Battery Energy Storage System (BESS) revenues have been on a rollercoaster ride over the past 18 months, closely tracking movements in gas prices. This is no coincidence—gas prices are a key driver of BESS energy arbitrage revenue.

How do gas prices influence BESS revenue?

Gas-fired power plants remain the dominant peak price setters across GB and EU power markets. As a result, fluctuations in gas prices directly impact the two key price signals that drive BESS arbitrage revenue:

- Power price spreads – particularly in the Day-Ahead market

- Power price volatility – across both Day-Ahead and Within-Day markets

When gas prices rise, peak power prices tend to follow, widening spreads and increasing volatility—both of which create more opportunities for BESS to capture value through charging and discharging cycles. Conversely, lower gas prices can compress spreads and dampen volatility, reducing the revenue potential for BESS assets.

The data tells the story

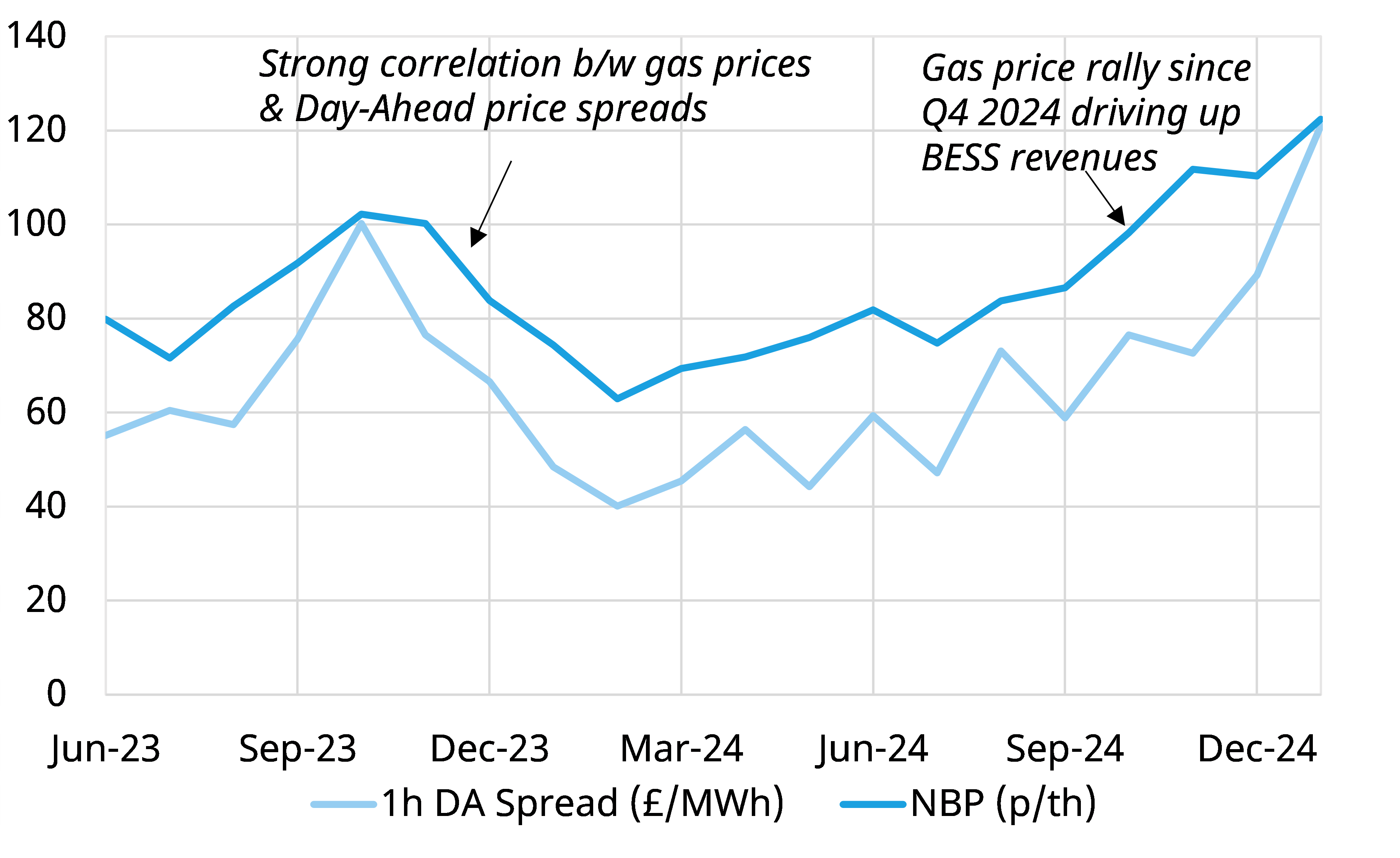

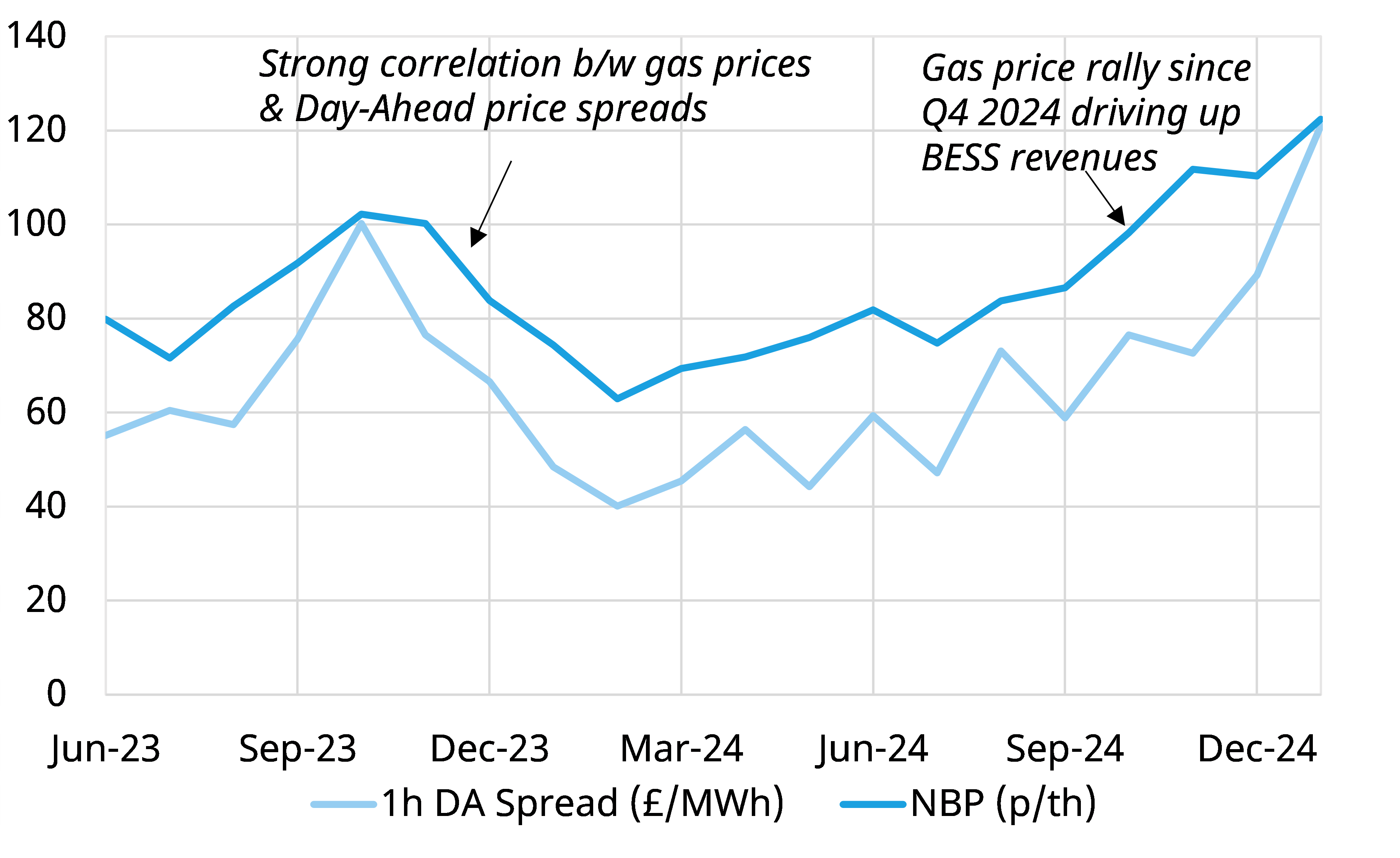

This relationship is clearly illustrated in Chart 1, which overlays the evolution of Day-Ahead (D-A) price spreads for a 1-hour BESS asset against the NBP D-A gas price over the last 18 months.

Chart 1: NBP gas price vs Day-Ahead GB power price spreads

Source: Timera Energy, ICE, Nordpool

Three clear examples of the gas-BESS linkage can be seen in the chart:

- Q4 2023: A recovery in gas prices was mirrored by rising D-A spreads, boosting BESS revenue.

- Q1 2024: A sharp slump in gas prices compressed spreads, dragging down BESS arbitrage revenue.

- Q4 24 -Q1 25: The recent surge in gas prices has supported a strong rebound in BESS revenues.

Impact of gas price relationship on BESS investors

For more analysis on gas price dynamics, we recently published 5 key charts outlining the current state of play in the gas market.

In summary: the gas market looks set to remain relatively tight but volatile in 2025-26, before a major regime shift as large volumes of new LNG supply come online 2026-29.

Gas prices play a key role in BESS investment cases, given their current impact on revenue and the looming market shift.

This is especially important over the next 5-7 years, when discount factors are high.

However, gas prices are just one factor influencing BESS revenues. Below, we outline five key drivers shaping the BESS revenue stack.

Table 1: 5 key drivers of BESS revenue stack evolution

Our Power Director, Steven Coppack, will be addressing all 5 of these drivers in a plenary presentation on Building a bankable BESS investment case at the Energy Storage Summit in London this Wednesday.

Timera will also have a stand at the event (Stand 49)—feel free to drop by or reach out if you’d like to catch up.

Timera at Energy Storage Summit 2025 (18-19th Feb in London)

Where can you find us?

- Steven Coppack’s presentation: 11:30 in the Main Conference Room

- Timera Energy – Stand 49

- Meeting Room 432 – reach out if you’d like to book a time to meet with us

It would be great to catch up face to face if you are coming along – feel free to contact Steven steven.coppack@timera-energy.com.