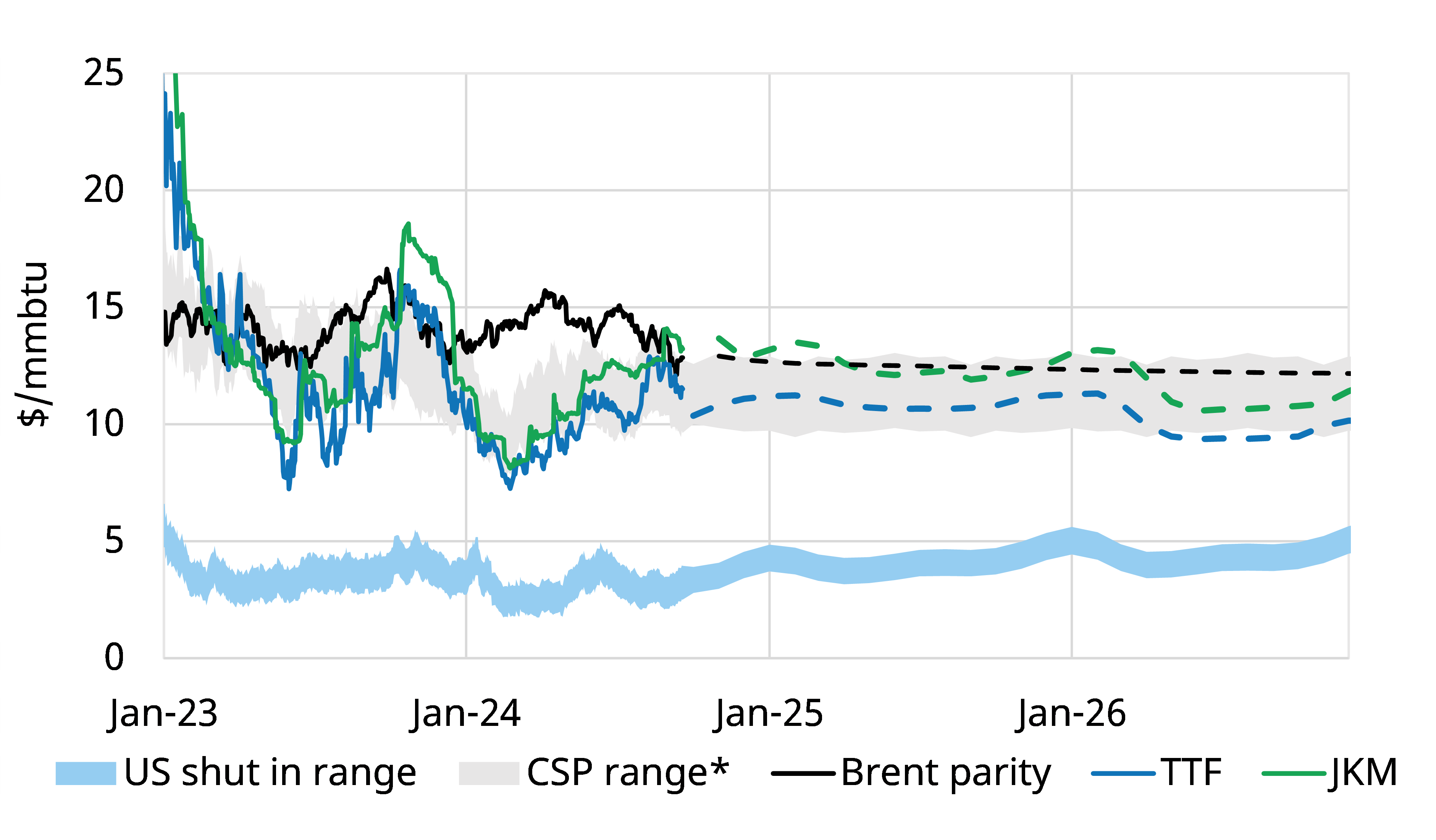

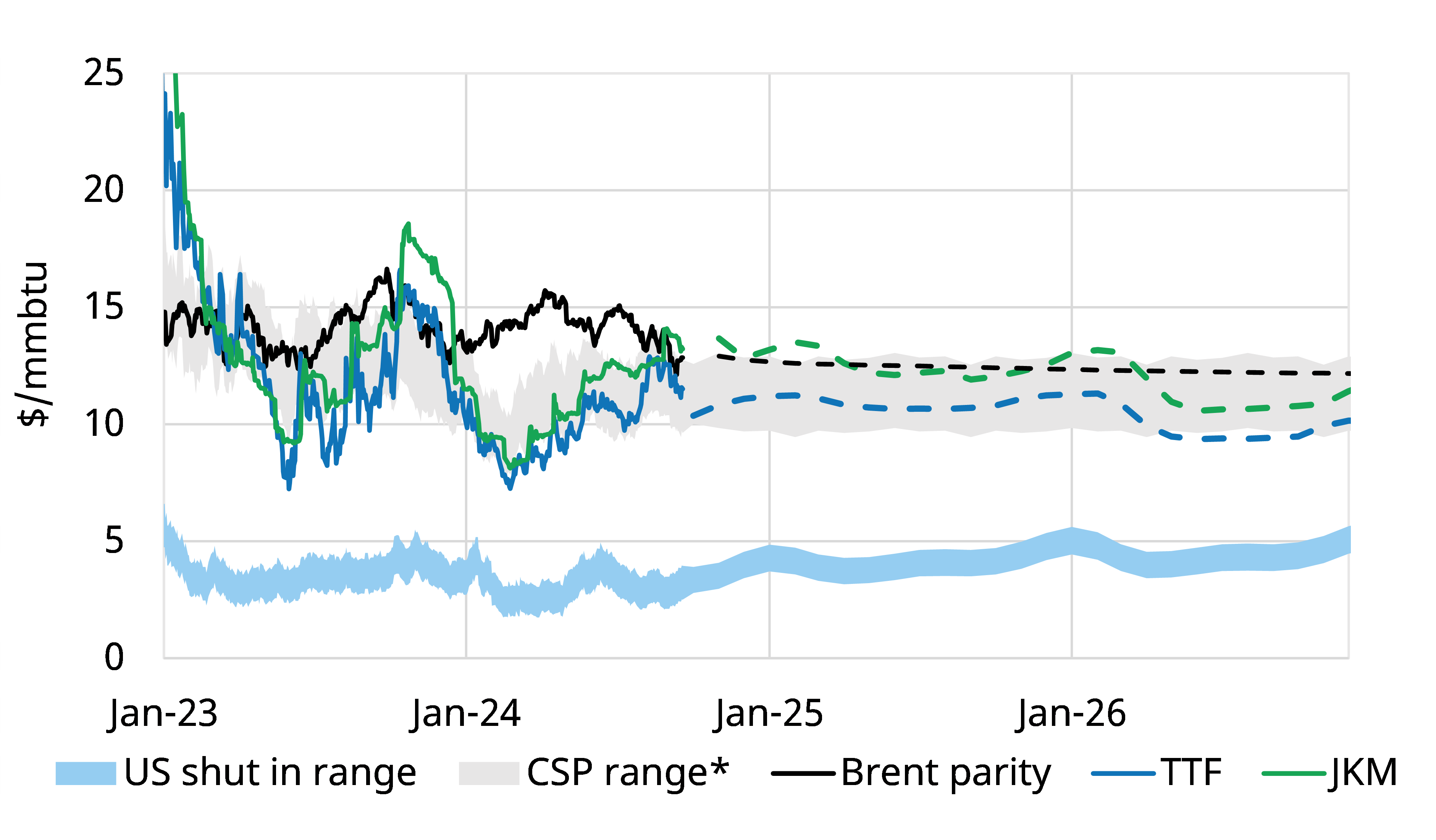

Last year saw a second consecutive mild winter, triggering a plunge in prices into Q1 2024 as shown in Chart 1. Europe quite comfortably survived its second winter post Russian gas supply cuts.

Chart 1: Key global gas price benchmarks

Source: ICE, CME, Timera; * CSP = Coal Switching Price channel for 50-52% efficient gas plants vs 38-45% coal plants

Exiting last winter, Europe faced the dual impact of a significant storage overhang and weak gas demand (particularly from the power sector). But from Feb 2024, TTF & JKM prices embarked on a significant recovery, supported by Asian LNG demand strength and supply side issues (e.g. US LNG project delays, Arctic LNG 2 ramp up uncertainty, Egypt flipping to a net importer).

Across Q2 & Q3 2024, the European gas market has re-anchored back into the traditional coal to gas switching range (driven by prevailing coal & carbon price levels).

The market has picked up again into Q4, supported by growing geopolitical risks, La Niña weather forecasts & a broader commodity price rally helped by US & Chinese stimulus.

There are clear downside risks from a third consecutive mild winter or a further weakening of demand. However colder weather, Middle East escalation and any demand recovery should support a continuation of gas price recovery.

The clear risk over a 3 year horizon remains rapid growth in new LNG supply into 2026. It is optimistic to assume there will be a smooth transition from a tight to a well-supplied market regime across 2025-27.

What happened last winter?

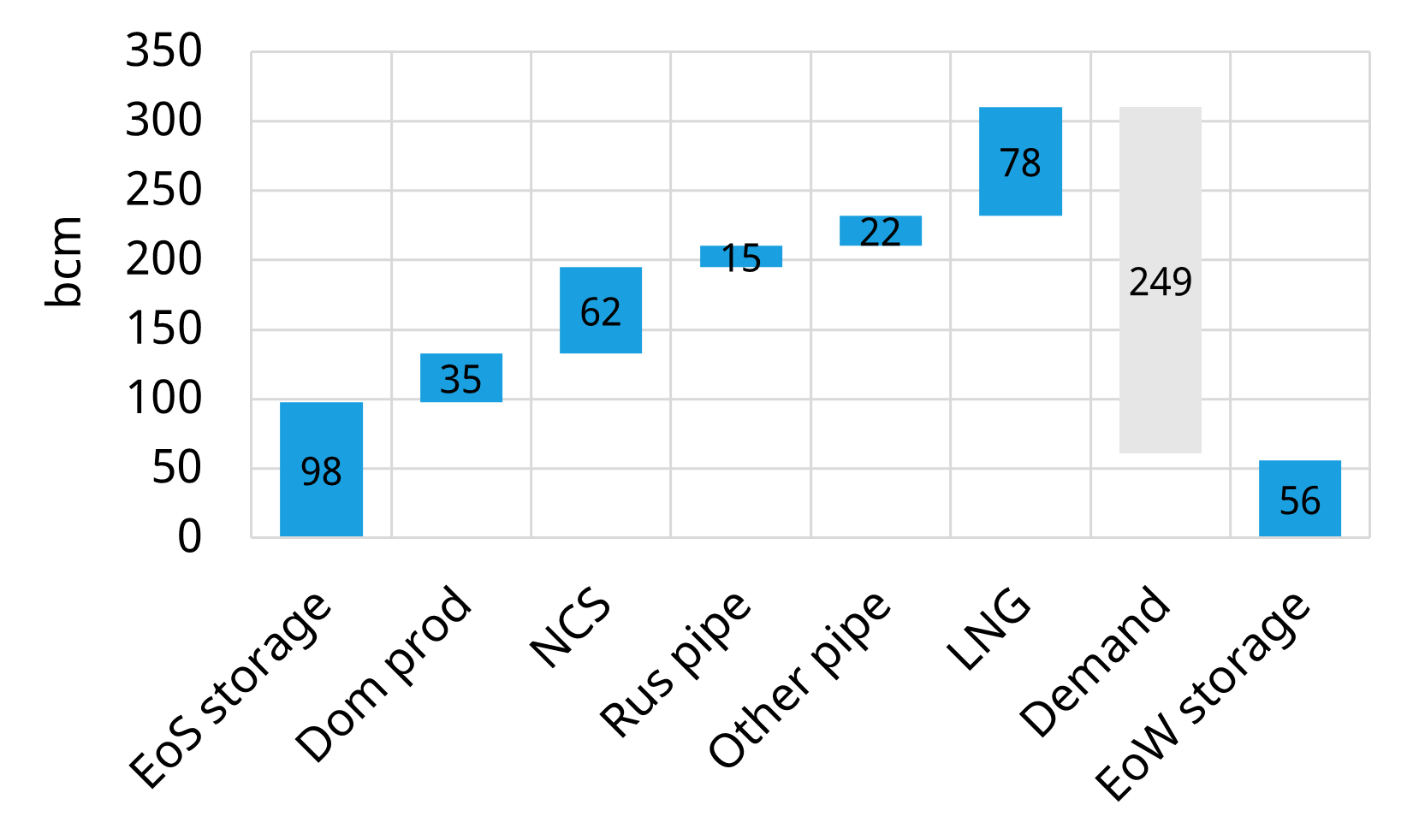

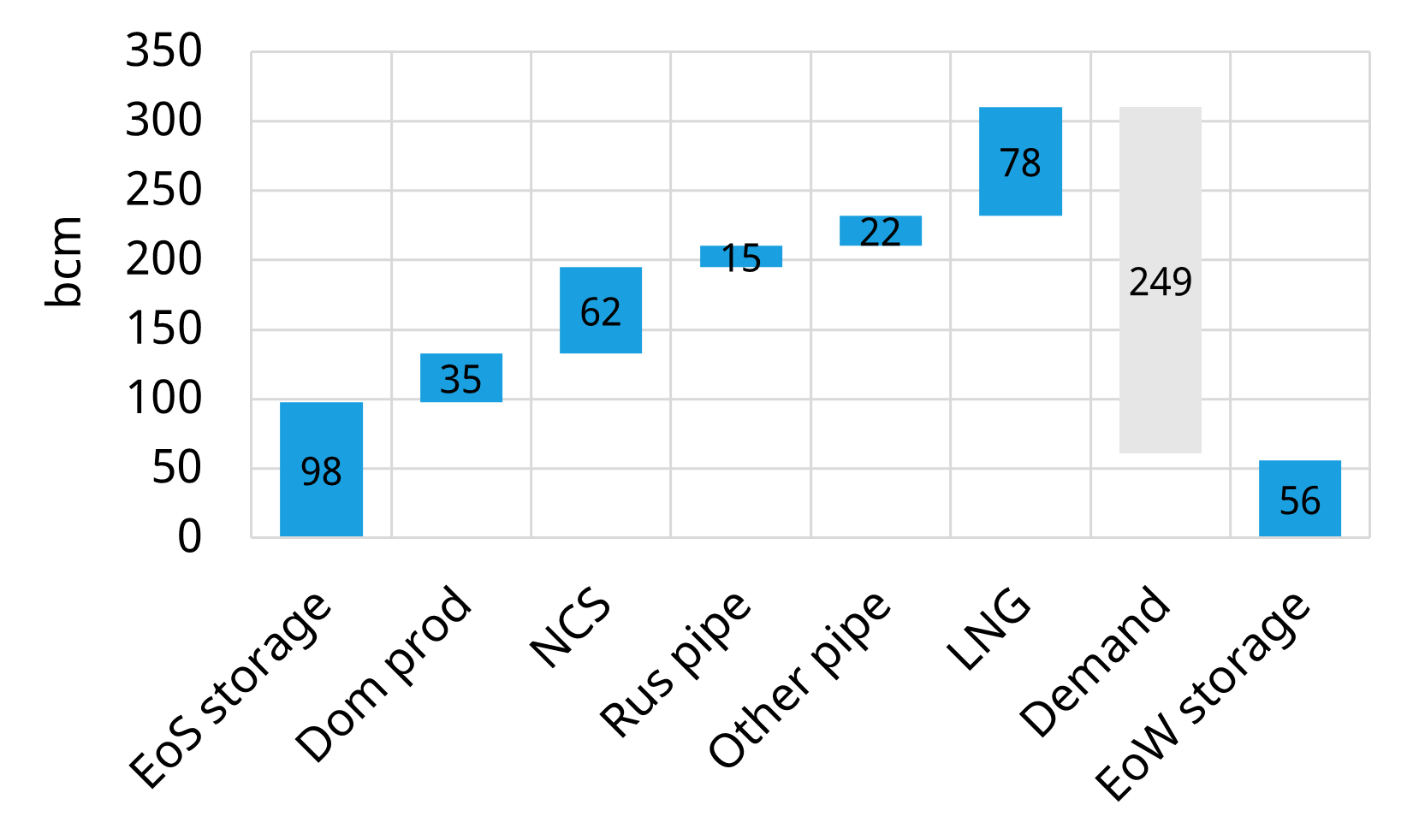

It is useful to start with 2023/24 as context for the challenges across the winter ahead. Chart 2 shows a breakdown of supply & demand balance across last winter and the ‘End of Winter’ (EoW) storage inventory.

Chart 2: Winter 2023-24 European supply & demand balance

Source: Timera Energy, IEA, Eurostat, LNG Unlimited; Europe defined as EU 27 + UK + CH

Europe entered last winter with stock levels close to tank top. It also exited winter with record levels, as demand remained subdued on the back of mild weather and continued economic weakness, offsetting a slight reduction in LNG deliveries.

European market balance outlook for this winter

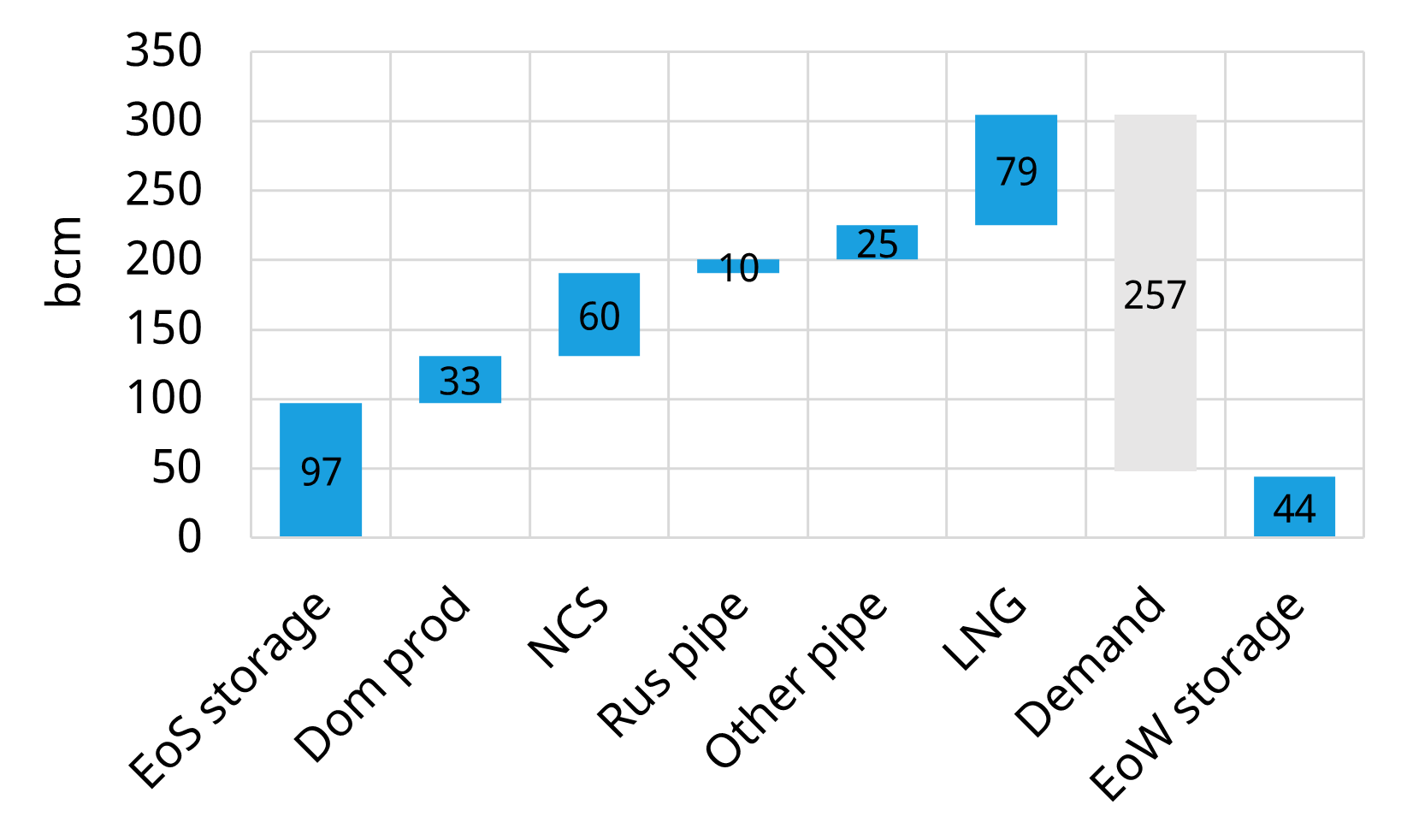

Let’s now turn to our ‘Central case’ scenario outlook for this winter drawing on analysis from the Timera Global Gas Model.

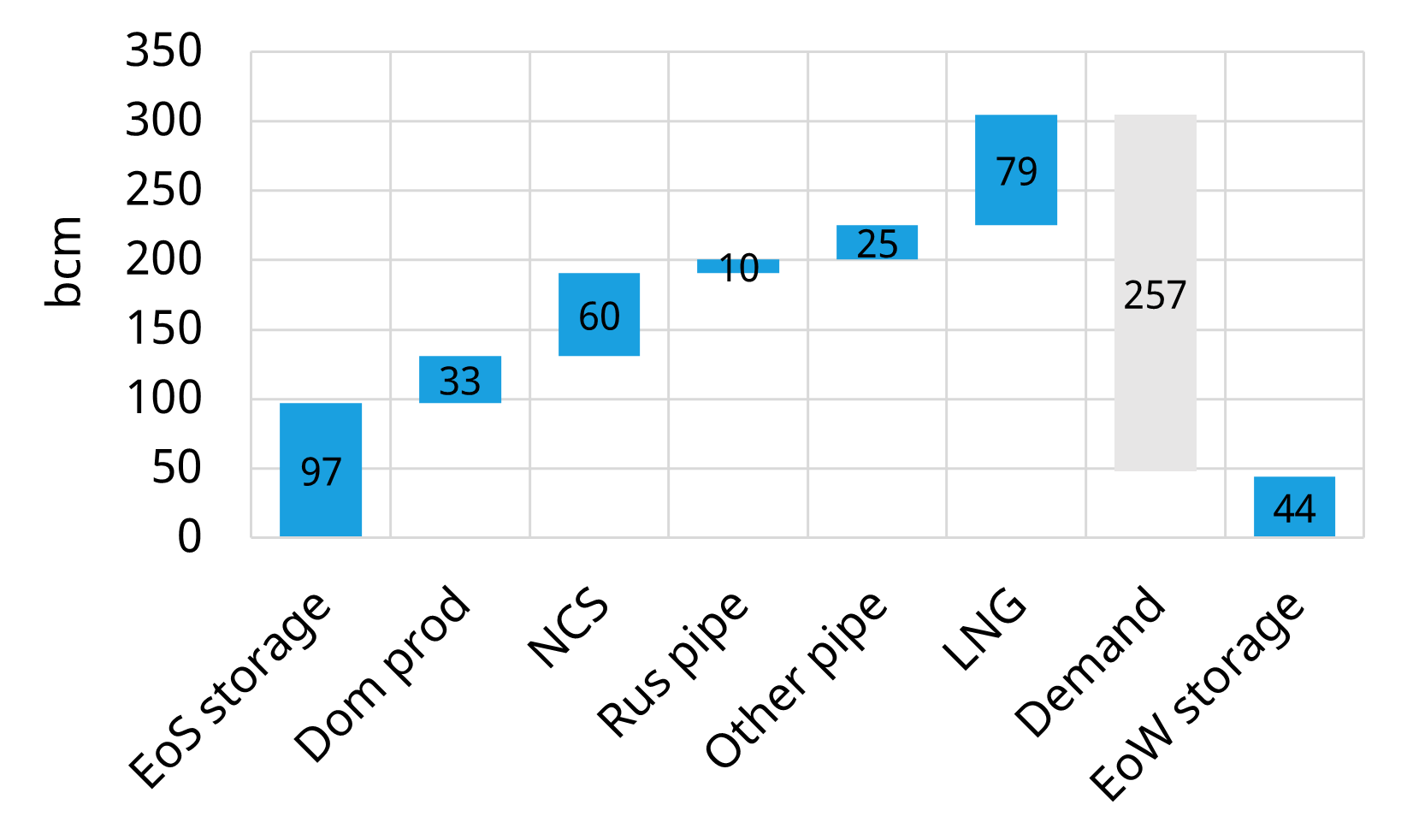

Chart 3: Projected winter 2024-25 European supply & demand balance

Source: Timera Global Gas Model

Our analysis shows a partial demand rebound on back of more normal winter temperatures .. alongside ~ 5 bcm further cut in RU pipe deliveries due to end of Ukrainian transit leading to stronger storage withdrawals, with stocks exiting winter close to five year average levels.

We see European LNG imports roughly flat year on year. With no LNG supply growth winter on winter, Europe is going to continue to have to compete against a growing Asian market for limited available flex volumes.

This is set to support continued price volatility across winter, with the market balancing via less elastic demand sources e.g. Asian demand flex in what is a supply constrained environment.

5 key risks across winter & into 2025

We finish with a set of key risks to gas market balance across the coming winter and into 2025.

Table 1: 5 key risks across winter

One of the key characteristics of a tight market regime is that small changes in market balance can cause big moves in price.

Most of the risks in the table above swing both ways. However there is currently asymmetric upside price risk given the inelastic nature of both supply & demand response if the market tightens.

In our quarterly Global Gas Subscription Service we have a particular focus currently on analysis of the impacts of market transition through 2024-27 as the next LNG supply wave is absorbed. If you would like a sample copy of one of our reports feel free to reach out to Joshua Belo-Osagie (joshua.belo.osagie@timera-energy.com).