BESS investors have been waiting over a year for clarity on the Italian MACSE auctions. It is now available, with the first auction scheduled for 30th Sep 2025.

As we have set out in previous blog articles, MACSE is an innovative mechanism underpinned by long term fixed price capacity contracts for storage investors. It will be the primary driver behind large scale capital investment in storage capacity, with a focus in high solar penetration areas in southern Italy and the islands.

In this article we summarise the path into the first auction for BESS investors.

The main regulatory updates

On 7th March 2025 Terna released final key details for investors preparing to participate in the first MACSE auction, after the Italian Ministry approved it. This auction targets capacity delivery in 2028.

Published information on MACSE auction participation now includes:

- MACSE auction regulation (approved and published in October 2024).

- Auction timeline, confirming 30th September 2025 auction date.

- Terna storage capacity requirements for 2028, detailing zonal targets constraints.

- Technical report for BESS, updating previous consultation documents.

For an introduction to the MACSE mechanism see our previous articles and webinars. In this article we focus on the main takeaways from the last 3 bullets of the list above.

The auction timeline

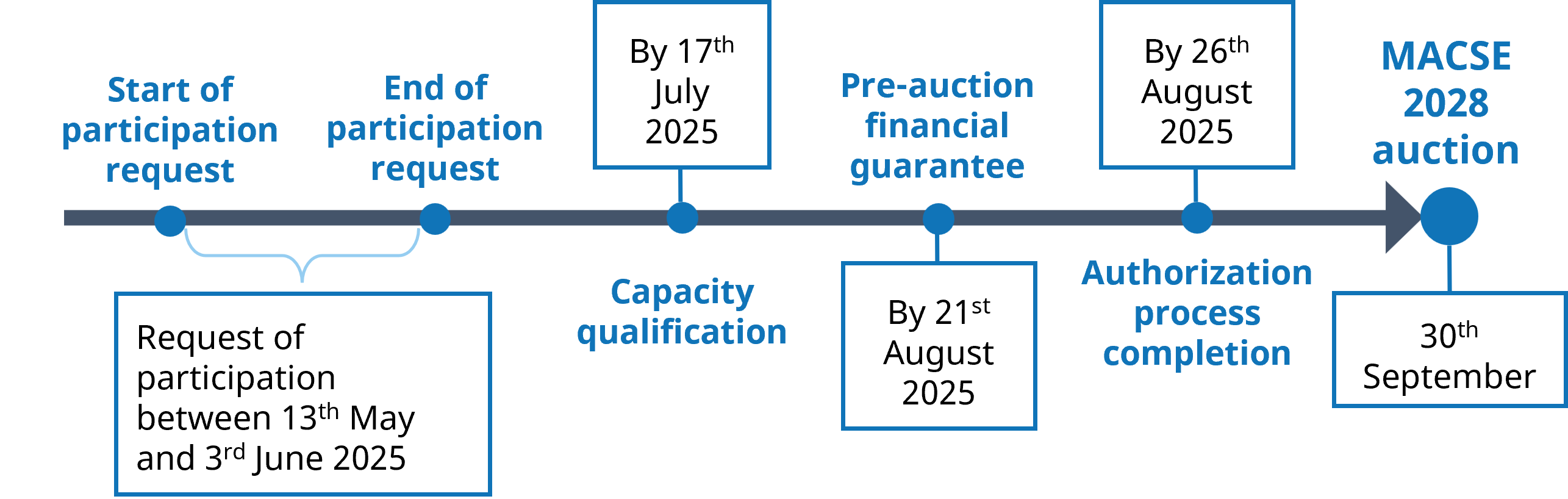

We summarise key dates leading into the auction in Diagram 1.

Key steps are as follows:

- The first MACSE auction will take place on the 30th September 2025, targeting 2028 as first capacity delivery year.

- MACSE participation request must be sent to Terna by the 3rd of June 2025.

- The capacity of the BESS project must be qualified by 17th July 2025. The capacity qualified for the auction can also be lower than the asset capacity, with relevance for players pursuing the Hybrid MACSE business model (as we define in our previous article).

- Constitution of the pre-auction financial guarantee by 21st August 2025. The guarantee will be 10% of the qualified asset capacity (MWh) multiplied by the reserve auction premium (€/MWh), that will be defined by ARERA soon. This preauction guarantee will discourage speculative auction participation.

- Project authorisation process must be completed by 26th August 2025: all stand-alone BESS projects authorised by this date will be eligible for 2028 MACSE auction participation.

Now let’s look at potential capacity volumes procured in the auction.

Terna’s storage capacity requirements for 2028

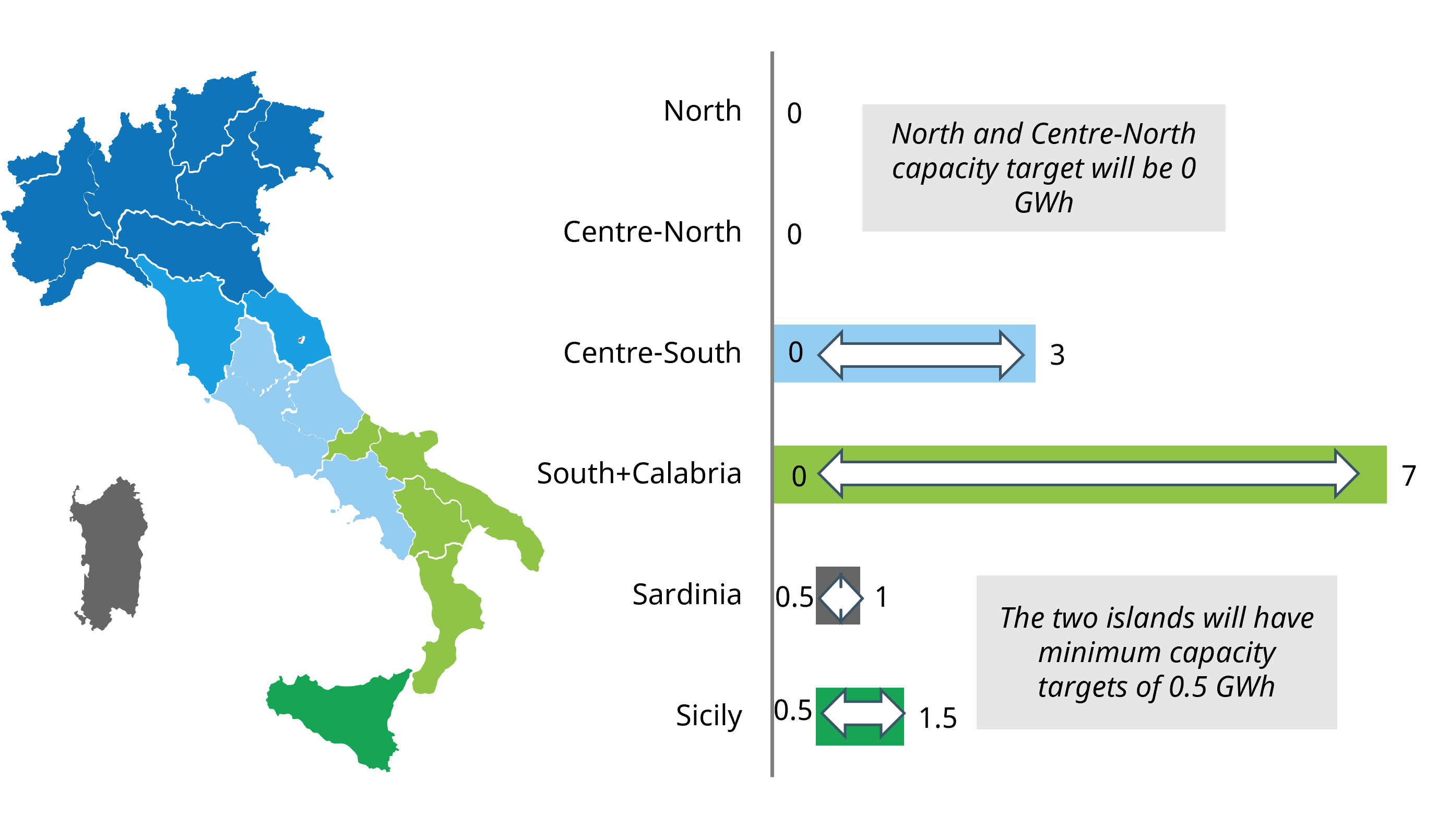

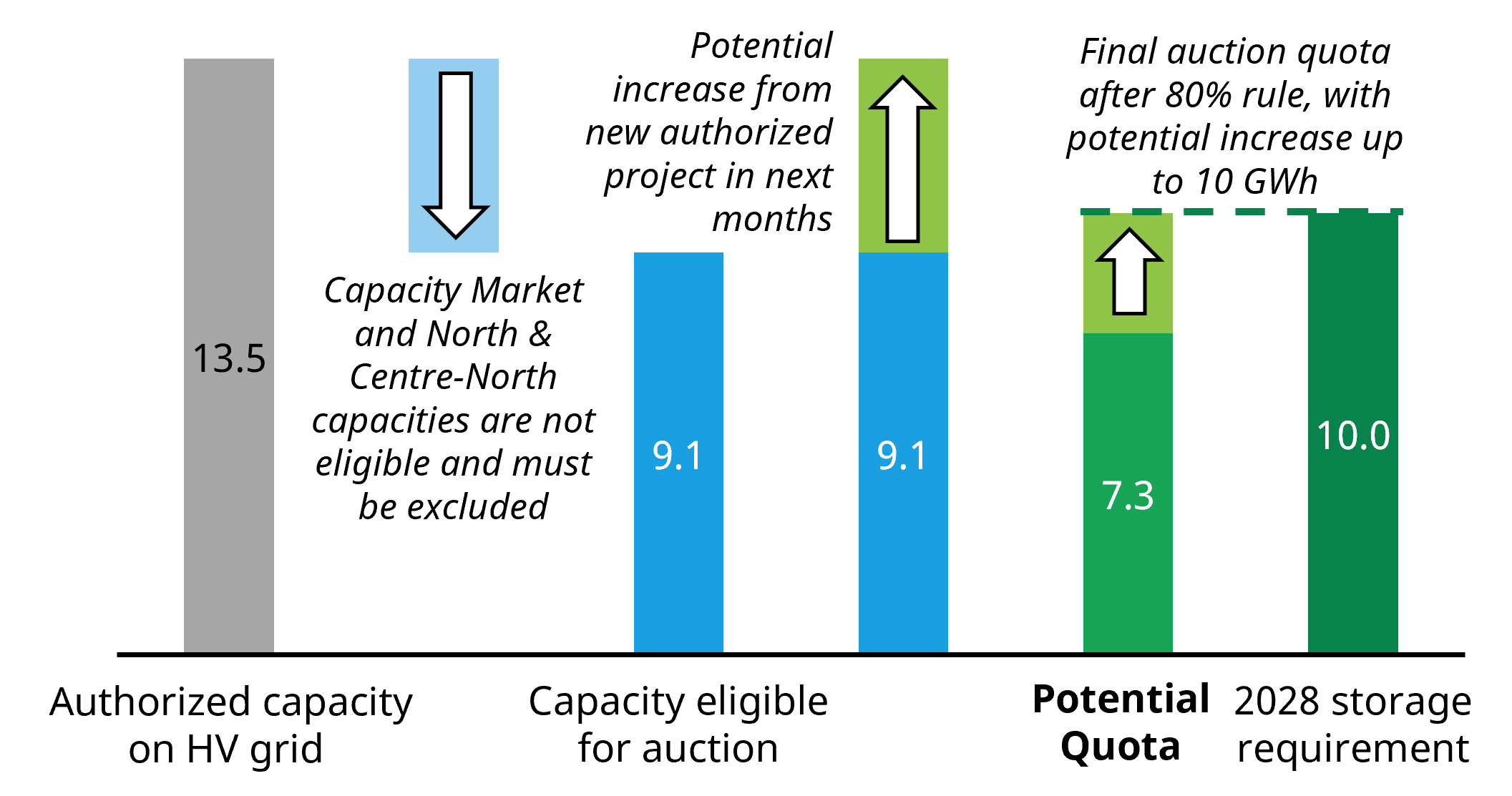

Terna has identified a target of 10 GWh of additional storage capacity for 2028 to be financed through MACSE. The maximum and minimum requirements for each of the 6 MACSE zones are summarised in Chart 1.

Some important context on volume procurement:

- To guard against an under-subscribed auction, the national auction volume quota will be equal to the minimum of (i) 80% of qualified capacity and (ii) the 10GWh national level target. The same logic will apply to define the actual minimum zonal capacity targets.

- The auction clearing algorithm will minimise the procurement cost considering the maximum and minimum zonal targets as upper and lower bound constrains on the geographical allocation of qualified capacity.

- The 80% logic is set to drive competition in all the zones regardless of their qualified capacity.

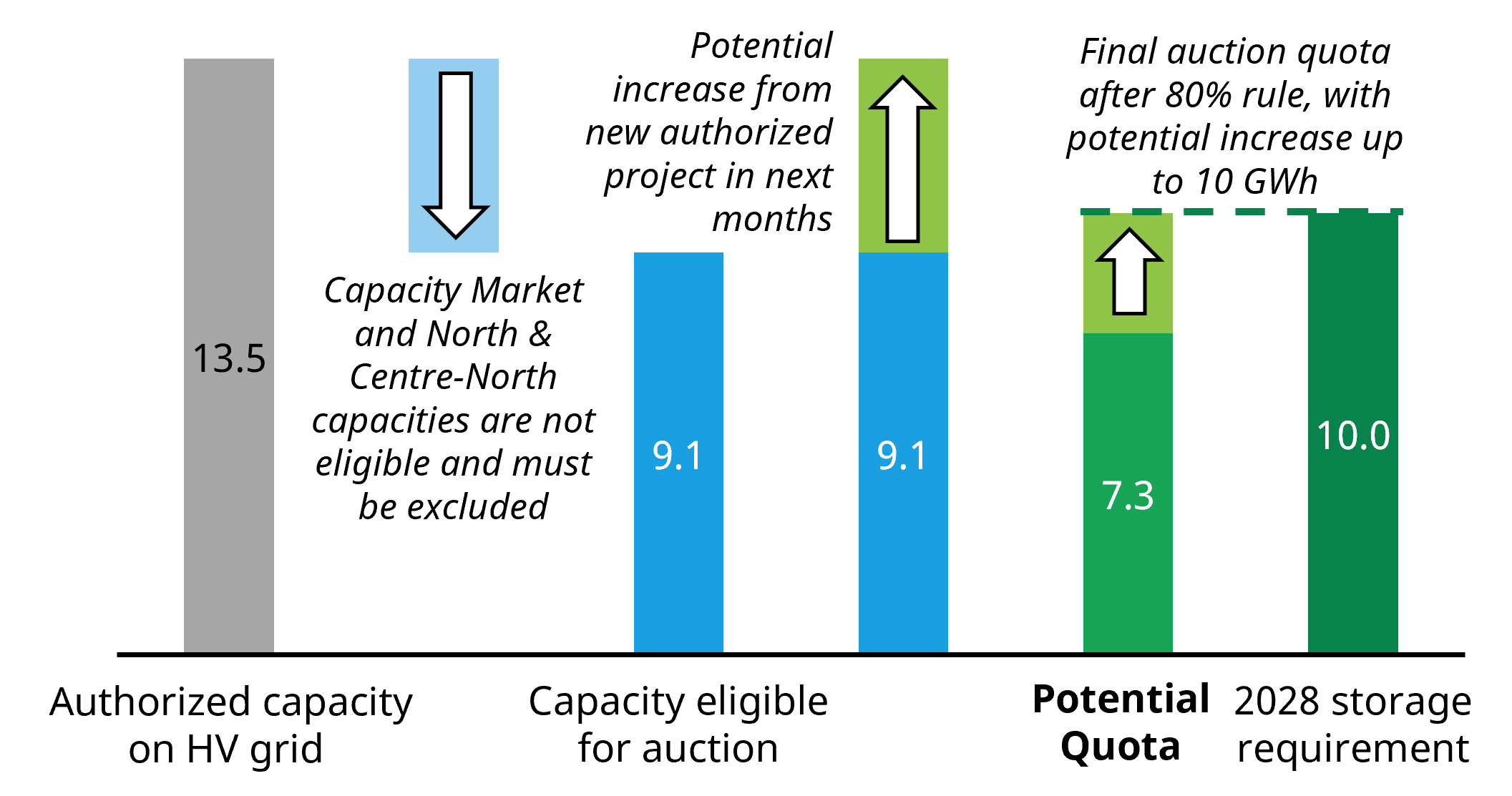

At the end of February 2025 9.1 GWh of authorised stand-alone capacity on the HV grid was eligible for auction participation. Applying the 80% rule to this volume, the national auction quota would be 7.3 GWh, assuming authorised capacity remains the same.

However new projects reaching authorisation before the end of August 2025 can increase the final auction quota as will illustrate in Chart 2.

Chart 2: Analysis of the potential auction capacity volume quota (GWh)

Source: Timera (note 7.3GWh is based on eligible capacity as of 28/02/25)

The participation of non-lithium-ion storage in the next MACSE auction may make up to 10% of the national quota, but it will be subject to the same competitive procedure.

Technical update for BESS auction

Key takeaways below from the latest published technical guidance:

- The new document targets a duration of 4hr for BESS assets instead of previous 8hr target during consultation phase, with impacts on the competitive coefficients for asset durations.

- Updated competitive coefficients for the asset round-trip efficiency, resulting in lower pressure on asset efficiency.

- Maximum 365 cycles per year as result of the physical allocation of the Day-Ahead + Intraday profile defined out of the upcoming Italian time-shifting products market.

- Confirmation of the degradation parameters, which can still be stringent causing relevant degradation risk resulting into potential unavailability penalties along 15-year contract horizon. However, this is counterbalanced by the updated less stringent allowance on unavailability time for the asset.

The technical update pushes investors to reassess financial models and bidding strategy simulations, as previous assumptions aligned with the consultation documents no longer hold.

The way forward for BESS investors

There will likely be another Capacity Market auction for 2028 after MACSE auction. However beyond this the future of CM for Italian BESS is less certain.

Terna’s latest assessments suggest the Italian system may have adequate capacity, putting future CM auctions in doubt. A Hybrid MACSE strategy with its flexibility in shaping merchant-risk exposure becomes more attractive in this context, even due to the shrinking clearing prices in the latest CM auctions.

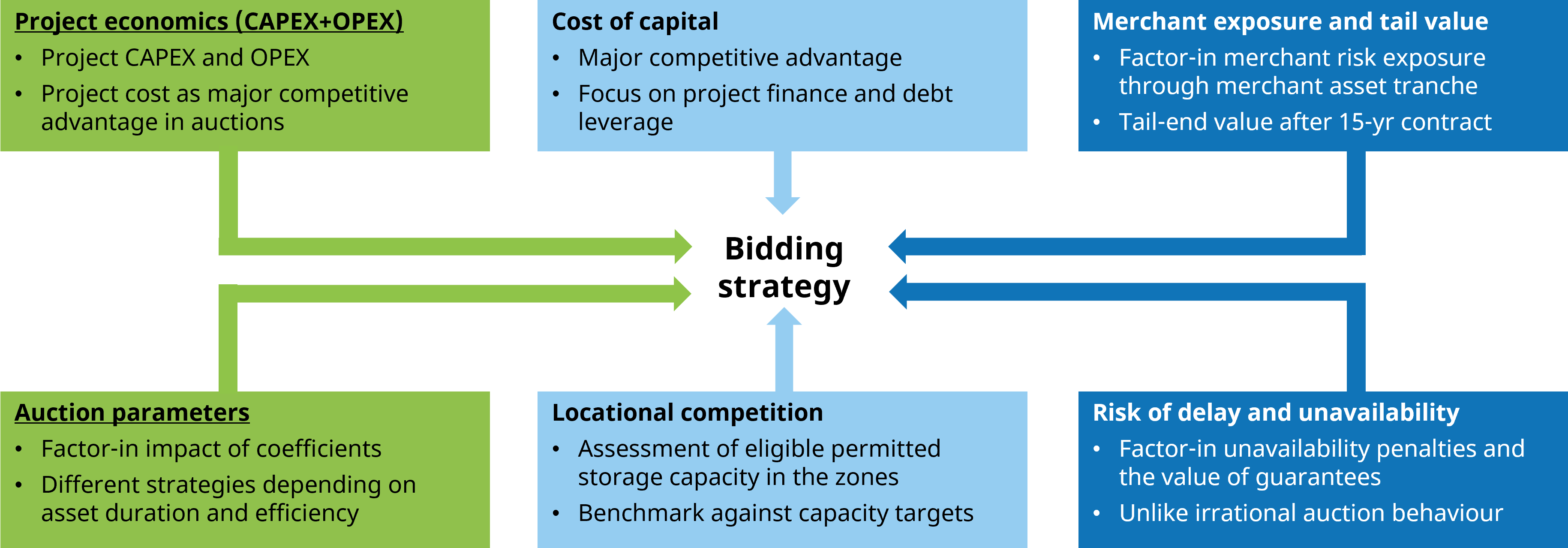

Italian BESS investors now face the challenge of evaluating the evolving risk-reward balance between merchant opportunities, CM potential participation and MACSE contracts as we set out in Chart 3.

The upcoming auction is a landmark opportunity, but the evolving landscape requires a careful assessment of merchant revenue opportunities for defining bidding strategies in an auction that is by design going to be very competitive.

We have launched an Italian BESS subscription service designed to support MACSE investors through this process. It contains:

- A highly configurable Italian Battery Investment Tool with BESS revenue stack projections for different asset configurations

- Detailed zonal level projections of the Italian power market evolution to 2050

- Comprehensive Italian BESS Investment Report covering policy & market drivers, MACSE & CM and 4 alternative BESS business models.

The service includes a full update of the above as the 1st auction approaches.

We have a special 20% reduction offer on this service for all clients who sign up by 30th April 2025. Feel free to reach out to our Power Director (steven.coppack@timera-energy.com) for details and a free sample copy of the Investment Report.

Join our webinar “MACSE start gun has been fired”

Topic: Timelines, guidelines & commercial considerations for BESS investors targeting 1st MACSE auction in Sep 2025

Time & access: Fri 11th Apr 10:00-10:30 CET (09:00-09:30 GMT)

Registration: Pre-registration required (access is free); webinar registration link – register here

Coverage:

- Timeline & key requirements into Sep 2025 auction

- BESS capacity procurement volumes

- Zonal / locational drivers

- Latest on MACSE investment route implications

- Bidding strategy considerations for investors