The German government’s recently published energy transition monitoring report outlines various proposals for ensuring security of supply whilst decarbonising at pace. With coal retirements looming, the government has acknowledged the requirement for new stable power plants to replace supply losses from nuclear and coal. The report reviews energy transition progress so far, where future risks lie, and what policy changes are recommended. We call out below several themes from the report that stand out for flex asset value:

1. Reality check for expected renewables and power demand growth

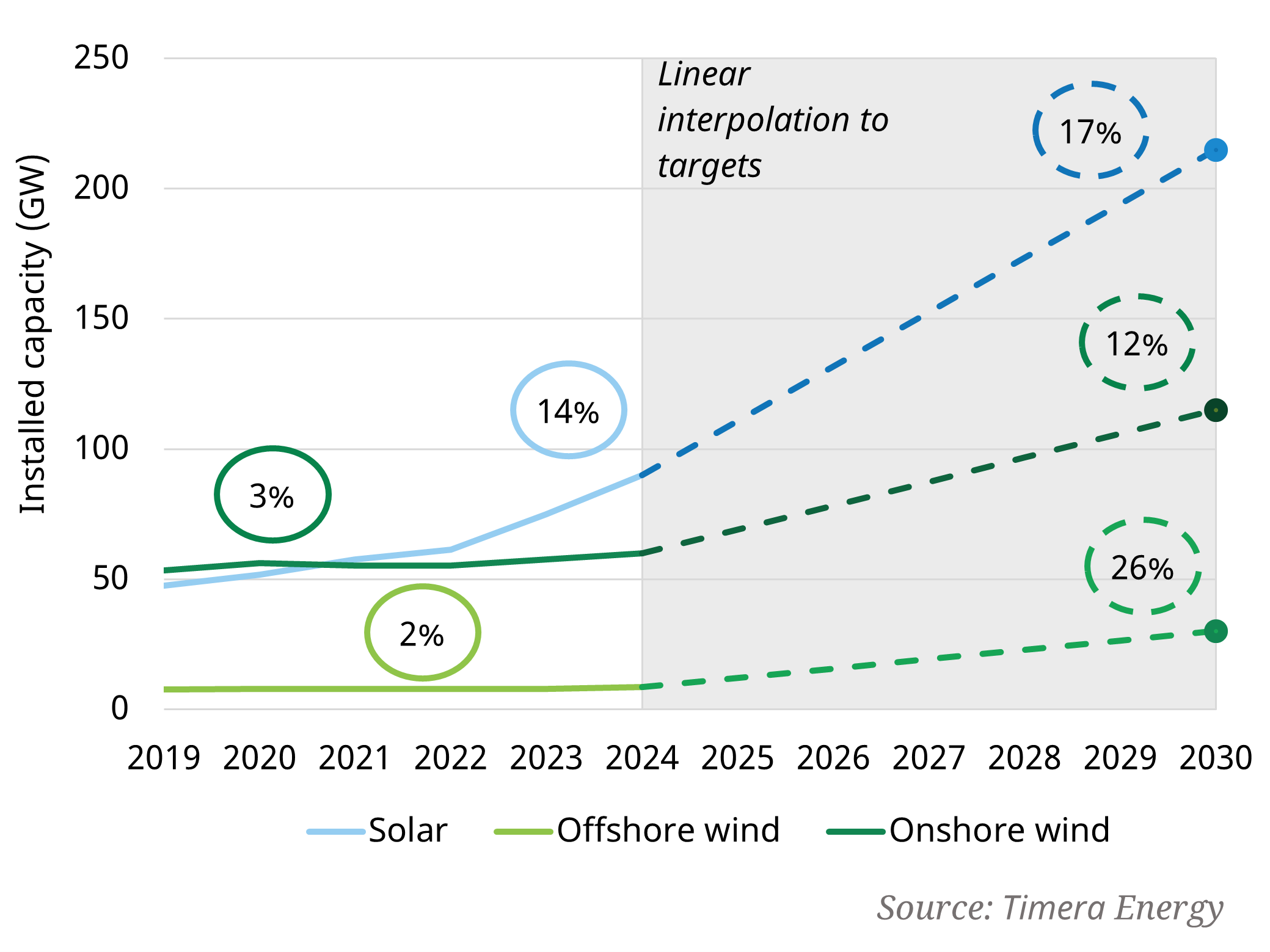

German power demand has wavered in recent years driven by lower than anticipated commercial & industrial power demand growth. The report recognises the possibility that power demand could lie on the lower end of current market estimates by 2030. This, coupled with a reality check on required system expansion to accommodate a more muted demand outlook e.g. power capacity and grid infrastructure buildout, could drive a more tempered RES buildout. Renewables on the system strongly influence the structural price shape and price volatility, which are key drivers of BESS value. As the chart shows, the average renewable build-out over the past five years (indicated by the ovals) has already fallen well short of the pace needed to reach the 2030 targets.

2. Reform of renewables subsidy support regime

The report proposes replacing the traditional feed-in tariff (FIT) system with two-sided contracts for difference (CfDs) and also eliminating compensation at negative prices. Shift of cost burden onto renewables developers could drive higher auction bid prices but support better spatial planning of renewables buildout and improve business case for colocated BESS.

3. Long-awaited technology-neutral capacity market confirmed

A technology neutral capacity mechanism has been discussed over the past years and the report reaffirms government intention to implement this; possibly as early as 2027. It calls for a technology neutral capacity mechanism that rewards all types of dispatchable capacity including BESS, gas and demand side response. Exact market design e.g. derating will decide economic advantage for different technology types.

Webinar: “Zonal pricing dead but locational value lives” – impact of the Jul 25 decision to kill Locational Marginal Pricing (LMP) on GB BESS investors

Time: 09:00 BST (10:00 CET) Tue 7th Oct

- 3 key locational value drivers for GB BESS

- Investor landscape post LMP

- Quantifying BM system value capture

- How to frame locational value in investment cases

- Locational value & key risks

Please register here

For more information on these developments, or information on the services we provide, feel free to contact Steven Coppack Director of Power at steven.coppack@timera-energy.com.