In June, global gas markets experienced heightened volatility, driven by escalating tensions in the Middle East.

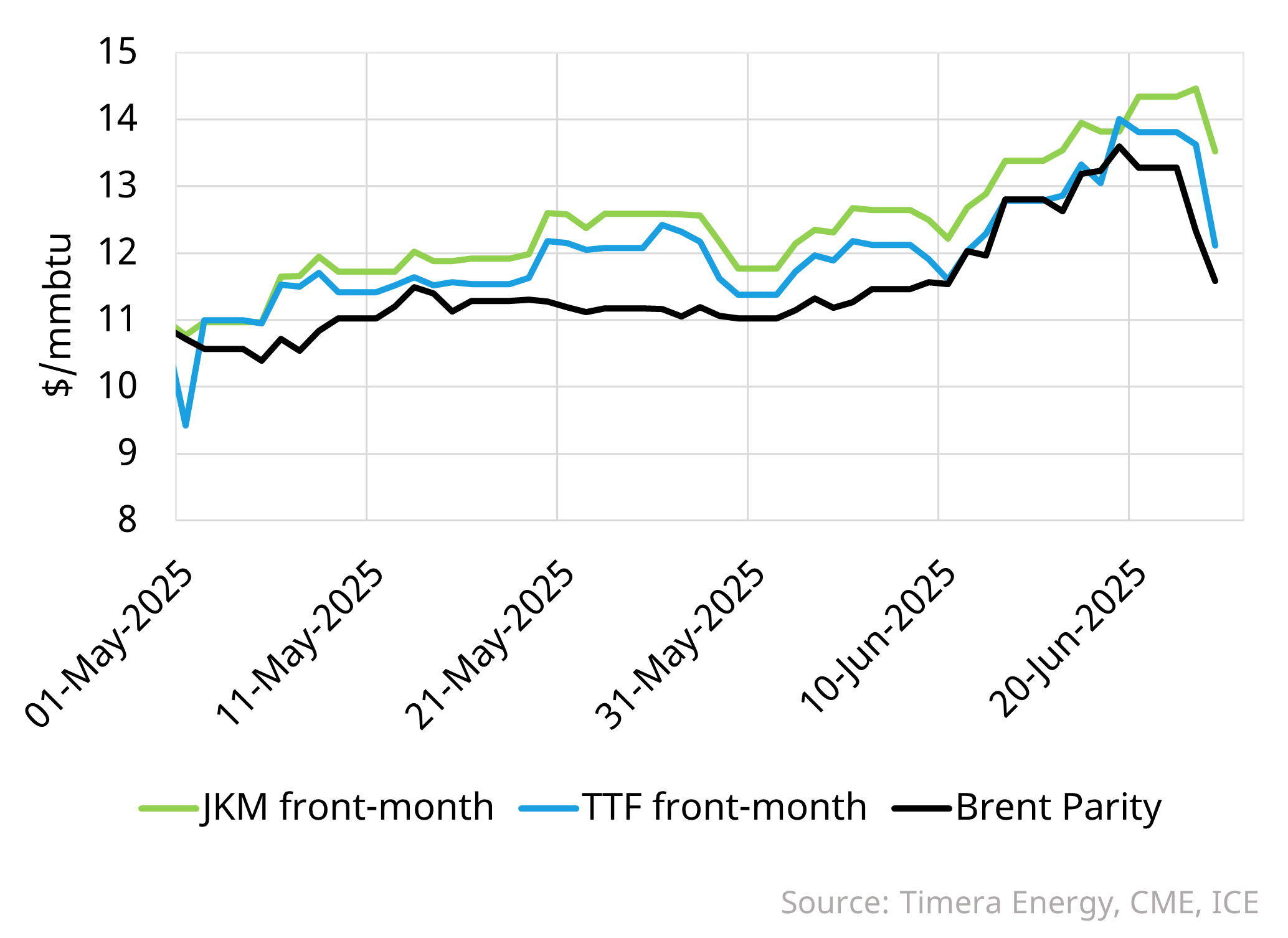

TTF and JKM front-month futures surged by a peak of 23% and 22% respectively since the start of June, fuelled by concerns over potential disruptions to exports through the Strait of Hormuz – a critical chokepoint for Qatari LNG & Gulf states oil exports. Additional upward pressure came from the loss of Israeli pied gas deliveries to Egypt.

Prompt Brent prices have been particularly volatile, climbing from approximately 64 $/bbl on the 10th June to a peak of near 80 $/bbl.

Despite markets pricing in a geopolitical risk premium, no actual disruptions to flows through the Strait of Hormuz have occurred. As signs of de-escalation emerged, the risk premium in gas & oil prices unwound rapidly. Nonetheless, the price movements over the last few weeks has evidenced the potential upside risk to global gas prices from supply-side disruptions in the current regime where supply is inelastic at the margin.

For more detailed analysis on recent gas price movements or information on our services, please contact David Duncan (Director, LNG & Gas) at david.duncan@timera-energy.com.

Join our webinar “Gas markets in flux: a framework for confronting macro uncertainty”

Topic: Navigating gas market uncertainty, unpacking macroeconomic drivers, detailed scenario analysis, and the evolving impact of uncertain demand on market dynamics and price formation.

Time & access: Wed 2nd July 10:00-10:30 CET (09:00-09:30 BST)

Registration: Pre-registration required (access is free); webinar registration link – register here

Coverage:

- Macro drivers of gas market uncertainty as new supply wave looms

- 3 scenario framework to navigate LNG & gas market evolution

- Supply & demand curve framework sheds light on pricing dynamics

- Why demand is key to shaping market evolution & price formation

- Commercial & value implications of different market paths