Negotiating LNG contract pricing terms is a high stakes business.

A 1 mtpa LNG supply contract covers more than $500m a year of annual cargo value. Many supply contracts are multiples of this volume with billions of dollars of annual value at stake.

Price review or re-opener clauses have become more common in LNG contracts over time, particularly in Asia where oil-indexation is more prevalent. These clauses provide a trigger for price negotiation & arbitration.

Price reviews act as contract protection for both counterparties against unreasonable economic impairment e.g. in case of structural deviations between contract & LNG market prices.

Large price swings across the last 5 years in gas & oil markets are resulting in an increasing amount of value at stake under price review clauses. In today’s article we map out price review negotiation strategy, look at key value & risk drivers and illustrate value at stake using an LNG contract case study.

Mapping out a negotiation strategy

A key principle to establish upfront is that price review processes do not need to start in open warfare. There are potential ‘win-win’ outcomes available from constructive counterparty engagement.

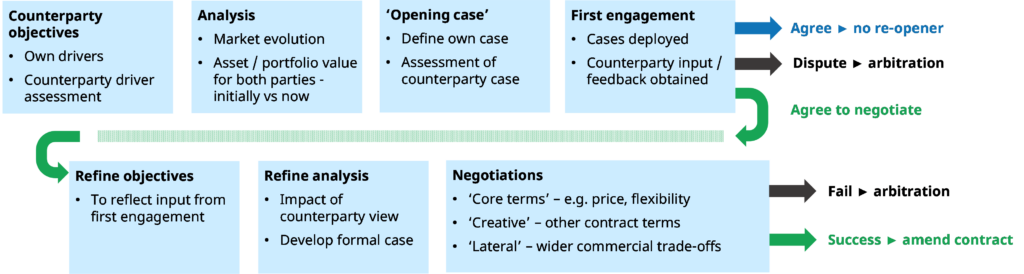

In Diagram 1 we map out the steps through a typical price review negotiation process.

The key to a constructive outcome is creativity. This facilitates a move away from a ‘win-lose’ outcome. Some examples of creativity include negotiated trade-offs around:

- volume flexibility terms e.g. an LNG portfolio player granting incremental contract flex (UQT / DQT) to a buyer who values this highly for customer management, in exchange for concessions on scheduling flexibility

- pricing terms e.g. concessions on indexation terms in exchange for future price review rights

- wider portfolio value trade offs e.g. linking changes in one contract to negotiation of terms on another

- legitimate valuation differences across counterparties (e.g. due to different market views).

Contract renegotiation should not just be confined to price reviews triggered by contract clauses. The creativity to negotiate ‘win win’ outcomes is just as possible via proactive counterparty engagement, a key skill of a strong origination team.

Why are price reviews important now

The simple answer is there have been major shifts in energy market fundamentals. This includes changes in:

- market price levels, both gas price swings and gas vs oil price divergence

- market regimes, e.g. the anticipated transition from a tight to a well supplied market from 2025 to 2027 (impacting price levels, correlations & volatility).

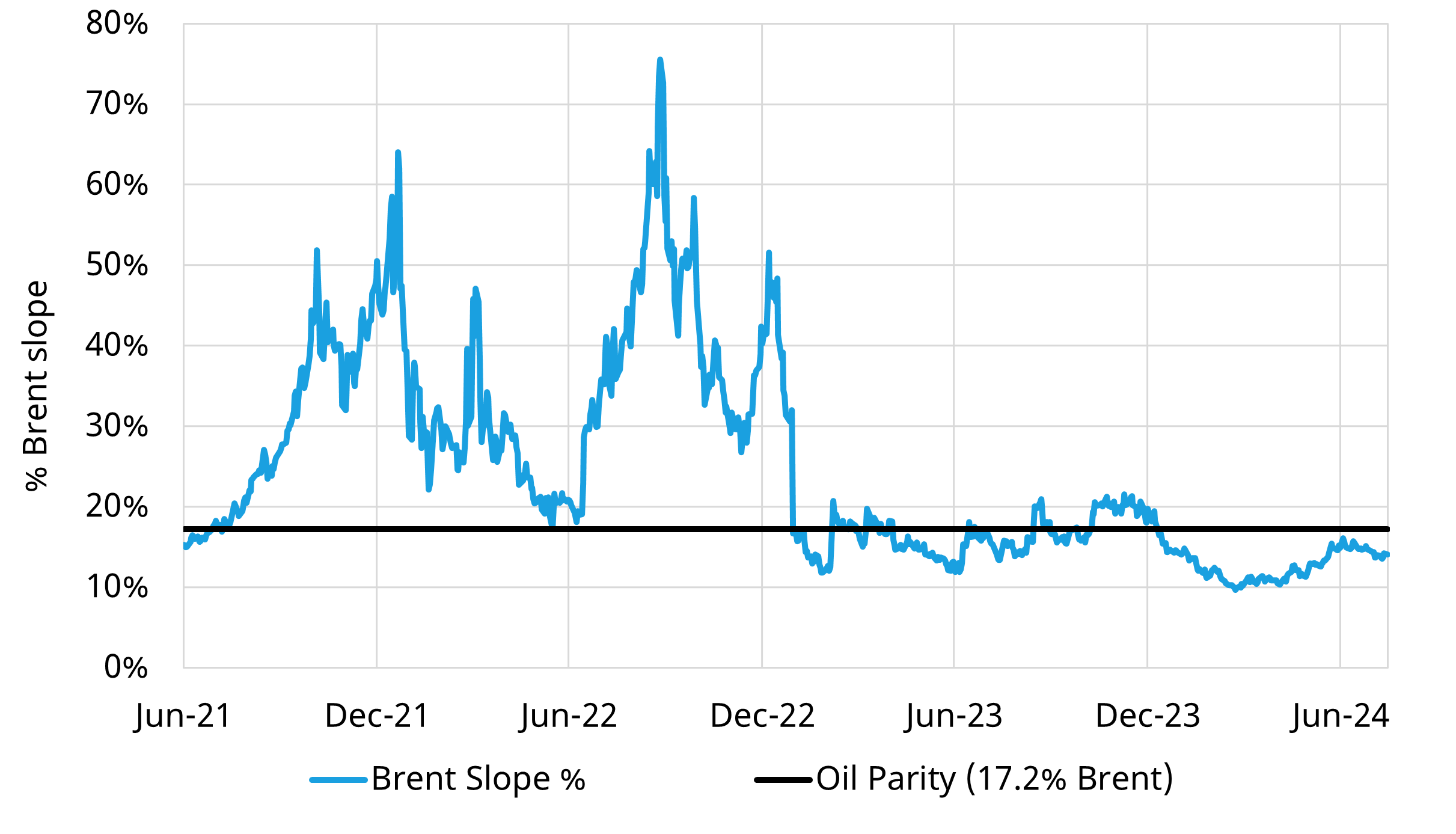

Low correlation between LNG market prices & oil indexes has caused significant shifts in value from LNG contracts with ‘oil slope’ price indexation as illustrated in Chart 1. The chart shows the extent of swings in the ratio of the JKM Asian LNG price vs Brent prices (JKM in $/mmbtu divided by Brent in $/bbl).

Chart 1 illustrates how swings in oil-indexed contract value have been exacerbated by significant volatility in global LNG markets. JKM vs Brent slopes have swung between a range of 10-75% over the past 3 years, vs typical LT contract pricing terms of 10-15% Brent. This range is even more extreme if we extend back to the Covid related impacts of 2020.

The impact of these large relative swings in gas vs oil price substantially increases the value at stake under price review clauses. To put this in context, a 10c per mmbtu shift in contract price across a 5 year 5mtpa deal impacts value by around $140m.

Changes in the value of contract flexibility terms can also be substantial (especially volume flex, e.g. cargo volume flex or DQT/UQT). These terms can be a key ‘creative’ negotiation lever and source of value upside as part of a renegotiation or price review process.

Value analysis to support negotiation

Robust analysis of LNG contract value underpins any price review or negotiation process. If you can’t accurately quantify value, competitive advantage shifts firmly against you.

Historically LNG contract value analysis focused on reported slopes from recent deals struck in the market. There are several reasons why this approach is inadequate:

- It is backward looking, not forward looking

- It ignores the often substantial value of embedded flexibility in contracts e.g. a DES purchase contract at 12% Brent is significantly less valuable than the same contract with DQT rights of 20% of ACQ, plus seasonal shaping of 10%

- It does not account for different values placed on the same contract by different counterparties (given unique portfolio impacts); this can have an important influence on negotiation strategy.

These factors have been driving a strong increase in focus across LNG companies on more robust contract valuation analysis, including capturing portfolio interdependency effects. We have seen direct evidence of this from our LNG client base in the form of an increase in LNG contract valuation work to support renegotiations using our LNG Bridge portfolio modelling framework.

Case study to illustrate contract value shifts

There is no better way to understand LNG contract value changes than quantifying them via a practical case study.

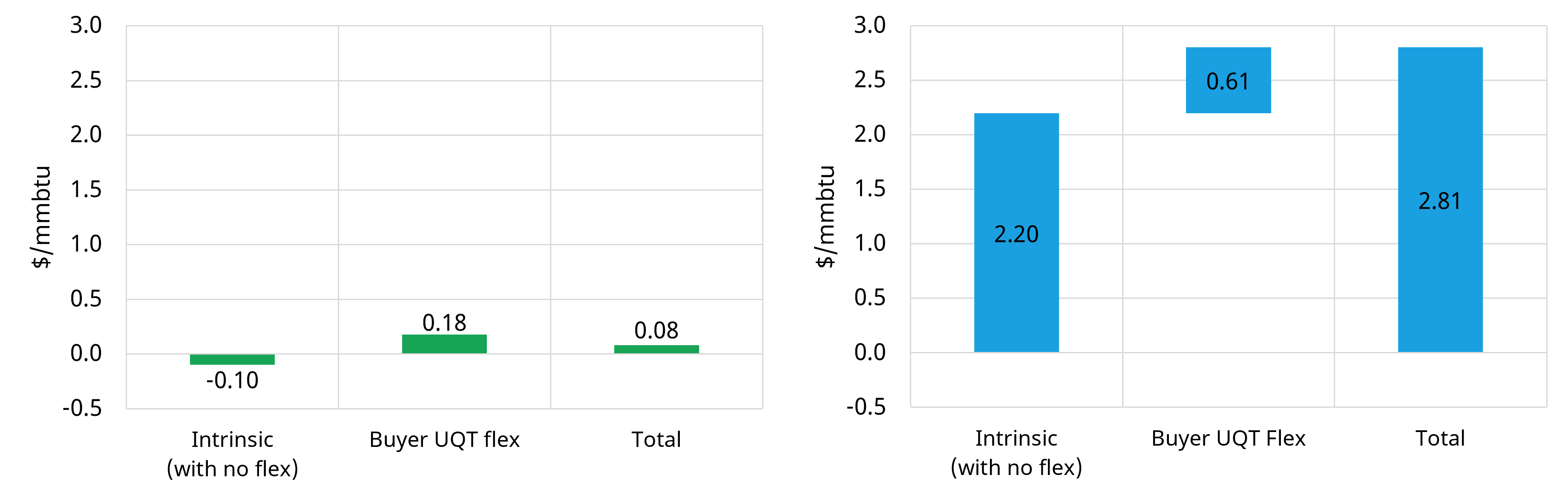

In Chart 2 we show the change in value of a 5 year strip of cargoes (for 2025-29 delivery) at two different points in time:

- In 2020 during the Covid crisis LNG market downturn

- In 2024 given current market conditions.

The contract we analyse is a DES NE Asia purchase (sell into JKM spot), with 12% Brent slope, 12 cargoes a year (ACQ) and 3 cargoes per year UQT for the seller (i.e. the seller has the right to take 3 additional cargoes a year).

Chart 2: Contract value breakdown in 2020 (left hand panel) & 2024 (right hand panel)

Source: Timera Energy’s LNG Bridge portfolio valuation model

The left hand panel shows the value of the contract shortly after it was signed in 2020. Value is relatively low given the contract is close to ‘at the money’. It is important to note that most of the contract value is driven by the value of the embedded UQT flexibility term.

The buyer UQT flexibility enables to buyer to nominate 3 additional cargos per year when contract prices are below prevailing spot prices. In 2020 with the contract ‘at the money’, this UQT flex consists mostly of extrinsic value.

Now let’s step forward 4 years in time to see how the contract valuation changes in 2024. LNG market prices (JKM) have risen substantially relative to the oil indexed contract price. This has driven some major shifts in contract value that illustrates the potential motivations (in this case for the seller) to trigger a price review or renegotiation process. A summary of changes:

- The intrinsic value (without any flex) of the contract has increased as JKM has risen relative to the contract price

- Buyer UQT flex accounts for a material % of overall contract value as it has moved into the money (can nominate additional cargos at a much lower value contract price vs market).

The case study illustrates the significant value that is often contained in the flexibility terms in LNG contracts and the importance of keeping these within the scope of negotiations. Creativity around use of these flex terms in a negotiation process can be a valuable route to conflict resolution. However competitive advantage here depends on robust quantification of value impacts (from both buyer & seller perspective).

5 commercial takeaways to inform contract negotiation

We finish in Table 1 with a summary of ‘lessons learned’ based on our experience supporting clients with LNG contract price reviews & re-negotiations.

Table 1: 5 takeaways on LNG contract negotiation

If you are interested in finding out more about our services & experience in this space, feel free to reach out David Duncan – Director of LNG & Gas (david.duncan@timera-energy.com).