“Apparently artificial” prices trigger regulatory focus

Italian power and gas prices have for many years traded at a structural premium to neighbouring markets. CCGT generation margins have also been higher.

This market price & spread premium has been an important driver of value for Italian power & gas assets. So there has been a strong industry focus on:

- A recent report from the Italian energy regulator (ARERA) citing ‘apparently artificial’ price levels

- The Italian government announcing it is exploring intervention mechanisms to reduce the price spread of Italian PSV gas hub prices over the EU TTF benchmark.

- Other regulatory interventions to reduce energy prices for consumers via market segmentation.

In this article we explore the drivers & asset value impact of Italian price premiums, with a particular focus on the power market.

Price premiums spark regulatory focus

In July 2025, ARERA published the results of a knowledge-gathering inquiry into 2023–24 day-ahead outcomes. The report identifies “apparently artificial” price levels associated with potential economic capacity withholding and sets out data and monitoring enhancements.

Industry reactions vary, from support for tighter oversight to formal appeals. In parallel, the government is exploring a solution to tighten the PSV–TTF spread, with expected knock-on effects for both gas and power prices.

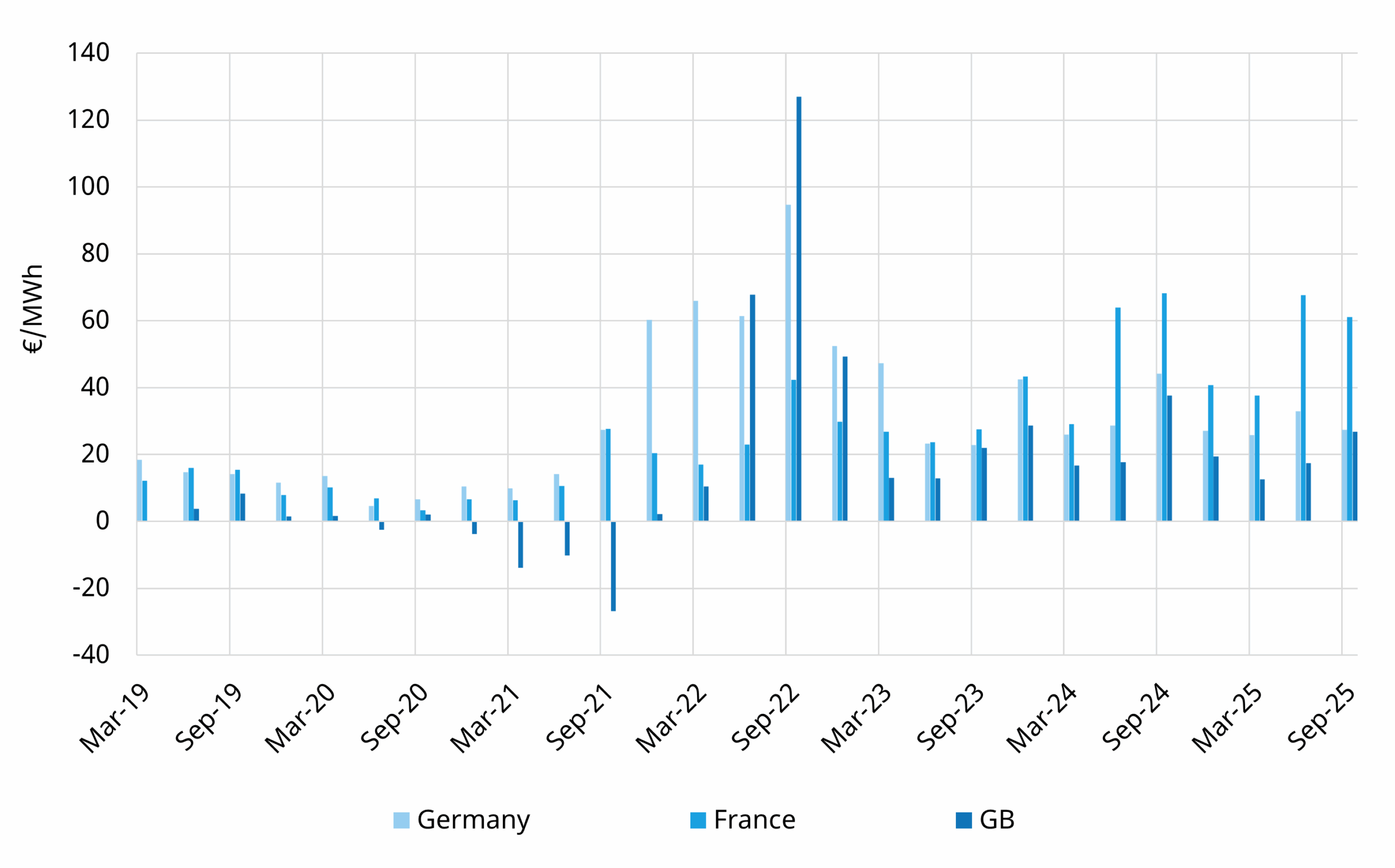

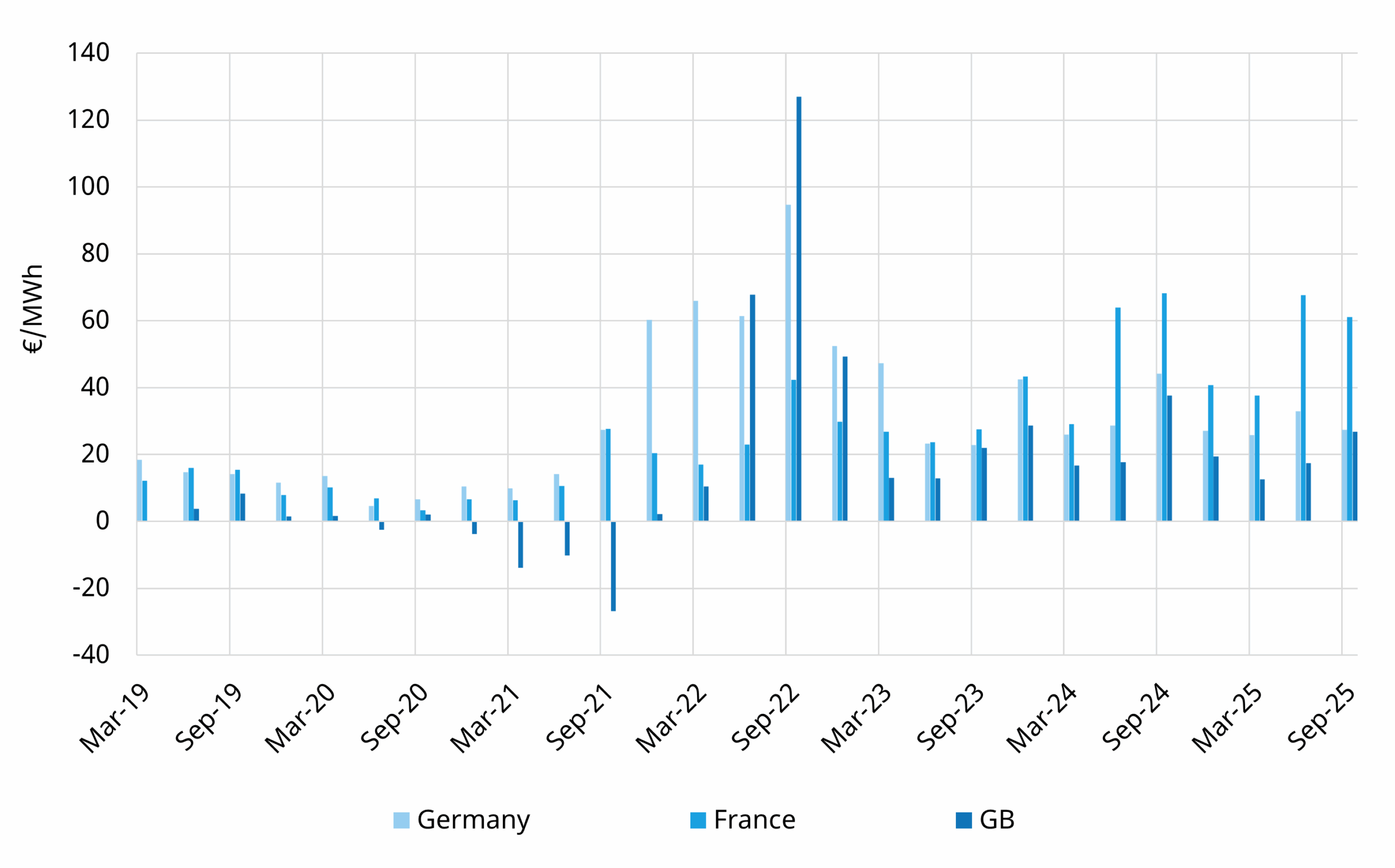

In Chart 1 we summarise Italian power price spreads vs Germany, France & GB, illustrating a clear market regime shift since 2022.

Chart 1: Italian day-ahead price spread vs key markets

Source: Timera Energy, ENTSOE

Let’s unpack some of the drivers behind the Italian price spread premium.

What’s behind the regulatory reaction?

The ARERA investigation — launched in October 2024— aimed to assess the correct functioning of competition in the day-ahead power market and to identify potential behaviours relevant under REMIT regulation. Results were published through Delibera 302/2025.

ARERA’s analysis found that prices in some hours appeared “apparently artificial”, suggesting the possibility of economic withholding — where available capacity is offered at levels not reflective of marginal costs.

Regulatory escalation from “apparent” to “effective” price manipulation however requires detailed case-by-case validation of cost assumptions and verification of technical & economic justifications. The regulator also observed that CCGTs were at the margin for around 70% of hours in 2023–24, reinforcing the central role of gas generation in setting Italian prices.

These findings triggered strong reactions. Industry associations questioned the methodology and the lack of consultation, while some operators filed appeals. ARERA’s work nevertheless sets a new benchmark for market monitoring, with the application of REMIT II regulation entered into force in May 2024 in a period where market manipulation investigations were opened by other European regulators (e.g. BNetzA for German spike prices in the end of 2024).

In parallel, the government is exploring structural measures to address high wholesale gas prices. The proposed solution for PSV–TTF spread reduction aims to align Italian gas prices with continental hubs. This initiative, while intended to support industrial consumers, could also reduce power generation costs and hence help close part of the gap between Italian and Northwest European prices.

Gas market intervention is not straightforward – it could distort cross-border gas flows in the broader European market. We’ll be tracking this as it evolves.

Why CCGT margins & spark spreads are important

Beyond fuel cost differences, the clean spark spread (CSS) provides a clearer metric for comparing CCGT generation margins & power price formation across Europe. CSS strips out gas and carbon costs from power prices, revealing the underlying margin for gas-fired generators and exposing structural competitive differences between markets.

Italy’s CSS has been consistently higher than in other European markets since before 2021, and the gap widened further after 2022. This reflects a mix of factors, including persistent PSV premia, that we describe below.

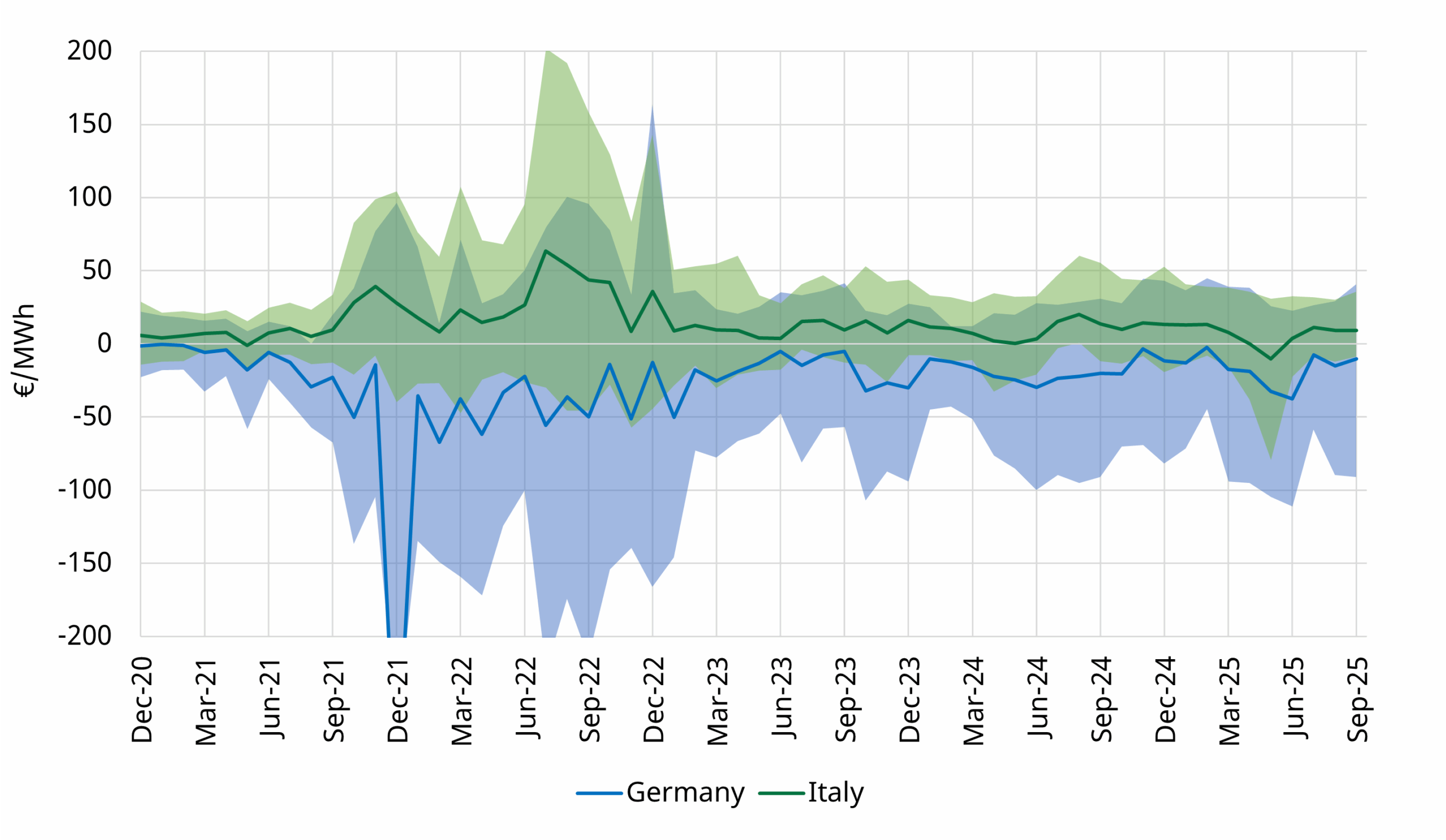

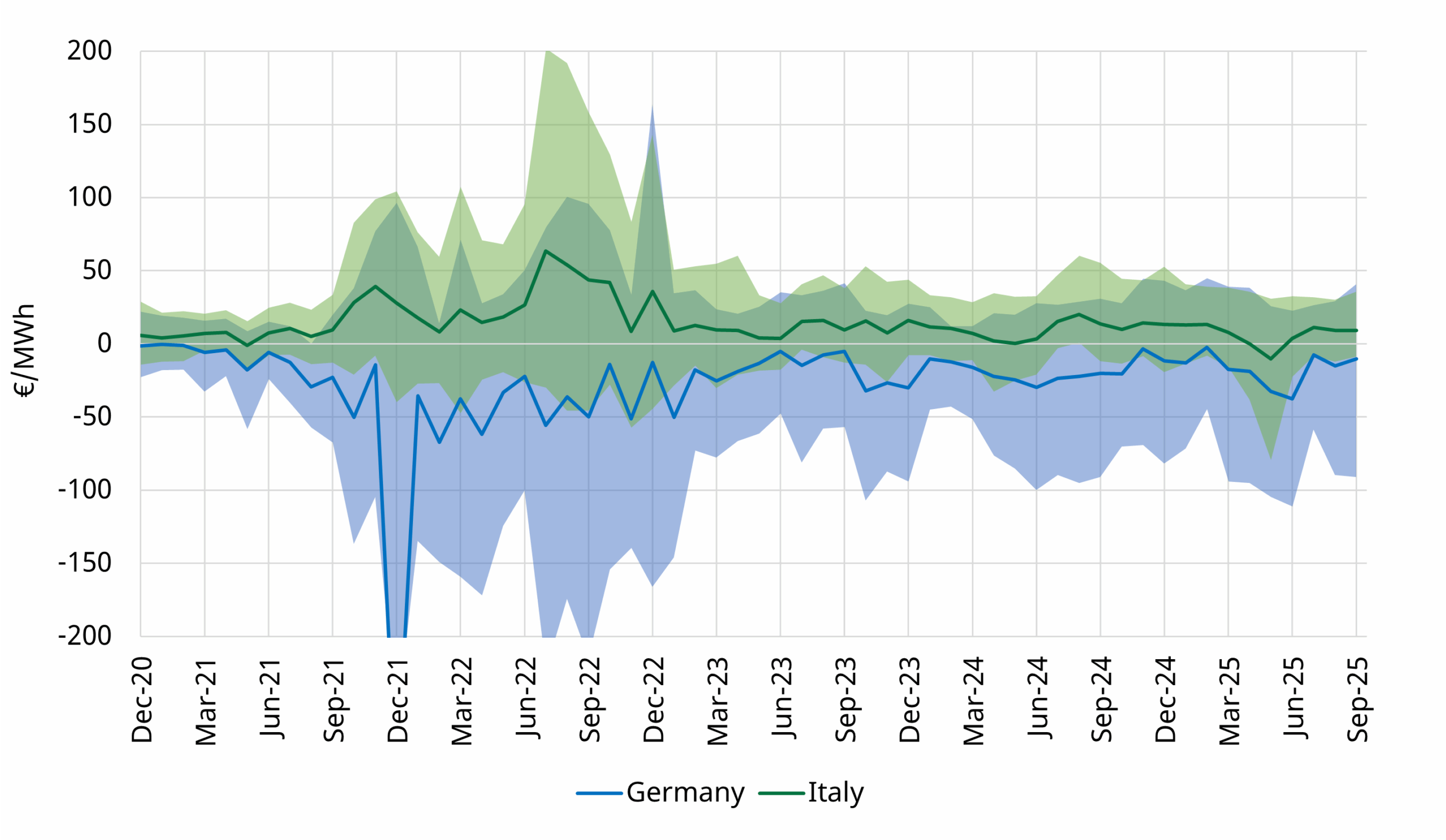

In Chart 2 we show how Italian and German CSS volatilities have increased since the energy crisis, raising the extrinsic value of flexible power assets. The lines show the mean CSS with the shaded range showing P10-P90 ranges (green shaded range = Italy, blue range = Germany).

While volatility rose almost everywhere in Europe, Italy’s average CSS level remained well above its peers (e.g. green line above blue line in Chart 2) — suggesting deeper structural dynamics rather than volatile shocks.

Chart 2: Distribution of hourly CSS, Germany vs Italy

Source: Timera Energy, ENTSOE, Spectron, ICE

Reducing the PSV premium could help narrow this gap, but it would not fully remove it. The underlying price differential also stems from a new market regime started in 2022 that was mainly driven by a CSS premium. This evidence was a core element that triggered ARERA’s investigation on price formation.

Italy’s power fundamentals are a driver

Several structural factors explain Italy’s persistent price premium relative to the rest of Europe:

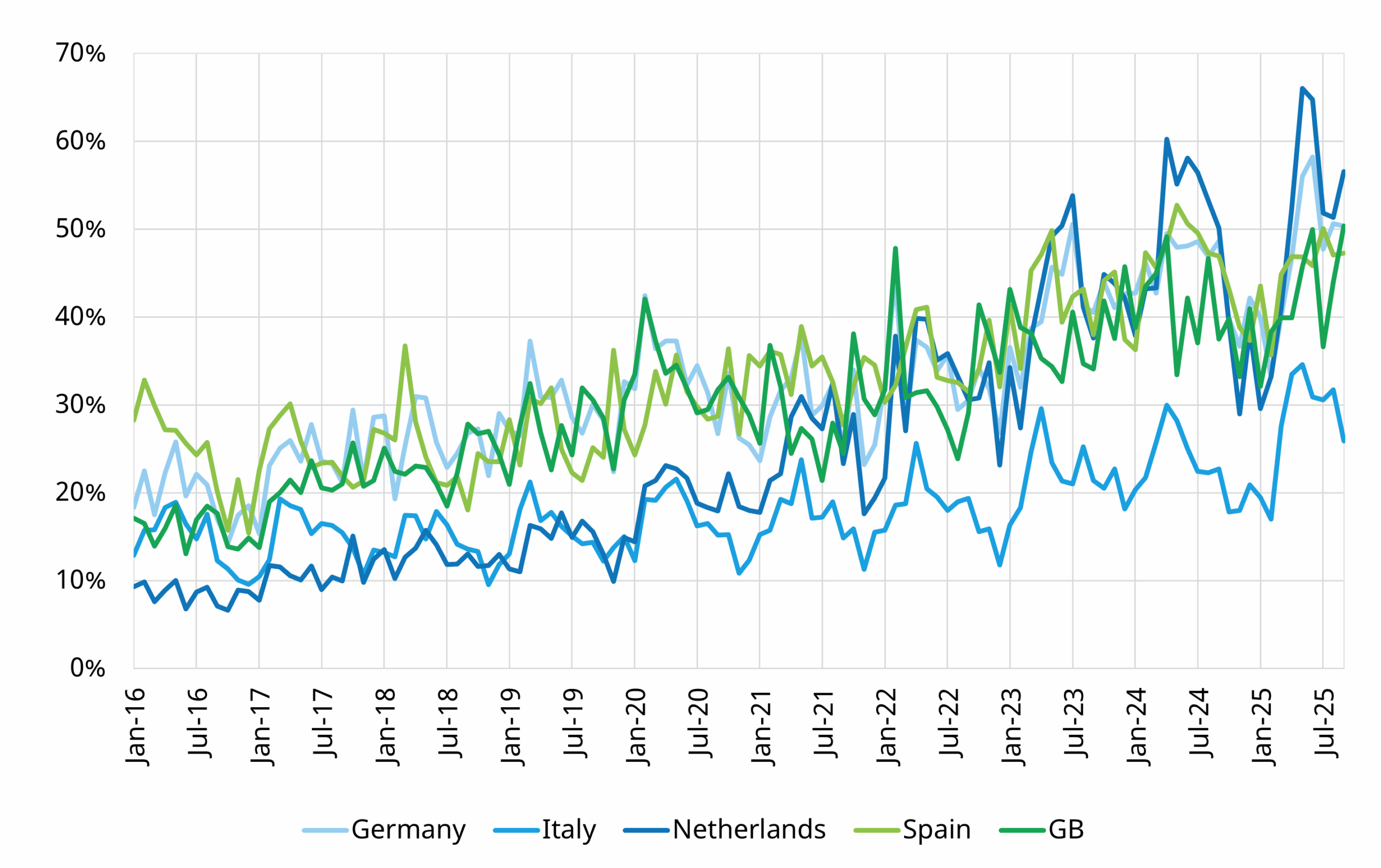

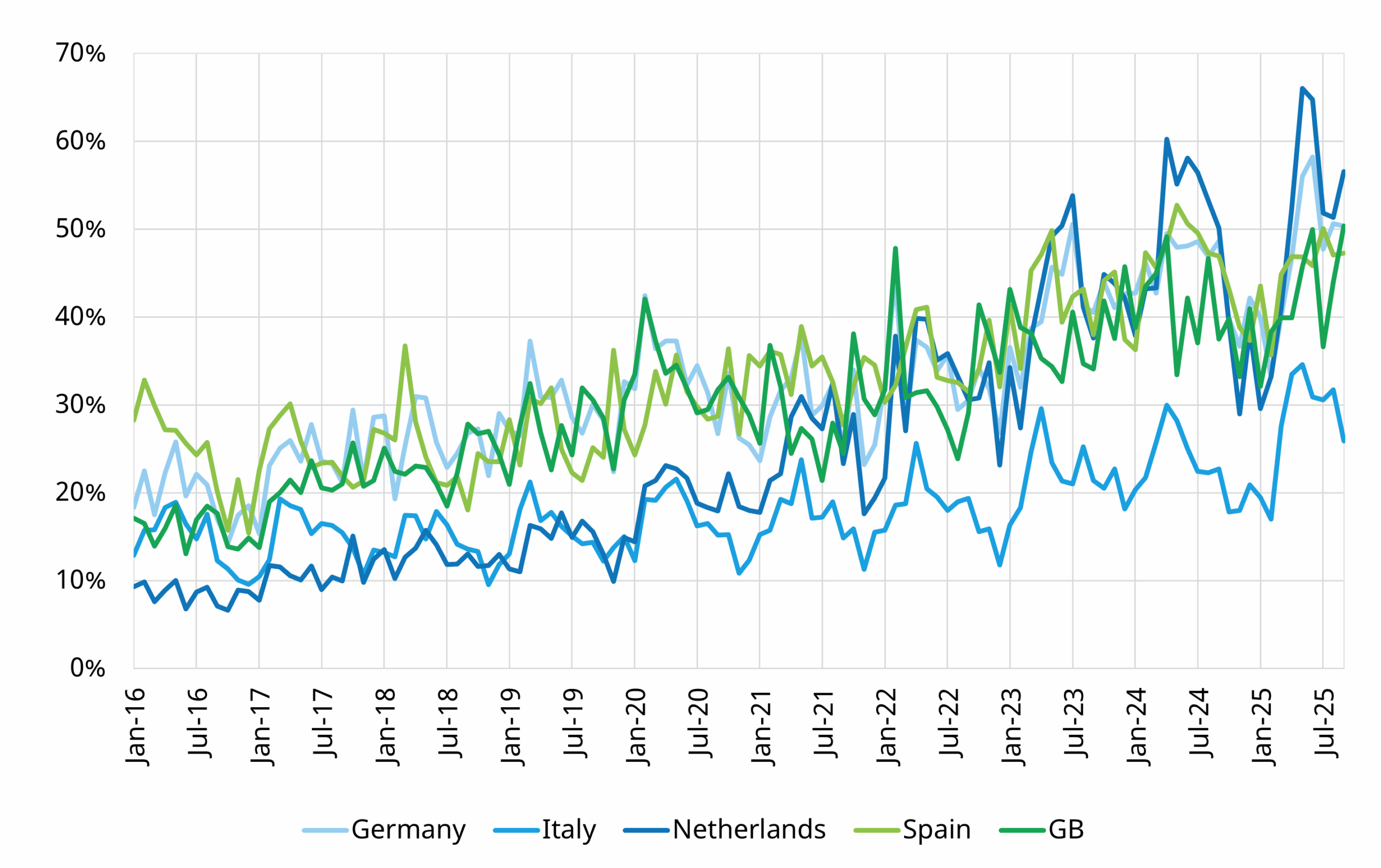

RES penetration: Italian renewable generation is growing but still lags the rapid expansion in other markets (see Chart 3). Solar and wind together account for a smaller share of total output than in other EU markets (where they already exceed 50% of generation in some months). This keeps gas at the margin more often – the absence of negative prices in Italy is clear evidence of that structural difference.

Chart 3: Solar + Wind penetration across key markets

Source: Timera Energy, Ember

Grid topology: Italy’s zonal market structure means that abundant renewables in southern zones do not automatically translate into lower national prices. Internal transmission limits and the NTC-based coupling constrain flows between zones with potential economic underutilisation of the grid, leading to major differences compared to other European non-zonal markets.

Cross-border integration: Since June 2022, most of continental Europe has adopted flow-based coupling, improving interconnection capacity allocation efficiency. Italy remains coupled to rest of Europe under a hybrid model, which restrict price convergence with core EU markets.

Fuel mix: Gas continues to dominate Italian generation with limited competition from coal, lignite or nuclear. Hydro contribution is important but constrained in total generation output, while lower coal and carbon costs elsewhere increase competition and reduce marginal prices in North-West Europe.

2022 ushered in a new Italian market regime

A more marked divergence in Italian prices began in 2022 — a year that saw a structural shift in how value is distributed across Italy’s power market components:

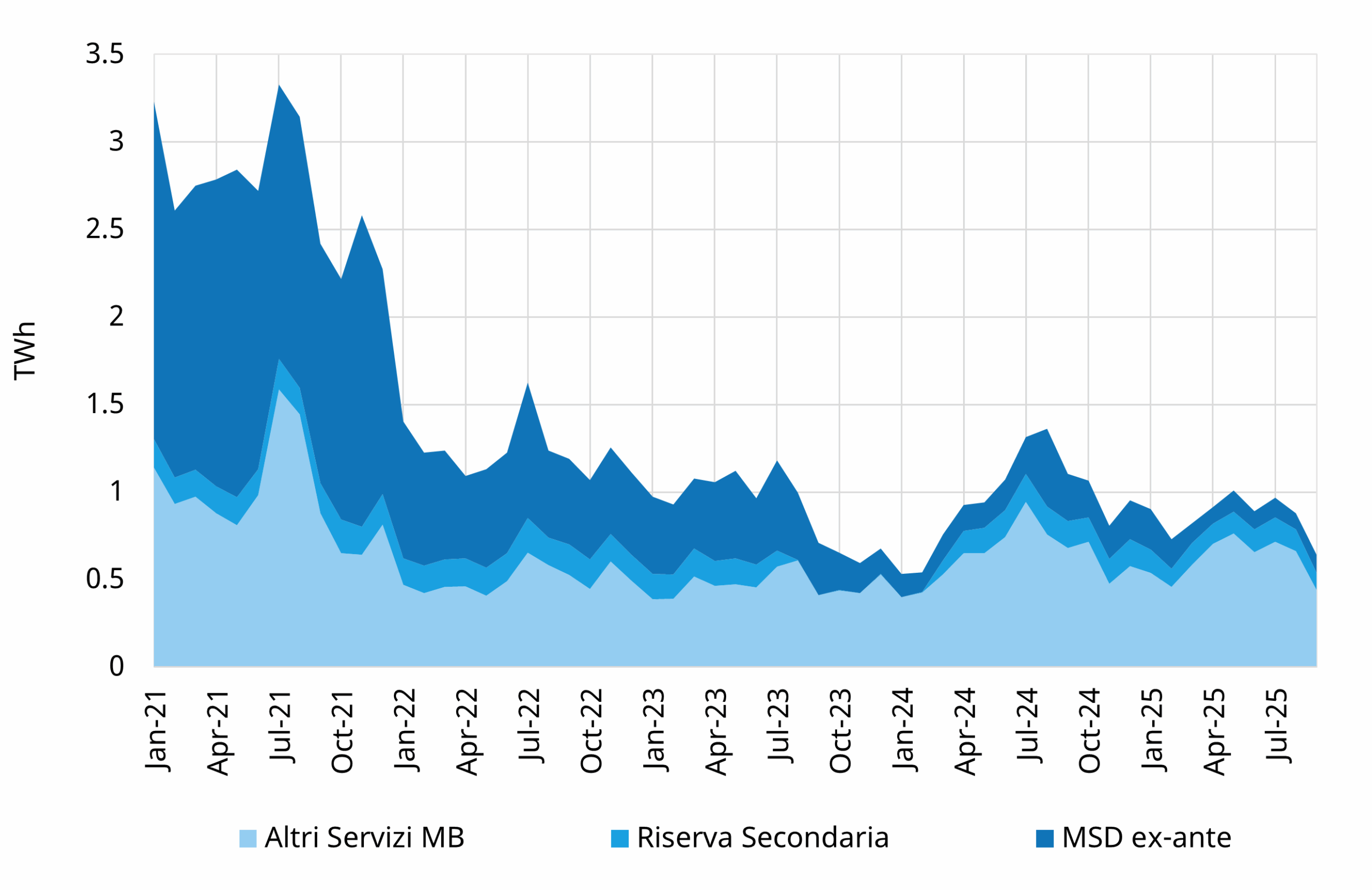

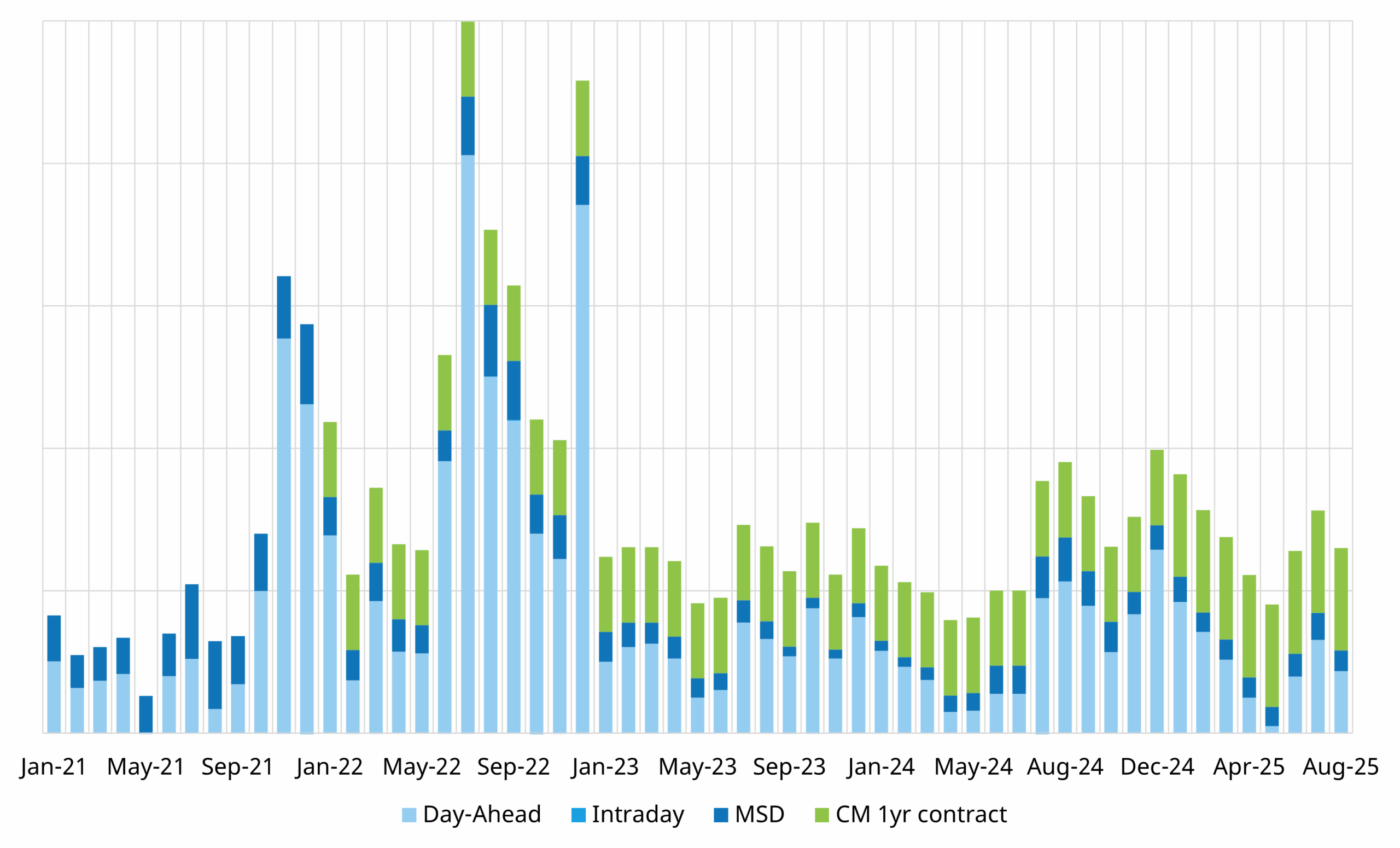

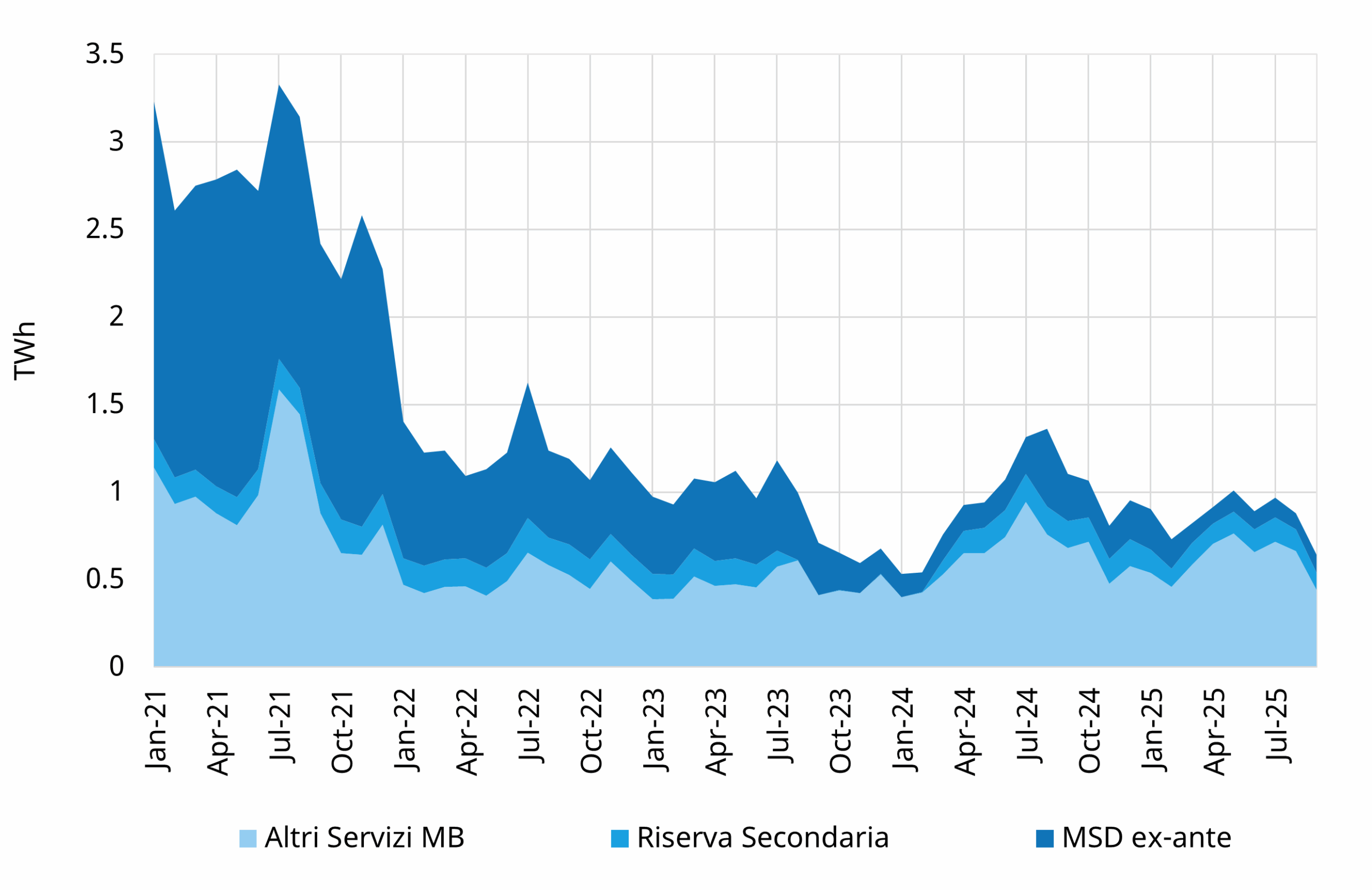

- MSD optimisation: Terna’s reform of the ancillary and balancing market reduced MSD traded volumes to roughly one-third of pre-2022 levels (as shown in Chart 4). This compressed re-dispatching revenues for thermal assets and shifted value capture toward day-ahead positions.

Chart 4: MSD total traded volumes

Source: Timera Energy, GME

- Capacity Market (CM): 2022 was the first delivery year for the Italian CM, covering over 40 GW of capacity. The strike price mechanism effectively capped revenues during scarcity hours while providing a fixed premium. Non derated CM payments for existing capacity rose from €33k/MW (2022–24) to €45k/MW (2025), offering fixed annual revenues adjusted to inflation.

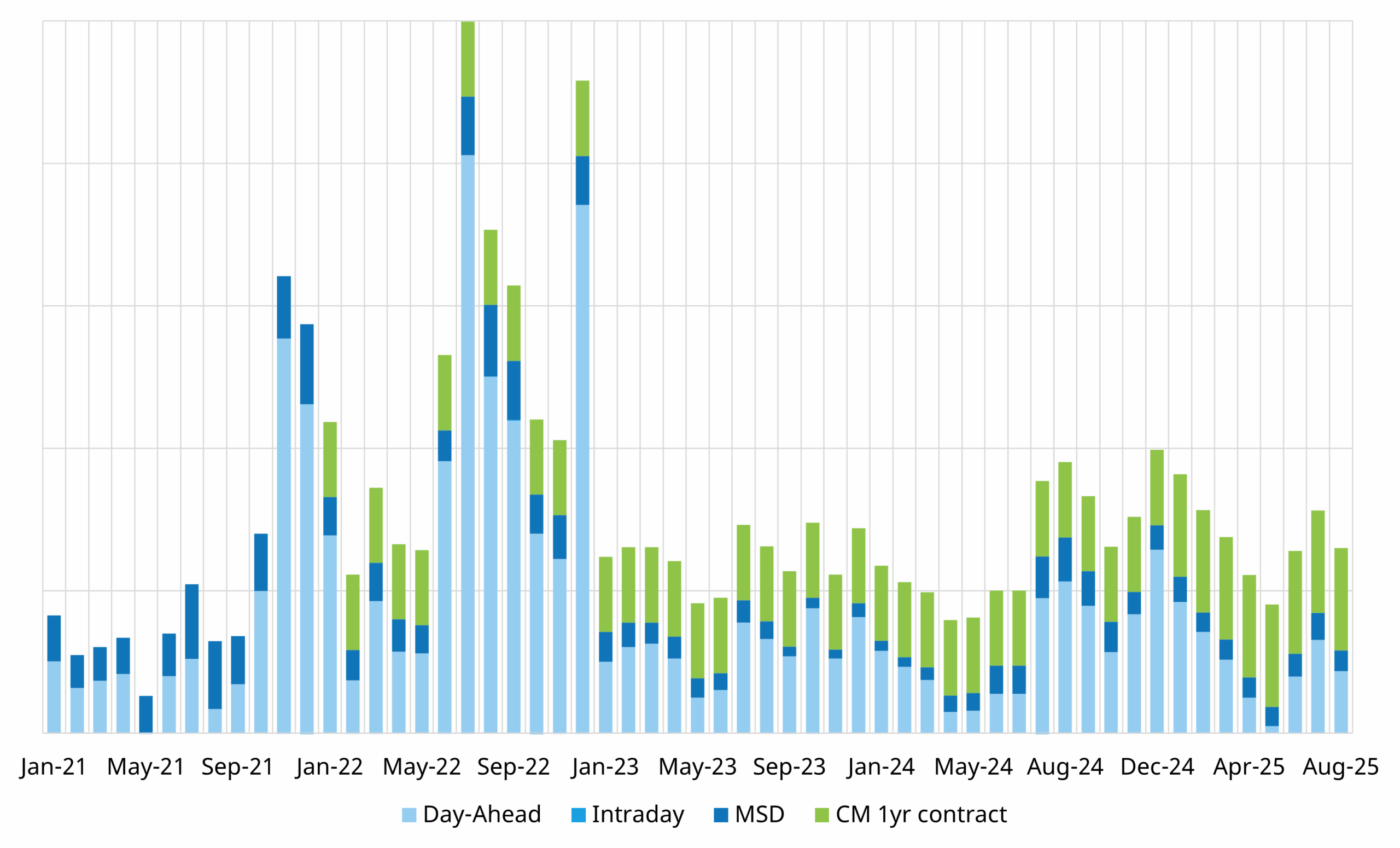

Before 2022, thermal assets were competing more aggressively on the day-ahead market to secure profitable dispatch in the MSD market, causing wholesale price pressure. After the 2022 optimisation and CM strike price introduction, the sharp drop in MSD value reduced this incentive, shifting margins and price premium toward the day-ahead market (Chart 5).

Chart 5: Evolution of the estimated margin composition of a representative Italian CCGT

Source: Timera Energy, GME

Key takeaways for asset owners & investors

Italy is currently a market that is being driven by a unique set of dynamics compared to North-West Europe. This is a driver of key differences between flex investment case in Italy compared to the rest of Europe.

However, what is true today is not necessarily going to be true tomorrow. Across an investment horizon many things are set to change in the Italian market due to:

- Penetration of RES supported by the innovative FER-X and FER-Z CfD mechanisms

- Higher integration in European market coupling for Day-Ahead, Intraday and Balancing

- Strong expected storage flex buildout thanks to MACSE and the Capacity Market, with implications for the regulation on market dynamics

- Gas price dynamics set to evolve with the European infrastructure and the Global LNG market, continuing to drive power price dynamics at the margin

Understanding the 2022 regime shift is not only essential for interpreting Italy’s power market, but also for anticipating how the investment case in flexible assets will evolve.

For more details on our Italian power market services feel free to contact Alessio Cunico (Associate Director) – alessio.cunico@timera-energy.com.