In any normal year it is safe to do an annual review of surprises in mid-December. How much can happen between now and the end of the year when everyone is focused on Christmas parties?

“Energy security trumped decarbonisation in 2022”

2022 has not been a normal year. In fact, the collective learning of 2022 has been to take nothing for granted.

So, with the caveat that further surprises may still unfold across the next two weeks, we look back today on some major surprises of 2022.

Risk management redefined

In many ways 2022 has been about survival. Risk management has trumped every other concern. By this we mean big picture strategic risk management of company & portfolio value (rather than the more operational measurement of for example P&L, mark to market or VaR).

2022 has been a humbling experience. We have built Timera on the principle of ‘respect for uncertainty’. This principle underpins all of our analysis and drives our focus on stochastic modelling and the analysis of value distributions.

The behaviour of the ‘left & right tails’ is popular subject matter for Timera water cooler chats, as are market events unfolding each day & their commercial implications. But like most energy market participants we failed to anticipate the pace & extent of the energy crisis which unfolded this year.

Markets have a history of ‘schooling’ their participants on complacency. 2022 has taught us as an energy industry that it is dangerous to ignore ‘the impossible’ in times of crisis. In that sense we suffered a collective failure of imagination in our assessment of risks.

2022 energy surprises recap

We started this year already in the first stage of a European energy crisis. This kicked off in Q3 2021 with the pre-invasion phase of initial Russian gas supply reductions. The 5 potential surprises we flagged at the start of this year were:

- Big decline in European gas & power prices – driven by an easing of the crisis & inelastic supply curves

- Policy mistakes and clumsy intervention – driven by knee jerk political reactions to stressed markets

- The year of long duration storage – given its key role in providing flex to enable RES penetration

- LNG market investment frenzy – given high prices & strong European demand

- Europe rings the power flex alarm – an acute lack of flex capacity is exposed across Europe (centred around Germany)

Let’s consider these one by one and layer on some of the other surprises that surfaced across the year.

1. Big price decline

Mea culpa – we were looking the wrong way. This was based on a preconception that it was not in Russia’s strategic interest to (i) invade Ukraine or (ii) weaponise gas supply. Like many others we were wrong on both counts.

Although we were directionally wrong on the risks, we did flag the continuation of extreme volatility driven by the inelastic nature of both supply & demand curves.

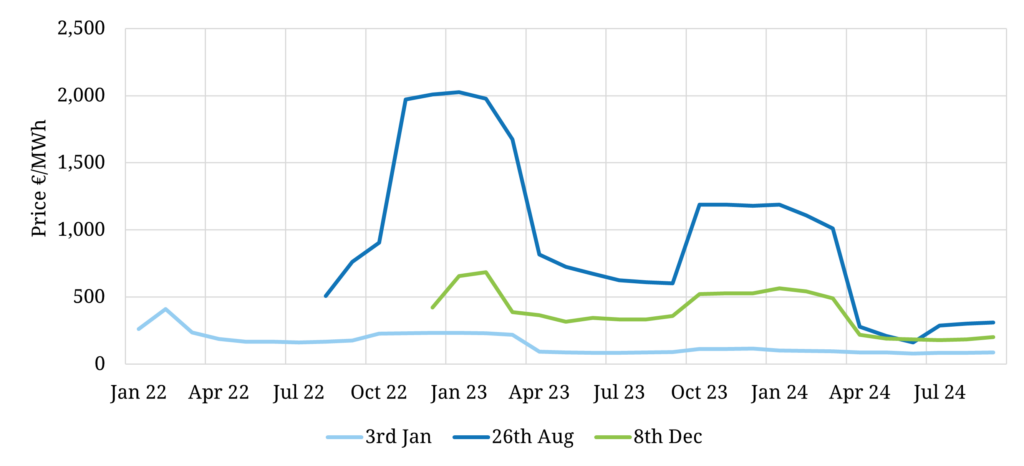

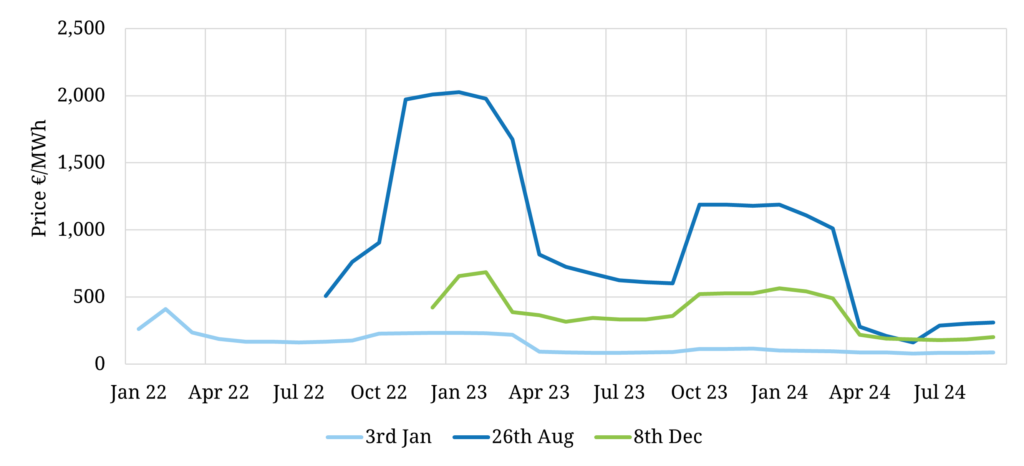

Chart 1 illustrates just how extreme volatility was across the year, using the French power forward curve as a case study.

Chart 1: Evolution of French baseload forward power curve

Source: ICE, Timera

To put these price curves in context, although you barely notice that small rise across start of the 3rd Jan forward curve (light blue curve), it was a big deal at the time. The market lacked historical context for baseload power prices above 400 €/MWh. By their peak in late Aug (dark blue curve), winter prices exploded to five times that level, reaching 2,000 €/MWh.

By the end of summer power & gas prices across Europe were at levels that spelled imminent economic destruction. The green forward curve from late last week shows how prices have fallen significantly since the summer. But this does not represent a return to normality.

Forward power & gas prices across the 2023-25 remain at levels that are causing extensive damage to European economies. High energy prices represent an existential threat to European industrial competitiveness and are driving a structural shift in policy focus.

Energy transition is now being driven by the necessity of security of energy supply as well as decarbonisation. Europe needs a solution to replace Russian gas to allow this transition. But it is difficult to see a path to energy security that doesn’t depend on Europe reducing its dependence on imported fossil fuels.

The crisis was ignited by a gas supply crunch, but the policy response has been to accelerate energy transition. In the short term however, it is coal & lignite plants that are keeping the lights on.

2. Policy mistakes and clumsy intervention

There were plenty of these in 2022. We summarise key areas of policy intervention in Table 1.

See here for more detailed views on why we are sceptical about many areas of this intervention.

3. The year of long duration storage

Europe’s long duration storage challenge has been exposed by the 2022 energy crisis. But with policy makers focused on keeping the lights on, a shortage of longer duration flexibility is being addressed in the near term by lifting constraints on coal & lignite capacity.

As we flagged in January, long duration energy storage (LDES) requires an effective policy framework to kick start investment scaling. Lithium-ion batteries have won the battle for short duration storage (e.g. 0 to 8 hours). The LDES landscape covers a much broader range of potential technologies (e.g. compressed air, flow batteries & thermal storage).

We have seen investors increasingly interested in LDES investment cases this year. But the common theme across a range of sites and technologies is the requirement for some form of capacity contract support to underpin LDES contribution towards managing a high RES system (e.g. across capacity, network & ancillary services).

The importance of LDES has been highlighted in 2022. But energy security has trumped decarbonisation in 2022. The policy focus on immediate crisis management has temporarily interrupted momentum behind LDES investment support.

4. LNG market investment frenzy

We let some charts do the talking to summarise the LNG market investment this year. Europe’s pivot from Russian gas to LNG is certainly driving an investment frenzy.

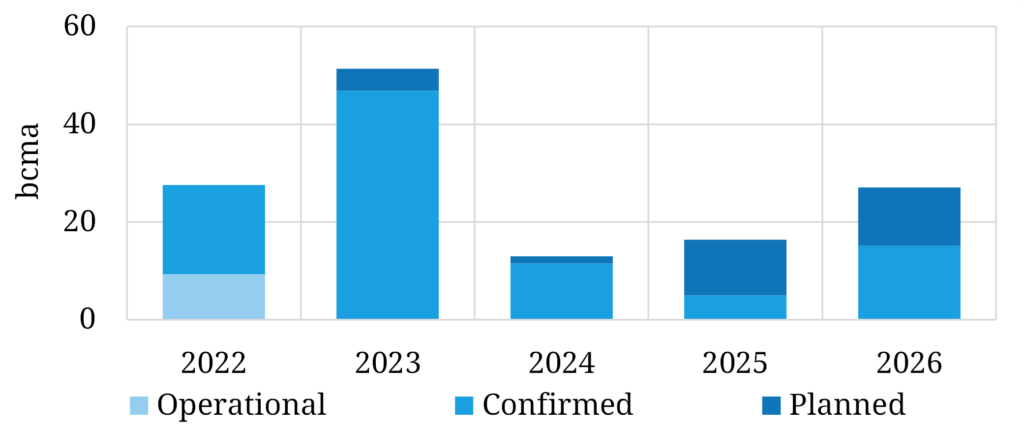

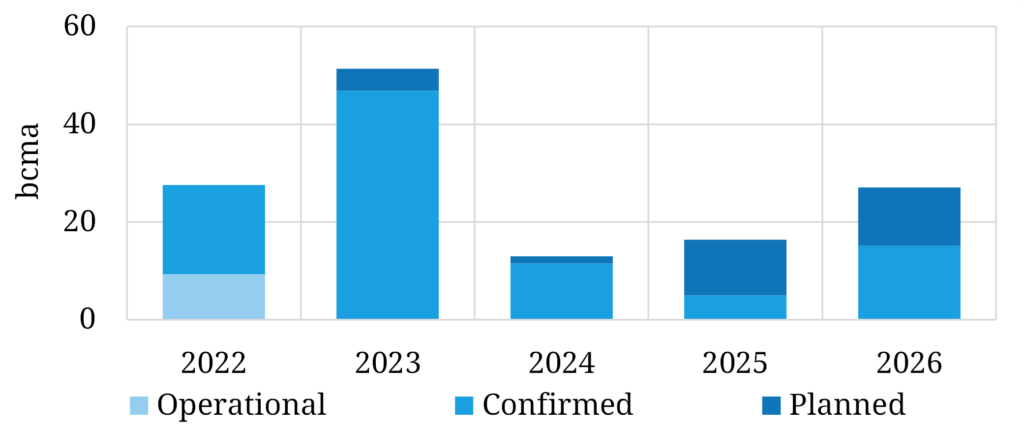

Two years ago European regas investment was effectively dead. This year has seen an unprecedented surge in investment. Chart 2 summarises incremental European regas capacity volumes triggered by the current crisis.

Chart 2: Incremental European regas capacity

Source: Timera Energy

Regas investment has been focused on alleviating entry bottlenecks into NW Europe, with new capacity under development in Germany, Netherlands, France, Belgium & UK (+ some additional Italy, Greece & Baltic capacity).

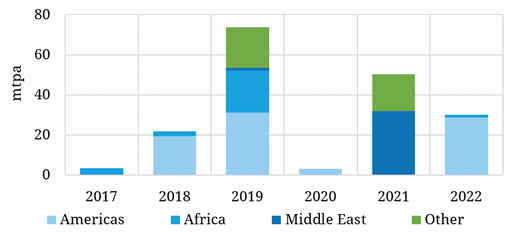

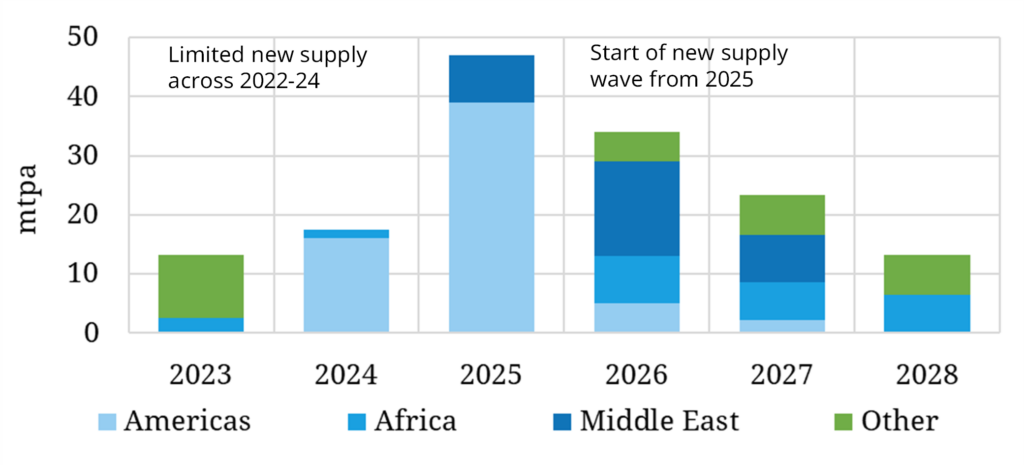

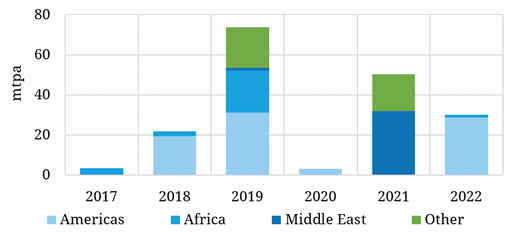

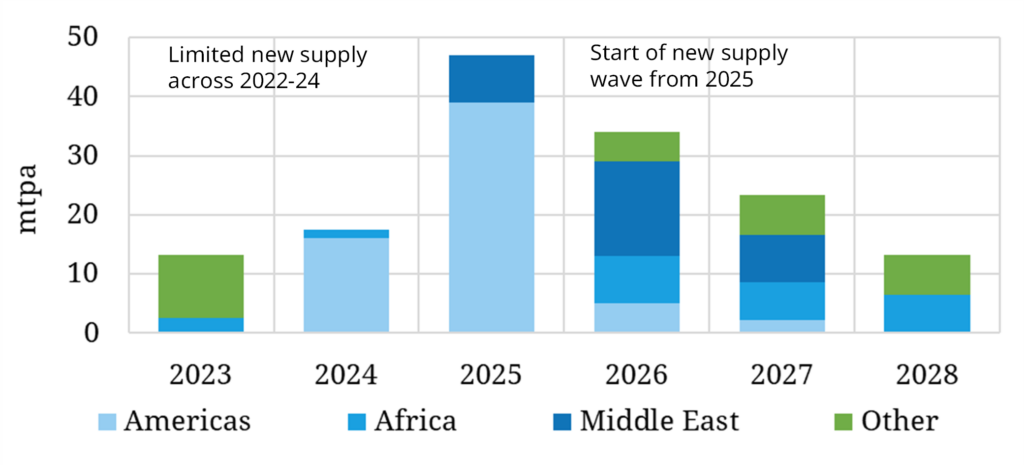

The second major area of investment capital deployment this year has been in new LNG supply, with a major new supply wave taking shape from 2025 as summarised in Chart 3. New supply volumes FID’d in 2022 have been focused on flexible US gas (e.g. Plaquemines, Corpus Christi, Fast).

Chart 3: New LNG supply FID volumes (top panel); incremental supply from FIDs (bottom panel)

Source: Timera Energy

New wave investment is set to continue into 2023 with further Qatari and US FIDs likely. Despite very high prices, it is still proving challenging for new supply projects to secure long term contract volumes given the risk around European and developed Asian LNG demand from the mid-2030s as energy transition momentum accelerates.

You can find more on LNG investment & portfolio value drivers in our recent ‘Regime shift’ webinar.

5. Europe rings the power flex alarm

This happened in spades in 2022. The gas crisis exacerbated the 2022 power flex crunch. But European power markets also faced a separate parallel crisis centred around a structural deficit of flexible capacity. We have been flagging this issue regularly across the last 3 years, for example in this client briefing on ‘Europe’s flex deficit’ we published in Feb 2020.

The 3 structural drivers that have driven Europe’s power flex crunch have been:

- Rapidly increasing RES penetration (required for energy transition)

- Closing thermal assets e.g. nuclear, coal & ageing CCGTs

- An inadequate policy framework to support investment in new flex capacity, particularly in some key markets like Germany.

These structural drivers combined with several more specific drivers in 2022 to cause the flex crunch. Hydro reservoir levels have been very low, there have been some periods of low wind and French nuclear availability has been hit hard (an issue that continues into 2023). Interconnectors have also not alleviated stress as anticipated, given correlated stress across markets.

Policy makers hit the panic button as this crisis unfolded. Scheduled coal & nuclear phase out measures have been postponed. Germany restarted a number of coal & lignite plants already flagged for closure, with other countries lifting coal production caps e.g. Italy & Netherlands.

Beyond these short term measures Europe still faces a huge low carbon power flex investment challenge. 2022 was the year that demonstrated this. Hopefully 2023 will be the year that it is addressed with effective policy to support investment.

A Timera end of year update

This is our last feature article for the year. We finish with a round up of interesting Timera work this year, that provides an insight into where our clients are focusing against the backdrop of an ongoing energy crisis:

- EU batteries: High price volatility and ancillary service market reform (e.g. aFRR) drove a big increase in clients engaging us to support BESS investment across Western Europe. Key focus markets this year: Netherlands, Belgium, Germany, Italy & Spain.

- GB batteries: Capital deployment by GE BESS developers so far remains a level above EU markets. We have also seen a rapid pick up in transaction work driven by BESS portfolio aggregation & new entrants looking to acquire sites (given connection access constraints).

- Hydrogen: We have seen a strong client shift in 2022 to focus on specific project investment case development as policy support take shape. Optimisation of site design is a key focus e.g. sizing & flex of electrolyser, storage & offtake.

- LNG portfolio construction: Europe’s pivot to LNG has driven strong client engagement for us to provide contract & portfolio valuation analysis. Key focus areas are new SPAs (US flex focus), regas capacity additions & re-negotiation of contract structures / pricing.

- EU regas & midstream: We have seen a specific client focus on investment in EU regas capacity. This has been both supporting clients understand the value impact of buying capacity & supporting developers structure offtake options.

- Peaking flex: We continue to work with peaking asset owners & investors on analysing market & asset margin dynamics. We have also worked with several clients on retrofitting & repowering peakers with hydrogen in the 2030s.

- Colocation: We have done a number of engagements on BESS sizing and revenue stack impact of colocation (both wind & solar). RES investors are also increasingly asking us to analyse diversification benefits of adding BESS to RES portfolios.

- Transactions: Our commercial due diligence & valuation support this year included BESS portfolios across GB, Benelux, Italy & Spain (several with RES colocation focus). We also supported major LNG portfolio & midstream gas processes. Thermal power transactions were quieter relative to previous years.

The common theme across all of this work is the flexibility required to decarbonise energy markets.

To support this work, we have continued to expand our team in 2022 and are actively recruiting. Let us know if you’d like some more details.