In our snapshot column last week we flagged a huge rally in power & gas forward curves. The move was driven by three announcements that surprised bearishly positioned markets last Tuesday.

The most important of these was EDF flagging potential new safety issues with its French nuclear fleet. Markets may have short memories, but not short enough to have forgotten the nuclear fuelled fireworks of Winter 2016-17.

Reinforcing the gas market impact of the EDF announcement, the Dutch government further tightened the production cap on the giant Groningen field and announced the end of production by mid 2022.

The third surprise came from the ECJ, which ruled that Gazprom access to the key OPAL pipeline into Germany will need to fall back to 50% of capacity.

Price rises and volatility are likely to continue into this week. The US has blamed Iran for a weekend drone attack that has temporarily crippled more than half of Saudi Arabia’s oil production (~5% of global supply). A very volatile front month Brent contract has been trading 10-20% higher than Friday since the market opened today.

3 factors behind last week’s market moves

French nuke risk

EDF has flagged ‘a deviation from technical standards’ relating to welds on the steam generators of some of their nuclear reactor fleet. The initial EDF statement provided little clarity on how many reactors may be impacted and what the timing of any outages could be.

The French nuclear authority (ASN) subsequently announced that at least 5 reactors had been impacted, with a more detailed statement expected from EDF in the coming week. The resulting uncertainty has seen a significant risk premium driven into French winter power prices, although the impact of outages this winter is unlikely to be as dramatic as in Win 16-17.

Groningen cuts

5 years ago the giant Groningen field in the Netherlands was producing more than 40 bcma of gas. Since then the Dutch government has consistently reduced the production cap on the field given increasing concerns over ongoing earthquakes. The cut announced last week caps gas production at less than 12 bcm for the coming gas year. By mid-2022 output will now fall to zero.

Production cuts had already been flagged earlier this year. But last week’s announcement was at the higher end of market expectations. This helped support a rally across the TTF gas curve, although the big surge in gas prices was more focused in Win-19 given the French nuclear issues.

Gazprom OPAL access

The ECJ ruling last week overturns a 2016 decision to allow Gazprom access to up to 80% of the OPAL pipeline that links Nord Stream to Germany. This effectively returns the 50% cap on Gazprom’s use of OPAL, reducing its ability to flow gas via the Nord Stream/OPAL route by 12.5 bcma.

This volume can flow via the Ukraine/Slovakia route instead. So it is unlikely to result in any immediate supply cuts to Europe. But it shifts the balance of negotiating power towards Ukraine for the very important transit agreement talks that are underway. The transit agreement that allows Gazprom to flow gas via Ukraine (one of its 3 key access routes into Europe) is due to expire at the end of this year.

How has this impacted market prices… so far?

The triple shock that hit markets last week is a great case study in the increasing importance of inter-market linkages. In an energy market version of the butterfly effect, the risk of nuclear outages in France immediately flowed through to higher JKM LNG prices in Asia.

The logic? Nuclear outages in France are ‘backfilled’ primarily by incremental CCGT output (both within France and from neighbouring countries). The implied increase in gas demand dragged up TTF prices, with a knock-on impact across other European hubs. This in turn was transmitted to Asian LNG prices which are underpinned by TTF as European hubs support a well supplied global LNG market.

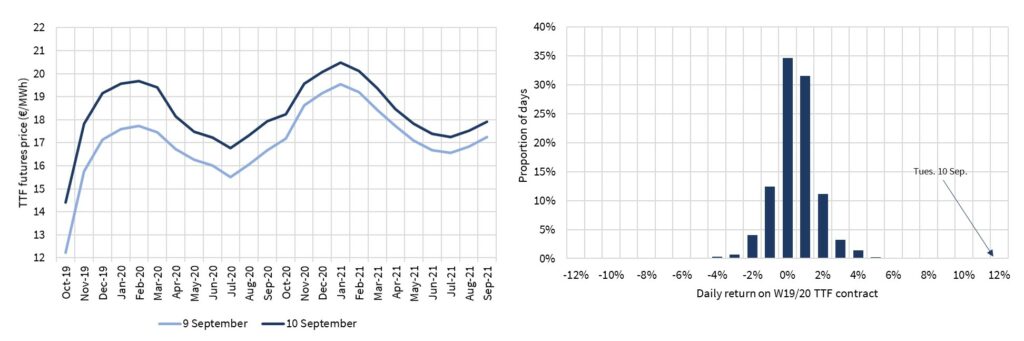

French power prices for the coming winter rose 12% last Tuesday as the risk of rolling nuclear outages lifted the curve. Power market curves across NW Europe were pulled higher in sympathy (e.g. in UK, Belgium, Netherlands & Germany).

The move in gas prices was almost as pronounced, with Win-19 TTF prices rising around 10%. While the price surge at European hubs was focused on the current winter, the whole gas curve moved higher as shown in Chart 1. This was in part due to bearish positioning after relentless price declines across 2019, but was also helped by the Groningen & OPAL announcements which may have more enduring implications for European gas supply.